After more and more people come out to say that leasehold will go down to zero value, more and more are preferring to purchase freehold than leasehold.

There is also this saying that only freehold and no leasehold.

So I wonder if you cannot get a decent compounded return if you held a leasehold for a long time.

So in this article, I will show everyone a case study of a local private leasehold and how its return profile looks like in the past and in the future.

Last week, I put my home and my friend Caveman’s home through my property spreadsheet to compute how the long term return prospects will look.

Both our place is about 21, 22 years old and without factoring any rental expense we saved had we choose to rent instead, the rate of return based on XIRR is about 1% to 2%, depending on how long we hold on to the HDB flat.

If we have factored in the annual expenses saved, then my Seng Kang home will have a terminal XIRR of around 7-8% while Caveman’s place will be 13%.

If we evaluate this solely based on capital appreciation, it does not look fantastic, and that is probably the wrong way to think about a property’s return profile.

This week, I have decided to do the same thing but with a private leasehold property.

The 24-Year Old Astoria Park

Since the 2 flats done the last time around was rather dated, I thought it is more appropriate to base this week’s case study on one that is around the same period.

Eastpoint Green that started in 1998 became a very good candidate to profile until I realize that after 21 years the capital appreciation is less than 1% a year. For some other owners that bought not at the launch, their experience will be rather different.

So in the end, I chose Astoria Park in Kembangan.

This is a medium-size condo of 350 units situated very close to an MRT station. In today’s climate, this will be a project that would attract enough buyers.

This condo first started selling in 1995 and we will assume that there is an owner who purchased one back then as an investment property and how much he would have made in terms of our standard return today (2019).

The buyer purchases an 1173 sqft 3-bedroom condo for $750,000 back in 1995. $750,000 is probably a lot of money back in 1995.

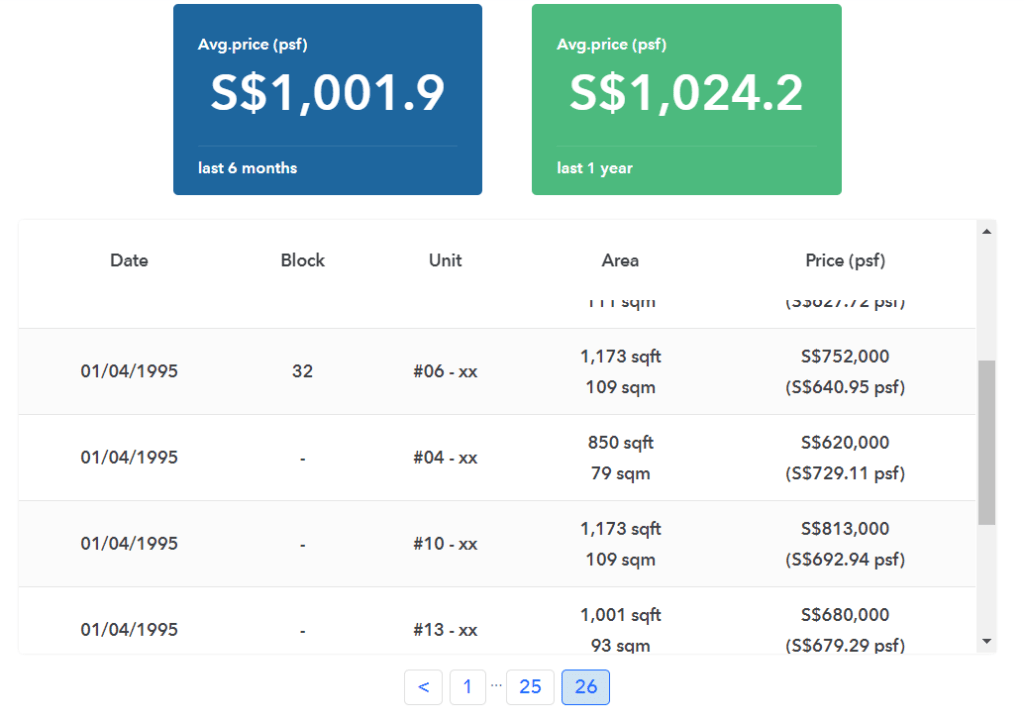

99.co has become a good place that provides some data on historical transactions. The great thing is that they have transactions that go back all the way to 1995.

