This is Kyith here. Just a little update.

I have been running different promotions for Futu SG since April this year to introduce you to their platform.

If you sign up today, the offer is slightly different from the previous few promotions.

Futu SG has decided to continue delivering a welcome package for those who decide to give their platform a try.

So here is the September 2021 promotion.

Nasdaq-listed FUTU Holdings have set up shop in Singapore, FUTU Singapore Pte Ltd and you can now trade Singapore, Hong Kong and the United States stock markets through their platform.

Their one-stop investment Singapore brokerage platform is called moomoo.

As part of a welcome gift, when you sign up with Futu SG before 2nd Oct 2021 and deposit SGD$2,700 within 30 days, you can get a share of Apple stock (Ticker: AAPL).

This bundle is worth an estimated SG$205. The best part is that I think you do not have to jump through a lot of hoops to get this $205. I completed the sign-up and funding in less than 2 hours but have to wait a while into the day to see the FREE Apple shares and cash coupon. But it did arrive eventually.

This Welcome Gift Package is only available till 2nd October 2021 so if you are interested you got to sign up FAST.

There is a limited redemption of 15,000 shares only!

Aside from this, if you wish to dip your toes into trading.

In this article, I will highlight some of the great advantages of Moomoo as well as how easy it is for you to sign-up and get this very accessible SG$205.

Attractive Special Welcome Bundle Worth SGD$205!

You might be using another brokerage account for your trading and may be reluctant to open another brokerage account to try.

To motivate you to open another account, Futu SG is offering you a very special bundle.

The bundle includes:

- Unlimited Commission-free trading in the US, HK and SG markets for 180 days

- Free level 2 Market Data for US market

- Free level 1 Real-time Market Data for Singapore market

- Free level 1 Market Data for China A-shares

- One FREE AAPL share after depositing SGD$2,700

Apple currently trades at around US$153. If we convert to SGD, that is almost SG$205.

The hurdle to secure this attractive bundle is very low.

However, this special bundle promotion will end on the 2nd of October, 2021.

Here is How You can get this FUTU Special Welcome Bundle

Here are the steps to get this bundle:

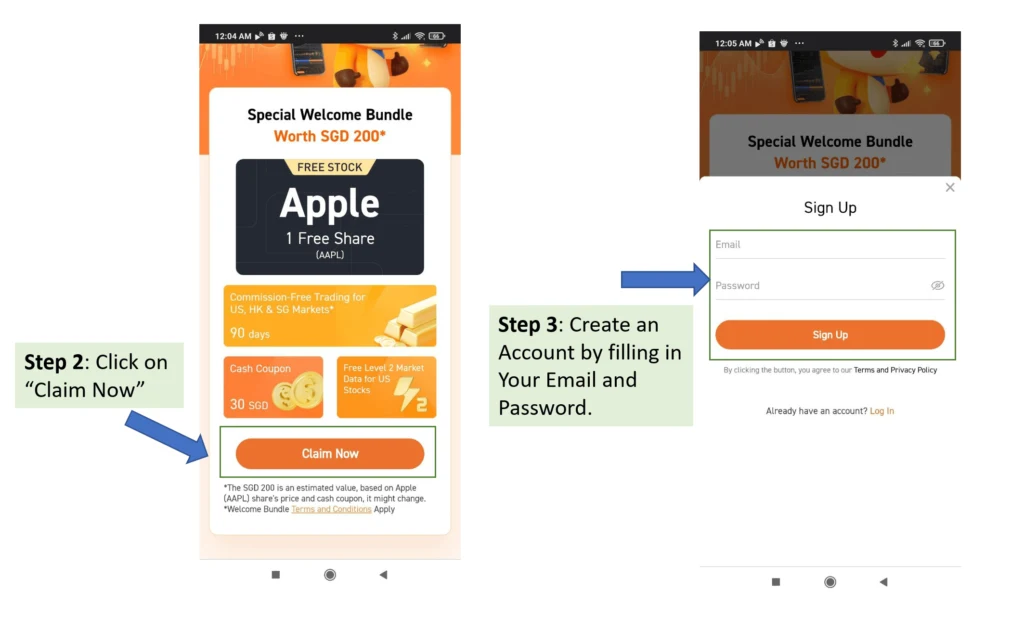

Step 1: Sign up using this special link.

