I am not one to make predictions but perhaps let the data speak for itself.

The PMI or purchaser manufacturing index in various countries is always the indicator a lot of smart money would watch to indicate the general health of the economy.

It surveys the purchasing managers and the aggregate of their views gives us a glimpse of how they see the manufacturing outlook going forward. Coming into the start of 2020, the PMI roughly hovers around the 50 line, which does not indicate strength.

Global PMI looks weaker than the US one. This was all before World Ex Asia got spooked by Covid-19.

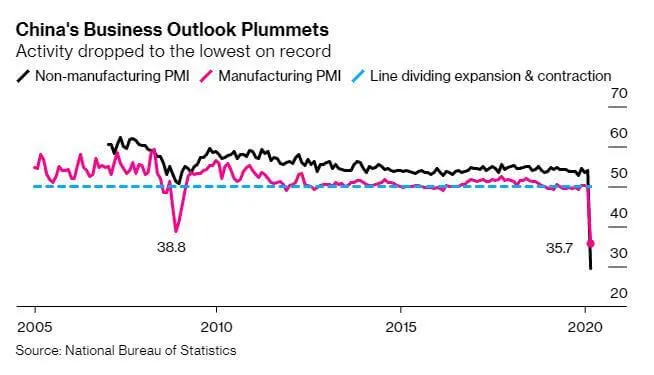

Of course, the key to see is also how the China PMI is going to do.

One day later, China announced its PMI. This PMI reading for the month of February, is even worse than 2008.

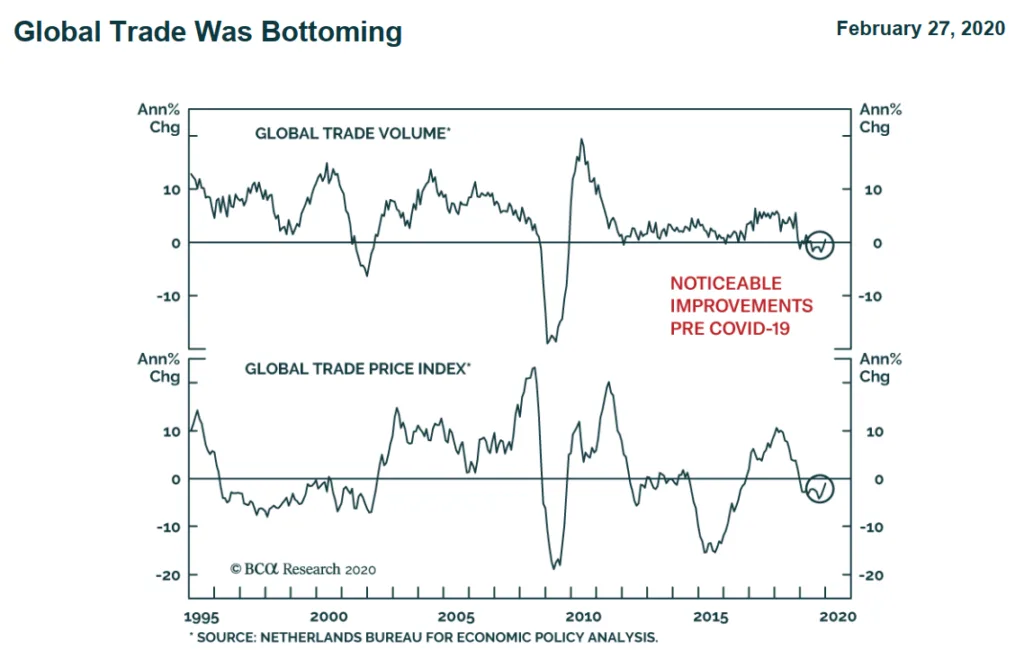

According to the Netherlands Bureau of Economic Policy Analysis World Trade monitor, global export volumes actually went up in December, Pre-Covid-19.

I think with the latest developments, this trend should be in the reverse. What I was more fascinated was how much lower trade volume was in the past decade, relative to the previous 2 decades.

