There are two new digital banks in the news, but one is trying to woo you to sign up for their credit card, and savings account with a blend of unique rewards.

The one that caught my attention was a free sack of fragrant rice. I feel we are in a bear market for carbohydrates, and they have too much rice to clear (Health warning: If you have read my experience monitoring my blood glucose 24-7, it should be enough warning to eat less white rice.)

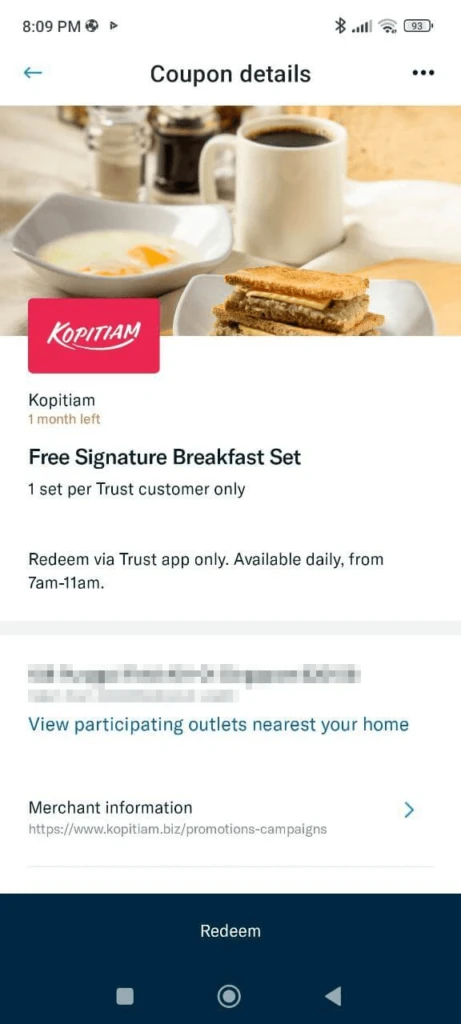

There is also an old-school breakfast set from Kopitiam.

And last but not least, you can easily get S$35 worth of FairPrice e-Vouchers to spend in FairPrice Group shops.

These are the sign-up bonuses to reduce the inertia of signing up for Singapore’s newest digital bank Trust Bank platform.

All you need to do is to sign up for the equivalent of the traditional NTUC Link Credit Card, which is called the Trust Link Credit Card.

I felt that the card replaces the current NTUC Link credit card and if you are already an NTUC Link card member, signing up for Trust Bank’s Trust card is a no-brainer.

But as someone who does not buy a lot of groceries from NTUC’s ecosystem, I never see the advantage of being in the Link ecosystem.

The interest you can earn on the deposits in Trust bank so not significant (but not too bad).

But if you are hungry for a sack of rice and traditional breakfast (as well as S$35), I will show you today how you can get them.

The Simple Steps to Secure Your Sign-up Bonus of a Sack of Rice and S$35 FairPrice E-Vouchers

You first need to go to Trust Bank and Download their App (on the top right corner).

Once you have downloaded the app, launch it, and it should bring you to the screen below:

On the first screen, you can choose to get started with a referral code or without a referral code.

