Evergrande, fed meeting dominates the news today.

However, when it comes to clients, they are less worried about things this time around. But the slow stair climb up with little correction in the S&P 500 do worry investors a bit.

Shortly after last week’s options expiry, we saw one of the bigger moves this week.

As I have said in the article, there is sometimes a period of weakness where the Vanna and Charm flow of the options are weaker. During this period, the hedging of the options dealers has less control of the S&P 500. Negative or positive sentiments are able to affect the index price more.

Cem Karsan explains on Friday evening (US time) last week’s slow fall, the demand and supply for the rest of the year, and how this will play out this week. The short summary is, a lot of things are against the bears for the rest of the year.

We will see how it goes.

In any case, fresh out of the oven is this interesting statistic from Jonathan Harrier.

Here are the rest of the Moat Market Intel.

Stanley Druckenmiller Tell us the Important Aspect about Managing a Concentrated Portfolio

The Science of Hitting (TSOH) has a good reflection post on a speech by one of the great investors of our time.

Druckenmiller explains that if we look at the great investors such as Warren Buffett, Carl Icahn and Ken Langone, they tend to make very, very concentrated bets.

He then explains that George Soros is more proficient than him because Soros has the guts. When he is betting, he bets a large amount when he thinks he got it right.

Then he dropped something important.

“I’ve thought a lot of things when I was managing money with great, great conviction, and a lot of times I was wrong. When you’re betting the ranch and the circumstances change, you have to change – and that’s how I’ve always managed my money.”

TSOH explains that when you run a concentrated portfolio, by nature you will only be making a few meaningful bets over the course of your investing lifetime.

When your thesis is wrong, and the investment becomes a value trap, that concentration can result in a meaningful impairment of your capital.

I think Druckenmiller is damn strong because to make money with concentration, you got to be both convicted about your investment but at the same time flexible enough to admit that you are wrong.

Both are seemingly at the opposite ends of the spectrum. It is really a skill.

Perhaps that is why you got to watch over a concentrated portfolio like a hawk.

Breaking down O’Reilly Automotive (ORLY) Good Business Model

Young Hamilton dissects the second-largest auto parts retailer in North America O’Reilly Automotive.

He explains O’Reilly’s distribution network, which in his opinion is O’Reilly’s core competency. The market is still very decentralized as over 60% of the two markets (DIFM and DIY) is not controlled by large public companies such as AutoZone, Advanced Auto Parts, O’Reilly and Genuine parts.

The business shines due to its economies of scale and brand recognition.

The return on incremental capital on the business is relatively high, and it is a business that can readily reinvest its free cash flow back into the business at a high rate of return.

Price-earnings based on the last twelve months earnings is 21 times.

S&P 500 Rolling 10 Year Sharpe Ratio at a High

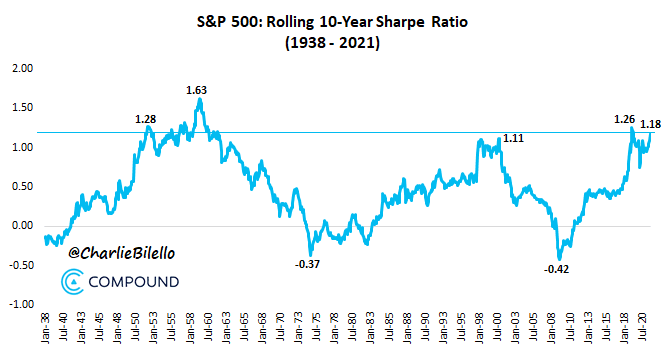

Compound Advisers has a chart showing the rolling Sharpe ratio for the last 10 years:

The Sharpe ratio measures the returns that are adjusted for risk (standard deviation). Charlie Bilello points out that the current Sharpe exceeds 95% of other periods and is more than the historical average.

If you look at the chart, it seems to rhyme with value investing: buy when things are uncomfortable and ugly.

