I still have some work to do over the weekends so its no stock analysis, less reading, all work.

Meantime, I came across some stuff that you might find interesting. Something on FIRE, something on media coverage, a little on the HENRYs and my thoughts on annuities.

My Thoughts on Annuities

In my last Sunday article, I profiled how an insurance adviser manages the potentially volatile nature of his income.

He has a question for me that I forgot to address and so I do owe him an answer.

Basically, what do I think about annuities?

It is a weird question but this question can be about what I think about it as a wealth accumulation tool and what I think about it as part of retirement spending. I think my friend is more interested in my opinion about it as a retirement tool.

As an accumulation tool, annuities are likely to be underpowered. They should return you 2.5% a year to 4% a year. If you take on leverage, you would boost your IRR to above 4%.

You do take on more risk when you take on leverage. Interest rate movement can be 50% up and down within a short time.

As a retirement spending tool, they look appealing. Guaranteed income + non-guaranteed income. Those that are close to being retired like them a lot because they promised passive income payouts.

As I have explained in this Providend Passive Income article, what matters is the total return when we are in the accumulation phase and it is as important in the de-accumulation phase.

When a person buys an annuity, it is a vote that

- I wish to have passive income

- I am not good at having a systematic way of varying my spending up and down. I prefer for someone to tell me how much to spend on

The greatest benefit to those retiring is that they transferred the investment to the insurance company. They have also transferred the cash flow management to the insurance company.

There is a cost to this. The cost to this should be lower returns.

If this is the case, it makes these cash value endowments and whole life to be poorer wealth accumulation tools. But if you are really bad with money, you can consider getting them. But at the end of the day, you cannot run away from some financial planning problems such as how much can I safely spend.

If you have 10 streams of income, and you do not know how to spend without exhausting your capital, having 10 streams of income is less useful.

Another drawback is… I think the payouts are not inflation adjusting. Thus annuities can be used to address your core/survival expenses. But they cannot take care of the inflation adjustment of your core/survival expenses.

Start Your Financial Planning at 40 and Forget about F.I.R.E

Alvin Teo wrote this pretty popular article over at the Astute Parent. The basic premise is that life is pretty volatile before the age of 40.

The advice is that realistically, you can only start planning your retirement after 40.

FIRE is difficult because

- You need a high income

- You need low expenses. But this is difficult to achieve

- Cars are a necessity and expensive

Alvin is a financial planner so what he said should hold some weight.

The 25 to 40 period is said to be the most volatile because you are in your career building phase. Your income has not reached a level where your family feels comfortable with. You have 2 young children and logistically you will need a car.

I think it is not because your cash flow is volatile.

The right word will be that your expenses keep climbing and you could not have a high savings rate. A high savings rate is a very, very important part of accumulating money fast for financial independence or other goals.

So he is not too wrong there.

But I got some push back.

No one said that if you do not retire by 40-year-old, you are severely missing out.

It seems that his brain is fixated on this 40-year anchor or someone imprinted that in his head.

Alvin cited Pete Adeney as one of the pioneers in this movement. One reason that he could reach his magical number at age 30 is because they are working in software engineering. They earn a good salary and thus they have a leg up.

If you read through Pete’s route to accumulating his US$600,000, you will realize that while he earns above average, relatively speaking, it is not out of this world kind of salary.

His first salary is US$41,000 a year. I am not sure if this is out of this world high. It probably was higher than average in 1997. In today’s dollars, this is US$71,000 a year.

What was a success for them was:

- Their magical number is measurably smaller

- They control their spending

- They control their family dynamics

- They well optimized their slightly above middle-income salary

Having a high salary helps speed up accumulation and improves planning a lot but overly focus on the high income dissuades people who fit these criteria from achieving something that is useful.

