Finance minister Mr Lawrence Wong gave his 2022 Singapore Budget yesterday.

Compared to the previous budget, this budget has more changes that affect the higher net worth more. But generally, I felt that the changes tax the ultra-high net worth more in a progressive manner doesn’t feel repulsive enough for them to reconsider their wealth allocation.

It also doesn’t move the needle too much.

I will go through a few notable ones. But let us start off with some CPF changes.

The Next 5 Cohorts Turning 55 Years from 2023 to 2027 Will See Higher CPF Basic Retirement Sum (BRS) Requirement Growth

3 of our Providend staff would be affected by this including my boss, our CEO and head of the advisory team. This is also likely to affect a portion of our clients in numbers but not in impact.

The government will raise the Basic Retirement Sum by 3.5% a year for the next 5 cohorts turning 55 years old from 2023 and 2027.

For those who are not aware, for the last few years, your CPF BRS, FRS, ERS typically grow at a rate of 3% a year. This is to ensure we adjust the amount we set aside for our retirement based on a 2% average inflation rate plus 1%.

The government most likely wish to set a guideline for Singaporeans to save more due to the higher inflation we see since Covid.

It remains a mystery whether the rate will step down after these 5 cohorts.

I think the posture we should take is that just like the Basic Healthcare Sum (BHS) for the CPF Medisave, the government can change the rate of CPF BRS, FRS requirements from time to time.

Mr Wong also said that there is no requirement for members to top up their CPF if they are unable to set aside their BRS. Those who set aside the BRS when they turn 55 in 2027 will receive payouts of close to $1,000 per month when they turn 65.

At first, we thought the government is going to give us magic internet money but we were disappointed when we realize that the payout is naturally higher if you contribute more to your CPF!

This change does not only affect the BRS. This table might give a better illustration:

The table above shows the estimated monthly payout provided by the CPF retirement sum for the next 5 cohorts when they turn 65 and the respective retirement sum at 55.

Observe that based on the illustrations, your FRS and ERS limit would be higher as well.

This is great for those folks mad about CPF who would take every chance to top up their CPF to FRS. But then if you have reached your FRS in your CPF SA, the growth of your CPF interest will be higher than the 3.5% growth so you don’t get a chance to top up.

This move really looks like shoring up those who have pledged or charged their properties to set aside more so that eventually, their CPF LIFE payout keeps up with inflation better.

Higher Marginal Personal Income Tax for Those Earning Above $500,000 in Chargable Income

This will affect a sizable portion of our clients.

The government will increase the top marginal personal income tax for those top earners with effect from the Year of Assessment 2024.

