When you look at enough data, you know that there is a spectrum of possibilities.

Some folks don’t look at so much data. Even worse, some folks present data in such a way to twist people to buy things. You can just gently data-mine and select great figures and leave out the less than desirable ones.

People not familiar with the subjects, or who are less data-focused dunno what to think.

But the most dangerous ones are the ones who genuinely want to do good to educate but didn’t realize the spectrum of possibilities for something is actually too narrow.

If someone is uncommon, or rare, different people handle it differently. The anxious and cautious ones would be concerned about it. The optimistic ones will dismiss that this would not happen to them.

This is probably why many do not actively do their own Lasting Power of Attorney for example.

Events can be uncommon… but that doesn’t mean multiple uncommon events cannot cluster together:

If you are planning your trading model or system, would you ever factor into your system that oil prices can go extremely negative? Can your IT system handle it?

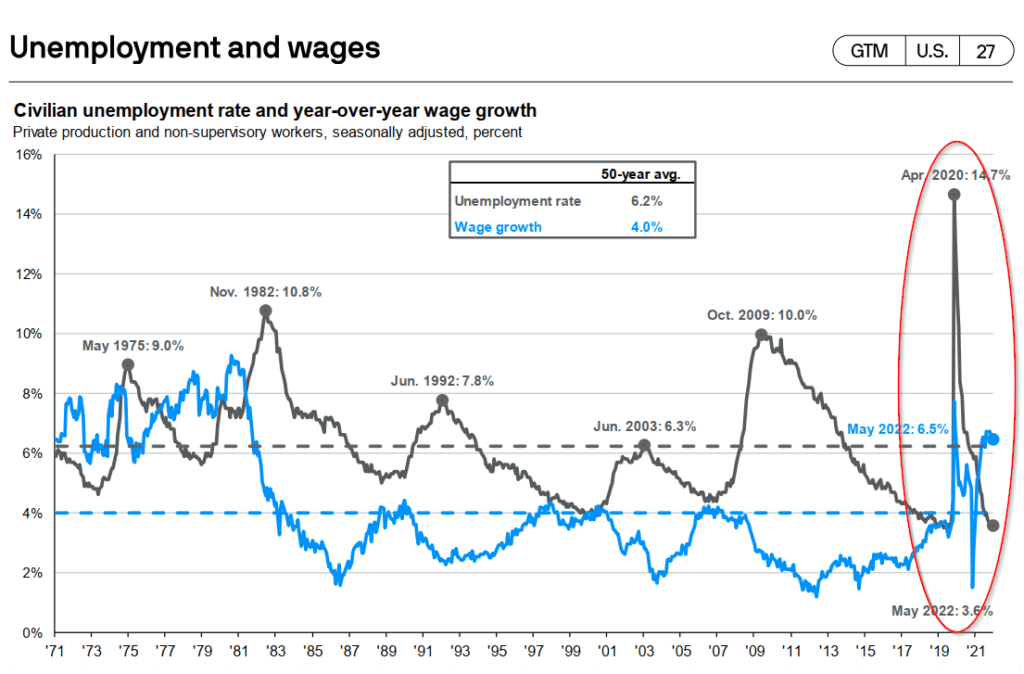

If you have a range of unemployment in this range, is there any possibility that we will have a higher unemployment rate than 10%? We probably discovered that not too long ago, which is quite close to oil.

