Lai Xiaomin was once dubbed the “God of Fortune”.

Xiaomin used to control Huarong Asset Management or China Huarong, a state-owned asset management company in China.

Used to because he doesn’t anymore.

On Jan 2021, Xiaomin was executed, 24 days after he was sentenced to death for receiving bribes and committing bigamy.

China Huarong was established in 1999 by the China government in response to the 1997 Asian Financial Crisis. As a government-approved financial asset management firm, Huarong acquired RMB 407 million non-performing loans from ICBC bank.

The idea is Chinese government provide the funding to acquire these loans so that ICBC bank would be kept in a pristine condition. From a third person perspective, this does not make much different as ICBC is also state owned.

However, this is like Kyith keeping two separate special-purpose-vehicle (SPV). One will house my mortgage loan and the other the investment property. If I just keep talking about the SPV that house the investment property, it may make me the envy of friends. They will not see the other debt-laden SPV that I refuse to tell them about.

All that is in past history.

Huarong rehabilitated quite well after that. Nowadays, they are quite detached from their origin. In June 2020, Huarong has RMB$1.73 trillion in assets and RMB$1.37 trillion in interest-bearing liabilities.

It’s core business is in buying and restructuring sour loans. This makes up about 50% of its total assets. The rest of the assets are meant for its banking, securities trading, trusts and inestment management business.

Xiaomin took over in 2012 and Huarong pushed into investment banking, trusts, real estate. Soon, global banks took notice and Morgan Stanley, Warbug Pincus, Goldman Sachs, BlackRock, Vanguard all took stakes in Huarong.

Huarong main advantage is executing a prevalent interest-carry trade: Borrow from the offshore market at interest rates as low as 2.1%. It then lends to companies that traditional Chinese banks turned away.

In 2018, Xiaomin was arrested. He confessed to a range of economic crimes in a state TV show. He kept a lot of cash, expensive real estate, luxury watches, art, and gold.

Huarong’s income and assets sank as the truth about Lai’s arrest came to light.

On April 2021, Huarong announced that the company would delay its 2020 results as the auditor needs more time.

That is when people starts sweating over it.

Fears of Near Term Default of Soon-to-be-matured Huarong Bonds Held by Some Singapore Bond Funds

Why am I telling you about Xiaomin and Huarong’s story?

Remember the part where Huarong issued low-interest offshore bonds to lend at a higher onshore rate?

When the news of Huarong’s troubles came out, it probably unsettled some bond fund managers.

If they have Huarong bonds on their books, they will be wondering if the bonds will default.

Different grade of bonds is priced differently based on the quality of company issuing, the features of the bond. The risky company need to compensate creditors with higher interest coupon in exchange of lending the company money. A high-quality company like Berkshire and Amazon will command almost 1% or below as the probability of them defaulting on the loans is so small.

Fund managers diversify the risk of a subset of bond defaults by holding a portfolio of bonds. A competent bond manager would have assess the bonds available, balance the risks versus the returns expectations and select a basket of bonds that he knows give a good risk-adjusted return.

If a subset defaults, it affects the short-term return but it does not impair the whole fund. Over time they can correct the mistake.

What if a fund that aims to preserve capital, provides high liquidity and better returns has a portion of its portfolio impaired by a default?

There was a couple issues of Huarong bonds that got people sweating.

One of them was a Huarong bond issued in 2017 that will mature on 27 April 2021. The maturity date was 5 days ago.

The coupon on this bond was 3.2%.

A few funds locally held this bond that was maturing in less than 6 months.

The shit thing is… the Chinese government and Huarong were real quiet about whether the bonds would be repaid or not.

When we got wind of the news, we checked Bloomberg and the bonds were already trading at a discount. A Huarong bond that is maturing later was trading at almost 50 cents to a dollar. For a bond maturing in less than 1 month, the 2017 bond should not be trading at such a discount.