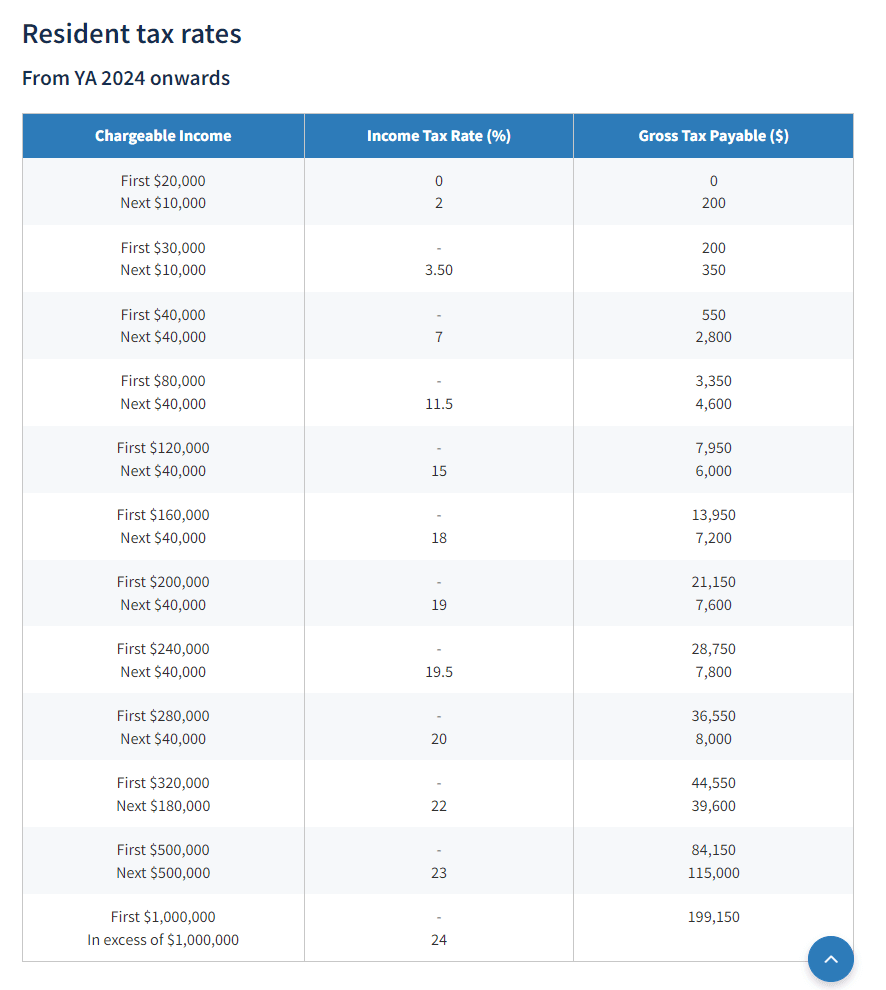

The chargeable income in excess of $500,000 to $1 mil will be taxed at 23% and the income in excess of $1 mil will be taxed at 24% instead of 22%.

IRAS usually are pretty on the ball in updating the marginal personal income tax table. You will observe that now the tier increases. This affects those earning $500,000 and above.

Most likely this affects the more experienced tech engineers, senior directors at MNC, business owners and C-suite in MNCs.

You will pay $10 more in taxes for every $1,000 more in chargeable income between $500k and $1 mil and $20 more in taxes for every $1,000 more in chargeable income above $1 mil.

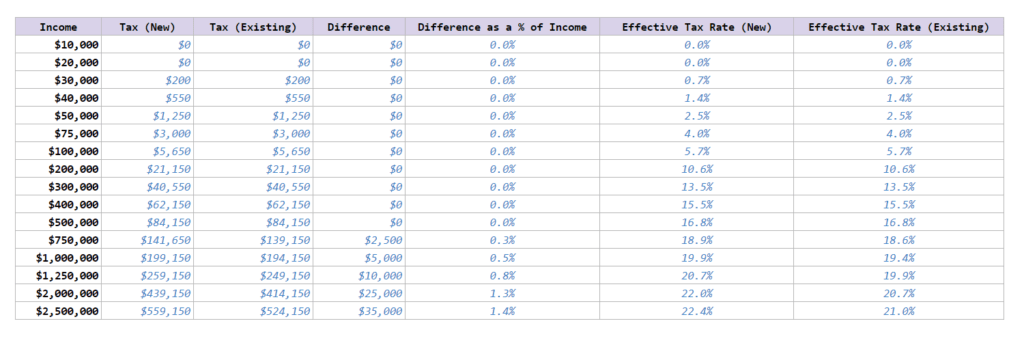

I did up a calculator to compute the difference between the current and new tax bracket for a few ranges of chargeable income.

In the grand scheme of things, the percentage difference is not a lot. $5,000 more for someone earning a chargeable income of $1 mil is a 0.5% impact.

Why Singapore Will Not Implement a Wealth Tax for the Time Being

Mr Wong explains that wealth taxes is a concept to help recirculate a portion of the wealth stock into our economy and in doing so, mitigate social inequalities.

Singapore would want to do that but it is not easy to implement.

It is difficult to estimate wealth accurately and it is quite a complex exercise. Furthermore, many forms of wealth are mobile and as long as there are differences in wealth taxes across jurisdictions, such wealth can and will move.

Mr Wong said that Germany, France and Denmark stopped levying taxes on individuals’ net wealth. The number of OECD countries that levy net wealth taxes has dropped from 12 in 1990 to 3 in 2020.