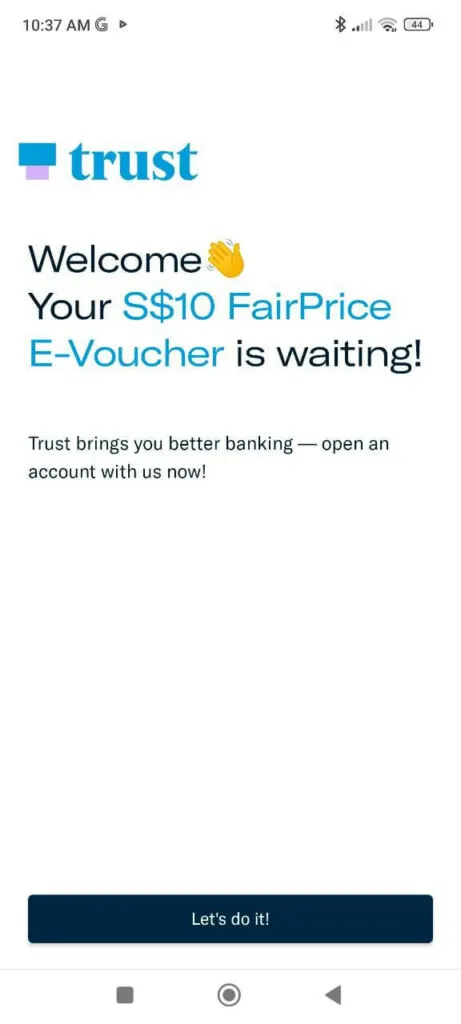

If you use a referral code, you will get S$10 FairPrice E-Vouchers to spend. If you have multiple family members, use a family member’s code.

If you do not have one, you can use my referral code: TBA1UDKV

(Note: I will get S$10 as well)

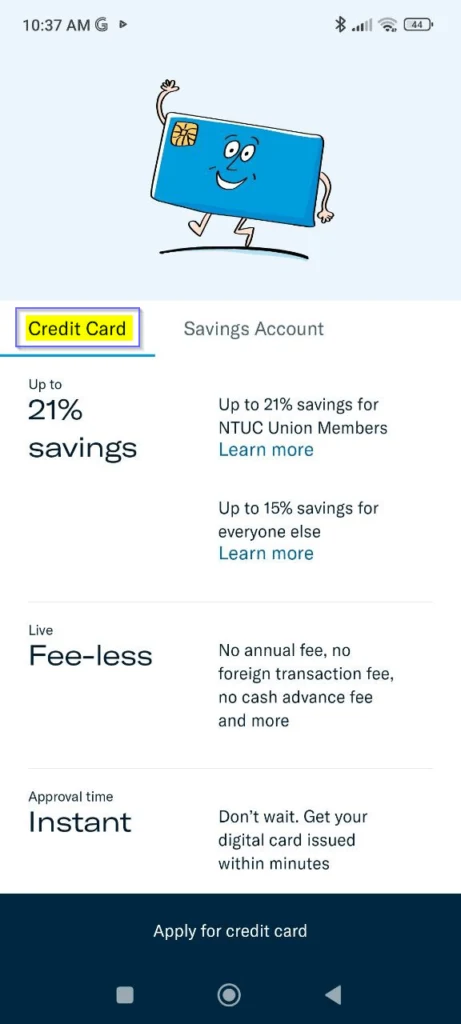

You can apply for a credit card or Trust bank’s savings account. Don’t apply for the savings account first.

Apply for the Credit Card. To get the freebies, you just need to apply for the credit card (you can consider whether it is worth your while to apply for the savings account later).

Go through the credit card application process by authorizing access to your personal info through SingPass.

