What are we saving for? Are we saving for food and expenses? Or are we saving for lifestyle.

I was reading this very thought provoking post by Early Retirement SG. Well, he is currently not in Singapore, following his wife to work. So now he is living in Paris.

If you follow his posts, you will realize that whatever skill set you picked up on Freegan living, can be applied in Paris as well.

So now he has taken food that will probably last for 3 to 4 days.

Early Retirement SG reflected on how our insecurity with food may be similar to our insecurity with money in a certain way. But at the same time, it can be rather different.

How Knowledge of Capacity and Perish-ability Changes Things

The main difference between his insecurity with food and our insecurity with money is that there is a certain capacity that we can hoard.

I explained it as his insecurity because this is unique to him. For most of us, the supermarket is always open. The supermarket for most is pretty close to us. So there are no insecurity there.

However, when you are able to gather food that people do not want, the dynamics changes.

You start thinking about

- How much exactly I need?

- How long these food will last?

- How much can I store in my home?

When I went on an experiment to see how many I can last with food I can gather from all over the place, these are the considerations. Most of the time, we can get too much food. Both cooked and uncooked.

However, you also start seeing your psychic change.

I developed the hoarding mentality. However, for food, I cannot hoard much because I have to think about where I can put them. I am also limited to how long I can store them.

But you will start going through that mentality of “this is free!” to whether you can systematized this collection, storage, cooking, determining the optimum amount to take.

To me, back then it was a project. It was not really a need. It will be difficult to make peace with my father on different food philosophies. So it ended after I went through this Freegan experiential period.

The biggest learning experience for me was to learn about

- the supply chain of Singapore fresh produce

- where to find these unwanted food

- how much you can get

- how could you roughly systematized these things if you wish

- seeing my reaction to stuff that does not cost money from a third party perspective

Daniel Tay said that when he had more money, being equipped and earning as a financial planner, he never felt a sense of security. Freegan living did. I gotta say I agree with him on many levels there.

I digressed a little too much.

The idea is that…. I cannot bring home all. These things are perishable.

Perhaps another reason is that…. we know there is a limit to our capacity. How much does Kyith eat? How much does my dad eat? Since my dad disagreed on this philosophy, he would not eat as well. There is a few stuff I do not take for health reasons as well, so that limits things.

Food is something that we know the capacity limits (the refrigerator and the number of stomach capacity x number of meals per day x number of people that wishes to eat).

We often saw on variety shows, or in the news some old folks that keeps… quite a fair bit of things.

They probably also have a capacity. How big are their room and flat. The difference is that these stuff are not perishable. You can put them there for a long time.

Do We Hoard Money as Well?

Hoarding is often described as an excessive acquisition of and an inability or unwillingness to discard large quantities of objects that cover the living areas of the home and cause significant distress or impairment.

Hoarding for me feels quite psychological.

It often stems from some trauma at certain pivotal periods of your life. It is pivotal enough that psychologically you wish to prevent yourself from going to that situation again.

This can be not having any money when you were young, not having things you want. Then you suffer at the hands of your school mates, friends, society for them having it “easily” while no one can give it to you.

Or it could be when your family lost everything due to failed business. The quality of life suffered that behaviorally it shook you .

When older adults hoard stuff, they may have this fear that “some day that they will need it”. When they need it, they are afraid “they could not afford or it is senseless to spend extra money on it”.

It is a form of insecurity.

And to a certain extend I felt we can say the same about our relationship with money.

Some businessmen have a poor childhood.

It haunts them. It gives them motivation to do better. They eventually did. They made a lot of money.

However, while their economic status, and lifestyle changes, psychologically they didn’t grew out of that insecurity. They just keep accumulating. They didn’t know when to step down their efforts. They explained it by that is their work ethic, there is a strategic direction. That may be true to a large extent.

However, I felt that this money insecurity can be the greatest motivator.

We do not Know What We Want and an Uncertain Future

Those who tend to excessively hoard do that because there is a certain limit to what you can use an item for.

With money, we do not run into that problem. This is because one of the advantage of money is that it is used as a medium of exchange.

If you have a lot of that, you can buy different goods and services. It can do a lot of different things.

We hoard money because we do not really know what we want. Whatever the excess, we will save it. However, if you ask the folks what are they saving for, they do not have the clearest picture or how much they need.

Having money is better than not having any.

How could financial planning solved this problem?

I felt that majority of this problem is not going to be solved instantaneously by just providing some financial plan.

What we can do is to established a good framework to show you different levels of security and independence. And then we show you where you are.

If our framework is very robust, you should feel more safe. If the framework is not very robust, then you will feel more safe, but it is a false sense of security. We have failed in our job.

The framework established the various capacity. For example, how much do you need for you not to fully work. We can establish a investment portfolio that can provide a cash flow for you for 50 yo 60 years.

Another example is how much you need for your 2 children’s education?

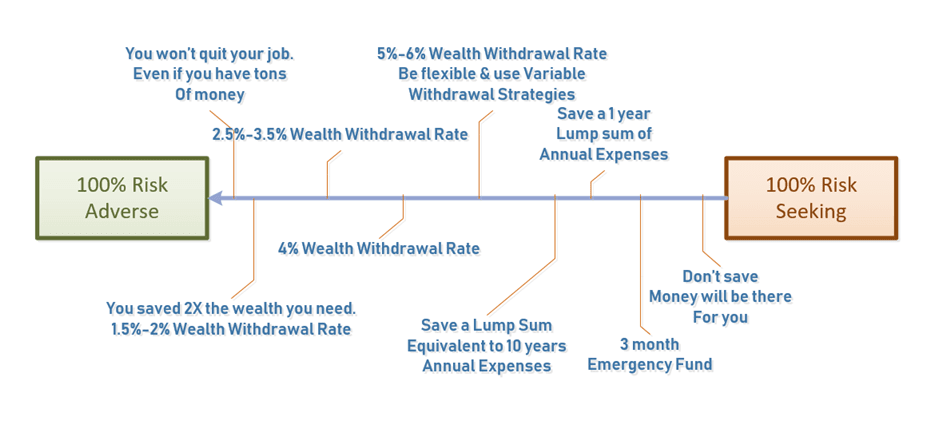

In my comprehensive article on establishing financial security, I showed the graphic above. We are all haunted by our past to different degrees.

What we can do is to established different level of capacities. Those that are more risk adverse, would need more. But still, there is a limit to that.

For example, a very conservative measure is that

- You map out how you want to live your life in the future. This is your annual expense.

- We buffer #1 by 100%

- Then you withdraw 1% of your wealth in the initial year. For subsequent years, you adjust that spending amount by whatever inflation that year

You need a lot of money for this plan. But even then, there is still a numerical limit! A strong framework will give you what is this very upper limit where we can soundly conclude you are rather secure.

And then you can think of what you want to do with your money.

For those excessively financially insecure ones, yet have less resources, they probably need to make peace with themselves.

They have to be able to move up the spectrum to more risk seeking. But up to a certain point where they could accept (and also fundamentally sound. Some risk seeking can be really crazy).

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024