“We will continue to study the experiences of other countries and explore options to tax wealth effectively. In the meantime, we will strengthen our current system of taxes.”

Lawrence Wong

I think there are a group of equity investors who may be slightly worried that this was the year that the government finally implement some form of wealth tax. But from this statement, I think it will be some time before they do this.

Most likely, it is when the major governments around the world can link up even better to index identity to the assets. If not, this will be a rather tough endeavour and not worth the government’s effort.

Active stock investors and passive ETF investors can breathe a sigh of relief.

The Logical Wealth Tax – Some form of Property Tax

As it is challenging to implement a wealth tax, the logical implementation is to tax the assets that are immovable.

I was quite surprised by this because, in Dec 2021, the Singapore government implemented a round of property cooling measures (You can read my commentary here)

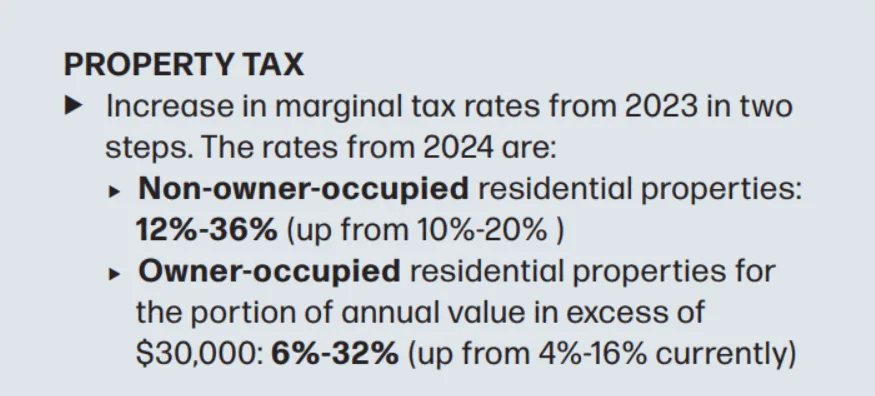

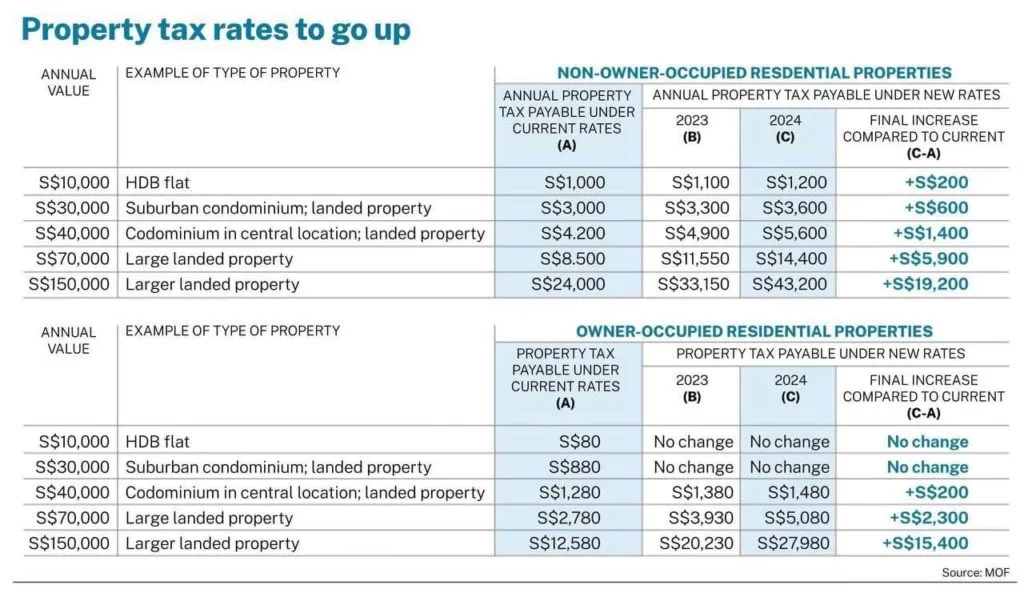

The government will increase the marginal tax rate levied annually on owner-occupied residential properties and non-owner-occupied residential properties.

