The goal of many investors is to invest well so that their capital will grow over time so that the capital can fulfil its financial goal.

Investing in them may be less of an ego-enhancing sport but a real need to escape the rat race, retire, or provide for their families. Many investors realize venture over to the US stock exchange to invest in US stocks, seeking better returns. They found a market that is as unforgiving as the local stock market.

There are vastly more securities that they can invest in.

However, many eventually realize that the key ingredients that will help them build long-term sustainable wealth are not stocks or securities but whether they have a fundamentally sound strategy. They can also get decent compounded returns if they have a sound strategy and can apply it well to the local stock market.

Investing in the US market does have an advantage because the market is vibrant. There are dangerous investing ideas that masquerade as great ideas, but there are also strategies that may have a place in your investment portfolio.

I observe that there are more managers:

- Attempting to replicate hedge fund strategies in an exchange-traded fund structure with much lower cost.

- Mutual funds and separately managed accounts shift their structure to ETF structure. This means strategies currently managed in structures mainly accessible to US investors are accessible to international investors.

- More solutions that cater to registered investment advisers (RIA) needs. This may include the use of options and futures.

The trend is a move towards an ETF structure. This means that as international investors, investors in Singapore gain access to good managers or these innovative strategies.

To be clear, investing in funds in the US is not the most tax-efficient structure in my books. Most ETFs in the US have to distribute dividends to investors (unlike Irish-domiciled ETFs, which have both accumulating and distributing share classes), which means your dividends are subjected to hefty 30% withholding taxes. The estate of non-resident investors who passed away is subjected to estate taxes, which come up to 18%-40% of the investments, depending on the amount.

We can observe more US-based ETF strategies diffusing into Europe, which will take time, but some may wish to take the risk to gain exposure to these strategies immediately.

If that is the case, if you explore what is listed in the US stock market, you can find exciting products that package futures, options, stocks and bonds in an excellent package.

In this article, I will introduce you to 5 different US-based ETFs (or groups of ETFs) doing innovative things that caught my eye.

Form Your Own Bond Ladders with BlackRock’s iBONDS

Most people can connect with the virtues of owning individual bonds.

They understand better that if I hold a bond that does not default, I will get back a defined interest coupon payment and principal back. But they will try to reach for a sweet spot in yield, but for some, the sweet spot ends up being bonds that are so risky. These risky bonds have already priced in the risk of default into the yield that they see, which means that the return might not be high at all, as the risk of default is very high.

They considered it hard because for individuals, the outlay to buy one bond is not a small amount and if someone chooses a bond with “attractive yields”, they may end up concentrating their net wealth in risky securities that can fully impair their net wealth.

Yet they struggle to understand bond funds or ETFs because these funds do not have a fixed maturity period. Investors can see the principal return of individual bonds better.

BlackRock created a set of bond ETFs listed in the United States with a fixed maturity period. These are the iBONDs.

You can learn more on the iBONDs Site

Here is a summary of the Investment objective of the group of funds:

- A group of bond funds that allow an investor to build a bond ladder.

- Each bond fund holds a portfolio of bonds with similar maturity dates.

- Each fund pays regular interest payments and distributes a final payout during the maturity year.

- There are bond funds of different risk levels and, thus, different credit premiums.

The upside of each bond ETF is that:

- Fixed maturity period

- Diversified (solves the problem of holding a risky bond and your wealth gets impaired because your risky bond defaults)

- Much less initial capital is needed (solves the problem of large capital outlay for individual bonds)

- Relatively defined returns

This is excellent for financial planning such that you can buy a bond ETF consisting of riskier bonds that will mature when you need the money, or form a bond ladder.

Here is an example of a bond ladder:

Suppose your goal is to have enough money for your daughter’s university in 10 years. You want to earn the best bond returns but don’t wish to be locked into a particular interest rate. You can create a bond ladder by purchasing 5 bonds maturing at different intervals. Everytime a bond matures, you can reinvest the bond at the prevailing interest rates.

You can see the appeal of bond ladders if you are in the low rate environment a year and a half ago when rates are below 1-2%.

The 0.5% yielding bonds maturity gets reinvested in 4% yielding bonds.

