Lawrence Yeo over at More to That has a pretty good, long, and deep post about the concept of enough. I would just want to highlight it to you so that you can take a look.

It is pretty long so I would just want to highlight the areas that resonated more with me.

Finding out your “Enough” point was something I brought up enough in the past, but often, there is a negative connotation if you yearn for something more, and what is “Enough” to you is kind of further away.

Lawrence uses the concept of quantum computing to make us realize that as we progress as a person, we will change.

Imagine that every decision that you (and others in your life) make, leads you down one path in life. Given how many decisions were made, there is so much of this branching that could take place.

For example, if Kyith didn’t grow disillusioned about his computing course in the last year of his degree and didn’t pick up some finance and accounting modules, how would life be different? You can think of what would happen if you bought the condo that seems a little out of reach in 2006 then.

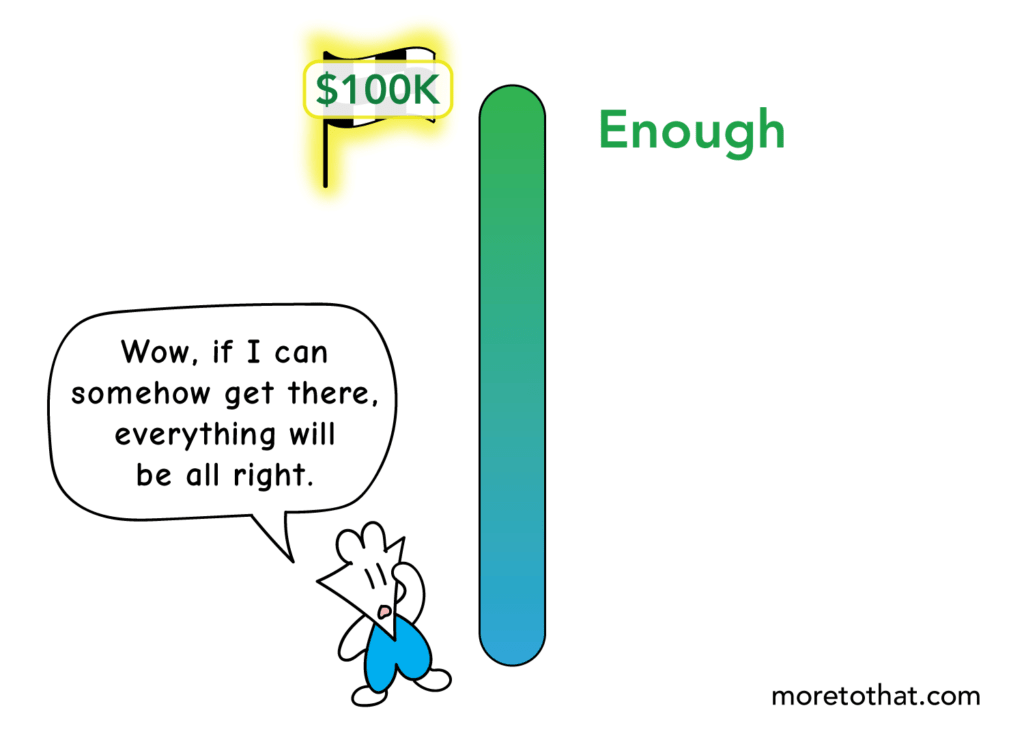

When we start out, the certainty of how much is enough for us is unquestionable. In some of your cases, earning $100,000 in income will be a really comfortable life.

