Over the last week, this YouTube video was recommended to me:

The hosts from Ritholtz Wealth Management brought on Bloomberg ETF analyst Eric Balchunas to talk shop.

Eric is a great follow on Twitter if you are interested in all the geeky ETF data and the history of ETFs.

Other than ETFs, the three also went into a discussion about whether direct indexing would threaten the future of ETF.

But there was a part of the discussion that I put down in notes.

You can start listening at 14 minutes.

In recent years, famed investor Michael Burry raise this concern that passive index investing using mutual funds (unit trust) and ETF may be creating a more dangerous environment.

I think this spooked enough investors and at the height of that period, our advisers have enough clients seeking their feedback on his comments.

Eric has seen enough ETF flow data and as a fellow data nerd, when you observe enough data, you get a different kind of appreciation. There are some things that worry people, but you would realize it is less of a problem. Yet there are some things that people think should not be a problem but you grew anxious about it.

So it is always good to see, after crunching so much stuff, how he sees some of this stuff.

Josh Brown wrote in 2014 something that was on his mind about the relationship between certain changes in the financial industry and the stock market.

What will happen when many brokers change to become fiduciary investment advisers? This means that instead of haphazard stock recommendations, there is a systematic purchase of portfolios made up of ETFs, which means there will be a systematic purchase of underlying stocks.

If advisers recommend to the clients to buy the dip, there will always be buying pressure after some sell-off.

So this is a group of advisers, doing this systematic buying on their group of clients, on a very systematic basis. Josh concludes that the bid is not going anywhere, and this together with the FED have changed the game.

The guys want to know what Eric thought about this 7 years later after observing the data.

Eric agrees that the FED is a big influence in that they seem to have eliminated the feeling that there is tail risk in the market.

He polled Twitter recently and 80% agrees that if there is something that is going to happen, the FED will step in. People do not worry about hedging, leverage issues anymore.

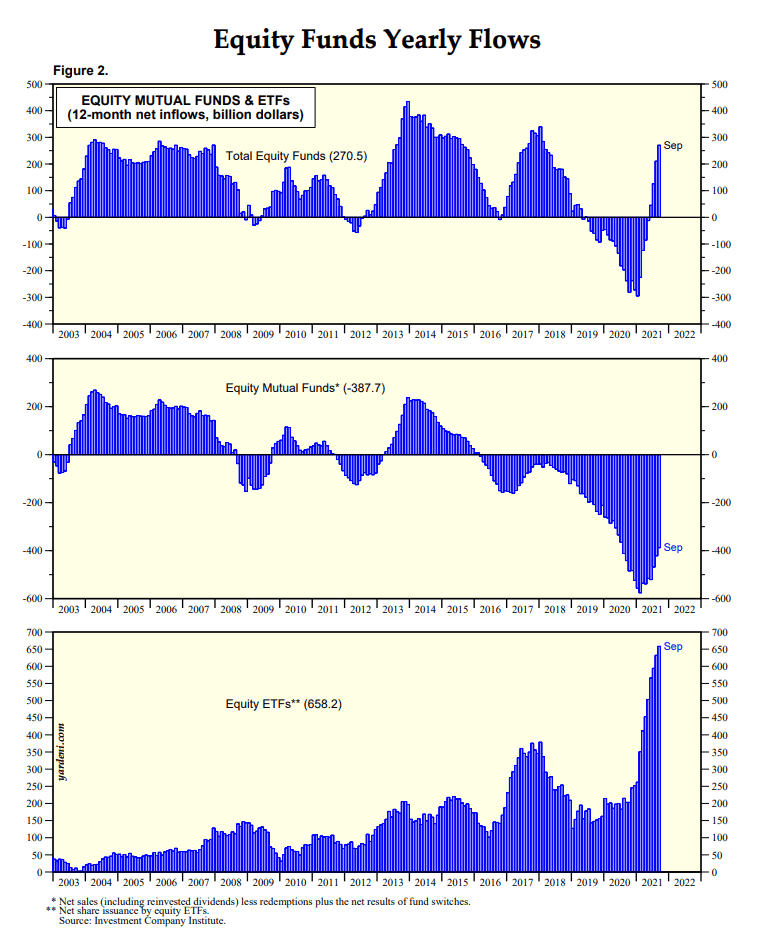

Eric thinks the relentless bid is FED driven. Over the past 5-6 years, the money flowing out of equity ACTIVE mutual funds have been almost equal to the money flowing into PASSIVE ETF funds.