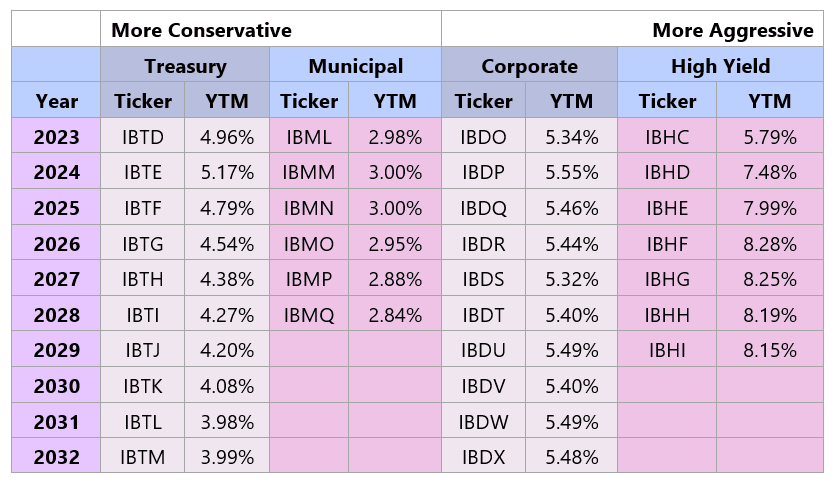

The table below shows the ticker of the series of iBONDs from BlackRock that is traded on the United States exchange:

You can see the corresponding yield. The bonds are grouped based on different classifications.

Some may already have ideas in their head how they can mix and match to create interesting bond ladders if they hold to maturity.

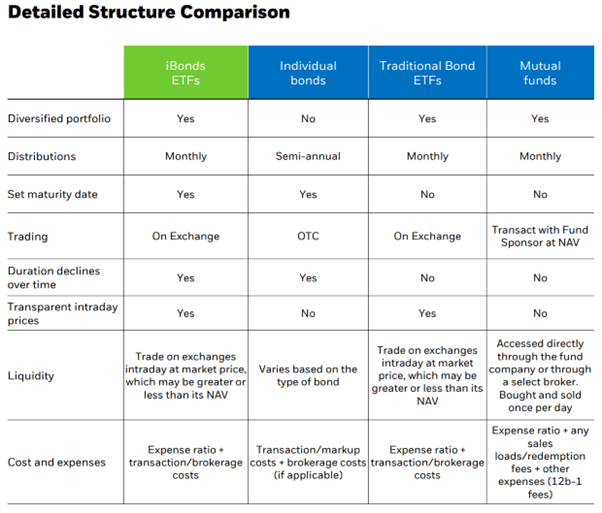

The table below compares the iBonds to different bond structures:

iBONDs do mitigate a lot of the long term financial planning risk but investors should note that you may not get back 100% of the capital.

For example, buying a portfolio of high yielding bonds prevents the risk of an investor losing a large chunk of his or her capital if the bond defaults, but numerous bonds can default in a high yield bond portfolio, which means there can be losses even in iBonds.