For those of you who wish to do research, you can take a look at how price changes.

Price Appreciation

For a similar unit, listings are trying to sell at $1.3 million. Transacted units go at around $1.3 million.

In terms of absolute appreciation, the property went up 73% above the price they purchased 24 years ago.

If you annualized the 73% return over 24 years, the compounded rate of return is 2.31% a year.

That is a return lower than Singapore government bonds, or the 2.5% to 3.5% XIRR of insurance endowment plans.

As an investment property, a part of the return is that you rent it out and collect rental income.

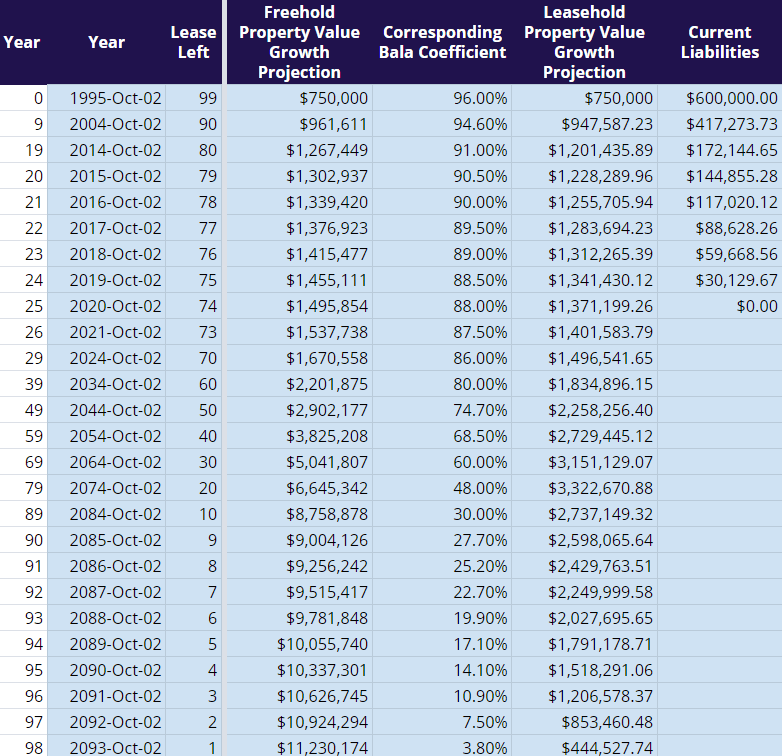

In terms of growth, I do find that the appreciation and the leasehold decay canceled out each other typically on the 80th year. Currently, it would have been worth 1.45 mil if it is a freehold. Value should go down over time.

Rental Income Growth

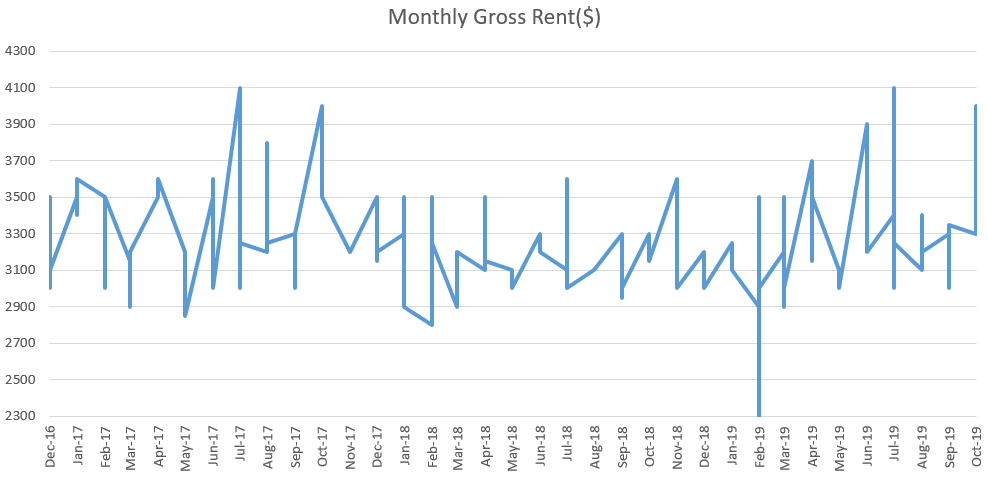

URA keeps a record of private property rentals on their website. It does not go back a long period but it is better than nothing.