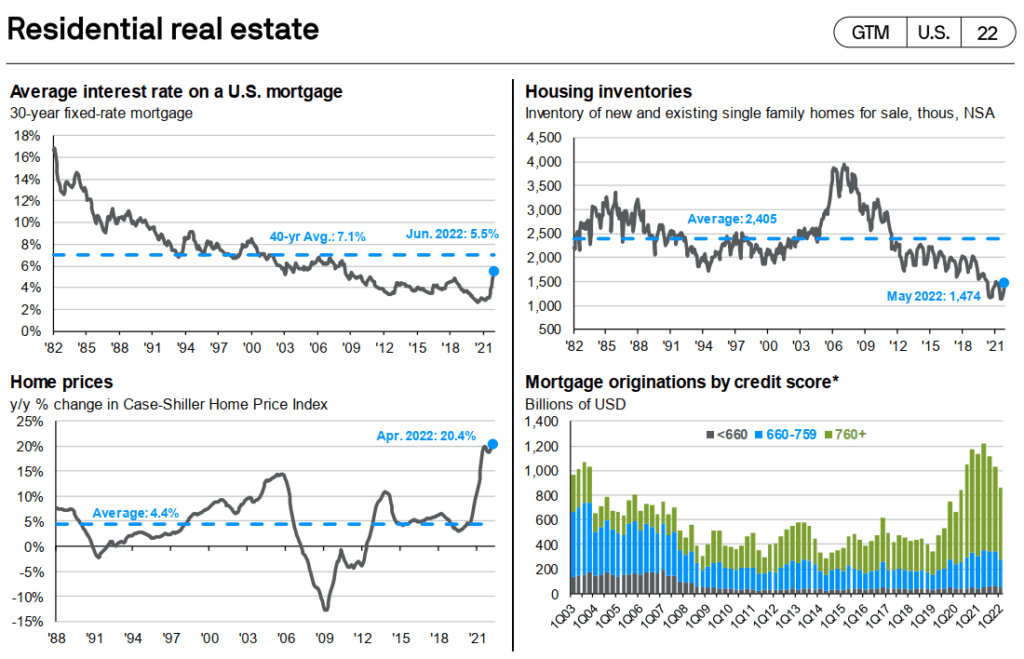

We thought that housing prices’ rise from 2000 to 2007 was a bubble.

Now, our prices are higher than that.

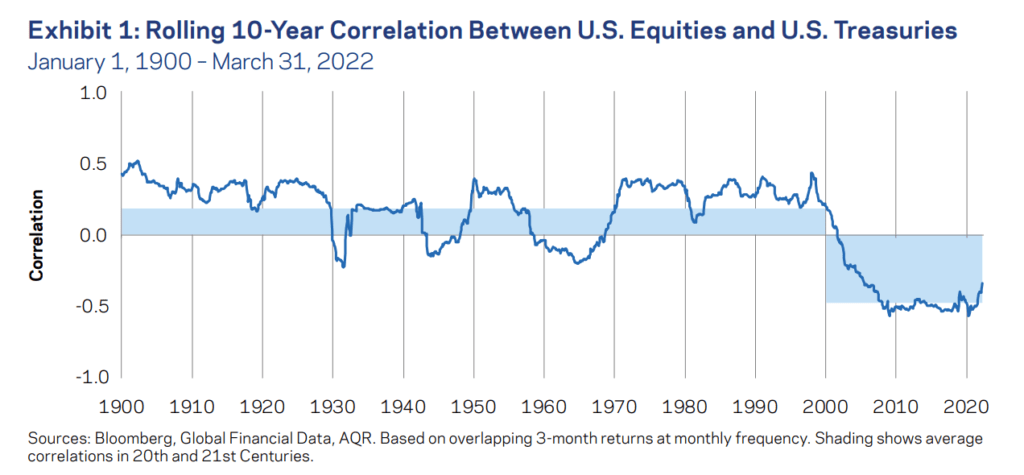

If you are planning your advisory narrative that bonds would cushion equity volatility, what happens when you realize that the past few years are not the norm, that the norm is bonds and equity correlations can be positive?