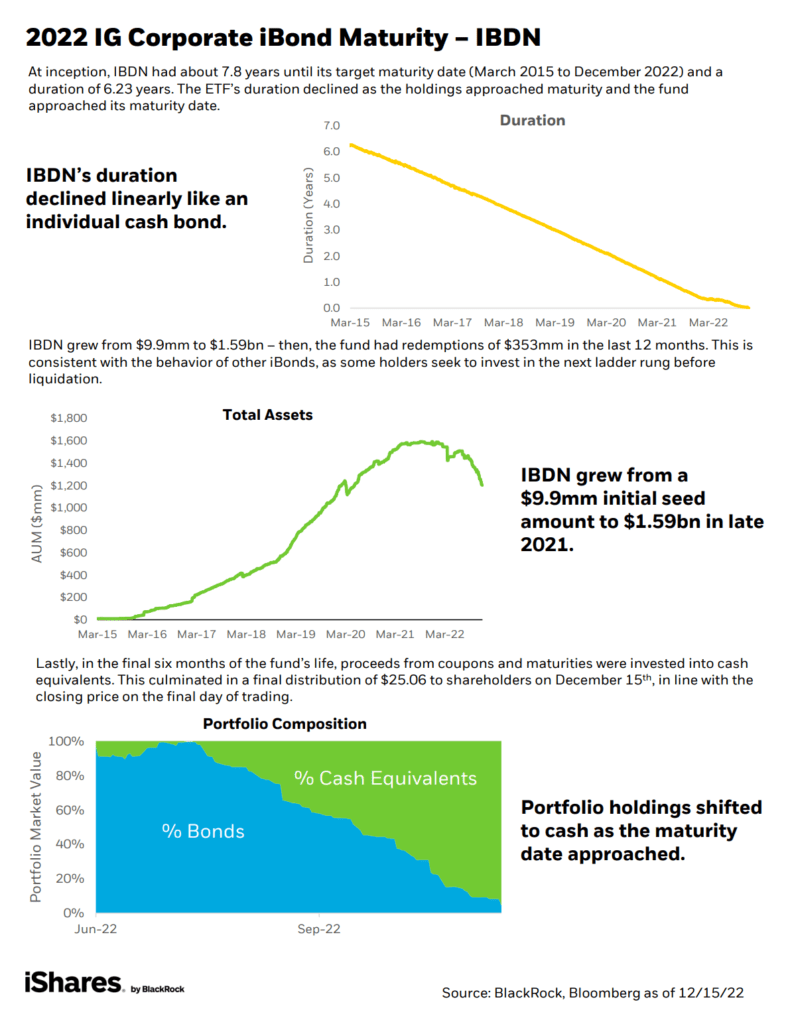

BlackRock provides quite informative info on the bonds that have matured. Since launching in January 2010, two treasury, two high yield, eleven municipal, and thirteen investment grade corporate iBonds ETFs have successfully liquidated. All twenty-eight iBonds ETFs provided a total return experience that closely approximated holding a portfolio of individual bonds.

You can review in BlackRock documents how those matured iBONDs actually behave in real life.

Have Value and Profitability Style Factor Exposure through Free Cash Flow

Regarding style factors in Smart Beta investing, there are the value and profitability factors.

If we screen stocks based solely on the value factor, we may get cheap companies that either are profitable in the long run or not very profitable in the long run. If we screen based on the profitability factor, we will get higher quality businesses, but we are unsure about the valuation.

If we marry the two, we will get stocks that are of higher quality and cheaper.

As a fundamental investor, we often look at how well a company’s cash flow is to assess the quality of the business. There is no best cash flow metric to assess that. Whether it is EBITDA, operating cash flow or free cash flow, they have pros and cons.

But we seldom get a factor fund that focus on free cash flow. This may be because free cash flow can be very volatile, and we may not be able to assess the actual quality of some businesses.

Until we see Pacer’s Smart Beta ETF US Cash Cows 100 ETF (COWZ): COWZ Site

Investment Objective of the Pacer US Cash Cows 100 ETF:

- Screen stocks based on average projected free cash flows and earnings (if available) over each of the next two fiscal years.

- Weighted by free cash flow.

- Companies with negative projected free cash flows will be removed from the universe (where the stocks are selected from).

- Companies are ranked by their free cash flow yield for the trailing twelve-month period.

- The top 100 companies with the highest free cash flow are included in the Index.

- The index is reconstituted and rebalanced quarterly in March, Jun, September, and December.

US Cash Cowz 100 is a large-cap focus fund.

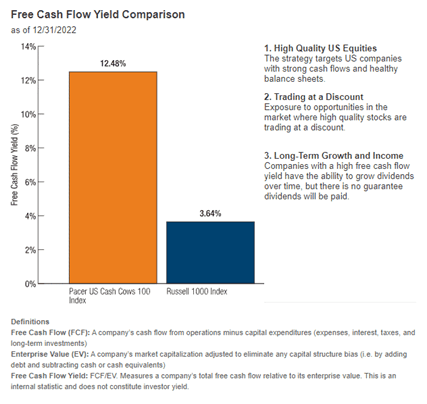

The average free cash flow yield of the ETF vastly dwarfs the Russell 1000 index, which is an index of the 1000 most prominent companies in the US.

A high projected free cash flow yield indicates that a company has higher quality but also that it is cheaper.