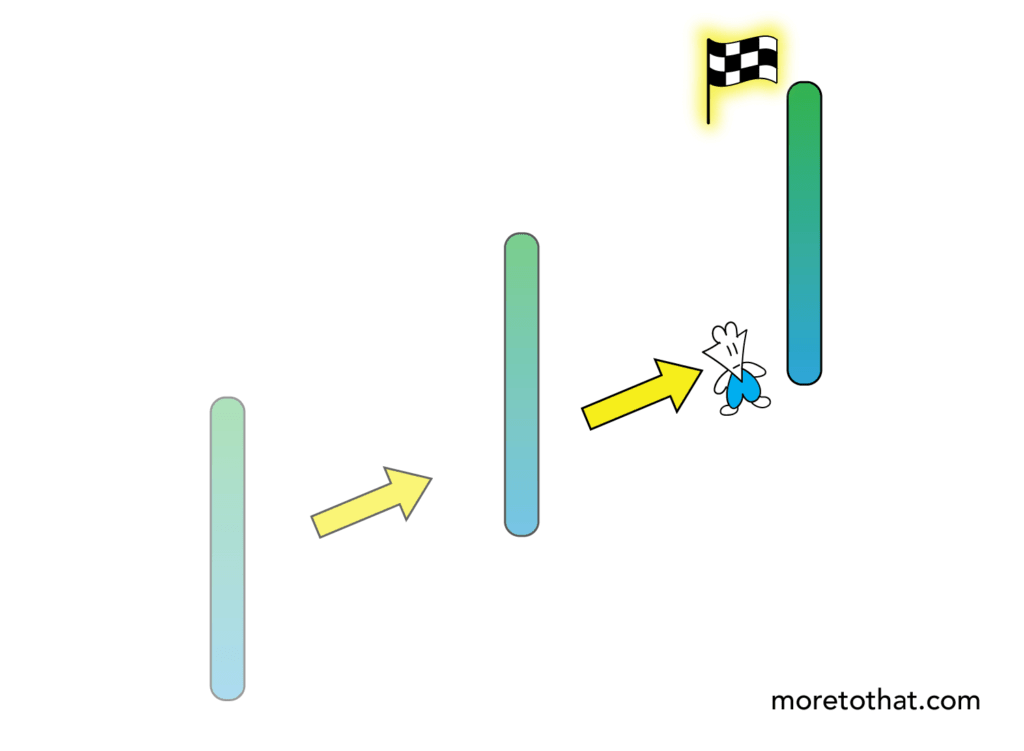

Lawrence explains that what will get us to that $100,000 income will change our identity. When our identity changes, what is enough for us is likely to shift. We are not the same person then anymore.

And because we are different, what we desired as “Enough” will shift along.

Lawrence tries to point out that this isn’t greed always.

Imagine that as a person just about to graduate from university, you would think if you could have $1 million that would be enough. But as you get out to work, and be able to earn $250,000 a year and start to have a young family, what is considered “Enough” would have to shift naturally.

This is not greed but that you are a different person from that kid almost graduating uni.