Step 2: click on the “Claim Now” button

Step 3: Fill in your email and password to sign up.

Step 4: You will need to download the moomoo app from Android Playstore or Apple App Store and install it. Then you will need to log in.

Step 5: Setup and open the trading / Futu Securities account.

Step 6: Wait for your account to be approved. This should not take too long.

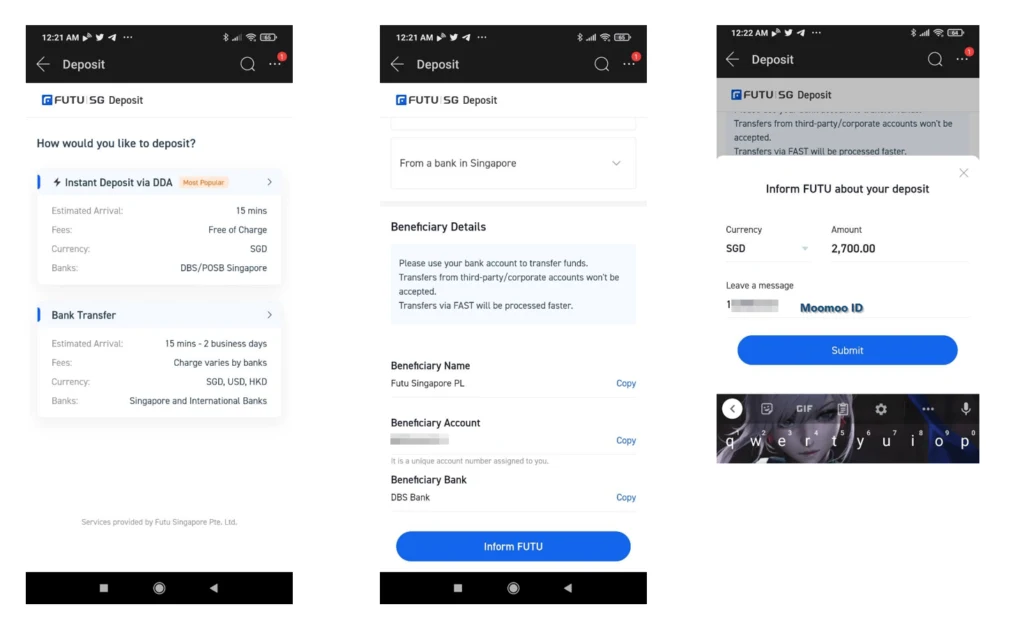

Step 7: Fund your Futu Securities account from your Bank with FAST transfer (the bottom method in the image.). Futu will provide the beneficiary account number and bank you need to transfer to. If you are also using DBS bank it should be a fast DBS to DBS transfer. Before you transfer, do remember to click on Inform FUTU and key in your moomoo ID. This is to ensure that Futu’s system can match the fund transfer to the right account. Deposit at least SGD$2700.

Step 8: You will have to make 5 trades to qualify for the Apple share. Since you have a free trading commission for 180 days in SG, HK and the US markets, you can make the trade to qualify for this.

My suggestion is to find a stock that does not have earnings soon and do not move around much, yet 1 share is pretty cheap. Some of the broad-based ETFs may be ideal to fulfil this.

Step 9: If you have done everything correctly in one day or two, you should see the FREE Apple share. The system will freeze the Apple share until the client deposits the money in 30 days. You do not need to click anywhere. The Apple shares will be sent automatically.

That is it.

I have personally opened the account, got the Apple share.

Complete the moomoo powered by Futu Sign-Up and Funding Process in Less than 2 Hours

Signing Up to moomoo powered by Futu was pretty seamless.

- Creating the user id and password, then downloading the application takes less than 2 mins.

- By using MyInfo to fill up my personal details, that took less than 5 mins.

- Waiting for approval from Futu usually may take 1 to 3 business days but based on my experience, you should receive an email notification within 1 hour.