Here are the gross rental income agreed upon from 2016 to 2019:

The gross rental income does not show an upward or downward trend for the past 3 years. Remarkably, it gyrates around $3250 per month.

Typically, real estate agents will estimate the net rental income to be 10 months of gross rental income (you can tell me if this is a good estimation). Thus, the net annual income is around $32,500 a year for the past 3 years.

The owner today would almost have fully paid off the condo, and his net rental income yield based on his capital outlay would be 4.3% a year.

Looks pretty good.

If you add the capital appreciation + rental income the total return is about 6.6% a year. Pretty decent.

However, if you purchase the home today at $1.3 mil your net rental income would be 2.5% a year. You would hope the growth rate is better than in the past.

XIRR – The Internal Rate of Return

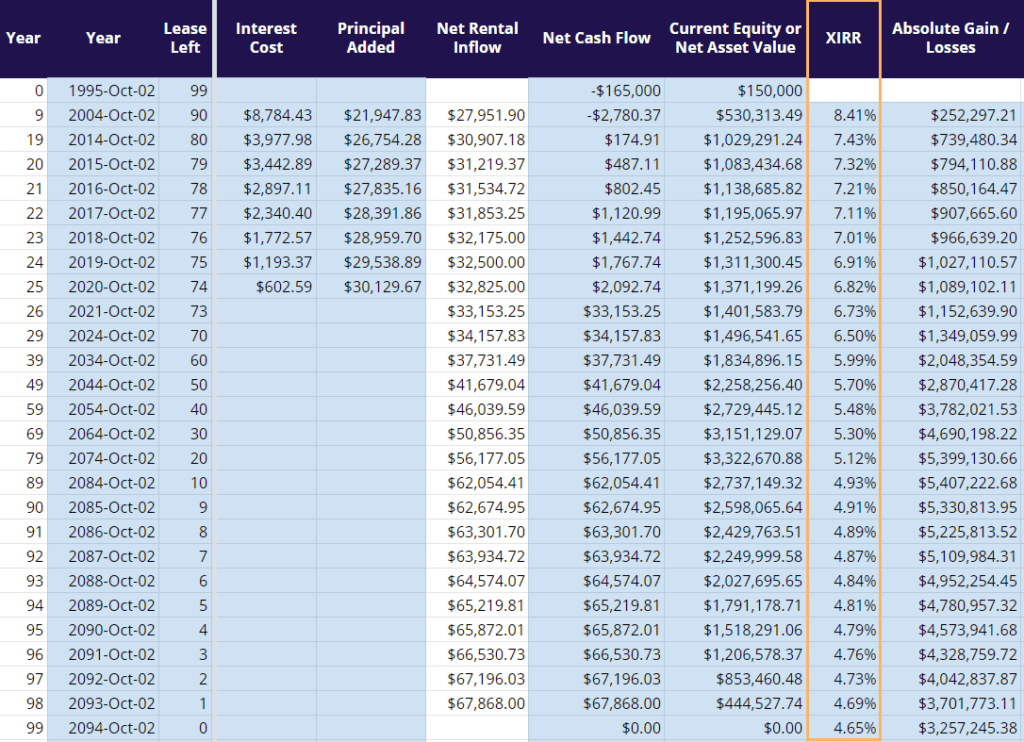

As an investor, you will

- put in a small 20% down payment

- pay renovation and furnishing costs at the start

- pay interest payment over 25 years

- pay for rental expenses annually

Think of XIRR as the “compounded interest rate” you earn per year for the stream of cash outflow that you have put in over the years.

In our calculation, we factored in a rent growth of 1% a year in the past and in the future and an initial $15,000 renovation and furnishing cost.

This return factors in the leverage factor. However, because you paid off the leverage over time, eventually your returns factor in the total cost of your home + interest payment.