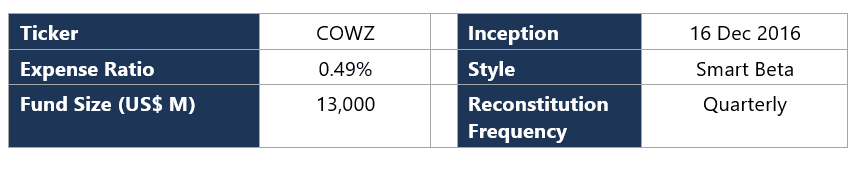

Some Details of the Fund

Calendar Year Performance:

COWZ past three years’ performance is almost double the S&P 500 ETF (SPY) and four times that of MSCI All Country World. It is one of the excellent value-style ETFs with a long enough record (seven years), yet it consistently do better than the index.

If you are a passive, value investor, then Pacer’s COWZ ETF may be something you are interested in.

Managed Futures

An investment year like 2022 was tough for most investors because almost everything is correlated.

When markets panic, the correlation usually goes towards 1. Correlation tells us the change in security when another security changes. It didn’t matter if you were in the technology sector or consumer discretionary, the securities all went down together.

For the first half of the year, commodities, which hasn’t been working well for a while, sprung to life as supply and demand dynamics and inflation rear their ugly head. They benefited.

Investors who managed to position their portfolio successfully to be tilted towards commodities did better than investors in the popular sectors going into 2022.

But is there a way your portfolio can benefit from these more significant moves in a more systematic manner?

Active funds that have a systematic trend-following philosophy may be able to benefit from it. These are funds that have their indicators that detect when specific sectors or their sub-sectors are trending and will systematically invest. They will also have their rules to exit a trade.

The funds that do these strategies are often called managed futures funds or CTA funds.

This might sound woo-woo, because we know most active managers failed to beat the market. But there is empirical evidence that shows outstanding trend-following results.

This may be why evidenced-based investors such as Corey Hoffstein (whom I profile in this great article), Wes Grey of Alpha Architect (See Wes’s net wealth) have a sizable amount of their net wealth invested in managed futures. Evidence-based firm AQR has also written papers and started managed futures fund:

- Should your portfolio protection work fast or slow? | AQR

- Trend-following: Why now? A Macro Perspective | AQR

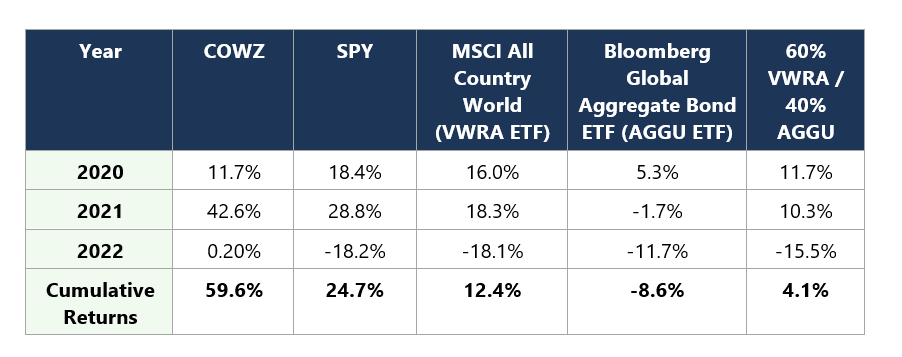

AQR’s research shows that managed futures can be rather uncorrelated with equities and bonds, especially during market downturns. There tend to be two kinds of drawdowns, the fast ones like Covid-20 and the slow one like what we experience in 2022.

Managed futures perform well during the slow ones. AQR’s research also contends that while tail-hedging funds based on buying put options may do better during fast corrections, it may be very challenging to capture the returns.

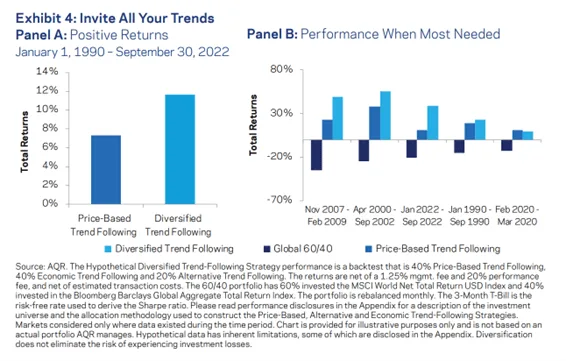

Typically, the downside of these protection strategies is… they are a drag on performance (there is always some cost or some weakness. No strategy is perfect.) Figure 2 and to a certain extent Exhibit 4 shows that the strategy works well during periods where equity did well. Part of the strategy is to be diversified across markets and so most of the funds also trades equity and bond market (if they satisfy the conditions.)

