Business Times published this commentary by Leslie Yee.

If you read his bio, Leslie knows what he is talking about when it comes to properties. He spends enough time at Linked REIT, Guccoland and is currently Senior Adjunct Research Fellow at the Institute of Real Estate and Urban Studies.

In this article, he was challenged to see whether permanent renting would make sense.

And he laid out a permutation where renting will equal buying and owning a home.

In his example, the sweet spot is to compare buying a $2 million condo on leverage versus renting one at an initial rent of $3,500 a month.

At the end of 60 years, when you sell off the home, the net gain is $4.6 million. The value of your REIT plus the distribution, net off the rent paid over the years is $4.6 million.

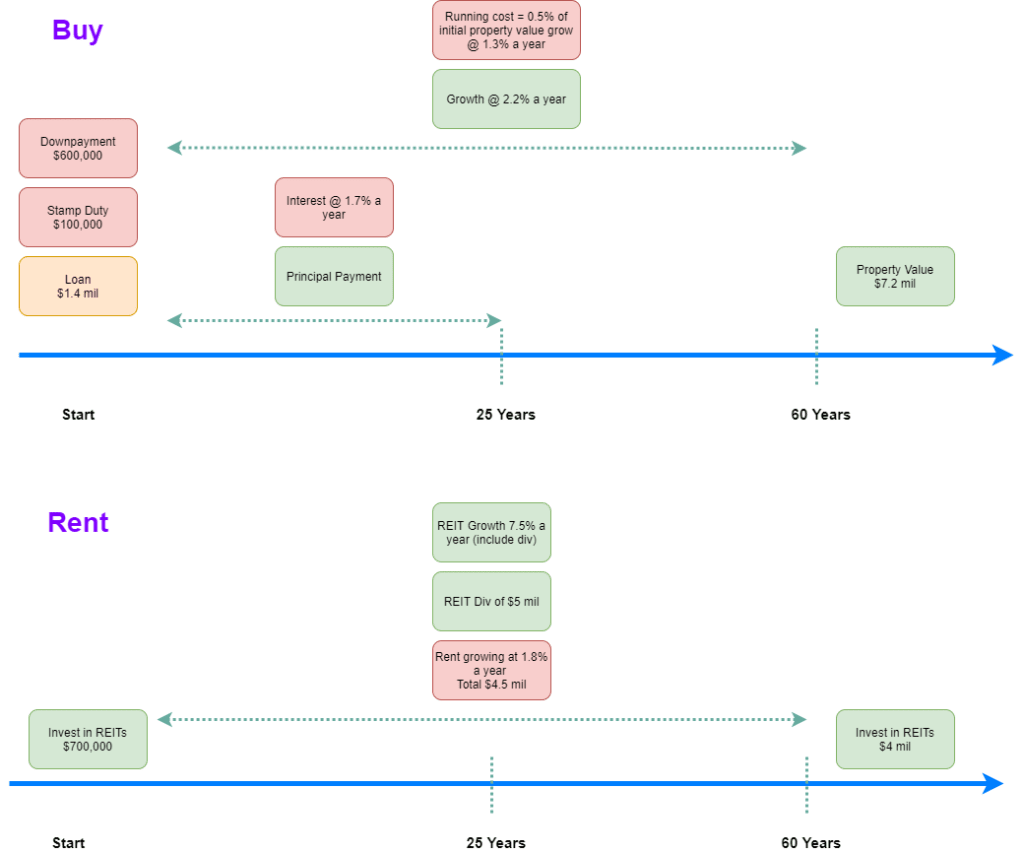

Here is the Buy versus Rent simulation as I understand it:

The person who chose to buy would make a downpayment and pay stamp duties worth $100k. He will borrow $1.4 mil at an interest of 1.7% a year. By 25 years, the person would have paid off the loan.

Leslie factored in the annual running costs of maintaining the home as well.

The renter would take the money, meant for downpayment and stamp duty and invest in a portfolio of REITs. The assumed rate of return is 7.5% a year.

At the end of 60 years, the home buyer sells off the home and compare the value versus the investments of the person who rent.

I think in general, whether you sit on the buy or rent side, this should be largely the template you use to evaluate which one makes more sense.

Leslie tried his best to make the comparison digestible for the general readers. But I do spot a couple of areas that might change how this analysis would turn out.

Some problems that I have with the buy versus rent Singapore comparison

I think the first thing is I do not understand why he has to deduct $1.7 million in principal repayment and interest.

Deducting the interest payment over the years make sense but the principal repayment is equivalent to his equity build-up. The equity build-up reflects the amount of equity value he will retain when he sells off his property.

In any case, the loan tenure was 25 years and by the end of 60 years, the loan would have been paid off and the value of his equity would be 100%.

Thus, I do think that the equity value of the home buyer at the end of 60 years is higher than 4.6 million.

Yet at the same time, Leslie calculated the value of the renter’s REIT investment to be dividends distributed through the years and growth of portfolio over 60 years.

I think Leslie didn’t assume that the dividends to be reinvested. Most likely, the renter does not need the dividends, and if the dividends were reinvested, the amount might be different.

If I compound it this way, the REIT portfolio value, inclusive of the dividends reinvested will be worth $53 million 60 years later!

Ok, let’s be less optimistic, such that the dividend, which is 4.5% of the initial portfolio grows only at 1.3% a year.

The portfolio value would be worth at least $11.3 million 60 years later. Net off the rent, it would be equal to $6.7 million, which is close to the revised buy figure if we exclude the principal repayment.

