I was discussing with one of my friends on Telegram on fund investment decisions and our topic gravitated towards whether I am concerned about the performance of a certain actively managed fund.

This is the moment where I detect that he might have to tweak the way he evaluates whether he should invest in some of these funds.

I suspect that many would try to evaluate investments the same way. If luck would have it, your investments may work out beautifully but in the absence of luck, future performance may not be up to your expectations.

And sometimes, you would draw the wrong conclusions from the performance that you experienced.

So here is something for everyone to think about when considering investments that are managed by others.

How Tough is it For Active Funds to Outperform their Benchmarks

Let us establish some base rate or first principles of how likely an active fund will do well.

We are somewhat indoctrinated to measure the performance of an actively-managed fund or passively managed fund against their benchmark index on a periodic basis.

Research shows that not all funds survive over the long run. Research also shows only a handful of funds outperform their index.

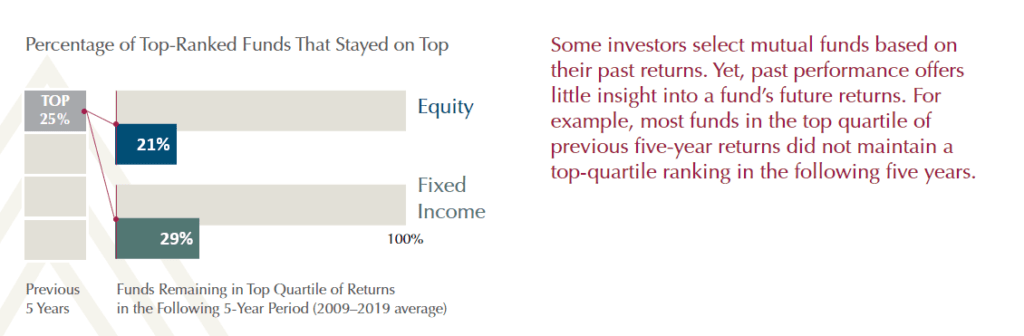

If you pick a fund that is amongst the top 25 performing funds in the past 5 years, the percentage of funds that will remain in the top 25 in the next 5 years is 21% and 29% respectively (for equities and bonds)

Outperforming the benchmark is challenging enough. Staying as a top performer is even more challenging. Based on the math, you need to pick a fund that survives, is among the top quartile in the past 5 years, and remains in the opt quarter in the next 5-20 years.

Based on the first principles, the odds are against the manager. (I suspect the percentage of funds that can do that is like less than 1% of the original fund cohort)

Of course, there are outlier fund managers such as Bill Miller, Warren Buffett who is able to do it. But it is likely that they are amongst the very small minority.

Outperformance does not happen based on the traditional period of measurement.

Usually, this is by every calendar year, 3 years, 5 years, or a decade.

The thing is… that is probably not always the right time frame to measure certain funds.

If you listen to your fund manager, they may say that they would typically hold their stocks for 5 years some even longer than that. They would buy quality companies that compound over time.

In the short term, their results are going to differ from S&P 500, MSCI World or their respective benchmark performance.

Most often, as an active manager, I am not going to say that crazy thing that I am to beat the index every single year.

