Uncle CreateWealth8888 passed away on Saturday evening.

Yesterday, I met up with an ex-colleague of mine after meeting up with a couple who wanted to hear my perspectives about my thoughts on financial independence transitions. I wanted to share a photo taken with my ex-colleague when I saw the news on Facebook and was shocked.

His wake was the fourth wake I attended, aside from the wake of my dad, in less than two-and-a-half months. If we include two more months, that would have been the fifth wake.

Each of those wakes relates to people that matter to me in some ways, but honestly, I feel greater sadness reflecting on Uncle createwealth8888 because of how our paths crossed.

Uncle CreateWealth8888 started blogging as early as I had. His blog is an acquired taste, much like Investment Moats. He probably “pokes” me among the many people he “pokes” enough. I think I know what the fxxk I am talking about, but Uncle CreateWealth8888 also thinks he knows what the fxxk he is talking about.

Those poking sessions can be unsettling sometimes (lol, this sounds a bit wrong if you think about it differently).

If there is a thing consistent about Uncle CreateWealth8888, he will share his stern and robust views. There was a bit I felt some of the points were not getting across to him, so I asked him out.

One thing I learn from my friend Thomas (My 15HWW) is that people in real life can be very different from their online persona. My kopi session with him emphasizes that.

CreateWealth8888 is one of the most pleasant guys I have come across. We spent a few hours sharing our perspectives on investing and wealth planning. If we abstract away some of the disagreements and how we do things, our philosophy can be kinda similar. It is just that I cannot comprehend some of his cryptic comments lol.

If I had any considerations over “what he says is not really right, what I say is correct”, that stuff all faded to the background when I knew just what Uncle Jacob had been through.

Regular readers would know how I am a big retirement income planning nutcase.

I think the test of everything is when you ACTUALLY need to depend upon your portfolio for income. Then you will know if your system works or not. There is something that I prefer not to say, but I respect the people that really need to depend on the portfolio with little other means.

It is ironic to learn about his passing as I met people who wish to know deeper about the concerns about spending down your portfolio. If people ask me whether a concentrated individual stock portfolio can be a retirement income plan strategy, I would tell people it is risky for a lot of reasons.

But the minority can do it, and be comfortable with it.

Uncle Jacob would be a good example.

The goal of managing your money well is to fulfil your life goals in your life.

Uncle Jacob is especially proud to put his three kids through university on mainly a single income. I don’t want to say where he last worked but it is not the kind of salary you imagine. And it is especially difficult if you had to deal with the “thing” he had to deal with nearly twenty years ago.

Thomas, Chris and I reminisce about Uncle Jacob at his wake.

Among all of us, Chris had the worse from Uncle Jacob’s poking in the past.

But one of the most vivid memories was the one we shared six years ago.

Back then in 2017, under our sister company BIGScribe, we were thinking about organizing a talk around CPF (this was pre-1M65 days). We were thinking about who we can invite to give a talk that people would pay money for.

We invited Uncle Jacob as one of our speakers.

Thomas and I remember that session well enough.

Chris and our friend Dawn (SG Budget Babe) went first. Uncle Jacob was the last speaker.

We have worked with Dawn before and know Chris has no problem delivering the goods.

The biggest unknown factor was Uncle Jacob. I was standing at the back, not sure what would come next. I am sure Alvin and Thomas were thinking the same thing.

Uncle Jacob started his presentation with “Old man talk ah….” and then he was off.

I feel Uncle Jacob gave the most captivating CPF presentations that evening.