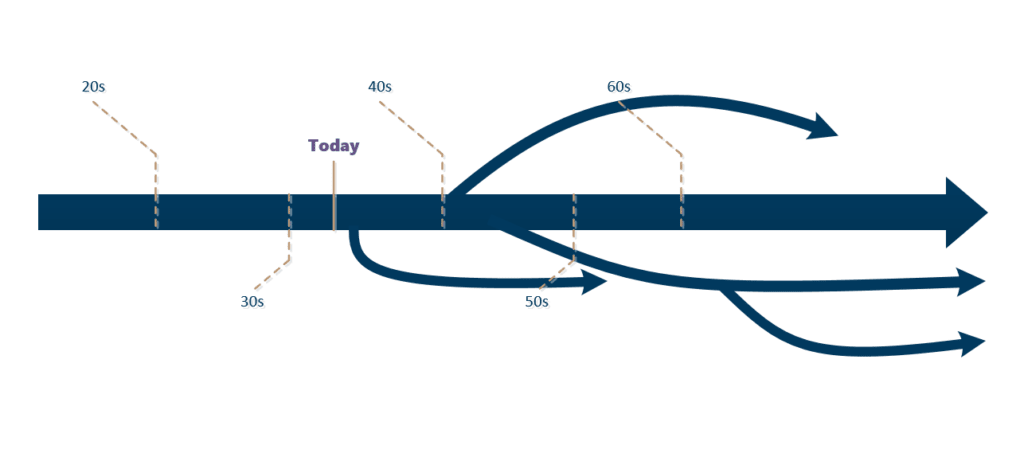

The 40s and 50s Can be More Volatile

So here is more likely his plan. Manage your expenses before 40 by getting your home infrastructure in place. This means get married, renovate your home, budget for both your children, pay off your mortgage.

By the start of your 40s, you should have a much more comfortable financial situation:

- should understand your family budget better

- have less big-ticket / lump sum expenses that you would need to pay for

- if you have done correctly, you may have de-leverage your home mortgage loan

The problem that we may face is that the 40s and 50s may not be less volatile.

We can roughly map the milestones

- 30s: Child-bearing, wedding, buy-house

- 40s – 50s: Kids tuition, Children tertiary education, taking care of parents

- 60s: Retirement spending

Many of us feel the expenses never go down. It just keeps going up. And so the salary would have to keep up.

An emerging problem is that the 40s and 50s is just as challenging

- Mid-life crisis & depression

- Your job hits terminal salary growth faster than you imagine

- Retrenchment and having to re-climb the ladder again

- Taking care of parents, losing your parents

Now, imagine being middle income and having limited resources, facing the above. Not less volatile isn’t it.

In fact, you may not be more employable.

We end up funding our lifestyle to just be in time for when our salary is more volatile. (Unless you believe the old corporate ladder system still existing)

The point is that 40s and 50s are not less challenging than the 20s and 30s.

Everyone’s Situation is Different

When you write for the masses, you have to use a very average person as an example. However, there are some of you who would really do better doing what Pete Adeney did.

Your spouse and yourself earn $160,000 a year that in 5 years you could amass $500,000. A $500,000 wealth at age 33 would be able to grow on its own over time if it is deployed well. You worry less about uncertain future career in the 40s and 50s by pre-funding it now.

And since you could maintain a frugal nature, it is likely your family can use 1 year of savings for wedding, renovation, and furnishing.

Funding goals need not be spreading your money out evenly over time.

You can choose not to fund retirement first. First-year save up $92,000. That is equivalent to your 2 children’s local degree in today’s dollars. You could put this $92,000 in a balanced portfolio and let it grow over time.

Then next year, commit that $92,000 to something else.

Higher than average salary, with knowledge, plus intentional living is what pursuing Financial independence is really about.

You can choose not to pursue it and go with a traditional route. But some of you would have missed out on some great life opportunity costs.

The Surprising Part of the Eagle Hospitality Trust Coverage

Recently, in the financial space, what is on people’s minds is the Eagle Hospitality Trust saga. A seemingly not very popular REIT became one of the most scrutinized REIT in a few short weeks.

Enough bloggers write about it because we crave for eyeballs and ad dollars but also… because perhaps this is a genuinely good buying opportunity.

When a stock goes down with poor news, either they have long term fixable issues, or that there is a change in fundamentals. The former would mean this is a good buying opportunity, and we might want to stay away if it is the latter.

However, I would like to comment on a certain aspect of this EHT narrative.

We realized that established news sources such as SPH have deeply researched company pieces. The same journalist who wrote a deeply investigative piece about Best World also wrote about Eagle Hospitality Trust.

