A week ago, during a quarterly performance check-in, I was briefed that my time in Providend would be spent more on dealing with the solutioning side of the business than the investments stuff.

When I joined the company, my time was split into two different aspects of the company:

- Solutions – Doing all the brainstorming, preparing the materials that goes into the ongoing advisory process. If you are a client or a prospect and have been through our advisory process, seen the wealth management plan, investment policy statements, investment factsheets, you may smell some of my sweat on the documents. Aside from that, there are always a few ad-hoc brainstorm work that land on my lap within the past 2.5 years.

- Investments – As part of a team, we sheperd the flagship investment portfolios that majority of our clients own, making sure that the funds in the portfolio do what they are suppose to do, make sure the portfolios client’s use are well-balanced. We also think about whether there are components that we should add to the portfolio or replace certain allocations with something better. There is also alot of ideas that were researched and rejected. I also did a large part of the parts that requires some kind of data-crunching.

With some of the latest quality additions to the investment team, as well as deliberate process improvements, my involvement in investments looks likely to be minimal going forward except for some ad-hoc data-crunching work.

Some of Investment Moats readers might be clients so it should be clear that the views that I shared through different media channels are my own views and do not represent that of the Providend investment team.

I think this is probably for the better. Less confusion at least.

In this post, I would like to share some of my thoughts, things I learn or didn’t learn doing the investment work in the company.

I Regretted Not Paying Attention to My Statistics Teacher in School

The job in the investments team involves reading up a fair bit of investment research.

This is where I realize that reading and writing research papers are like another foreign language. I do not understand why they have to write in such a manner that is so hard to comprehend and not in a more conversational way. I go a feeling that academics are comfortable with this like they are comfortable with German.

At different points in the Singapore school system, we would have learned some kind of statistics. But if you ask me, I aced my maths through knowing the answers but not understanding how things really work.

Not having a strong grasp of stats really impeded my speed of understanding when I read a lot of these papers.

Not understanding some of these maths and statistics became a big problem in some parts of my investment and solutions work.

I had to do research work to validate the potential problems and design a solution in one of our planning products. It involves interpreting some of the math and statistics work someone else has done.

Working on that project has got to be one of the loneliest times I felt in my working life.

I had to interpret and validate the math in an existing spreadsheet, see whether we can use the math in a different way and use it correctly. Then when the results came out, and the results did look not very favourable, I needed to figure out if I am interpreting it the right way or not.

While I did say that most of the investment framework that is needed for work is not too difficult for me to understand, this was something that I could not comprehend that well.

In a company where you are brought in specifically to do something that is different from others, it is a big problem when you have no one to turn to. I went around asking a few of my friends outside who are stronger in statistics and math and they too could not help me comprehend things.

It is only later when someone in the firm advised me to turn to someone for help that I managed to frame and understand this problem better to figure out some solution.

In life, most of the time, simple math can carry you for most situations but probably not in this job.

Data Reveals a Different Investment World to Me

One of the bigger joys about working in Providend is the easy access to historical market data.

For a student of the market, access to these historical data is similar to having access to a pantry full of Doritos.

I really enjoy the periods where I can crunch those data with people interrupting me.

If you are able to review historical inflation and returns data of different class/geographical regions of the market, it affects you in different ways.