- Funding your account via a FAST transaction or even faster DDA may depend, but from a few of my experiences, it can be as fast as 15 minutes. Personally, I would recommend that you choose the DDA option.

Thus, if you complete this process within such a short time, you will be able to get the Special Welcome Bundle pretty fast.

What is Level 2 Market Data and Why it is a Big Deal?

Level 2 market data allows you to gain greater insights into the current trade pattern for the stocks that you are interested in.

- You can tell what is the current price taking place instead of only seeing the price 15 minutes ago. (Unless you purchase the data, most brokers will only display the stock prices with 15 minutes of delay.)

- Allows you to see the market depth. As a sophisticated investor, you might be able to detect funny pattern and risk manage your position better.

In the screen capture above, you are able to see the number of shares on buy and sell queue.

If you sign up today, moomoo will give you FREE level 2 data for the US market.

Services Provide By moomoo

Futu has provided the kind of sophisticated platform that we wish to exist a few years ago.

They have done their research and provided their clients access to the markets and instruments that are popular for Singaporeans:

- Trade stocks, ETF and REITS in the US, HK, SG markets.

- Trade OTC, options and ADR in the US market.

- Trade warrants and CBBC in the Hong Kong market.

You can open either a cash account or a margin account.

A sophisticated investor may prefer the flexibility of the margin account to tide them through periods of short-term liquidity crunch and sensible leverage level.

moomoo powered by Futu is what we will call a broker custodian account. Unlike your traditional Singapore broker, your Singapore shares are recorded or “stored” with the broker. In this case, it is Futu holdings. Typically, your local Singapore shares will be held in CDP accounts.

However, if you are trading overseas shares such as trading shares in the United States or Hong Kong it does not matter. This is because every broker will be the custodian of your foreign shares.

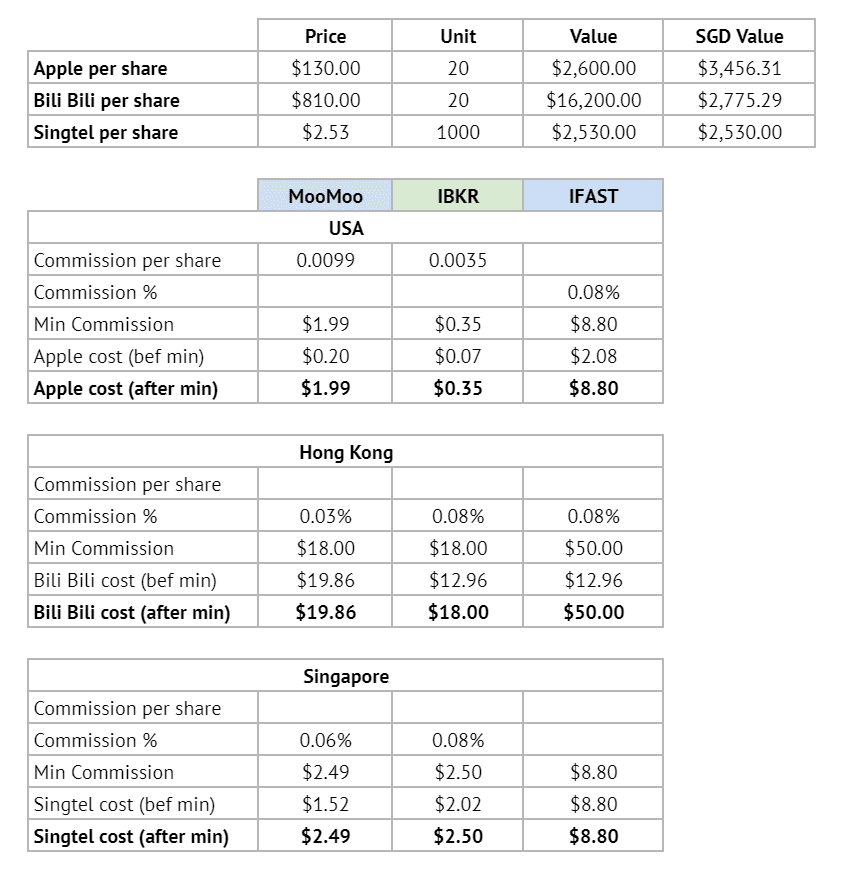

FUTU’s Commission Rate is Quite Competitive

The commission rate or sales charge every time you have to pay when you trade with Futu is rather competitive.

