I got some updates from the folks at MoneyOwl that the pricing of some of their services will be changing.

For those who are new to Investment Moats, I have been working with MoneyOwl on and off.

MoneyOwl is a financial adviser and fund management company license by MAS. MoneyOwl is a joint venture between NTUC Enterprise Co-operative Limited and Providend Holding Pte Limited.

(disclosure: Kyith works for Providend Ltd, a subsidiary of Providend Holding Pte Limited and is a customer of MoneyOwl)

You need to pay attention to MoneyOwl for the following reasons:

- One-stop shop to

- Have a comprehensive financial plan

- Fulfil your insurance protection needs such as term life insurance, late-state critical illness, early-stage critical illness, disability income, whole life insurance, personal accident, health shield plans

- Build a low-cost, diversified investment portfolio

- A money-market fixed deposit fund solution that lets you earn high interest in a safe and liquid manner

- Create a simple will

- Access to a human adviser

- Commission-free advice

- Access to Dimensional Fund Advisers funds

- Social enterprise

- Advise on national health and retirement schemes like CareShield, Medishield, CPF Life. They will ask you to top-up your CPF SA for retirement instead of investing in their portfolios if that is most suitable for you.

- You know what insurance you wish to get, and do not wish to have an agent trying hard to influence you to get this or that instead.

- Rebate 50% of the commissions earned on the insurance products you purchase from them.

There are a few updates. Let us get down to it.

Reduction in Investment Advisory fees and absorption of Platform Fees

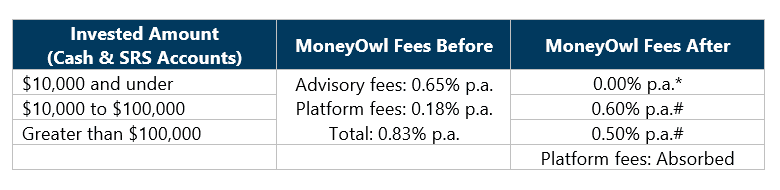

MoneyOwl will be shifting their advisory and platform fees to a new set of tiers.

If you invest with cash in any of their 5 low-cost, diversified investment portfolios, your cost of investments will be reduced. In some cases, the fees are as low as zero percent.

Your advisory cost paid annually will depend on your assets under management (AUM) with MoneyOwl.

The changes are illustrated in the following table:

* Promotional rate applicable only to cash investments from now till 31 December 2021. The 0% fee may be effected through a rebate.

^ Applicable to both cash and SRS investments, based on total AUM across all portfolios excluding WiseSaver.

For more details and terms and conditions please. See FAQs.

The MoneyOwl fees are the fees you pay for

- To access specific funds that you could not access at other platforms

- Sound portfolio construction, fund addition and subtraction in the future if better products comes along

- Periodic rebalancing

- Performance monitoring, tracking and reporting to you

- Direct communication channel to the manager to enquire about investment philosophy, thought process, addressing your fears and possible misinterpretation

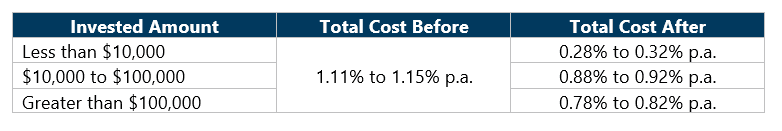

These are not the only fees that you will pay. Your portfolio consists of a few lower cost, diversified unit trust. This is like the competitors, who are either using unit trusts, or exchange traded funds.

The fee change for less than $100,000 (0.60%) and more than $100,000 (0.50%) is permanent. For a limited time until 31 December 2021, if your AUM is less than $10,000, the advisory fee is 0%.

There is an annual set of fees incurred by these unit trusts and exchange traded funds you indirectly paid for. This is represented by the total expense ratios or TER for short. These set of fees are payable to your Dimensional, Vanguard, Aberdeen, Schroders, JP Morgan etc.

The TER for the 5 portfolios MoneyOwl has is between 0.28% to 0.32% p.a.

If we consider the TER, the total cost of investment if you put your faith in MoneyOwl is like this:

How the 0% AUM Fee for Investments Less than $10,000 will be Structured

The first thing to note is that for many of these robos, boutique funds, fund of funds, you do not pay these annual investment/advisory/wrapper fees out of your pocket.

They are deducted from the units of the investments you own.

For example, you decide to invest $1,000 into a portfolio and this fund charges an annual TER of around 0.50%.

If you divide 0.50% by 12, you will get 0.04%.