The increase at the top end of residential properties looked big.

But how big is the impact?

“With these changes, a large non-owner-occupied detached house in the central area with an Annual Value of $150,000 will see an annual property tax bill of about S$43,000 per year.

Lawrence Wong

Actually, my question is… how big of a detach house do we need to get an annual value of $150,000?

“This increase will impact the top 7% of owner-occupied residential properties. The increase will be higher at the top end. To illustrate with the same landed property with Annual Value of $150,000, the new property tax bill will be about S$28,000”

Lawrence Wong

So here are some data that may help you make sense of things.

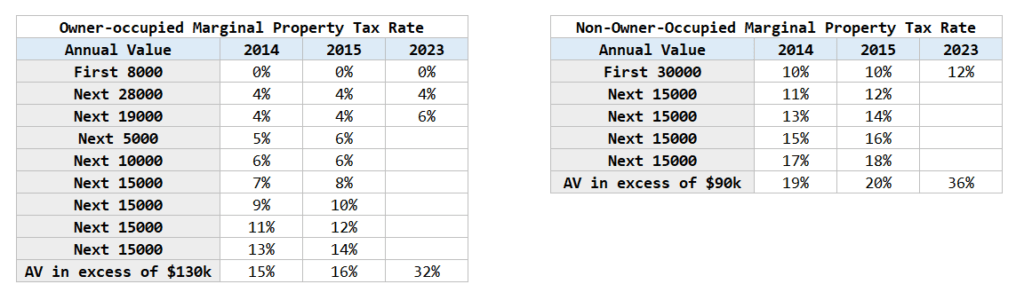

Here is the recent change to the marginal property tax rate for owner-occupied and non-owner-occupied. Not much change from 2014 to 2015 and as far as I know, since 2015 there wasn’t much change. So this change will kick in next year which will be like 8 years since the last change.

The non-owner occupied will all be affected to a different degree. I do not have the breakdown so it is from 12% to 36%. Even at the lowest level, you should see a 20% increase in taxes.

If you own an owner-occupied property, you would only be affected if the annual value of your property is above $30,000.

My Telegram group member reminded me that the 20% increase in non-owner-occupied can be easily passed by charging a higher rent. Depending on the demand and supply dynamics, this move by the government might be more inflationary.

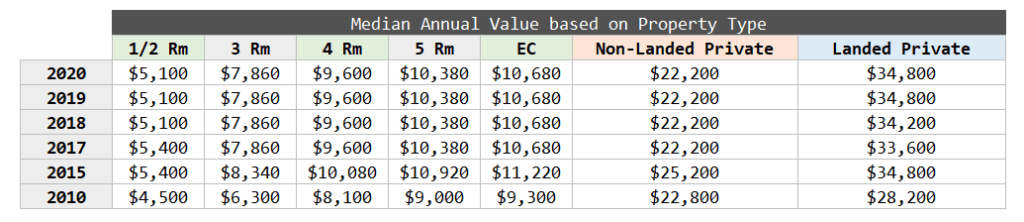

The above table shows the change in the median annual value of a property based on different property types.

Observe that the property values in 2015 is the highest for all the properties.

The median annual value for non-landed private is $22,200 and landed properties is $34,800. We are not sure how wide are each spectrum.

But I suspect the majority of the non-landed private should be below $30,000. 45% of the landed private will be affected.

Basically, for owner-occupied, if you are living in a non-landed property, there should not be any differences. This makes sense.

Perhaps only the very rich in Singapore will be affected by that 6% to 32% range with the 32% taxing the good class bungalows (GCB).

Business Times have a good update on which type of property would most likely be affected by this. Those with larger landed property would be most affected.

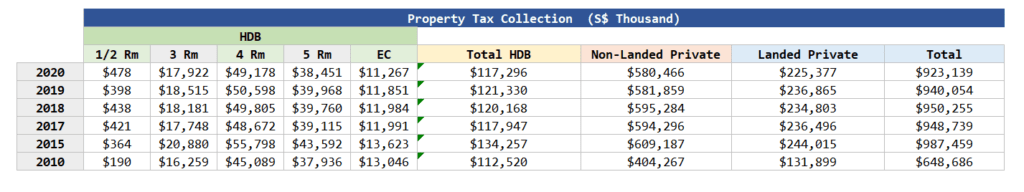

This table shows the annual tax collection for different property types over the years. There are a few observations.