But what we need to be aware of is that while there is evidence of good performance:

- Not many managers may be able to implement and execute well.

- Those that are able to execute well and have good results may be out of reach for many investors.

There are reasons to be cautious.

However, with the change in tax laws and competition, we are seeing more and more firms launching funds based on these strategies.

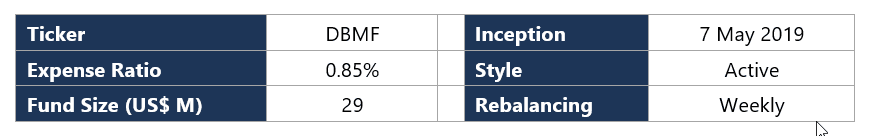

iM Global Partner’s iMGP DBi Managed Futures Strategy ETF (Ticker: DBMF) is an ETF that has capture a few people’s attention. This is because:

- Andrew Beer, founder and managing member has been explaining his fund in a few podcast and video interviews.

- The performance of the fund did well (for the majority of 2022), and that will definitely get more people to take notice.

DBMF is unique when compared to other implementations such as Kraneshares KFA Mount Lucas Managed Futures (KMLM) or Simplify Asset Management’s Managed Futures Strategy ETF (CTA) because it pay attention to the execution decisions of a group of managed futures hedge funds, aggregate the decisions and execute the decisions.

Out of the three funds attempting to do the same thing, DBMF is the most active, less rules-based and most concentrated. What we need to pay attention is whether they managed to achieve this “index-like” managed futures return.

This means whether they delivered positive expected returns over time, low correlation, especially during crisis.

They were up in 2022 because of the inflation trade. Not just that, they were in early.

Some Details of the Fund

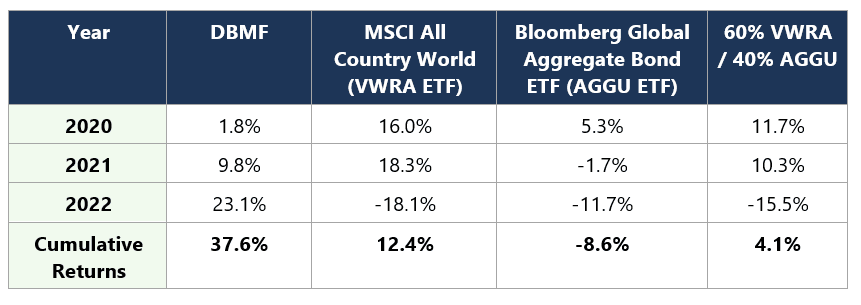

Calendar Year Performance:

If you are reviewing your portfolio at the end of 2021, I won’t fault you for wondering why you have DBMF in your portfolio. Sometimes, specific allocations in your portfolio won’t do well when others did well. If they all do well together, you need to be worried because… what happens when equities don’t do well?

And we all have the answer in 2022.

If we calculate the cumulative returns, DBMF did the best by virtue of not losing money in those three years.

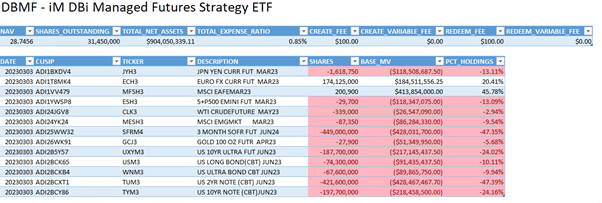

Here is a Snapshot of current holdings:

A Different Kind of Income

Some investors are more attracted to income.

This group of investors can be retirees or accumulators who prefer the certainty of income in their hands. Due to their income need, or a psychological need to accept yield not lower than a certain yield, these investors often push themselves out of the risk curve to take on higher income, unaware that they are taking on risks that will show up at the worse time.