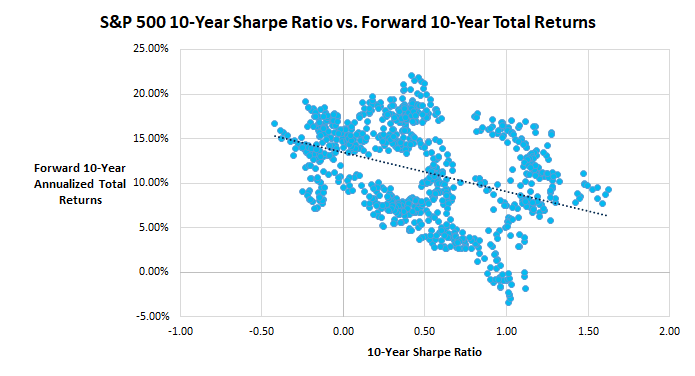

Here is a scatter plot of the 10-year Sharpe ratio. The downward sloping line indicates that long term, there seems to be an inverse relationship where higher Sharpe Ratios points to lower future returns on average (and vice versa).

This would indicate that the future may have higher volatility and drawdowns instead.

From the narrative, it is likely Charlie sits in the camp to be more prudent and defensive.

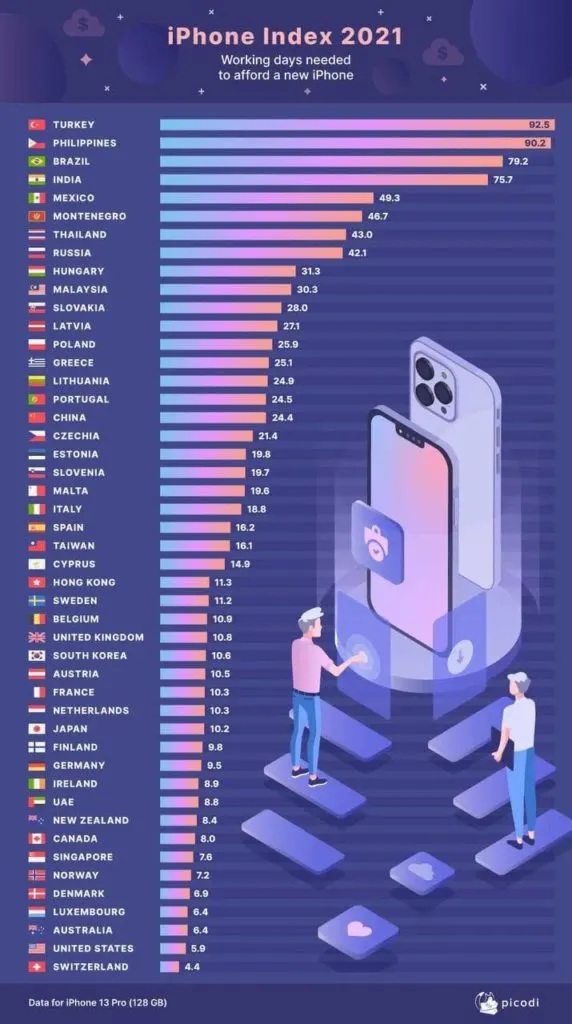

iPhone is a good barometer of income and cost of living

The iPhone is a $1200 to $2200 machine. The phone now costs as much as what a computer used to cost.

Perhaps that is why affordability is better in developed countries. Only the well-heeled in the developing countries are able to afford it.

Perhaps that is why Xiaomi does very well in countries like India and the Philippines.