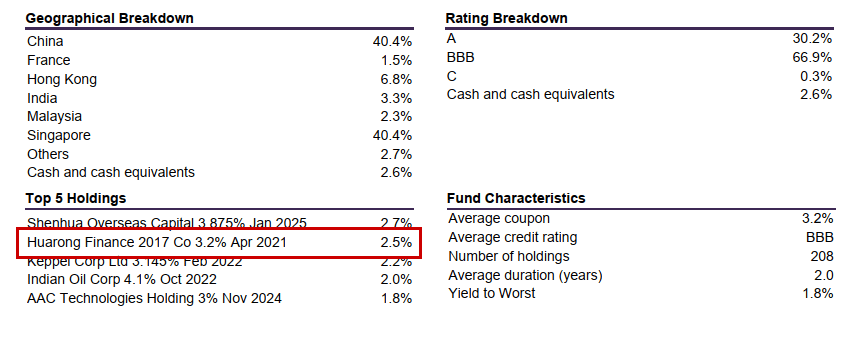

The most prominent was LionGlobal SGD Enhanced Liquidity Fund. Here is a peak from the fund’s Feb 2021 factsheet:

Quite a sizable holding.

Here is Fullerton Short Term Interest Rate Fund‘s Feb 2021 factsheet:

This is within their top 5 holdings.

LionGlobal Enhanced Liquidity is prominent because… this fund is in almost all the cash solutions of the Robo-advisers (with the exception of MoneyOwl). It is in

- StashAway Simple

- Syfe Cash+

- Endowus CashSmart Core

- Endowus CashSmart Enhanced

- Endowus CashSmart Ultra

- iFAST Cash Sweep

Fullerton Short Term Interst Rate Fund is in Endowus CashSmart Ultra.

Basically, Endowus CashSmart Ultra had the largest share of Huarong 2017 bonds.

There is a silver lining to this story. From what I understand, China Huarong finally said they will make payment on the bonds.

These cash solutions should do ok, for now.

Some Important Lessons We Can Draw from this Huarong Stress

There is this very pervasive, unsettling behaviour that I have observed these two years.

An intense focus to search for the highest-safe-yield for cash.

This search is more pressing for some because they are risk-averse to investing, and so there is a pressing need to find greater returns for their cash.

Yet, they wish to preserve their capital.

Hurdle savings accounts from banks and financial institutions become very popular.

Robo-advisers start coming up with cash solutions.

StashAway was the first robo-adviser that they came up with a cash solution. And it is likely they took in gob-loads of cash, much more than their bond and equity portfolios.

If you see a competitor getting such good results, it is likely that everyone will follow suit. Just recently, Endowus came up with their CashSmart Ultra. They already have a Core and Enhanced. They even have a Defensive portfolio using their Pimco unit trust portfolio.

3 of these short-term, safe-like portfolios was not enough to segment the financial planning needs of their clients and they needed a fourth.

What is the rationale here?

Asset-grab.

During those period, you can go to Google, search up and preview their site and you will realize the focus is not on their bond-equity portfolio solutions but on…. cash management.

To be fair, there is the advantage of a cash solution managed under the same house that manages your more risky portfolio.

You have a single view of your finances.

In a way, the risk-averse savers are the ones partly enabling this behaviour because you wanted it.

Cash Management Solutions should preserve capital and give liquidity first and formost. And as such, I think it should be limited to unit trust that invest only in fixed deposits.

The key criteria as a cash solution: If I put in $50,000 three days ago, and I need $50,000 in 3 or 5 days time, I should be able to get it, not a single cent less.

It is less about the return. Returns are important, but that has to be reviewed with the risk profile of the assets you allocate your funds to.

The risks of fixed deposit imploding are very, very low (As a data point, in the Great Financial Crisis, the value of LionGlobal Money Market Fund, which invest in very short-term notes and fixed deposit lost value but recovered later.)

But because the risk is very, very low, the returns are low as well.

And the returns of money-market funds alone are unappealing to many wealth-builders. They are definitely very unappealing when your competitors touts north of 1.5% a year returns for a “very safe” portfolio while yours is less than 0.8% a year.