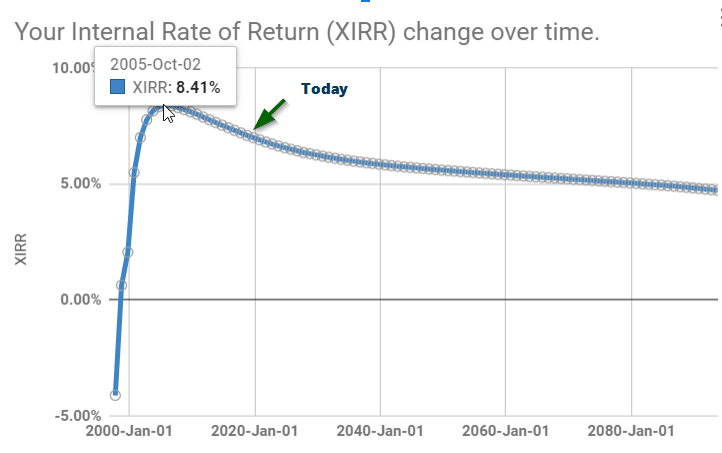

The XIRR starts off low, peaks at 8.4% before stabilizing at 5%. Here is a better illustration:

The XIRR is useful to compare against other investments, be it Singapore Savings Bonds, low-cost passive portfolio, hedge-funds you came across.

You will ask can these investments can beat a terminal XIRR of 6% for such a long duration.

En-Bloc and Collective Sale Potential

One of the advantages of a private property is that you can exit the property through a collective sale or otherwise known as en-bloc.

The whole environment gets very excited because suddenly there are many automatic millionaires. They have so much money that they could pay for 2 condos, and rent out one of them.

I wonder how would the returns look if we factor in En-Bloc Sales.

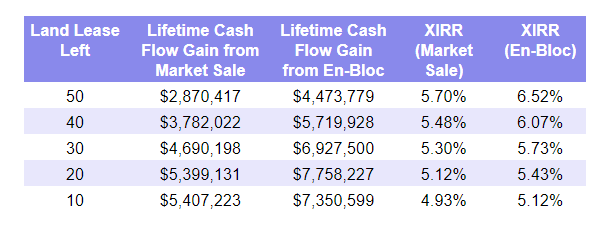

So let us compare the XIRR and absolute return before and after En-Bloc. In this way, we can visualize the difference in compounded percentages and not get too crazy.

The issue with collective sales is that the collective sale premium, which is the amount above current market valuation, varies across projects and time. It can be 25% to 100%.

So let me set these parameters:

- Enbloc potential only after 50 years

- Premium of 75% above the prevailing value

- Exit cost of 4%

Here are the results:

The lifetime cash flow gain measures all the net cash inflow that the investor earns for holding on to the investment rental property all these years.

So a lifetime cash flow gain of $2.8 million means all the rental cash inflow, net off the expenses, net off the mortgage payment plus the cash inflow that the investor get from the sale of the property at market valuation.

If the investor was lucky to En-Bloc his property, the gain would become $4.4 million. That is substantially better.

However, if we look at the XIRR, after 50 years the differences get narrower and narrower. My interpretation is that the majority of the gain comes from rental income, not from the sale of the asset.

While the absolute amount looks great, if we look in terms of compounded returns, you might get a different perception.

Summary

An investment property has the following main cash flows:

- Downpayment (- negative cash flow)

- Mortgage (interest payment + principal) (-)

- Rental Income (+)

- Rental Expenses (-)

- Renovation and furnishings (-)

- Sale of property (+)

The property’s eventual value is zero.

However, even though the value eventually is zero, a property investor investing in a leasehold can extra a good return from it. Your mileage will depend on your purchase price and what you do with it.

When viewed using XIRR, we can compare it to other investments.

We can compare this investment property to your Singapore Savings Bonds, bank interest rates, a low-cost passive portfolio, hedge fund returns, cryptocurrencies.

So if the XIRR for a decaying leasehold can be 5 to 7%, your active or passive portfolio over 40 to 50 years needs to average 5 to 7% in XIRR or more in order to be comparable.

Yet if you compare to the previous XIRR of the HDB that I have done (7-8% for mine and 13% for my friend), the compounded returns of a private condo is not always better. It depends very much on different time periods as well.

Of course, each investment has its nuances. You may not have $200,000 for downpayment, and a stock or fund portfolio might be easier for you to start. You may not like to actively managed tenants (In recent times, I been hearing this is a big niggling reason people sell off part of their property portfolio)

Your mileage may differ if you got it at a good price. But if you sell it off, you got to reinvest it well.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Teo See Hwa

Sunday 1st of December 2019

The first Leasehold 99 years lease top-up is Southbank.

The first Leasehold 60 years landed in Geylang Lorong 13 leases run out.

The last land acquisition Merpati Road freehold homes.