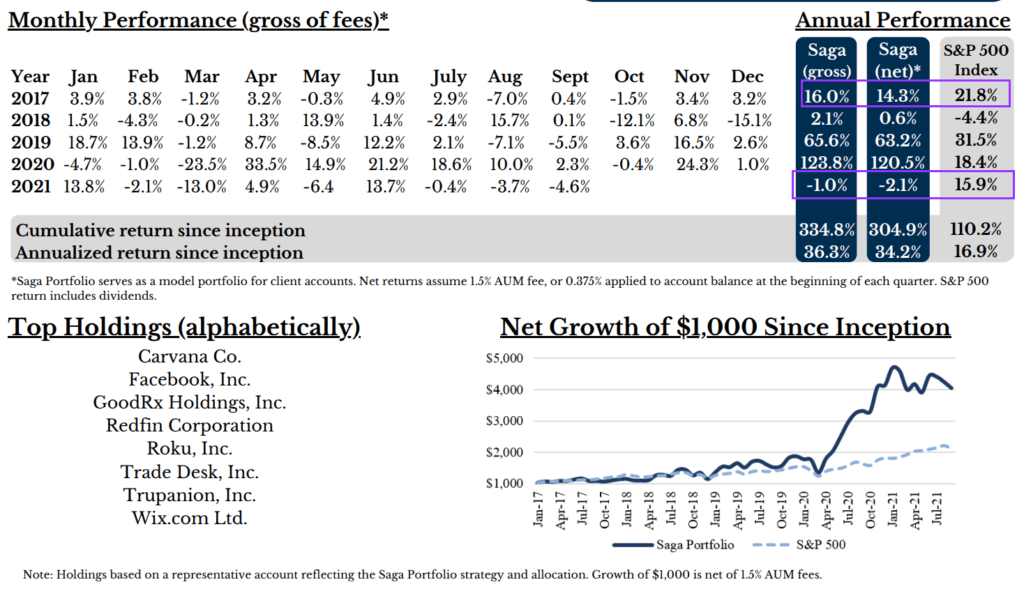

Here is a snippet from Saga Partner’s factsheet (Sep 2021):

Saga’s 4.5 years return looks good. We can say they did better than the S&P 500 index, which is the index the managers decide to measure themselves against.

But not every year is rosy. In 2017 and this year, they underperformed.

This year is especially bad.

So are they a poor fund?

Recently, I came across the performance of a local boutique fund. From 2012 to 2020, the fund compounded a cumulative 2,500%. By all accounts, that should be quite a good performance.

Most of you would agree that last month’s return is pretty good. This said fund did -34% in a month.

This year’s performance is dragged down by two month’s of underperformance.

Should this poor recent performance affect whether we continue to invest in this fund?

I think the metric of evaluation has to be more than calendar year or short term performance.

Returns are not like 1%, 1%, 1%, 1%, 1%, 1% every month.

There is also an important reason why fund performance will deviate in certain time periods from the benchmark: In order for funds to greatly outperform, the manager cannot be a closet indexer.

The manager has to take a direction:

- He has to be overweight and underweight.

- He has to concentrate.

Usually, to get that outstanding outperformance, it usually involves some sort of concentration or overweighting some sort of factor premium that show up during the period.

This brings us to the next point.

You need to understand the drivers of return

There are many different drivers of return.

There are different levels of drivers. I would classify them into two:

- Economic drivers of return

- Style/strategy of implementation.

Economic drivers of return

Managers design their strategy based on different underlying instruments:

- Investing in equities. Equities earn a stream of cash flow from today into the future, as long as the business is alive.

- Investing in bonds. You lend money to an institution and in return, the institution pays you interest.

- Investing in the property. The property provides shelter for someone, who pays you rent in return for providing them with that utility.

- Investing in commodities. By and large, commodities do not generate cash flow. But their value changes based on demand and supply, deflation and inflation.

These are some examples. For all the legit asset classes, and perhaps sub-asset classes such as convertible bonds, small-cap equities, they have their unique drivers of return that justify why we should invest in them and why they are not scams.

Style/Strategy of implementation

Managers design unique strategies to drive returns.

Some of these strategies are proprietary. Some are secretive (black box strategies) and some are open and well used by many.

Here are some strategies:

- Value stocks. Invest in a portfolio of stocks that are relatively cheaper. There are sub-strategies such as deep value, value growth, quality value. Premiums appear due to reversion to mean, and migration of stocks out of value (when price rises) and migration into value (when stocks fall in price until they become cheap)

- Growth at a reasonable price (GARP). Invest in a portfolio of stocks that are smaller, have good growth metrics and are not too expensive. Generally, smaller and growing companies are uncertain and thus, it requires the manager to do enough due diligence.

- Risk parity. The manager identifies sub-asset classes that tend to have low correlation, and create a portfolio that is equal-weighted not by value, or price but by risk.

I listed these strategies as an example to give you an idea. It is definitely non-exhaustive.

You could even say some strategies depend on how the stars aligned and managers will shift their portfolios from equities to bonds, to certain currencies accordingly.

Some strategies have deep historical empirical evidence that they work for the different asset classes.

Some strategies simply do not have a long history, if not any history.

Some strategies are just scams.

Most asset classes and styles/strategies do not work in all market regimes or conditions

Why do I explain asset classes and style/strategies to you?

Just because there is a manager managing your portfolio doesn’t mean that the manager can perform miracles on your portfolio.

Generally, a fund’s performance is constrained by how well the asset classes, style/strategies perform during market regimes.

Since 2006, the value premium struggled to show up. Naturally, most active value funds do not do as well as growth funds.

Since the financial crisis, stocks have generally gone up, if you are a hedge fund that makes a conscious decision to risk manage your portfolio by hedging over certain periods, it will be challenging for your fund to outperform the index.