There is a lot of trusts placed upon your adviser, in this case, the Robo-adviser, that this cash management solution is safe.

I observed that the conversation shifts to “Should I shift my money from XXX-robo and put in Syfe Cash+ because the yield is higher?”

Everyone evaluates based on the returns, but there were less conversation about how volatile the underlying unit trust is.

It is as if those portfolios will not suffer from a contagion.

Huarong case study didn’t turn into a contagion, but you could imagine in another case study, there is an Asian bond or China bond contagion. The whole climate becomes uncertain.

If you own these unit trust, one day these uncertainties and probable volatilities is going to hit them.

These cash management portfolios are partly bond portfolios. They are likely higher-quality bonds but you should be keenly aware that when you invest in bonds, they are higher up the risk curve compared to fixed deposits.

Higher yield than normal exist either because there are some credit, term risks or liquidity risks.

If they are a “very, very safe” solution, the LionGlobal Enhanced Liquidity should not have a yield to maturity of 1.6% but closer to 0.8% a year.

In today’s climate, if you reach for greater than 1% yield, you are taking on higher credit or longer term duration risks.

Some of you may be taking on more risks even though you have less intention to.

To round this off, bond defaults are uncommon for portfolios of high credit rating but they can occur from time to time. If you wish to invest in bonds, investing via a bond unit trust or ETF is safer than investing in individual bonds (Imagine if you put your money in 4 bonds and one of them is a Huarong bond.)

A 3% default in a bond portfolio is recoverable. The unit trust return would suck in near term but if the fund manager manage the portfolio well, the value will come back .

A contagion and a host of bond defaults might be a bigger problem. Investing in a bond portfolio will still be safer than individual bonds (especially if you lack the sophistication to analyze the quality of the bonds). An impairment of 15% of your portfolio is better than a 100% impairment of your capital.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Sinkie

Monday 3rd of May 2021

If Huarong had been allowed to default, it is not just those holding Huarong bonds who will be affected. Everybody holding any China bonds AND stocks will also be whacked HARD. The news will call it contagion.

People need to differentiate between MAS-authorised money market funds (MMF) & short-duration bond funds or "cash solutions".

MMFs like those from Lionglobal, Fullerton, Phillips, and Eastspring are much more resilient. Lionglobal one seems to push the envelope of MAS definition of what MMF here can hold; no surprise it's the highest-yielding MMF (but still only about 0.8%).

In the worst part of GFC, when Lehman defaulted and global credit markets froze before Fed stepped in, I remembered Lionglobal MMF max drawdown was 0.06% over a week or so.

The Phillips MMF & Eastspring MMF (as FSM cash fund at that time) didn't have a drawdown. But you can see their yields are like 0.2% today.

During the years before GFC, the favourite "cash solution" was the DBS Enhanced Income Fund yielding 3% in those days --- also a short-duration bond fund. It dropped about 4% within a month during GFC (Sep/Oct 2008) which freaked people out, and took 1 year to recover.

So if you want/need to maintain large cash amounts, you may want to apportion them according to liquidity & access needs e.g. emergency funds & living expenses (bank savings deposits), can wait a few days (safer MMFs), can wait 1 month (Lionglobal MMF), can wait 1yr-2yr (short duration bond solutions).

PS: I believe the DBS Enhanced Income Fund is now the Nikko Shenton Short Term Bond Fund. The Nikko one *seems* to have better risk mgmt than other short duration bond funds, perhaps after their experience during GFC. But the problem with all short duration bond funds constructed locally is the high allocation to China bonds, at least 30+%.

Sinkie

Thursday 6th of May 2021

Addendum to my above...

The future of Huarong Asset Management Co., a troubled Chinese financial conglomerate, may be determined by a man who believes that allowing more state-owned companies to default is just what the country needs: Vice Premier Liu He.