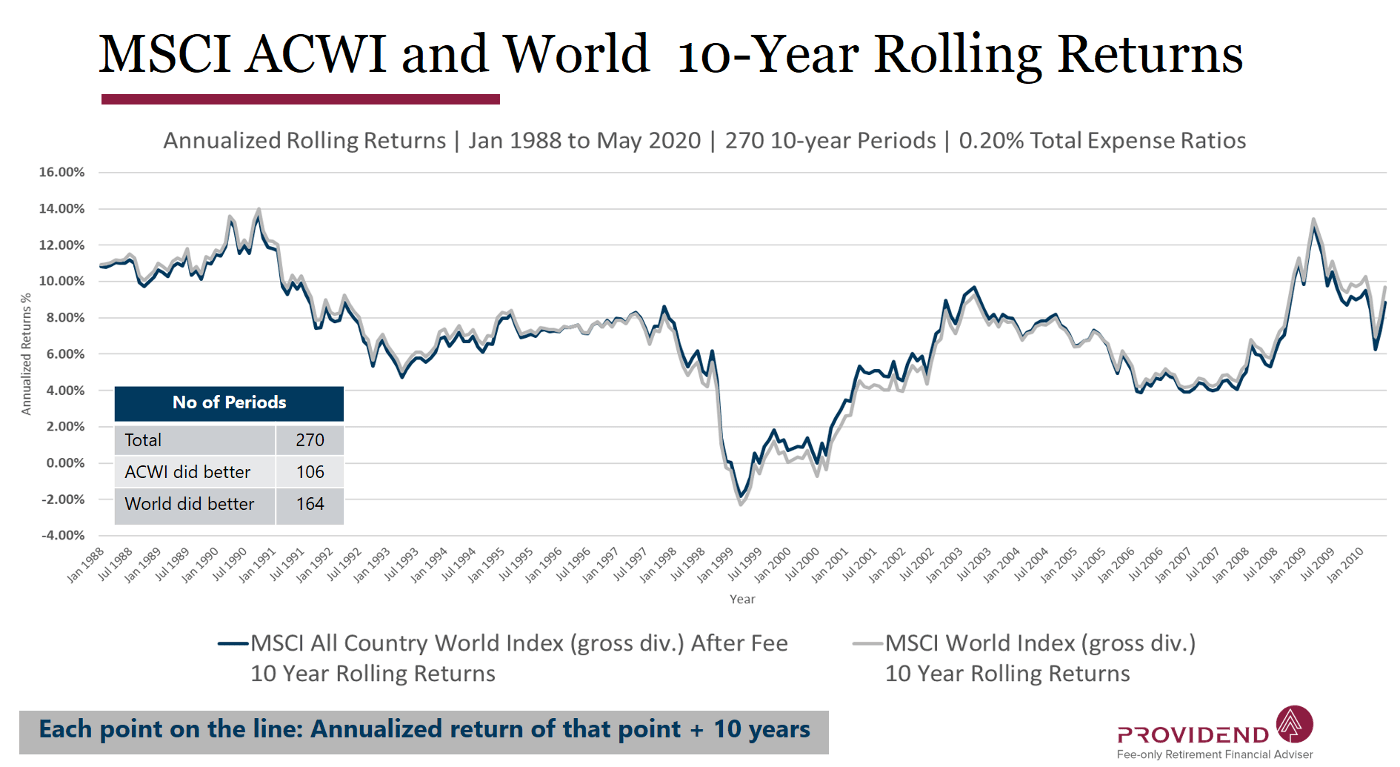

After a 10-year bull run, everyone has anchored the expectation of their return to 10-14% a year. Many people didn’t realize that there were enough 10-year periods where the annual returns were negative (If you are interested, read IWDA vs VWRA).

Some investors today cannot fathom why there were so many of their older friends still having funds invested in the BRICs or in small-cap value.

If you see the data, your perception of the markets will change.

It may make a pessimist more optimistic but in some other situations, it can also tamper with an optimist’s wildly positive expectations.

Inaction In Your Portfolios is Also An Action

If people pay you a fee, there is always an expectation that some decisions and actions need to be performed on their portfolios from time to time.

But often, if a portfolio is well thought out strategically, less shifting within the portfolio is better.

That does not mean not changing things.

We do a fair amount of work considering things and in the end, we decide some ideas do not have enough empirical evidence that they will improve the portfolios.

But these are seldom mentioned and it may lead to people wondering if it makes sense to pay money for that.

Perhaps the other way of looking at this is whether more actions on your portfolio impede you from capturing the returns.

Good Communication Increases Conviction and Keeps Clients Invested

I feel that one of the value propositions of a Robo-adviser is that they are able to connect the client to the funds and ETFs.

Some Robo-adviser is able to arrange for sessions or webinars where the fund managers of the funds are able to explain their investment philosophy, how they do things and answer some queries the investors have.

By doing that, the investors understand the fund better, and with the help of the Robo-adviser, they are able to frame the role of this fund in their portfolio better.

This may allow them to have a greater conviction in the funds and stay vested longer.

In the past, many buy unit trust to gain exposure to an underlying sector or geographical segment. If a fund underperforms, they have no idea why it underperforms and often, the investor does not give the fund enough time to work itself out. If the fund did extremely well, they have no idea as well.

The great thing about using index funds and multifactor funds in our portfolios is that it makes performance attribution very clear.

If our portfolio underperforms or outperform, we can tell you it’s due to this region, that this profitability factor not showing up and the size factor doing well.

When we consistently communicate and explain to our clients the performance of our portfolios in such a granular manner, it shifts the conversation not so much to the funds but to the strategy, philosophy and the factors.

I would like to think that greater understanding gives a sense of control over their wealth which increases conviction.

Investments versus Solutions – Which do I prefer?

The work of designing solutions is very dynamic work.

Every year, things are different and if you enjoy working on different things every time and being mentally challenged, solutions work is for you.

Touch my heart, if I were to chose, I think it will be investments mainly because while investment work can be dynamic, on a high level, investment stuff largely stayed the same. The investment models do not change much and since I came into the work with an interest and understanding of a fair number of models and concepts, doing that work is less taxing on my brain.

There are definitely things that I am unfamiliar with but largely there are fewer mental demands.

Doing solutions requires you to not just think about the solution from the financial planning angle but also the investment aspects so there are greater permutations to think about.

I guess I just enjoy doing repetitive things.

In my old job, there was a lot of repetitive things. Every morning log into 12 remote desktops to check and make sure the world is not burning down. Every month run around for 2-3 days doing patching in different sites.

Many of you hate that kind of work but I dunno, it allows you to be disengaged mentally sometimes.

But if it is repetitive, the value of that work is much lesser and it is not a good thing to keep doing that in your career.

Investment work I feel is like IT application and system problems sometimes. You will figure out how to go about solving the majority of the application and system problems over time. At first, it is definitely tough because you are trying to piece things together.

Over time, there are bigger IT bombs but usually, no matter how big, the problem and the solutions are quite fixed.

In contrast, solution work is like starting and closing projects constantly. It feels like going back to the project management days. Every project is a different kind of experience. Either the schedule is too short to complete the project, or the sales team sold a set of requirements that is technically undoable given the budget given.

Your brain is constantly taken in various directions. It probably prevents dementia but fxxk it is not very nice as your brain NEVER rests. After finishing with one solution, then you have to think about another thing which is totally different.

Being a Steward of Client’s Wealth is a Heavy Responsibility

Perhaps the biggest realization is that clients entrusted their future to us when they believed in our advice.

And it is a heavy responsibility to manage their money well.

If I fxxk up my own portfolio, at most my family suffer. If we do not consider things well at work, numerous families’ futures gets affected badly!

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024