Whichever way, based on this growth assumption, the case for permanent renting is still alive and kicking.

Lastly, I wonder how Leslie got the $100k for stamp duty. That feels high for a $2 million dollar property. The most I came up with was about $64k.

Good points when considering whether to rent or buy

I think more and more, we are seeing twenty-something or thirty-something renting. They would like to be more independent.

But I think moving closer to where they work may be a very big thing.

I really cannot take a long commute sometimes and if I had to take up a job closer to the west, the appeal of renting somewhere close by increase a lot.

Leslie pointed out that your profits from the property may come from your accurate speculation of the property cycle.

If you had bought during the 2013 high, your profits would be much lower.

If you review the data, the older properties growth rate since 2013 would either be 0% a year or 3% a year. That is from the group of properties reviewed.

If we can speculate with private properties, then we would also have to assume the same person is as shrewd speculating REITs to earn crazy good returns. That should even things out.

But I do feel if the future growth environment is slower, we should use a more moderate growth rate for REITs other than 7.5%. Perhaps a 5.5% would be better.

Lastly, Leslie’s buy versus rent worked out because he compared a $2 million private property to rent an equivalent one.

The case would have been weaker if he does it with our build-to-order HDB flats. The cost of our build-to-order HDB flats is made more affordable and thus our mortgage would most often be much lower than comparable rent in the same area.

Still, Leslie did leave us with enough things to ponder about.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

- The LionGlobal APAC Financials Dividend Plus ETF Won’t Give Singapore Investors 5% Dividend Yield Always. Further personal thoughts (with some data). - April 13, 2024

blankdoe

Thursday 21st of October 2021

I dont think it is fair for leslie to assume a constant growth of 2.2% in property price over 60 years. If we are considering 99 year leasehold properties - how can it be possible that a property with less than 40 years left on the lease is worth multiples of its purchase price.

Also its quite illogical to restrict the comparison to REITs as the alternative asset. Why not equities?

Kyith

Tuesday 26th of October 2021

i think its ok to use REITs. The long term returns profile of REITs and equities are almost similar (from the data that I see). While 2.2% is on the low side, to your question... he has smoothed out the return... so in the earlier years... your property will go through more appreciation and in the later years... the appreciation will be lower. Is 2.2% too high or too low for you.

H

Wednesday 20th of October 2021

Unlike the DBS article which is about investment, this article is about home for own stay. So the key assumption I will make is that a person will not put 100% of his future money into the house for own stay. This means that he will have extra money maybe not today but 5 years later when income grows) to put aside for other investments and retirement sufficiency.

So then the comparison is really about which is the better deal for this single asset only. In that case, if we consider the bad outcome for both the rent vs buy, the bad outcome for buy (bought house but stock super outperform) is more palatable, you would have a roof over your head during old age that did not make you much money (which does not matter if you did not intend downgrade to raise equity).

The bad outcome for rent (rent but property prices outperform, or you just make bad choices) is a lot worse. Potentially you will NOT be able to afford a roof or you will be force to downgrade and rent cheaper housing.

So the question is, would a person chose to risk not having a roof over ones head for outperformance on a single asset? My choice long term choice (short term can differ) would still be to buy (but a reasonably priced palace ) and invest the difference.

Furthermore, for the more adventurous, property allows you to safely borrow (even if you have money to pay up) With such a setup, you have have your cake and eat it (ie buy but "rent" from the bank)

H

Thursday 21st of October 2021

@Kyith,

Consider version of buying: 1. Buy a place for 2M, take 1.4M loan 2. Every 5 years take new loan to max out LTV again (draw down on the equity that you have paid back over 5 years) 3. Invest that into stocks.

Never modeled that before but I am pretty sure will be better than both buy and rent options.

H

Thursday 21st of October 2021

@Kyith,

Yes, true price and rent need not climb by similar percentages. But the direction, especially over 35 years, will be the same and there is a limit to how much rental yield compression there is.

My "bad" scenario for rent is not just property prices/rent go up a lot but also stocks do badly at the same time. This means the money we did not put into buying a place did not reap the expected returns in stocks and in 35 years we will potentially be in a very bad situation.

The bad scenario of buying (bad property prices but very high stock market in 35 years) , is not great but at least you have a roof over your head.. and your spare cash over the 35 years could still be invested in the market to reap the benefits of the booming stock market.

Kyith

Wednesday 20th of October 2021

I think the additional money should not be factored into the evaluation. Leslie tried to evaluate a person with the means to select any of the two options. I think the bad outcome for rent is valid. I think you meant rent and not the value of the property. This is what we are seeing in UK for a long while and what we are seeing in US now. For now, the people are still able to afford rent, which means that rent may not be rising as far as the property prices. There is also the case where folks are living like in London. The property prices are so high that you take on so much just to own a home versus renting. Would that make sense?

lim

Wednesday 20th of October 2021

I don't have access to the article but given that I can borrow money at a low interest rate and see the value of my loan reduced by inflation, buying has always made more sense to me if I intend to stay in the property for a long time.

I also don't know what inflation assumptions were made - inflation will "reduce" the value of my loan if I am a buyer, and increase the rental charges if I am a renter.

Kyith

Wednesday 20th of October 2021

Hi Lim, I think they made some reasonable assumptions on inflation. Those are embedded in the growth of the running costs(1.3% a year) growth, growth of rental (1.8%). The big difference is the opportunity cost of the downpayment. That downpayment grows at 7.5% versus 2.2% for owning the property over time.