The last time all these value factors didn’t work so well, for such a long time is in the 1920s.

That is a long time.

Our brains would probably reason that there are similarities today to the time back then. When there are periods of extreme financial upheavals, the value factor does not seem to work so well. (When we say extreme it is this kind of financial meltdown, not your typical 20-30% market drawdowns)

Looking back, the value factors came back. As an investor having a 30 years horizon, you would have enough time to benefit from it.

There is also another dislocation.

The investors living through these past 10 years will form the opinion that the only place to be is in United States stocks. And they are not wrong.

Their experience with the market is that U.S Stocks Trounced all others (that is not true. There are more obscure markets that did better).

Albert Bridge Capital did some data crunching and present some insightful data.

They are based in Europe and thus, they are more concerned about the market performance in Europe versus other markets.

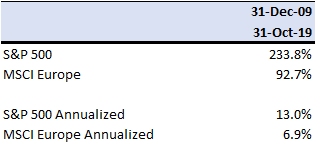

For 3 decades, the performance of MSCI Europe has matched the S&P 500. Europe did better in the first and third decade. United States better in the second.

If you are a wealth builder, I would say that if you have $50,000 on 31st Dec 1979, and you add $3,000 a year for the past 30 years, you would have amassed $652,528 at the end of this 30 years.

But after 2009, everything changed.

We can observe the difference in the last decade. United States did better.

My friend Mr 15 Hour Work Week said something along the lines that Europe and Hong Kong is Trash. I guess it is ridiculous to invest in them.

Sometimes I do not know.

Most folks expect that if these markets are so visibly poor, then it should mean they perform very poorly. Most folks are also heavily influenced by what is happening recently.

They have this idea that these correlations between asset classes, geographical markets that they just experienced will stay consistent throughout.

It is only older farts like ourselves that see the period where the United States were doing not too badly yet the markets were not performing well (refer to the second decade in the chart above)

My Judgement was Also Clouded

We recently have to help one of our advisers do up a growth of wealth comparison. Basically, we want to compare how much $1 invested in different indexes will be at the end of a certain time period.

In SGD.

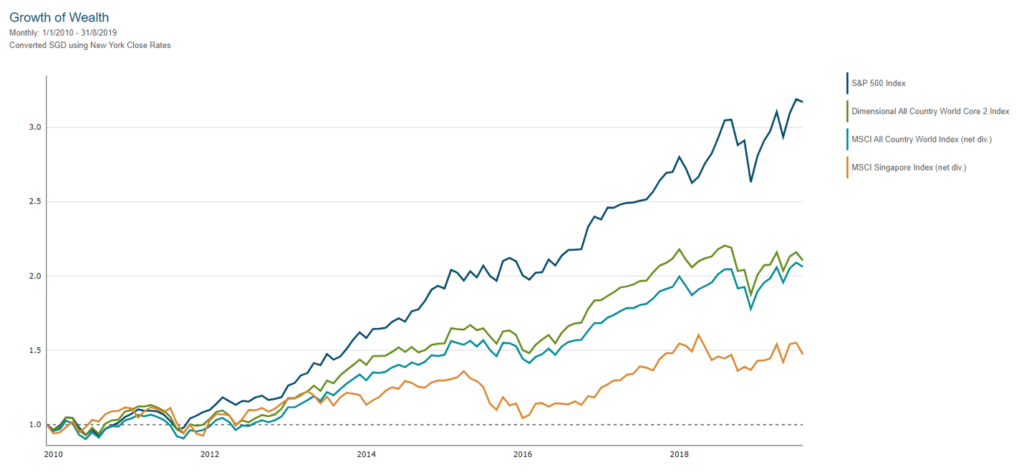

Both my solutions head and myself have this mindset that the S&P 500 will do the best.

We were not wrong.

From 2010 to 2019 1 or 2 months ago there was this tremendous outperformance. And for those who are saying Singapore market is shit, you are not wrong as well.

I choose to see that for our Providend clients who invested in the Dimensional World Equity Fund, their money would double in Singapore dollars.

