The most suitable money advice for you should be personal.

Yet, it doesn’t mean general advice is useless. There is a level of effort to discern whether the advice is helpful for your situation.

I read Ben Carlson’s post about filling up your dream bucket and got fascinated by the wealth framework used by an adviser to manage his professional athlete’s money. In the post, Ben tries to guide a reader to decide if selling off a piece of land that has been appreciated 4-5 times is a sound decision. The context is depressing (I will comment on that at the end of the article.)

Financial adviser Joe McLean graced the event with his clients, NBA player Isaiah Thomas and MLB player Dexter Fowler. Former Orlando Magic players Nikola Vucevic and Aaron Gordon are clients, as is current Golden State Warriors guard Klay Thompson.

Joe McLean’s Three-Bucket System for Managing Professional Athlete’s Wealth

To retain Joe’s services, his clients must agree to put aside at least 60% of every dollar they earn. This rate climbs to 80% if the client is fortunate enough to land a long-term deal.

Based on Kyith’s wealthy formula, clients have to boost their surplus rates severely.

Joe begins his conversation with his clients by talking about three buckets:

- The safety and security bucket

- The growth bucket

- The dream/entrepreneurial bucket

In the safety and security bucket, they recommend cash to cover at least one year of all fixed and variable costs, including costs of life insurance, a will and trust, and possibly their first home.

After filling the first bucket, they can move on to fill the growth bucket.

The growth bucket is filled with low-cost, tax-managed equities and fixed-income assets. They will also be investing up to 15% of the portfolio in income-producing real estate but only when a client has some investing experience under their belt. If not, Joe will keep them very liquid.

After these two buckets, 5% to 10% of the money is for the dream/entrepreneurial bucket. The clients can invest in private equity, venture capital, and small business ventures. This would also include buying a second car or home they want.

Most people want to fill their dream bucket first, but with this approach, the clients can take risks with their third bucket, knowing they have taken care of the first two buckets.

I thought this was a relatively sound way of segmenting the cash flow into their wealth. The safety and security bucket addresses our financial security needs or the lowest level in Maslow’s hierarchy of needs. The growth bucket is crucial. Without success in the growth bucket, the clients may not have sustainable passive income after their playing careers.

Some of this is marketing, but having a dream bucket means most athletes desire aspirational goals. If we aspire to be like them, we also have our own aspirational goals.

Rather than suppress and tell us not to have aspirational goals, maybe it is better to tell us the ranking of these buckets.

I like goal-related bucket segmentation better than other types of segmentation because I firmly believe that the nature of the goal, when we need it, and the frequency of income that is needed to come out from the goal will determine how we structure the portfolio to fulfil the bucket.

Great Money Tips from Isaiah Thomas, Dexter Fowler and Joe McLean

CNBC covered the money tips dropped by Thomas and Fowler. These can be general advice, but you may appreciate it if you “earn on borrowed time”.

1. Save more than you spend

Joe takes their savings rate to a degree similar to the serious financial independence pursuers. There are good reasons for that.