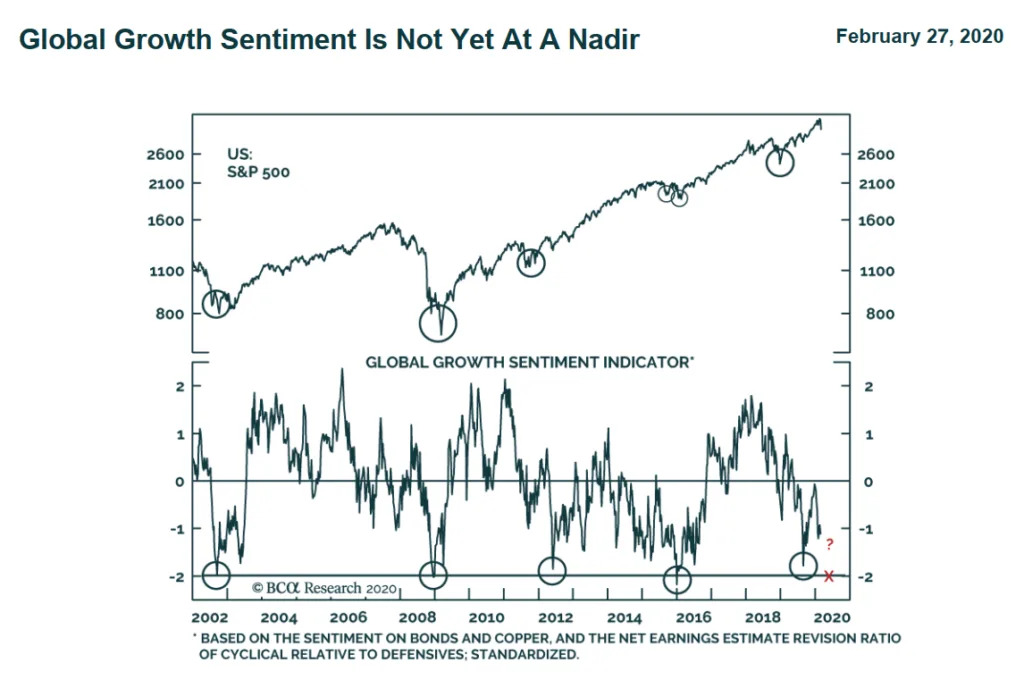

BCA research tries to capture the pessimism and optimism of investors towards global growth through their own index.

The index shows pessimism is prevalent but not at levels that of pessimism that were historic.