2015 is the year with the greatest tax collection. That is also the period where the property value is the highest. No surprise there.

The majority of us live in HDB flats but the total property tax collection is much less than the private property.

The largest bulk comes from non-landed private. While the number of non-landed private properties have gone up over the years, the biggest tax collection is still closer to 2015.

These changes to marginal tax should affect 60% of the landed private.

According to a 2021 Business Times article written by an executive director of Savills Singapore:

The stock of GCBs here has been a subject of debate by market observers. The mid-range is about 2,800 units which we will use as the count of such properties here. This accounts for only 0.7 per cent of our total island-wide stock of about 411,000 private residential properties (as of Q4 2020) or 3.8 per cent of all landed private residential stock.

In 2020, there were 75,472 landed private residential accounted for. 3.8% is quite close to 2,905.

Let us be optimistic and say 60% of the landed will see an 80% higher tax. This may boost the $225 mil landed private tax to $333 mil or $108 mil more in tax revenue. That looks significant.

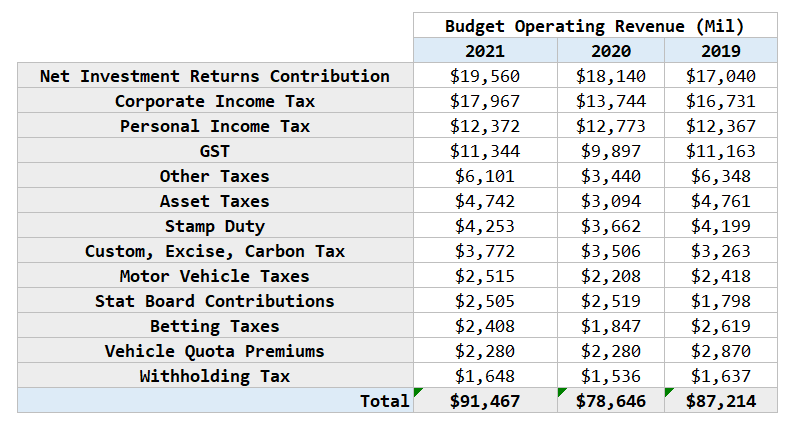

The table above shows the budget operating revenue for the past 3 years. Notice how badly we were affected in 2020. The biggest contributors are from our investment returns (always increasing!), corporate income tax, personal income tax and GST.

An increase of $108 mil amounts to 0.12% of our annual operating budget. Every drop helps but in this case, I think the government managed to tax the rich but I think a 28% increase in GST is more significant.