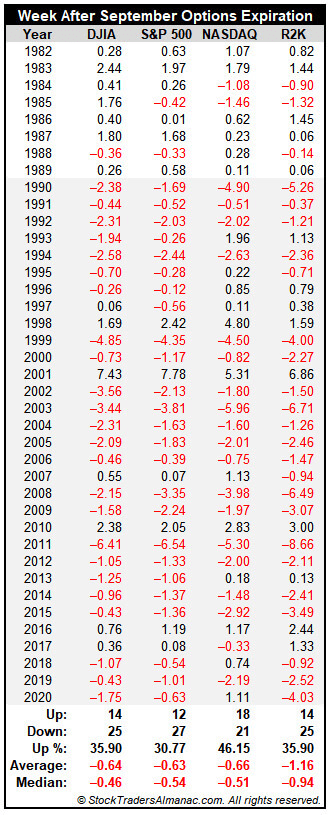

S&P 500 down 25 of 31 during the week after September Options expiry week.

Jeff Hirsch at Almanac Trader show us these crazy stats for the week after the options expiry week in September:

After 1990, it has been dreadful.

But still, keep in mind that there are also big gains in 1998, 2001, 2010 and 2016.

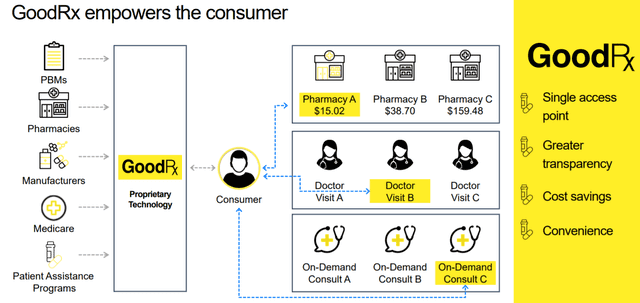

Breaking down GoodRx’s Business Model (GDRX)

Richard Chu, an analyst at Saga Partners, shed more colour on the operating environment of GoodRx, a US-listed company.

Getting drugs in the US is complicated. The whole system is rather expensive, complicated with a few intermediaries.

GoodRx creates a marketplace that offers prescription information and allows you to compare the discounts provided by the different pharmacy benefit managers (PBM).

This allows the consumer to be able to buy the drugs they need at a cheaper price.

GDRX’s business is highly predictable where 80% of transactions are repeated. GDRX do not carry any inventory, and so the gross margins are nearly 95%. The crazy thing is that through GDRX, users paid less for the drugs than the average insurance copayment 55% of the time!

The healthcare system is complex and it remains a debate how strong GDRX’s moat is and whether they have a moat at all.

Chip Brain Drain at Apple AAPL

Semianalysis updates that with the release of the new iPhone the CPU gains of the new A15 from the A14 is less than their previous iterations.

They also shed light that there seems to be some brain drain taking place at Apple:

SemiAnalysis believes that the next generation core was delayed out of 2021 into 2022 due to CPU engineer resource problems. In 2019, Nuvia was founded and later acquired by Qualcomm for $1.4B. Apple’s Chief CPU Architect, Gerard Williams, as well as over a 100 other Apple engineers left to join this firm. More recently, SemiAnalysis broke the news about Rivos Inc, a new high performance RISC V startup which includes many senior Apple engineers.

This may explain the lower performance improvements for the CPU and we will see this affects things going forward.

Logan Mohtashami – Bear Crusher

I enjoyed this Bill Brewster interview with US housing expert Logan Mohtashami.

This is not the first Logan interview I profiled on Investment Moats. You can read the previous one here.

Logan brings a very data-driven perspective in assessing the health of the US housing market. In all honesty, he did not say much different from my previous article.

However, he did shed some interesting things about investing through 2020. Logan’s read about the macroeconomic data allows him to sense that the recovery was underway, invest and profit very well such that he is able to make his money and reach the wealth goal he needs.

A lot of the conversation was about him contrasting the data and against housing and guru doom-mongering.

He has this take that most of the doom-mongers cannot be this stupid to be bearish. If you asked for how their investment is like currently, none of them would dare to show it.

If they showed it, it will show that they are net long instead of net short.

Lastly, like it or not, Logan is one of the rare commentators that is able to link the importance of the 10-year treasury levels to the market and to Mainstreet.

I thought its important but not this meaningful.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024