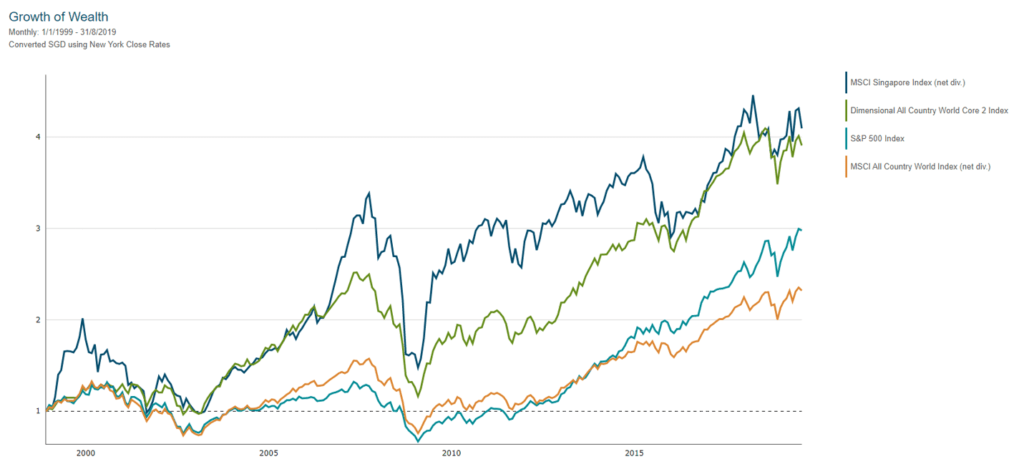

But let us factor in 10 years before, from 1999 to 2019, and see how is the result:

The MSCI Singapore and DFA World Equity Index proxy in SGD, absolutely killed the S&P 500.

My boss and I originally think this is because of the strong SGD. We shifted it back to USD. Still the same. It is not a currency thing.

Nothing is Set in Stone

Will Europe or Value factors go back to “the balance”?

I am not sure. I guess that is my posture in all this. I am currently an individual stock investor. As an individual stock investor, whether which market outperform or underperform, you can have a game plan to do relatively well.

If you are not good, you get smashed pretty badly.

If you are a passive wealth builder, this might matter to you more.

And my answer to this is, I do not know.

If you lean towards an opinion that despite what Kyith presented, I still think there is no way the United States and growth would do worse than any other markets than you should invest that way.

But if you are of the opinion that I do not know whether THIS TIME IT IS REALLY DIFFERENT, the better way is to hold a moderate portfolio that gives you exposure to all and let the market tell you.

This can be an MSCI World ETF, a low-cost global equity unit trust like the Dimensional World Equity or Dimensional Global Core fund and a global bond fund.

The takeaway I get from this is… man… we have really short term memory of things. But also the future is unknown. “the balance” in the past might not be “the balance” after factoring the future.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Thinknotleft

Thursday 7th of November 2019

I am both a passive and individual stock investor.

My take is just invest in world index fund. US stock mkt is around 50-60% of world index. If US drop and the rest of world rose, it balance out. If US continue to outperform, the world index also benefits.

Kyith

Friday 8th of November 2019

Hi Thinknotleft, that was what i am thinking. it can be very nuance because a lot of us companies are global as well. I suppose going for an MSCI All country world index would enable us to not missed out if some emerging companies become stronger.

Sinkie

Thursday 7th of November 2019

Don't need to go back to 1920s.

During the 1990s, growth also slaughtered value. Those who were into investing then can remember Warren Buffett being constantly ridiculed in the financial news as practically being the Alzheimers clown of investing, too old-fashioned & demented for the New Economy.

Berkshire shares dropped -49% from March 1999 to Feb 2000. At the same time, Nasdaq shot up + 105% during the same period.

During a good part of the 2000s, Singapore, Asia, EM & Europe outperformed US & the "growth" stocks.

E.g. from 2003 to 2007, STI went up +185% compared to S&P 500's +71%.

Mean reversion in all things.