The income source comes from:

- Interest from Risk-free bonds

- Income/interest derive from business

#2 may be affected when the business cycle moves towards a recession or a crisis.

Are there other income sources that help you diversify your income?

Private bankers attract relatively less savvy yet rich investors to buy structured products based on income derived from options. Most people have a lower risk appetite than they are willing to admit. The reason they would still buy risky structured products is because they were lead to believe the risks are smaller than the reality.

Income from options strategies are risky but it is a different sort of risk. Instead of equity or credit risk for equity and bonds respectively, income from options is based on volatility risk.

When you engage in these options strategy, you reallocate part of your portfolio of risk from equity risk to volatility risk.

Your risk is more diversified such that you are less expose to a single type of risk.

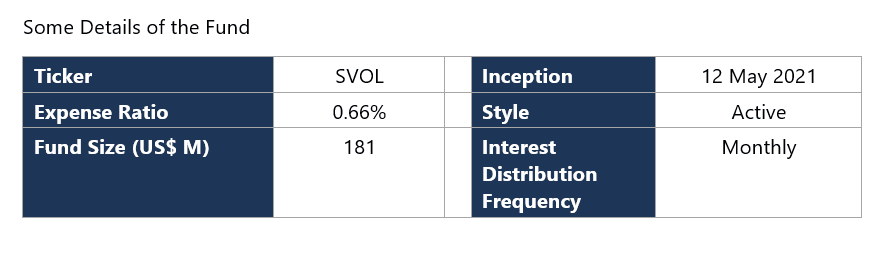

Simplify’s Volatility Premiums ETF (Ticker: SVOL) is one of their income solutions based around options. The ETF held a large number of treasury bills as a base. The treasury bills has income on its own but the fund boost its income by shorting the VIX futures ( the VIX is the volatility on the S&P 500).

By shorting the VIX futures, you are betting the volatility do not spike up but remain in a relatively manageable window.

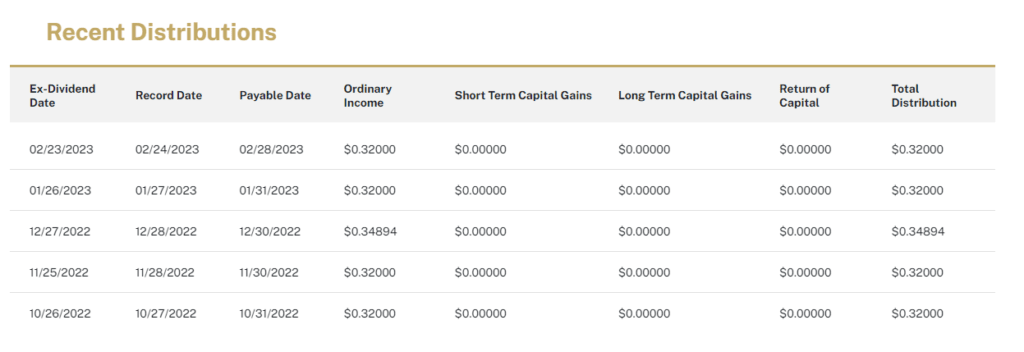

Here is the recent distributions from SVOL. The ETF provides income every month:

You may notice that the monthly dividend unit per share is relatively consistent.

If you annualize the payout, the yield is closer to 17%.

Here are more details:

How does an ETF have such a high-income yield?

Because volatility can be relatively high, with high implied volatility, there is a risk the volatility works against you, and you are compensated for taking that risk.

Can you lose money? Yes, volatility can shoot up.

This is why SVOL buys a VIX call option with a 50-point strike as part of this strategy. This means that if VIX shoots up very high, SVOL captures the return.

However, an investor will still lose money if volatility is not so high but higher than your original shorts.