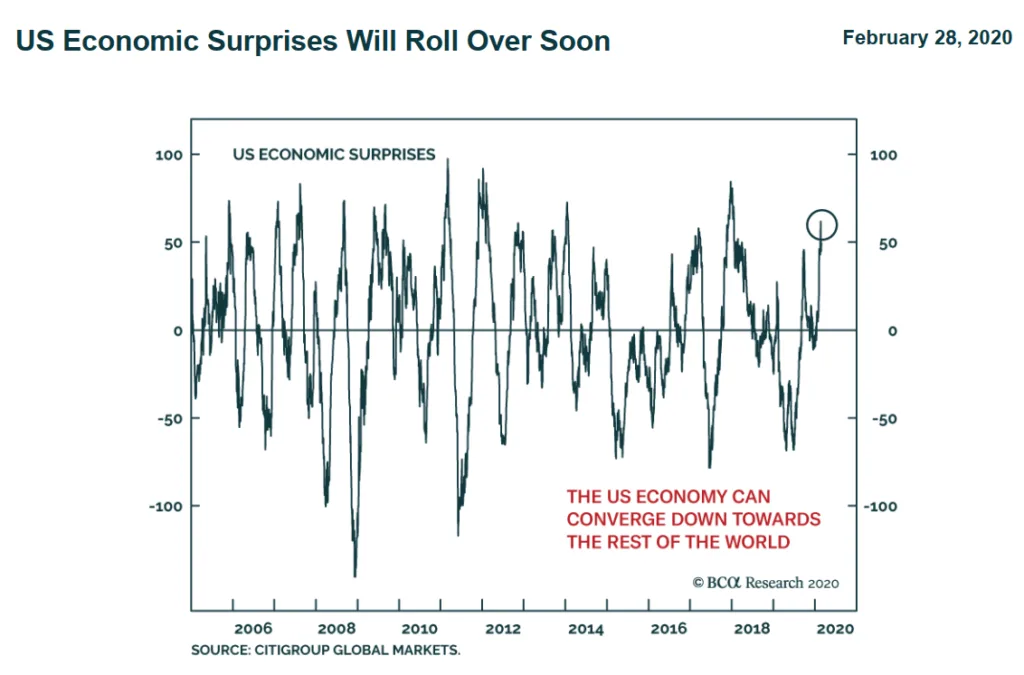

The index above shows the US economic surprises relative to the rest of the world. Since the start of the year, they have done well. The charts do show that this is oscillating and thus at some point, it should be moderated downwards.

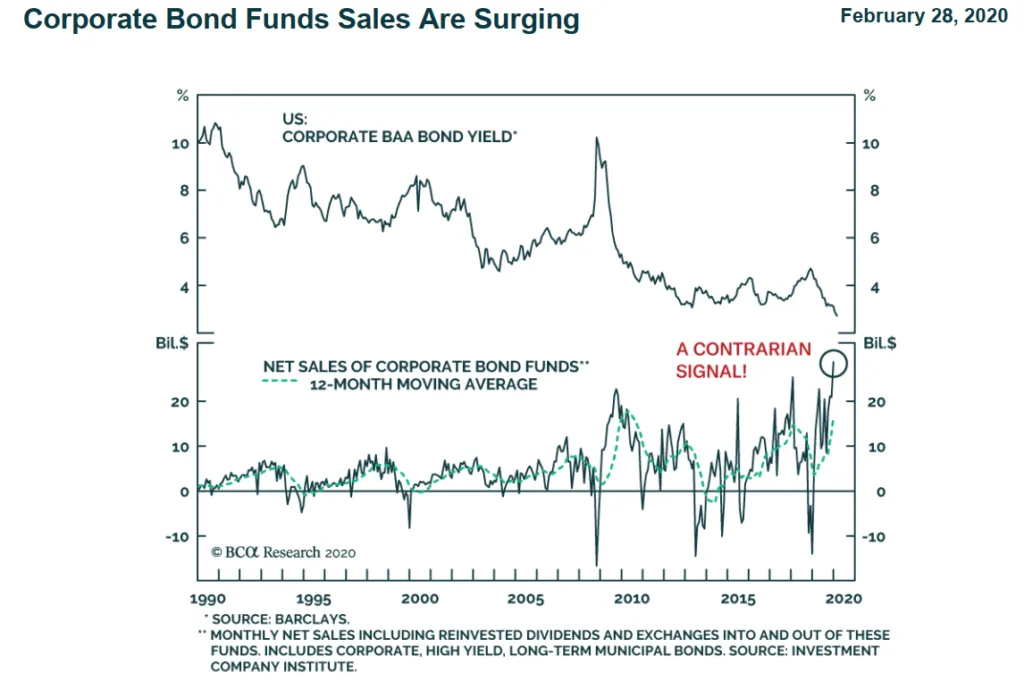

The net sales of corporate bond funds to the public are often a contrarian indicator. A high net sales usually coincides with a bottom in corporate BAA bond yields.

In recent months, the corporate bond funds have been receiving a record-high amount of funds from the public. There are enough securities to meet this demand for bond funds. BCA seems to think that this demand and supply is inversely proportionate to corporate bond yields.

The demand for bond funds looked… excessive. At some point, even after Covid-19 has passed, corporate bond yields should head higher.