With a range of scenarios still possible -- including a state-backed cash injection or a lengthy restructuring that involves losses for bondholders -- analysts, economists, and investors see President Xi Jinping’s economy czar as playing a critical role. “In the end, Liu He will be the person to make the final decision,” says Chen Long, an economist at Beijing-based consulting firm Plenum. “He doesn’t want to bail out everybody, he doesn’t like moral hazard. And on the other hand, he doesn’t want to trigger a financial crisis.”

While he’s yet to speak publicly about Huarong’s fate, Liu’s past comments suggest he believes allowing SOEs to default is a necessary step to force lenders to price risk based on a borrower’s business prospects rather than its Communist Party links. Last summer, while China was still struggling with fallout from the coronavirus pandemic and politicians in the U.S. and Europe were supporting their economies at almost any cost, Liu announced that the task of eliminating weak companies “must be handed over to the market.”

Removing implicit state guarantees is seen by Liu as a pivotal part of “an overhauling of capital markets so they can be made fit for purpose,” says Dinny McMahon, author of China’s Great Wall of Debt. “They don’t properly price risk, they don’t efficiently allocate resources. If China wants to foster growth and innovation, capital markets have to change.”

Liu, 69, has known Xi [Jinping] since childhood. Both men are the sons of veteran Communist Party leaders, and they were among the masses of young people dispatched to work in impoverished rural areas during the Cultural Revolution.

https://www.bloomberg.com/news/articles/2021-05-05/huarong-s-fate-may-rest-with-xi-confidant-who-loathes-bailouts

Sinkie

Wednesday 5th of May 2021

I would classify it as country-specific emerging market bond ETFs. A lot is riding on the "mercy" of Beijing i.e. one of the big bond risks --- country / jurisdiction / political.

I also dunno who does the bond ratings in this ETF (no interest to go look). If it's mostly China ratings firms doing it, then I'd take them with a big truck of salt. Western rating firms like Moody's, Fitch and S&P are not infallible (e.g. mortgage CDOs of 2006-2008), but they are a heck more reliable.

i.e. I would treat it as a junk bond ETF and wouldn't put a large % of my portfolio into it. Some % is OK I suppose from diversification aspect & of course depending on risk appetite.

But I suspect you're more concerned with safety & wouldn't accept a -30% correction in a financial crisis...

lalaman

Tuesday 4th of May 2021

@Sinkie, would you have insights or analysis into the CSOP China Govt bond ETF?

http://www.csopasset.com/sg/en/products/sg-wgbi/etf.php

Supposed to be investment grade and yields ~3%? Seems like long term bonds too (where older bonds are called and newer bonds are added every month so there is no bond expiry date to the ETF)

Wondering if there is any underlying risk that ordinary folks cannot see (other than China's central bank going bust?)? Appreciate your thoughts.

lalaman

Sunday 2nd of May 2021

Nice write up. you are right huarong bonds is a key holding in many bond funds so the implosion of huarong would have some impact (hopefully below 5% of all bonds held by the various funds).

Your call out on the growing prevalence of cash/money market funds is timely because so many local players (Syfe, endowus, philips, FSM etc.) all have some form of money market fund. Believe the original intent is to create customer stickiness so that investors would trade using their platforms. However, some investors treat them the same as the current account of local bank, that they can deposit money and withdraw anytime they wish.

It was not too long ago (GFC? probably also last March/Apr before Feds cut interest rates and threw in stimulii after stimulii) that rumours of bank runs would occur when liquidity dries up. Banks can probably survive with government help but I dont think govts will bail out trading platforms ... hence cannot treat them in the same light (despite 0.X% higher interest being offered or a APPL/DIS/SBUX share) ... hence the usual caveat emptor applies (no free lunch because higher interest comes with higher risks).

Kyith

Sunday 2nd of May 2021

Hi lalaman, yeah i think you might remember it better. I would qualify that perhaps having a bond fund is still better in this regard than individual bonds. But these funds are not riskless and hopefully many recognize that.