Here is the price chart of Cambria Tail Risk ETF:

The performance of this ETF looks the opposite of the S&P 500. Except for a few spikes, if we had invested in this ETF, we would be losing money for 2.5 years.

However, if you understand what the ETF is trying to accomplish, then you would realize that this ETF may exist in your portfolio for a specific purpose.

When the volatility picks up, the value of Tail will go up and that is where you need to harvest those gains and rebalanced them to the portions of your portfolio that were down.

In short, you cannot view the returns of such fund by itself but its function in your overall portfolio.

Here is an ETF people may be more familiar with:

This is the performance of the iShares S&P 500 Info Tech Sector ETF versus the S&P 500. The ETF has done very well in performance because this sector has generally done well for the past 10 years.

What people may not realize is that while some sectors may do well for a period, in other periods, they may underperform.

Your investment experience depends on whether you are able to catch the sectorial trends successfully.

Tying all together: Why you have a hard time evaluating fund performance

Generally, I observe that we have a problem evaluating whether it is a good idea to invest in a fund because:

- We cannot discern the style/strategies that the fund is trying to do. If we don’t know what is the style/strategy, how do we frame our evaluation correctly?

- We expect the fund to have a great performance every year.

- We forgot or didn’t realize the first principle: It is generally quite difficult for managers to outperform over the long run.

Usually, investments come in some fancy name. As the manager wants you to get invested in their fund, the most explanation is packaged nicely so that you can understand.

A lot of the time, they dress up those things that you want to hear and suppress those things that would confuse you (if you are confused, you are less likely to invest)

The ironic thing is… we usually want to invest in a fund that has performed well in the past.

If we go back to the first principle, funds usually struggle to stay in the top quartile over the long run.

Sectors tend to mean revert. There are times certain asset classes do not do well. Strategies all have some Achilles heel (read they have weaknesses). There are always periods of weaknesses. And periods of weaknesses vary in durations.

Usually, investors pile into strategies at the wrong time. That is when the manager will struggle to invest with good risk versus reward.

But I think what is hardest for most investors is that it requires some sophistication to understand how those strategies work.

Then, you can roughly know:

- How is the risk versus return trade-off like?

- What are the strengths of those styles/strategies? Under what kind of regimes would those strategies work well and under what regimes would those strategies falter?

- Are these absolute return strategies?

- If these are black-box strategies, do you know what are the economic drivers behind these strategies?

- Taking out the manager, what are some of the worst-case scenarios possible of these strategies?

- How important is the manager?

A lot of the funds out there are trying to capture certain factors such as momentum, value, quality, profitability, low volatility, size, liquidity manually or quantitatively.

If you are able to discern the factor style that the fund is trying to do, their great performance may not look so great when measure against a small, value and profitability index.

I have seen enough comments from investors fledging certain popular funds, popular Robo-adviser’s portfolios when they are not doing well.

By escaping from one portfolio into another fund or portfolio that are doing well, without understanding whether there is a difference in style, you run the risk of jumping from one poor situation into a situation that is about to turn poorly.

Ultimately, the lack of understanding of the style and strategies is likely to stop many investors from investing in certain funds long enough to harvest the return.

They end up chasing after good returns, measuring funds based on returns, forgetting entirely about the first principles.

The more appropriate thing to do is to identify the styles that work in the long run, understand their unique characteristics, whether they fit your temperament and then stick with them.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Jaime

Wednesday 24th of November 2021

Great article.

Do you mean to say that a passive index fund may be more suitable for the average novice investor vs trying to understand the complex style/strategies in the hope of choosing a success active manager (given odds are empirically stacked against them)?

Kyith

Friday 26th of November 2021

Hi Jaime, sometimes simplicity is better than these complex strategies. But the point of my article is that a lot of people are evaluating things the wrong way. Even if we invest in a passive ETF, your friend will comes along and tell you hey you should invest in this Moonshot fund (there is such a etf ticker Moon) and its returns are much better. Our lack of sophistication unfortunately may lead us to take the money from the passive ETF and put in these funds. How do we evaluate whether Moon is really better? That is what i feel a lot of people (including myself) struggles with. We cannot always just look at the return.

lim

Saturday 13th of November 2021

I think there is room for balanced funds like LionGlobal All Seasons or First State Bridge. These funds will probably never be in the top quartile, but they are valuable in helping investors reduce risk by constantly rebalancing to hit their target bond/equity allocation.

By the way, your webpage has recently starting showing video ads that auto-play with sound. The problem with this sort of ad is that it makes users start using ad-blockers. I would prefer not to use ad blockers, but I draw the line at ads that autoplay with sound on.