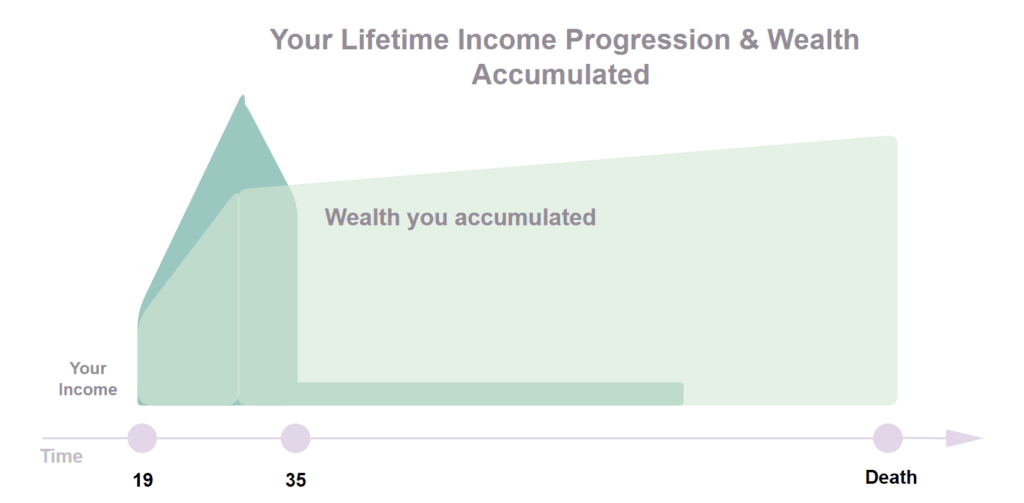

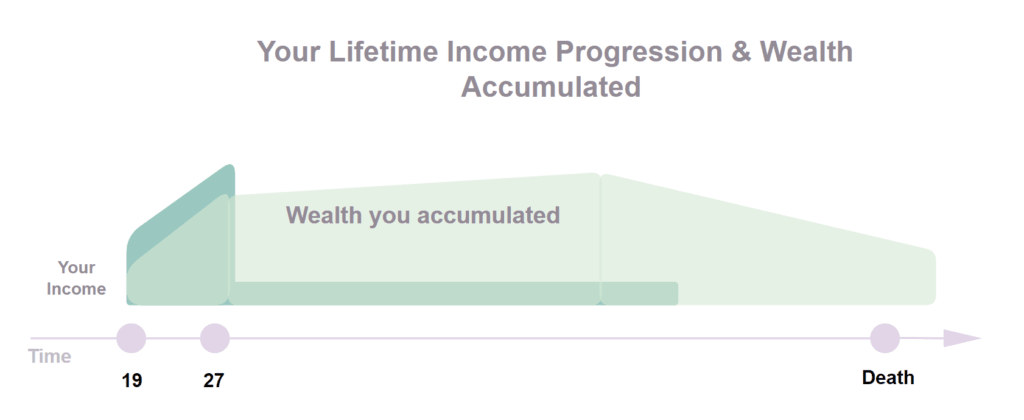

Most of us would imagine a chart of their lifetime income to look like this:

You make an excellent salary due to your talent and hard work, but you can only do it for a limited duration. After that, you will earn relatively much lesser in whatever role you move into unless you stay as the right-tail outlier in your new profession.

This is possible for some to move into broadcasting or maintain their brand & sponsorships well.

By saving 60-90% of your income, you can successfully convert your human capital to wealth, providing the residual income when you stop playing.

If you fail to build wealth soundly or fail to save up, without the wealth, you will struggle after playing.

We often struggled to see how much we needed to save for when we were financially less literate. Some may follow the standard personal financial advice, but that may not apply to you because of your unique situation (you are earning for a limited time)

The general advice to adopt a more balanced approach between saving and spending is also different for them as they can live a great life even with 10-20% of their income.

2. “Always prepare for rainy days.”

In recent years, Thomas has endured a demoralizing career. Shortly after being an All-Star while playing at Boston, he suffered a back injury and has struggled to recover ever since.

Your risks are also higher when so much depends on your ability to do unique work.

If you are prudent, even if your career gets cut short or you do not fulfil your full potential, the accumulated wealth can be a springboard for the next phase of your life.

3. Be mindful of financial consequences

“If you’re walking across a log, you have to keep your eye on where you’re going, and if you take your eye off of it, you fall in the water,” he said. “If you take your eye off your money when making a lot of money, nothing happens.”

If you make a lot of money, the room for error is also greater.

But when you become unemployed or have to downshift unwillingly, that is when you realize you don’t have enough.

4. “Live like you’re already retired.”

It is hard to downshift to a more frugal lifestyle if you overspend during your working years.

This may be more crucial if you do not have a nest egg to support the lavish spending (again, this goes back to whether you have accumulated enough.)

5. Look beyond the lump sum

We all have different perceptions of what is considered a large or small amount of money. Same for what is considered enough.

Fowler warns that what might seem like a significant amount, in reality, may not be large if we understand our financial math.

Some may think having $4 million means you do not need to invest prudently.

However, $4 million may not last for someone with a certain type of lifestyle.

6. Alphas have Detrimental Investing Traits

A lot of professional athletes crash and burn because of their age. “The younger you are, the greater the likelihood you’re a knucklehead. We’re working with young people who typically don’t look past next Friday, and we’re talking about 20-year-olds making money that, if proper planning is in place, will last for generations.”

The traits that make you a great athlete or a successful entrepreneur are not the same traits to be a successful investor.