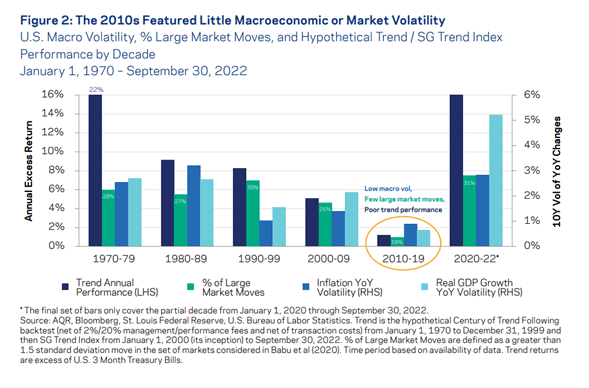

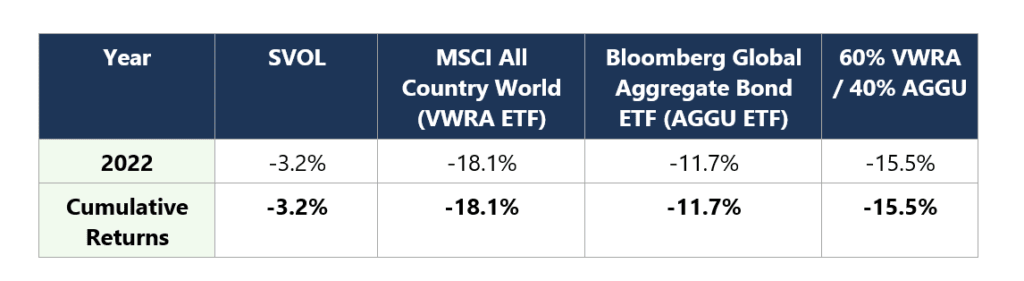

Here is how SVOL fare against the MSCI All country world ETF, Bloomberg global bond ETF and a 60/40 portfolio.

If you are on SVOL, for income, your performance is better than the MSCI All Country World, REITs and balanced portfolio in a period of drawdown. However, we have to see how the portfolio does in a period where the equity and bond market do better.

Most importantly, There were numerous occasions where the VIX spiked to 36, not enough for the VIX call bought by SVOL to be in the money for the fund to monetize, yet the overall performance, including the income, is reasonable.

Conclusion

BlackRock’s iBONDs, COWZ, DBMF and SVOL are just a few unique strategies packaged into ETFs that are not available in Singapore or on London Stock Exchange yet. DBMF and SVOL are funds that have not been operating for a long time in more complex strategies so you might want to take your time to review whether they are well implemented or do what they are supposed to do.

Out of all of these ETFs:

- iBONDs by itself is suitable to form a large part of your portfolio for specific shorter term to intermediate term financial goals.

- COWZ are suppose to replace a large chunk of your US allocation, if you believe in the value and profitability style factor.

- DBMF can be used to replace part of your bond and equity allocation.

- SVOL can be used to diversify the risk of your income portfolio, not in terms of reducing the correlation (SVOL tend to go down when VIX goes up, which is when equities does poorly as well), but the risk and returns it is targeting.

I hope that this fund strategy spotlight is helpful to you and if you would like me to do more of these spotlight, do let me know in the comments.

A Word from Our Sponsor

You can start investing and trading exchange-traded funds such as the iBONDs, COWZ, DBMF and SVOL through moomoo Financial Singapore Ltd.

moomoo is the first digital brokerage to receive full memberships as a trading and clearing member of the Singapore Exchange Derivatives Trading Limited and a Trading Member of Singapore Exchange Securities Trading Limited.

Their trading app was also named the 2022 Best Trading Platform given by the FinTech Breakthrough awards.

If you signed up with moomoo today, you could get up to S$208 worth of stocks and cash coupons. Do read the instructions in the affiliate link above.

In addition, Forex Trading is now available on moomoo’s app from 25th Feb 2023 onwards! You can trade 36 different currency pairs on the platform and can take leverage up to 20 times with a minimum order of US$50. However, leverage trading is high risk, and trading forex may not be worth your while.

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

- The LionGlobal APAC Financials Dividend Plus ETF Won’t Give Singapore Investors 5% Dividend Yield Always. Further personal thoughts (with some data). - April 13, 2024

zen

Monday 30th of October 2023

whats the witholding tax on these?

Kyith

Saturday 4th of November 2023

It depends on where the ETFs are domciled or incorproated and if they are in the US, the withholding tax is 30%.

Revhappy

Sunday 12th of March 2023

No article about SVB? :) Thats all people care about right now :)

Kyith

Sunday 12th of March 2023

no.