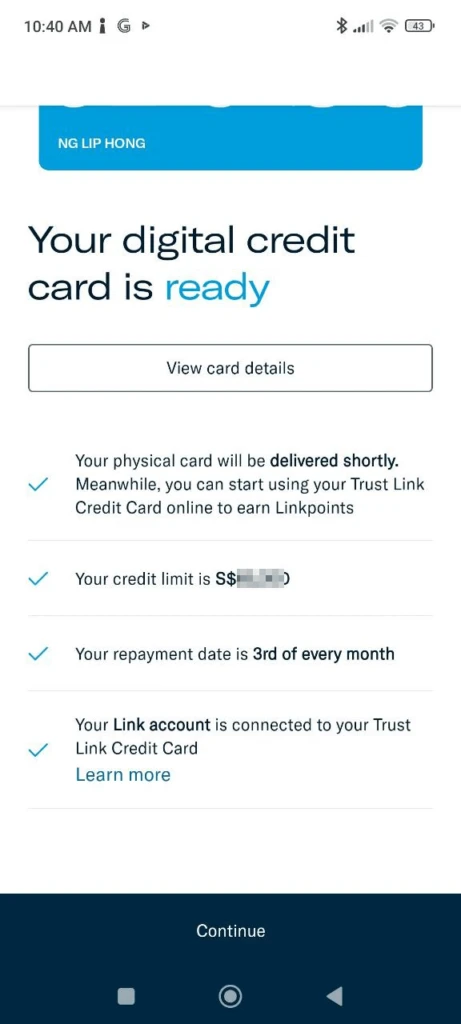

If you go through the application successfully, your physical card will be delivered to you, the credit limit is provided, and you can adjust your credit card repayment date.

If you have an NTUC Link account, that account will also be connected to your Trust Link Credit Card.

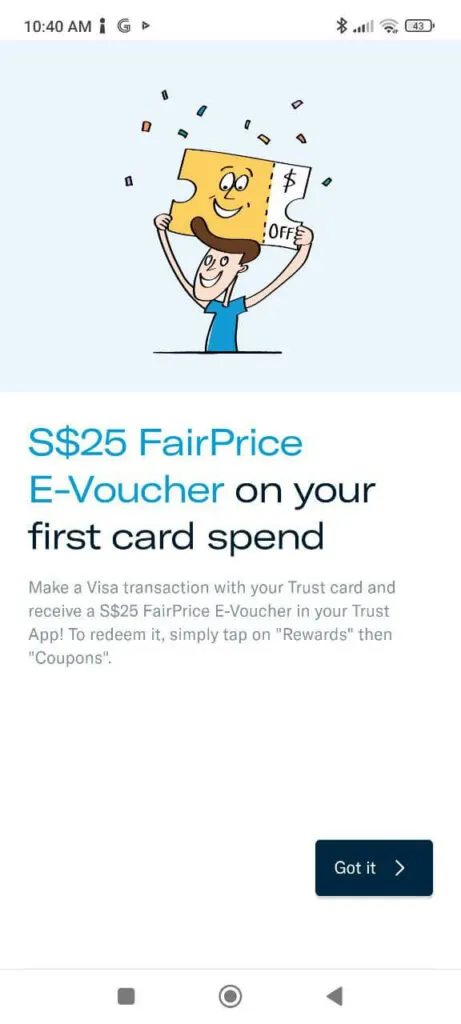

To get an additional S$25 FairPrice E-Voucher, you must make a Visa transaction with your trust card. You do not have to wait for the physical card. Perhaps you can use the virtual card to make an online transaction, which would satisfy the requirement.

You can choose to buy something small, or some people had success making top-ups to their Revolut account.

So where is your sack of rice and S$10 FairPrice e-Voucher?