Logical Wealth Tax – Greater luxury vehicle tax

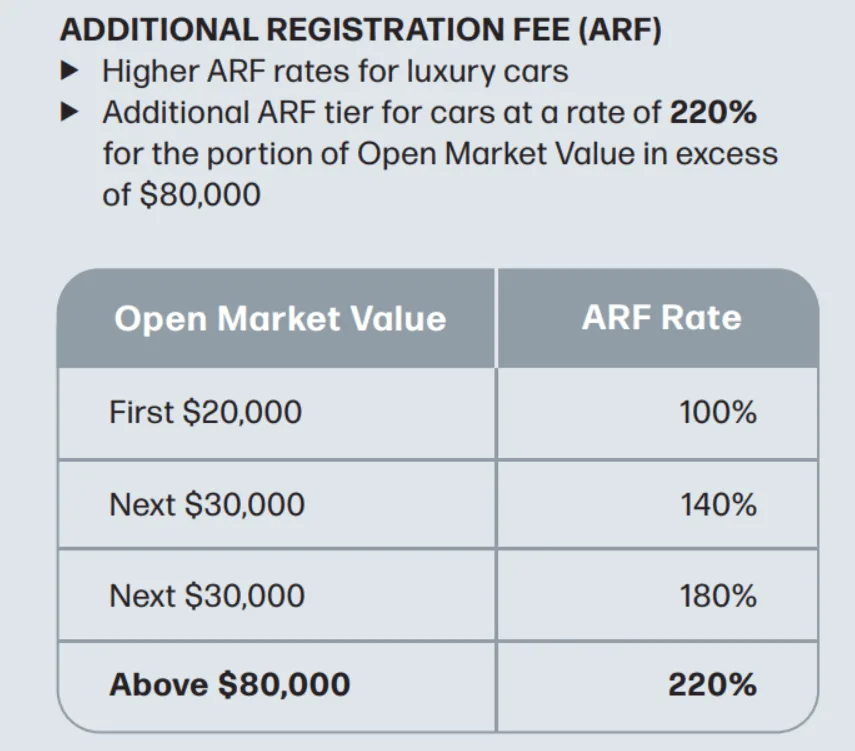

The government will also tax luxury cars at a higher rate to make the vehicle tax system more progressive.

The government decided to introduce a new additional registration fee (ARF) for vehicles with an open market value above $80,000 at a 220% rate.

Most of your vehicles will not be affected.

The cars that will be affected are the Porsche Cayenne, Lambo, Bentley, Rolls-Royce, Aston Martin.

The new ARF structure will apply to all cars, including imported used vehicles, registered with certificates of entitlements (COEs) obtained from the second bidding exercise in February 2022 onwards.

As an example, a Ferrari Roma with an OMV of around $311k will see its ARF rise from $531k to $624k.

Commentators say that this increase is not a lot, especially for the very rich. A more progressive tax would be to levy a surcharge instead of an ARF, which the owners can recover when they scrap the car.

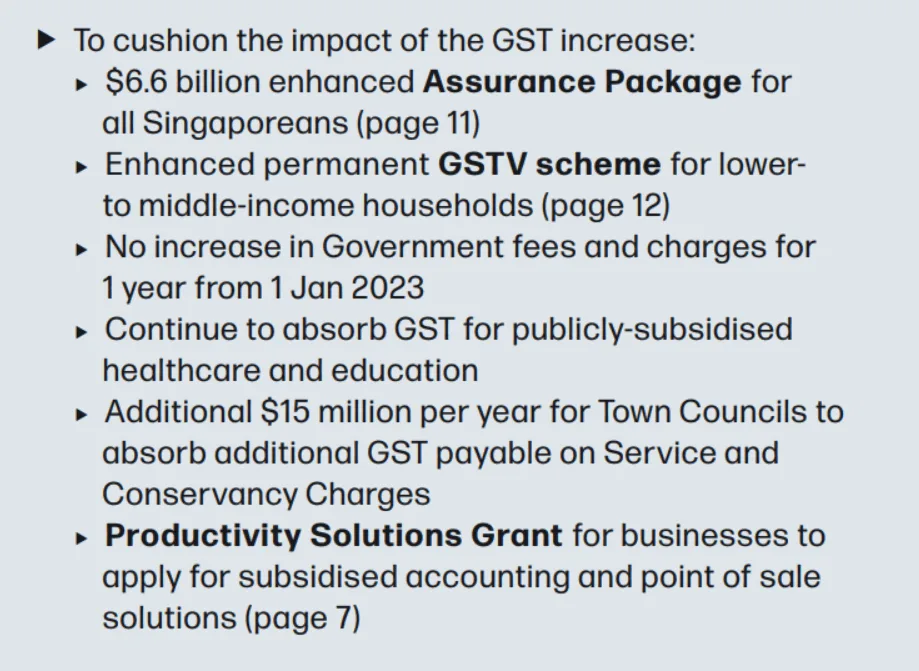

GST to Increase in 2023 and 2024

We will finally get a clear timeline for when our GST will increase.

If you saw the budget operating revenue table before, a 2% rise is about a 28% increase in GST tax collection. Of course, there are some things that would be exempted.

- First increase: 1 Jan 2023 – 7% to 8%

- Second increase: 1 Jan 2024 – 8% to 9%

Government fees will not increase for one year from Jan 2023.

Here are the stuff to help cushion the rise in GST:

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024