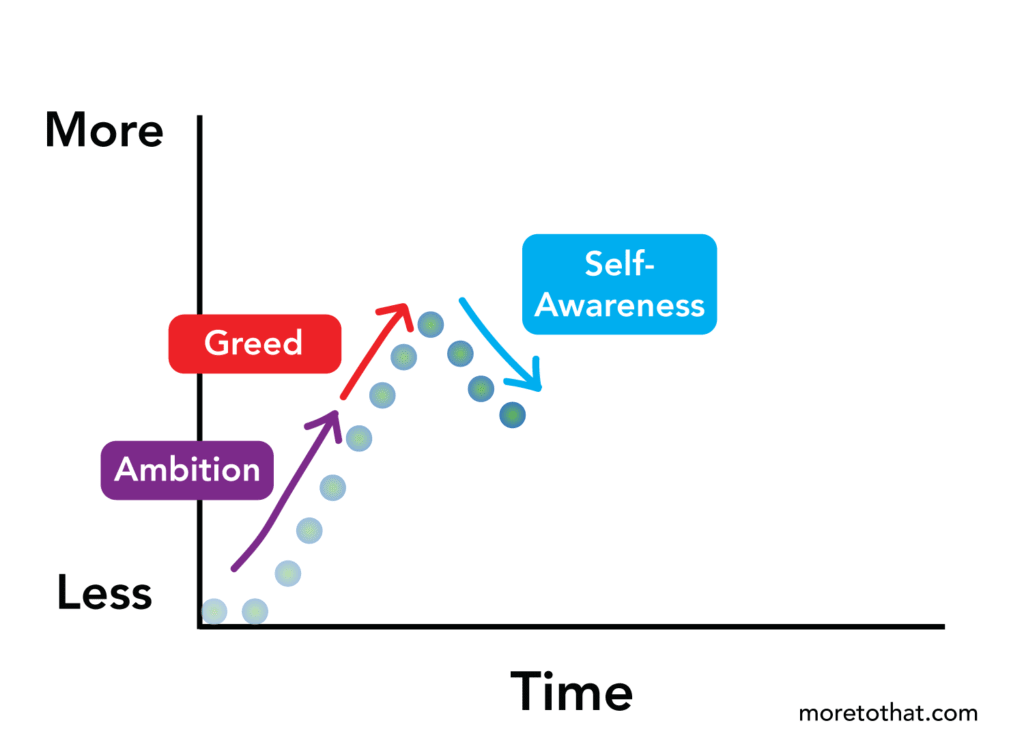

Ambition vs. Greed

Lawrence tries to make a distinction between ambition and greed:

- Ambition is largely driven by self-actualization, the desire to become a more capable person. When you become more capable, good outcomes arise.

- Greed is when the outcomes become your primary desires. What drove you is more prestige, praise and power.

What happens usually is we start off ambitious but eventually be consumed by greed.

Lawrence cites the work of William Blake:

“You never know what is enough unless you know what is more than enough.”

You cannot know that excesses have consumed you unless you experience what is too much.

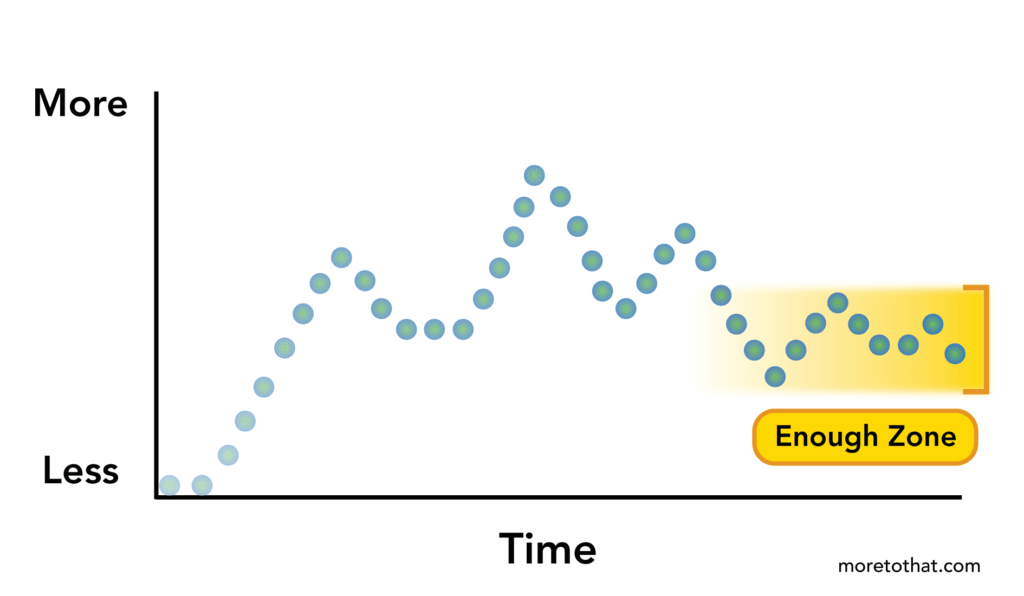

There is a continuous interplay between ambition, greed and self-awareness and they seldom stay stagnant. In other words, the way to visualize “Enough” is more of a zone not a single point.

Be The One Deciding Things Instead of Being Forced Into Decisions

Lawrence says that when success is automatically fed more success if left unchecked, will leave you in a world that is far from having any connection to your humble beginnings, or in a world so out-of-touch with the everyday person.

You must be the one to adjust the definition of what is “Enough”, instead of having it forced upon you.