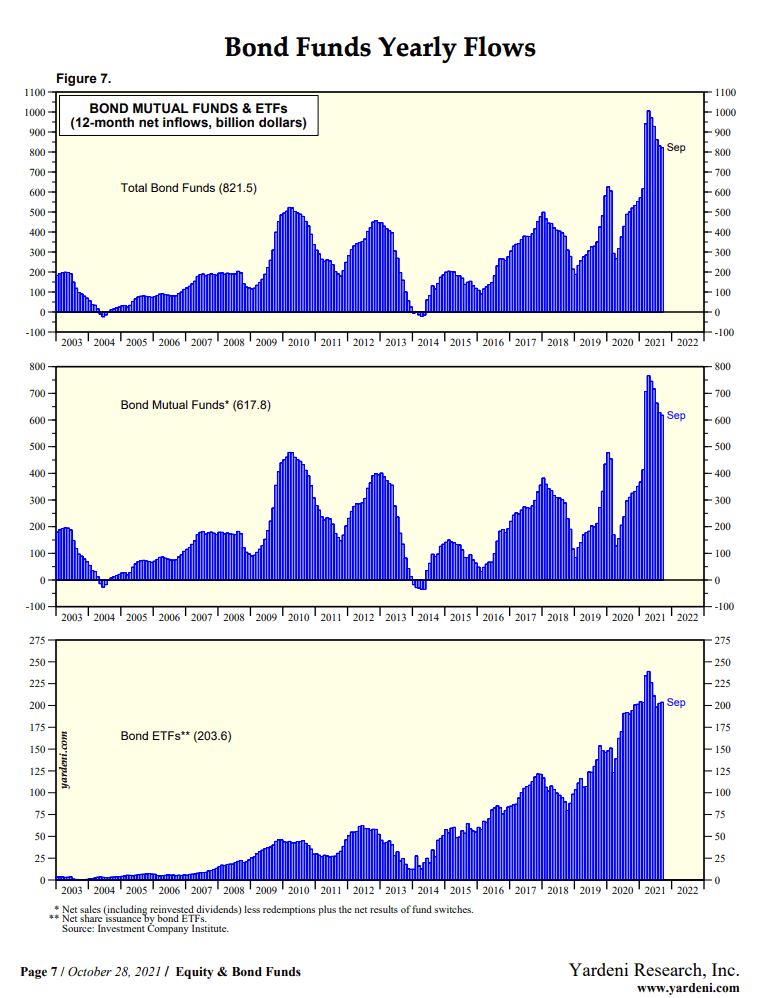

The majority of the fund flows seem to be a format change. Numbers-wise it is offsetting but three of them agrees that money from equity mutual funds can flow to bond ETFs through rebalancing, or being used. (Bond ETF inflow is huge).

Eric thinks that the ETF holders don’t sell, but unit trust or mutual fund holders are another story altogether.

He cites the example of General Electric selling off big some time ago but if you observe the flows of the big funds, the ETF funds held their positions. Index funds may in the future be creating a natural bid to buffer sell-offs.

Eric thinks that in the next big selloff, the money is going to come out from active bond mutual funds in a very big way because the investors fail to recognize the original reasons the money was put in there and they need to spend it.

The active bond mutual funds are the new too big to fail.

During COVID the equity mutual funds was seeing outflows but it wasn’t until the bond mutual funds got hit, then we start seeing 180 billion in outflows from bond mutual funds in 2 weeks, and Eric was forecasting that 1 trillion would come out from it.

Underneath all these, Eric thinks that the active mutual funds will not be able to sell bonds in another same situation. The bond ETFs can still trade, it’s just that there will be a big discount between the price and the NAV. The active mutual funds may have to halt redemptions and when they do that, it will result in further panic.

If there is any conspiracy theory, Eric thinks that too many boomer decision-makers have dramatically increased incentives not to let the market fall.

After all, the boomers own 80% of the stock market and they would not want to see their wealth collapse like that.

Josh believes that the regular dollar cost average at 401k Retirement Accounts would add to the systematic buying as well.

Eric estimates that the passive index money in Vanguard and Fidelity may come up to 15% of the stock market. 45% of the stock market is actually owned by households. Eric jokes that those folks worried about ETFs being too big to fail may need to be worried about households being too big to fail more.

Eric feels that ETFs and funds are a progression from the old pension world for retirement purposes.

In summary, these passive investing phenomena seem to have an effect on the market. If we understand how financial advisers think, they will use any opportunity to get clients to invest more money.

After a decade of training by the FED, we might all be conditioned that there may be a big drawdown but there will eventually be some sort of support.

But ETFs is not too big to fail here. Active unit trusts and other owners still dwarf the size of combined ETF holdings out there.

Despite the very low-interest rate, the data shows that the flows into bond ETF are at historically high levels.

You can take a look at some of the most recent charts of equity and bond fund flows pulled from Yardeni Research:

While we may have a feeling that more people are invested in equities, the net flow into equity mutual funds and ETF (first chart) is not as high as before COVID.

Since 2016, has been flowing out of equity mutual funds (unit trust). Even during the COVID year we do not see meaningfully higher inflows to equity ETF until 2021.

The inflows to bond mutual funds and ETF have been rising, despite the lower interest rates.

Interestingly, I found Cullen Roche comments on the Relentless Bid in 2014. He sort of agrees with this phenomenon because if tail risk increases near recessions, eliminating the prospect of inflation does create an environment that people are confident to buy more.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024