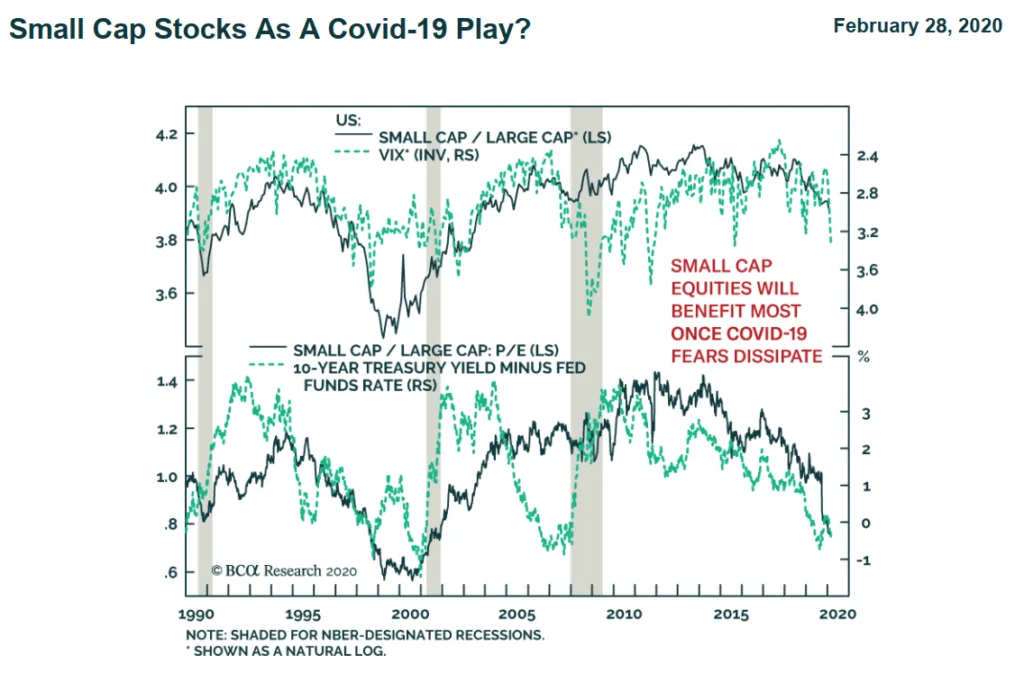

The onslaught in the smallcap space is even worse than the large-cap during this carnage. This explains the underperformance of Dimensional funds versus the Vanguard funds.

If the small caps were so compressed then like a spring, they might do better once this is over.

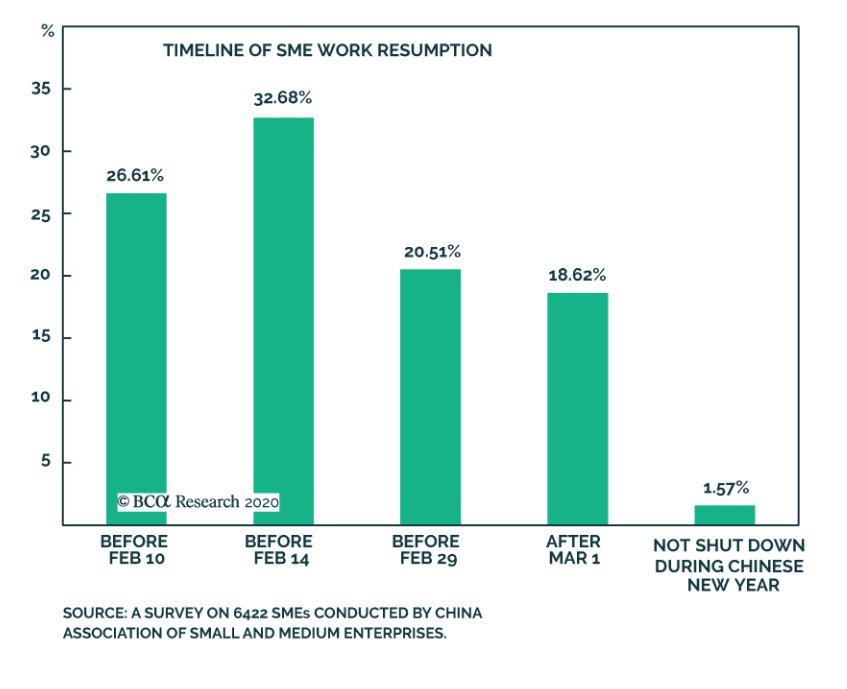

Finally, a survey of China’s 500 top manufacturers by China Enterprise Confederation indicates that most of the 342 respondents have resumed production as of Feb 20. They have indicated more than half their employees have resumed work and utilization rates reached nearly 60%.

The China Association of Small and Medium Enterprises survey of 6,422 small businesses show that as of Feb 14, more than half have resume work as well.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024