In a September post, I explained that due to QE, there is more liquidity in the market, which creates a conducive environment for options participants to dictate the stock market instead of the stock market dictating the options markets.

Read How the Options Market ends up Controlling the S&P 500 in 2021.

Since I wrote the article, the market decided to stop behaving the same way as the S&P 500 index experienced greater volatility before the options expiry for the month.

However, the influence of the options market dealers is still intact.

Last week we experienced an intense period where the volatility index of the S&P 500 went above 30:

The chart above shows a snapshot of the price action of the S&P 500 in recent days. The first mark shows the day of options expiry.

Prior to options expiry, there are very strong Vanna and Charm flows, and if there is any weakness in the S&P 500, due to the out-of-money nature of the index, the options market dealers will be buying back their shorts, this creates a natural tailwind to stop any downward moves.

After options expiry, these Vanna and Charm flows are gone. After that, the markets are freer to rip up or down.

The market does still need a trigger to move lower, and this comes in the form of a combo mixture of greater aggressive Fed taper talk and Omicron virus.

This brings down the market. While the S&P 500 went down 4%, a lot of other stuff was sold down big time.

The VIX reached a high that was last seen in March 2021 this year but as we all know, the market rallied since the start of the week and the VIX died down.

Were we able to tell beforehand the probability that the markets were about to turn?

Two metrics from the options markets might give us clues in the future if the market is going to turn positive.

What is Dark Pool Indicators (DIX)

The DIX stands for the dark pool indicators of the S&P 500 Index. Since 2010, FINRA has collected the short sale volume data from their Trade reporting facilities. Trade reporting facilities receive data from exclusively off-exchange, or “dark” venues.

The dark pools indicate the amount of short selling volume in these off-exchange pools. This is a contrarian indicator, which means that if the short selling is high, it means it’s time to go long.

High short volume above 45% is typically associated with future positive intraday returns. If DIX is below 35%, then it is an indicator to short-sell.

What is Gamma Exposure (GEX)

We can layer with the DIX a study of the Gamma exposure (GEX)

The GEX measures the positions of options market makers, how much the market makers will have to buy or sell in order to hedge their books.

GEX positive

- MM buy the amount of stock into falling prices

- MM sell the amount of stock into rising prices

GEX negative

- MM buy the amount of stock into rising prices

- MM sell the amount of stock into falling prices

So, in short, negative GEX numbers create volatility while positive GEX numbers inhibit volatility.

Strategy #2: Gamma Exposure Index GEX:

- Buy when GEX normalized hits 0.00

- Short sell whenever GEX normalized hits 1.00

DIX and GEX

At the end of Friday, on the 3rd of Dec, the DIX reached a high of 44.6%, which is higher than 35%. This is not too surprising because there were many instances that the DIX was higher than 35%.

But the GEX was negative for the first time since Sep 21.

Given how these two metrics turned out, it would be rather difficult for the S&P 500 to end up lower on an intraday basis.

And true enough we have a strong recovery this week.

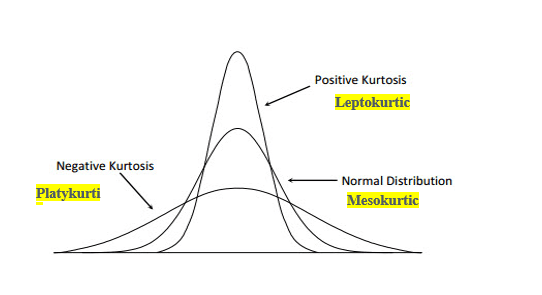

The actions of the options market makers have altered the distribution of returns for the most important stock market in the world to become more Leptokurtic.

This means that the distribution of returns is less spread out with the range of returns is more concentrated within a tighter range.

This is good.

But it also means that you may get returns that are further out in the tails, which means very good or very bad.

It should also be noted that metrics such as DIX and GEX are shorter-term signals and more suitable for short term traders but for longer-term investors, it wouldn’t hurt to pay more attention to what happens after options expiry.

Could have very nice or very nasty surprises.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024