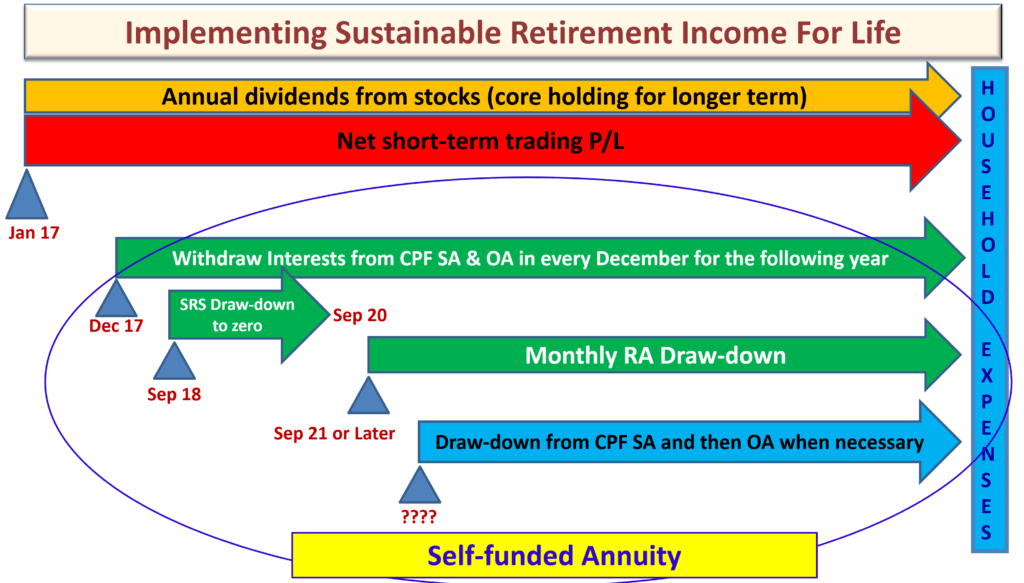

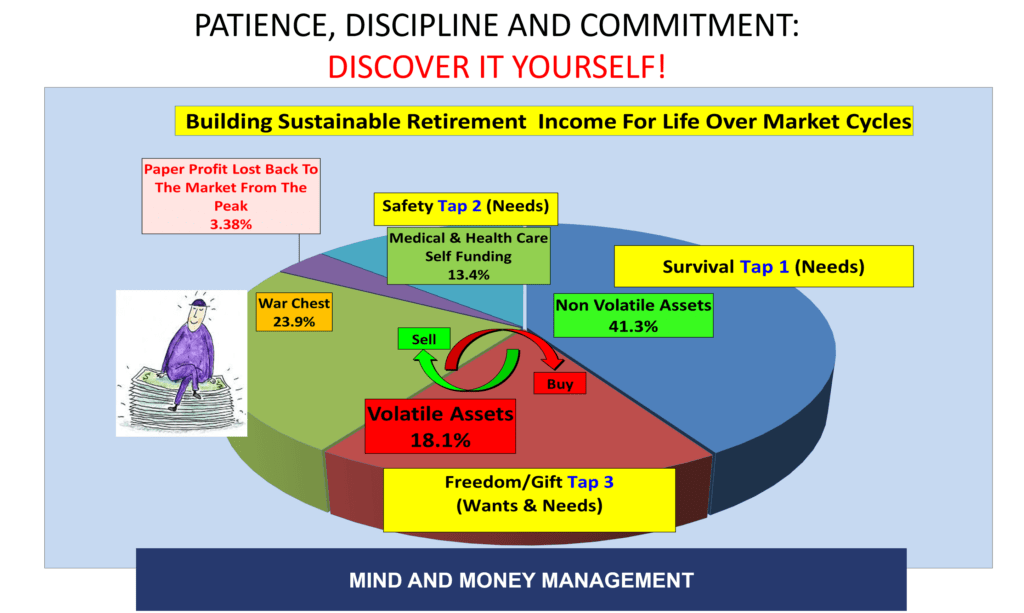

Uncle Jacob delivered a concise version of his planning philosophy around CPF, with the slide theme we are familiar with:

The crowd should appreciate hearing the perspectives of someone nearer to the end of the accumulation.

That session also gave us a glimpse of Uncle Jacob’s fans and readers.

I am sure many of you have been touched by Uncle Jacob’s sharing in some ways.

Many would not be in better positions without his very frank sharing.

We learn even at the end that finance is a big part of his life. His readers are a big part of his life.

Thank you, Uncle Jacob, for helping us back then and for walking together with us as part of our community.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024