Here are some traits that can be highly detrimental to wealth building:

- Strong drive to win

- Willingness to take risks

- Bet on yourself

Handing Over the Reins of Your Wealth to an Adviser Can be Risky

Joe McLean does a lot of stuff for his clients:

- He bought 25 cars for his clients in 2018 and sold many.

- Customize their cars.

- Renovate their houses.

- Polish their bowling alleys.

- Risk manages some of their koi ponds.

Clients hand over a lot of control to advisers like Joe, and this could be highly detrimental if Joe is a financial charlatan.

I always think it is risky to trust a financial adviser fully from the start and invest all your money with them. What makes me so sure that this adviser is more right than wrong? It is better to take a “trust but closely verify” approach in the initial phase of the financial relationship.

I think the default mode is to assume that our prospects and clients have met their fair share of financial charlatans in their journey to find a trusted adviser than to wonder why the prospect or clients have trouble trusting their advice.

Some started off trusting that everyone they met had their best intentions. There are more financial charlatans than competent people with integrity in the financial realm.

Many have been disappointed enough to be warier despite how solid you think about what you offered.

Sometimes, You Need to Prioritize the Dream Bucket

Joe says that everyone wants to fill their dream/entrepreneur bucket first.

The right thing to do is to fill the buckets that traditionally are the most sensible and rational.

The dream bucket does give you the decision to be more irrational. There is a reason it called the dream bucket because it often takes some crazy returns to bring you closer to that dream.

Here is the reader question in Ben’s post again:

My wife bought some land in New Zealand a few years before we met, with vague ideas of building a house. Turns out its value has appreciated by 4-5x so she asked me if she should sell it while the prices are high. We don’t really need the money for anything, so I thought the tax burden sounds like a hassle, and I don’t know if the money would be better off in stocks. One wrinkle is that she has stage IV lung cancer and probably only has a few years, so it’s unlikely she’ll ever build on it. Should she just sell it? – Jared

I don’t know about you, but when a couple realizes they do not have much time together, you take risks by diverting cash flow or assets from sensible stuff.

George Kinder’s three questions make you realize that money is more of an enabler than a scorecard.

It forces you to go beneath the surface to find out what is essential to your family. If you struggle with an answer, that is also an answer. Your struggle may mean fewer reflections and awareness about other aspects of your life.

I first learned about the aspirational goal concept one and a half years ago. The more I reflected, I think we should all contribute to the aspirational goal if we can articulate it. We need to understand the priority of our aspirational goals in the context of all our goals.

But if we don’t contribute to it, how important is that aspirational dream of ours?

Everyone Wants Personalized Advice

We cannot be professional athletes, but some of you can.

The meaning behind the advice of being mindful of consequences and living like you are already retired can be easily mistaken if applied to all of us. However, there are groups of people that Joe’s three bucket system is still relatively applicable.

People who earn a lot but are trading energy and intensity for money.

Top consultants, traders, people in investment professionals may be some.

One of my junior college classmates used to tell me that his mom worked in a company that provides divers. These divers earn a lot, but their lives can also be cut short.

I think the advice here can be a good rule of thumb for this selected group of people.

End of the day, everyone’s situation is different. Every athlete comes from different background and has financial baggage to settle.

“Joe helps me pump the brakes. I like the idea of instant gratification. I want to hit home runs every single time. Joe’s been dealing with money for a long time, and he understands it’s not about home runs, you know, it’s about the singles, it’s about the doubles. Longevity.”

“Say I need golf clubs — like, custom golf clubs,” Mr Gordon continued. “He knows exactly where to go, who to get it from. Or say I need my car shipped across the country. He does that. He’s just a do-it-all guy. He has so many resources. And he connects you with the right people so you don’t get, basically, played.”

Aaron Gordon

“The last six or seven years, I’ve been through so much. And Joe’s been right by my side. Whether he has to tell me, ‘O.K., this month you spent too much, we gotta calm down these next few months — I trust him that much. This is just how it’s always been. We’ve hit lows and we’ve hit highs, but we’ve hit them together. I think that’s where the trust lies, because it’s bigger than my finances.”

Isaiah Thomas on his recent injury nightmare and having Joe to quarterback the financial and logistic side.

I concluded everyone wants trusted, and competent advice.

Another matter is whether they are willing and can pay for it or find it. But everyone wants that.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024