Deep scuttlebutt is not something that journalist cannot do. Even the average joe can do it if they put their minds and deductive minds to it. I have seen conscientious average retail investors try their best to do it. If you are willing to dig, you are able to find things.

I do think that if you write as a job, there are just so many things to do. So much so that I wonder if someone is providing journalists with areas to look into. I grew to empathize with analysts when people say some of their reports do not value add. I want to see you put your heart and soul into writing when you have to cover so many companies.

Would the people providing these sources have some agendas?

Let us pay attention to whether there are deeply researched articles without the crisis elements in SPH Business Times next time.

The HENRYS – Huge Opportunities that can be Lost Easily

HENRY is short for High Earners Not Rich Yet.

There is this site called HNWORTH with a rather well-researched article on it. I appreciate him trying to do the research work.

This is a group that is likely earning between $250,000 to $500,000 a year. It is probably the dream of all financial advisers to make up the majority of their client base with clients of this stature.

The take-away that I get from the article is that the gap between this group and those above them, versus the rest are getting wider. Their income and wealth are growing versus other groups which are struggling.

Not just that, the data seem to give me an impression that

- deposits and cash have growth a lot

- private property have grown a lot

- CPF has grown a lot

The rest have not grown as fast.

There seemed to be a pent up demand for private properties, as if, there is not enough residential private properties around for investments.

I have sort of form this view about a segment such as this. The typical higher decile Singaporean household would spend between $4000 a month to $9000 a month. Those on the high side would spend between $7000 a month to $12,000 a month. This depends on how frugal or spendthrift they are.

What this means is that it is likely they will have a high savings rate (about 40-70%), to channel into saving and investments. So there is much pent up money waiting to be invested.

The main instrument would be private properties. With the ABSD, psychologically this might deter some of them from buying another one. Other good investments for the HENRYs would be what is provided by the private bankers.

The HENRYs are in a position where a lot of people wishes to manage their money and eventually, they might end up with an assortment of financial assets that they forget the initial reasons for buying them (if there is any)

They have great opportunities, but they may easily lose all these opportunities as well if they are not careful.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Thinknotleft

Wednesday 13th of November 2019

Hi

Alvin Teo's article noted on starting retirement planning at 40s. This idea seems incorrect to me. He is asking people to forgo the compounded interest from investing or topping $ into CPFSA for 20 yrs.

Imagine that you can top up $1,000 into CPF SA at age 22. You get about $2,000 at 40 yrs old and $4,000+ at 60yrs old. It is less costly to accumulate retirement funds when you start earlier.

Kyith

Sunday 17th of November 2019

Hi Thnknotleft, the principles of wealth is to start early and start with more. this violates it definitely. so what we are saying is forgo our dreams first so that we can build up the nest egg.

Sinkie

Sunday 10th of November 2019

1. Delayed annuities are terrible for accumulating retirement assets due to the ZIRP or financial repression that is ongoing in S'pore for almost 20 years now (with no end in sight). Immediate annuities are probably OK if they form PART of your retirement assets. Most annuities from insurers in S'pore are escalating, although their starting payments are very low.

2. The big question mark for S'poreans in their 40s & 50s is job security & income security (i.e. many end up in lower-paid jobs after retrenchment, or driving Grab). This is due to Singapore having very open workforce environment & regulations, AND easy availability of younger, cheaper & increasingly well-educated human resources from nearby countries around us. Millennials & Gen Z should hope for rapid economic improvements in ASEAN/India/China such that their home salaries rise rapidly & close the gap with S'pore's.

3. HENRY --- I suspect it's due to high pressure to conform to their social / professional peers. I have couple of relatives who are lawyers & up till their early-to-late 50s I had the impression that they were just head-above-water due to leveraging on many properties & expensive lifestyles for themselves as well as their children. But as long as they maintain their high incomes, it can be a happy problem once they start to streamline & housekeep their financial framework & assets.

Kyith

Sunday 10th of November 2019

Hi Sinkie, thanks for your sharing of HENRY and annuities. I would probably expand on annuities next time. The HENRY have the same issues as the typical middle income. they feel like somewhere in the middle of the pack, and these society pressure is always there.