On a certain day of the month, the Robo/fund of funds would sell off an equivalent of 0.04% of your units to pay for these costs. For others, they will first deduct this from dividend income, if there is.

These wrapper/advisory/investment fees are encapsulated away from you.

If your AUM is less than $10,000 before the end of the year, you will be first charged an advisory fee of 0.60% p.a. rate.

At the end of the year, MoneyOwl will rebate you the 0.60% depending on

- How long you have invested

- How much you have invested

The money will be rebated back to your Investment Cash Account.

This will also mean that if you trade in and out of the account and did not remain invested, you do not get the full rebate.

How the AUM Will be Calculated

The AUM is calculated across all portfolios (in MoneyOwl, you can create portfolios for different goals).

The AUM calculation include monies in your cash, SRS. However, AUM of joint account will be attributed to the main account holder.

Who Benefits from this Fee Reduction the Most?

The ones who would benefit the most are those that have limited amount of money to invest and manage to learn the lesson not to trade in and out of their accounts.

These 5 portfolios are good if you wish to capture the market returns, according to your risk tolerance, so that you can build wealth in a passive manner.

However, if you freak out and sell all your holdings into cash, then you do not get the rebate benefit.

I think this is an excellent initiative by MoneyOwl because as a social enterprise, your priority is to

- Help those who have a tight surplus (their income minus expenses is low), wish to get started

- Those who just got started investing

- Parents who wish to help seed accounts for their children who are young adults and learn investing the right way

If the above fits your profile, you will also benefit by getting your fee reduced.

Returns compound over time but your cost compounds as well. Thus, if you can minimize your cost well, you have a higher chance to build more wealth.

Introductory fee of S$99 for Comprehensive Financial Planning

Out of all the players in this space, MoneyOwl provides the best comprehensive financial planning.

If you would like to find out what the financial plan entails, you can read my review of the service here.

For SG$99, you will get yourself a comprehensive plan.

MoneyOwl will review your current financial situation. If your situation changes next time, and you need to consult their advisers again, and give them an update, you do not have to regurgitate everything.

You also get yourself a commission-free financial plan.

There is no need to worry that an adviser will slant the mathematics or the qualitative advice in a way that asks you to buy an early critical illness plan due to the fat commissions that they can earn as they are not commission-based.

If your whole plan tells you that you are in a good shape, then it gives you a peace of mind.

The comprehensive financial plan originally costs SG$535.

However, MoneyOwl is reducing the price of the plan in light that there are many who needs to take stock of their current financial situation and see how to move forward from their current state.

Free Digital Will Writing Service

If you are 21-years-old and above, non-Muslim and your situation is simple, you can use MoneyOwl’s Digital Will Writing Service to help draft a will.

You can then get 2 people to be your witness and sign this will.

Muslims will need the advice of a Syariah-trained lawyer to help advise.

Fortify your Financial Life with Resilience Workshops

MoneyOwl will be providing a set of financial resilience workshops.

I think if there is a time where people really need a compass on which direct to take their financial life, it is now. PMETs or their families may be facing reduced income, job losses and other form of financial stress.

These workshops will be FREE. No Cost.

The focus of these workshop would be on cash flow management and debt management.

MoneyOwl’s experienced financial literacy trainers will transfer knowledge and introduce tools and resources that can serve as handles to help participants build financial resilience.

The hope is that this will set people up better in the future.

More details will soon be released on their website moneyowl.com.sg, in the meantime, if you are interested, you can email [email protected] to register your interests.

Conclusion

As a social enterprise, I always felt that MoneyOwl’s mission is very different from the rest.

The core of a social enterprise is to help the segment that are not well served by the (private) market.

The product and services identify closer to that:

- 0% advisory fee for those with $10,000 or less till 31 December 2021 and 0.60% after that. The rebate for $10,000 is only for cash investments.

- Minimum lump-sum of $100

- You can dollar cost average monthly with a minimum of $50

- Continuous education on cash-flow and debt management

- Educating people on the fundamentally sound way to invest

Singapore is getting more polarized.

The middle-class is splitting into those who struggle and those who are more comfortable (but they do not realize they are). The 2nd quartile of Singaporeans struggles to pull themselves out of the rut because every time they were to get somewhere, society threw them a spanner and they are back down again.

Out of all the features MoneyOwl provides, #4 is probably the most important, but it is the one that only altruistic planners will provide. Cash flow management and debt management won’t always get them out of the rut, but not knowing these two severely reduces their probability of getting out, or in the worse case, sink deeper in.

If you would like to find out more about their services, do check out MoneyOwl here.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024