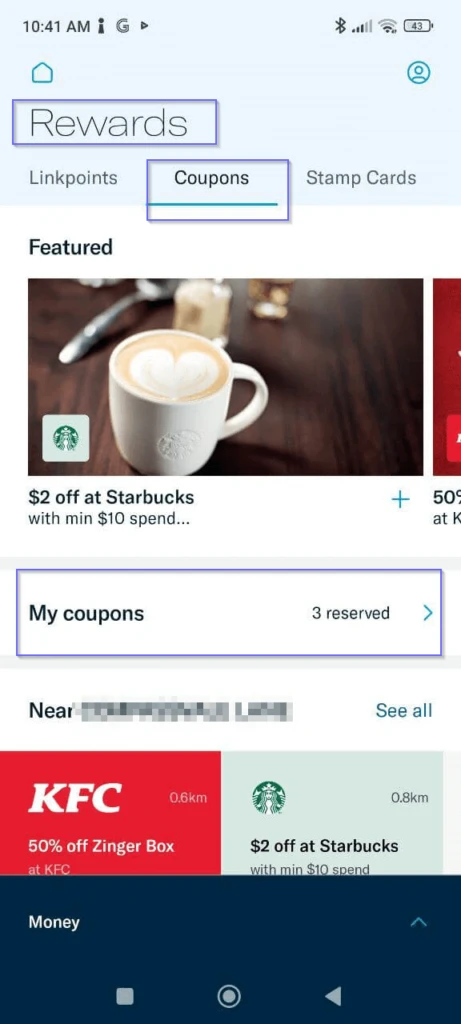

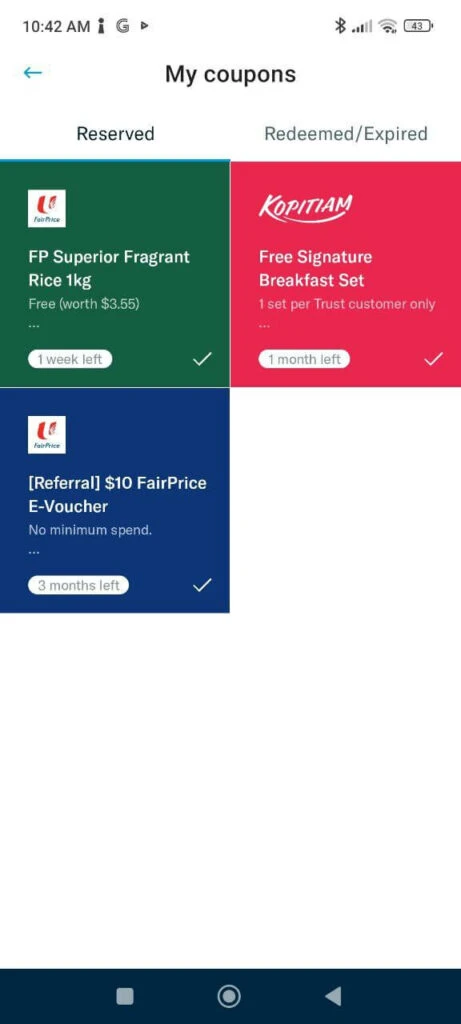

If you go to Rewards, under coupons, you will see 3 Reserved coupons.

You will see the coupon for your fragrant rice, a complimentary breakfast set in Kopitiam and a $10 FairPrice E-Voucher.

That is it!

Do note that the FairPrice e-voucher has a four-month validity.

Where can you spend your FairPrice Group Voucher?

Here are the possible places:

- FairPrice

- FairPrice Finest

- FairPrice Xtra

- FairPrice Shop

- Warehouse Club

- Unity

- FairPrice Online

- FairPrice Cheers and Xpress (except those found in Esso stations)

- Kopitiam (stalls and top-up card)

A lot of places to spend for Singaporeans.

Any Fees on the Trust Link Credit Card?

The Trust Card, which is a combination of credit and debit function, are relatively free of fees:

- No annual fees

- No cash advance fees

- No foreign exchange fees (both on the bank and Visa’s side)

- No ATM withdrawal fees

- No card replacement fees

- No over-limit fees

However, if you take a cash advance, you would incur interest from the date of your transactions. And credit card interest is not low.

Who is Trust Bank?

Trust Bank is a digital bank joint venture between Standard Chartered Plc and FairPrice Group. FairPrice Group belongs under NTUC Enterprise. Standard Chartered owns 60% of this venture and would drive the banking and credit infrastructure.

It makes sense for them to partner with someone with an enormous and very sticky retail footprint, such as FairPrice Group. The supermarket group has a network of close to 570 touchpoints, including groceries and meal offerings. NTUC’s Linkpoints is also a unique, established rewards ecosystem to further built and grow.

If I get a reward, I want it to be liquid enough. If I can spend my reward on my default grocery and essential meal choice, then it increases the incentive to be in the ecosystem.

However, I wonder if digital banking services can revolutionize banking other than offering variations of traditional banking services. This may be a topic to expand upon in a future article.

For now, I need to think about when to take my Kopitiam breakfast set.

If you don’t have a referral code, you can use mine:

TBA1UDKV

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024