Futu charges your typical commission on a per-share basis or a percentage of the transaction.

What is unique is that they charge a platform fee per order. From what I understand, this platform fee is not based on the value of shares invested on the platform but based on transactions.

To let you gauge where Futu’s commission stand in the available local brokers, I compared Futu’s structure with the very competitive Interactive Brokers (represented as IBKR below) and a rather popular and competitive local broker iFAST’s FSMOne.

We went through three different small stock purchases in the three markets that moomoo is available in. These stocks are Apple in the US, BiliBili in Hong kong and Singtel in Singapore.

Due to the small value of the transactions, the investor would incur at least a minimum commission + platform fee.

- In the United States, Interactive Brokers (IBKR) is the cheapest but Moomoo is not too far from IBKR.

- In Hong Kong, moomoo and IBKR is quite close.

- In Singapore, the commission cost is not too different between moomoo and IBKR.

If your trade size is small, Futu’s Moomoo is very competitive.

(Note: in this comparison, there are some regulatory costs, goods and services tax (GST) that are levied by individual stock exchanges that are not included. However, these costs are levied regardless of which platforms you used)

Regulation and Protection

Since Futu Singapore Ptd Ltd is new in Singapore, you might be interested to know the level of regulation and protection your money is subjected to.

Futu Singapore Pte Ltd is a capital markets services license holder regulated by the Monetary Authority of Singapore (License No CMS101000). Futu holdings limited, the ultimate parent company of Futu SG, is listed on the NASDAQ under the stock ticker FUTU. This will allow you to scrutinize the financials and assess their financial robustness.

Currently, they hold a Capital Markets Services (CMS) licence (view license in MAS directory).

This license is not so easy to obtain. Hence in a way, Futu has to be compliant with the MAS level of audit on a very consistent basis.

Under Securities Investor Protection Corporation (SIPC) protection, securities customers like yourself are protected up to US$500,000 (including US$250,000 for claims in cash) in U.S. securities purchased from Futu.

It is important to understand that SIPC protects customer accounts against losses caused by the financial failure of the broker-dealer, but not against an increase or decrease in the market value of securities in customers’ accounts.

SIPC does not protect against market risk, which is the risk inherent in a fluctuating market.

Moomoo provides very Comprehensive Fundamental Data

Even if you are not trading through moomoo, the mobile platform provides a lot of value add.

Aside from the level 2 market data for the US market, moomoo have very comprehensive fundamental data.

This is one aspect that they managed to do better than Interactive Brokers and the traditional platform.

Let me show you some of the fundamental data that I appreciate quite a bit.

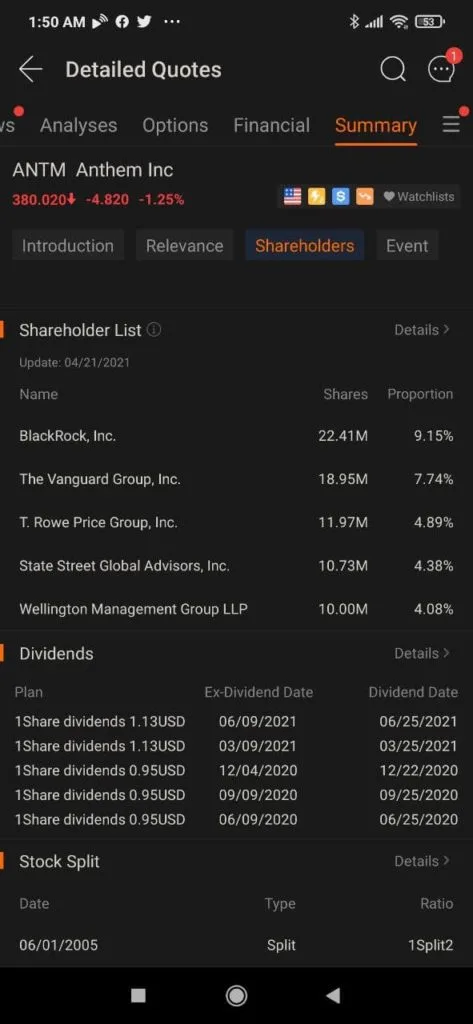

We will use Anthem in this example. Under Financial, you will be able to have a quick glance the 5-year performance of Anthem’s revenue, operating income and net income.