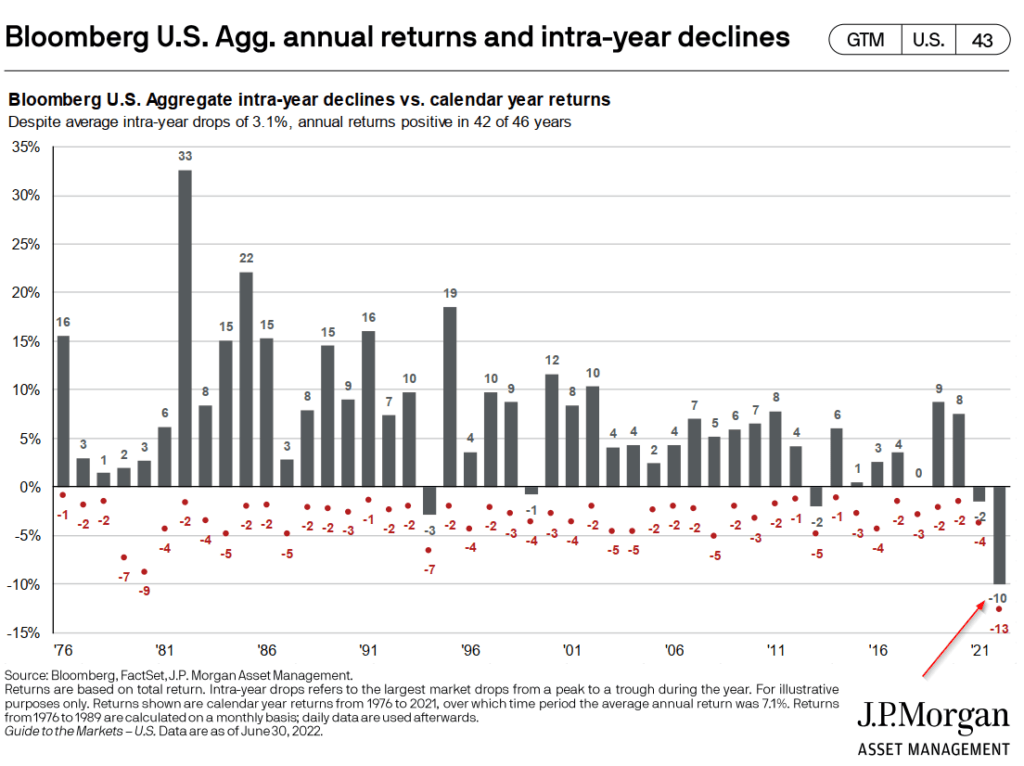

Just because bonds don’t have big drawdowns in your lifetime, does not mean bonds cannot have very big drawdowns.

Some things that may be rare to us… may not be so rare. It is just whether we take things seriously in our planning or not.

Boundaries are there because they will happen, and it is for you to factor into your systems and planning processes.

The question always is how do you plan well knowing the boundaries matter and not so fixed.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Sinkie

Monday 11th of July 2022

Some people get PhDs & base their careers on uncommon events & boundaries.

Just ask Nassim Taleb, Nourial Roubini, and Michael Burry!

(Burry likely incurred multiple loses in last decade's bull run, but he's relatively quick to cut loss)

But it's important to be nuanced & aware of the context.

Don't wanna be like Meredith Whitney who became a star prognosticator after correctly predicting the collapse of Citibank & other big banks before 2008, only to make a very public prediction about the collapse of US municipal bonds & state govts that didn't happen.

Over-hedging can be a big drag, which may still be ok for those more interested in staying rich than getting rich, and protecting their 500X annual expenses savings.

E.g. Meb Faber's Ivy Portfolio did well during GFC and currently in 2022, but overall from 2008 till today the IRR is only about 3.5%-4%.

It works well as wealth protector as the focus is on risk mgmt. But at the expense of returns over the long run.

Using dual momentum strategies will have better long term returns in exchange for slightly more volatility.

The old Wall St saying still rings true: Be quick to be a bull & slow to be a bear.

PS: While US property will definitely come down, don't expect a bloodbath like in 2006/2007. Mortgage originations are now multiple quality levels higher than the NINJA mortgages of 2005 & 2006. Inventory (months of housing stock) are still at multi-decade lows. The developers need to build more & have been building, but are still very wary about another housing collapse.

Just like oil majors now are still very scared of the previous 6-year collapse in oil prices & refuse to invest more capex or reopen oil wells even though oil went up to $125 recently. They've been burned before. They want to see more proof of oil demand sticking & not disappear when economy slows down or recession. More dirty energy concessions & rollbacks by govts will also be a bonus. In the meantime they're happy to collect fat margins & wait.

Kyith

Monday 18th of July 2022

agree with most of it. but i think the last 10 years have also been a deviation of some sort. the property loan quality is higher but the prices got to this state more because of lack of supply so it is very different.

lim

Monday 11th of July 2022

"If you are planning your advisory narrative that bonds would cushion equity volatility, what happens when you realize that the past few years are not the norm, that the norm is bonds and equity correlations can be positive?"

Thats the problem with bond funds - most of them have to mark to market as they have to sell the bond when it reaches a certain maturity. eg: iShares medium term bond ETF will sell their bonds to the iShares short term bond fund at about 3 years maturity.

Fortunately, there are other bond-like alternatives - some might say CPF is a 2.5%-3.5% bond. I maxxed out last months' 2.71% SSB at $18k and will apply for the max for this month as well.

Holding retail bonds to maturity is another option. This year my Frasers 3.65% matured with no losses (I bought during IPO and even bought more from open market at $1 since I felt it was the "best" of all the SGX retail bonds), while I think my SIA 3.03% is also in no danger of defaulting (and last traded above $1).

Other than that, I have been accumulating the Astrea "bonds"; they look relatively safe given the build-up in the reserves account and the relatively short first call date for V and VI, and also the undemanding 'interest' they have to pay out.

Kyith

Monday 18th of July 2022

Oh that is interesting. I think bond index funds should still work. They usually only sell off very close to maturity (unless you know something otherwise). Bond funds are difficult for people to deal with because they cannot see the inner workings.

But i do know that it is possible for active bond funds to sell at a loss so that the P&L looks good. That is bad.