You will be able to see its balance sheet and cash flow statements as well.

If you require greater detail, touch on the Details and you will be able to see more.

Instead of having to comb through the financial report for a new company, reviewing the Summary will show us who are some of the top shareholders. In this case Anthem is dominated by funds.

What is very helpful is that in a quick glance you can review the frequency of the dividend payout as well as when there was a stock split.

Whenever I prospect a company, what frustrates me was where to find whether a company have split or combine their shares in the past. So being able to review it here is a big plus.

Under Summary > Shareholders, we are able to see the institutional participation in stock as well.

Summary

I think you will get a pretty good deal if you sign up with Futu SG.

The rates are rather competitive, and there are other bells and whistles that you do not get in a lot of other places.

The process is smooth and fast and if you do not like it, you can withdraw your money easily and move on.

But at least you experience the platform.

Here is my affiliate link to sign up. You have to sign up through this link, then go to the app store to download the application.

Here are some information asked and not covered:

- There is no custodian and dividend handling fee.

- You can deposit US$2,000 or HKD16,000 instead of SGD.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

CK

Saturday 18th of September 2021

The system will freeze the Apple share until the client deposits the money in 30 days. You do not need to click anywhere. The Apple shares will be sent automatically.

what do you mean they will freeze the apple share until client deposit money. What money are you referring? the $2700?

When can I sell the apple share and withdraw all the money back to my bank?

Kyith

Saturday 18th of September 2021

HI CK, when you create the account, the stock will not be available to you. They withheld it until you deposit the money and make 5 transactions. If you deposit the money and make the 5 transaction correctly, the Apple share will appear. Then, you can sell the share.

Wil

Wednesday 8th of September 2021

Hi Kyith,

May you share what is the best way to convert HKD and transfer to Moomoo if want to trade the Hongkong share? Thx

Terry

Sunday 5th of September 2021

Hi Kyith,

Is it possible for me to redeem the prize if I signed up for Futu way before all the promotions started? Unfortunately, I signed up for Futu after its very first promotion during its foray into Singapore. A few weeks later, another promotion was launched and I am not sure if I could redeem the prize as I didnt sign up during the promotional period

Customer service did not get back to me on this and I didnt follow up as I thought $100 wasn't much. But thinking of it now, it is quite unfair that every new customer can get to enjoy the promotion so I thought of trying my luck again.

Given your influence, are you able to check if unlucky customers who have signed up in between the promotions run by Futu are eligible for these free gifts?

Appreciate your help!

Kyith

Monday 6th of September 2021

Hi Terry, I did check with them on this as someone else asked. From my understanding, that may likely be not possible.

Ben

Monday 31st of May 2021

Does this mean you do a bank transfer through DBS (setting up beneficiary name and account) or do you use the instant deposit via DDA?

Kyith

Monday 31st of May 2021

Hi Ben, I did both ways. But I think doing DDA is better.

Wil

Tuesday 4th of May 2021

Hi Kyith,

May i know if we can purchase this fund, Dimensional Word Equity Acc SGD (Which you also purchased) via this platform? Or we ca only buy it via Moneyowl?

Wil

Friday 7th of May 2021

@Kyith, Thx for reply. May i know what is the Endowus expense ratio for this Dimensional Word Equity Acc SGD ?

Kyith

Wednesday 5th of May 2021

Hi Wil, not possible because Dimensional World Equity is a unit trust and usually can only be purchase through advisory platform. MoneyOwl advise with a fixed 5 portfolios and World equity is not part of it. I think you can get it with Endowus.