I guess this last one is important and true in that if Kyith tells you having $200,000 is enough, deep down would you be able to accept that? Accepting another person’s view of what should be enough for you is useful if the person truly understands you. But most often, they know less about you so how could you assign strong weight to what they say?

Advice from me is a very good example. My worldview on a lot of things is narrow enough so if you look at what is considered “Enough” through my lens, it may leave you with a smaller amount than what is really enough for you.

Perhaps the best way to know how much is enough is to overshoot it.

Finally, Lawrence also emphasizes an important point: Enough is often more than money.

It is possibly a life zone that you are more than comfortable with. Money features partly in that enough mode, but it is not everything.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Revhappy

Sunday 10th of July 2022

I look at it more like an equation. We all have certain amount of IQ, ability, skill, knowledge, hunger, willingness to learn etc. All this I would combine into what I call Human Capital. Every day when we go out to work, we are converting our human capital into financial capital. A bit like having a cow which gives you milk everyday. If the cow gives you more milk than what you can consume, you go and sell it and kind of conserve that produce to be used in the future.

So the human capital -> Financial capital conversion is one side of the equation. The otherside is how we spend this financial capital. We spend our monthly salary for our expenses and some people's expenses are way below how much they are earning, so they are busy accumulating financial capital for future use and then there are people who are not earning enough and they get into debt, spending their future human capital today.

So that is all there is. Some people like Elon Musk are blessed with so much human capital that they can create so much financial capital enough to spend for 100s of generations. Others die of poverty in places like Africa.

We are all pretty much balanced, in terms of our earning and spending. We all fantasize to retire early basically we are only creating about 2X of the financial capital times our spending. So we can retire about 10-20 years early, thats the max we can hope.

But the question is after you retire early, you still have the human capital latent in you, what are you going to do with it? I know the FIRE crowd always says we get back our time and get to decide what to do with it. But I personally believe, someone who has the potential to generate 2X the human capital, would just give it all up? Like you said people change, initially we just want to retire early because we feel stressed. But when the time comes to actually retire early, we are now more used to taking the stress. We may downshift gears, but I doubt, if we can just give it all up and quit working completely. Certain personalities probably will do it. But I doubt whether most will.

Steveark

Sunday 10th of July 2022

Because I led a very large company in a very small state I got to know a lot of CEO's and wealthy corporate types. We are mostly all retired now but still take some trips together each year. My wife and I live on way less than half of what these other couples spend with their multiple houses and very expensive cars. Our tastes are much simpler with our preferred activities being things like tennis, running, hiking, fishing and pickle ball. None of which cost much to pursue. We did change from the early days of our marriage and our lifestyle costs may have almost doubled in inflation corrected amounts. But our income went up much faster than that. We just leveled out sooner than my friends. I don't begrudge their expensive lifestyles, they can easily afford them, and they do not ridicule my simpler life. We just ended up at somewhat different places due to all those quantum branches taken or not taken. But we do share one thing, we all know we have enough.

lim

Sunday 10th of July 2022

Thanks for the link to the blog. He writes well but he needs a good editor. I've been using a blog as an investment journal since 2016 to record the various investment 'milestones' that I've cross and I haven't actually changed that much when it comes to money. What has not been considered is that when you reach a certain income that is comfortable (the example given is $100k, but with inflation, lets say $120k is more comfortable), self-actualisation remains important but may have very little to do with money. There are different ways of self-actualisation that don't involve counting how much money you have.

I reached Financial Independence last year, but am still accumulating wealth past the "enough" zone, however, my goalposts have not shifted and anything beyond the enough zone is just extra that I have no intention of spending.

Maybe I'm largely the same (at least my 'enough' zone actually hasn't changed) because I keep my old social circles and networks, and so I have no need to 'upgrade' my spending. Maybe wealth alone doesn't change identity, but instead as you get wealthier, some seek to move to a different social circle and leave their old ones behind, and with new social circles, there may be different expectations/norms and thus shifting of goalposts. I actually have zero interest in doing that.

Kyith

Monday 18th of July 2022

He will be quite disappointed to hear that, considering he teaches people how to write philosophically. I think it is less about lifestyle inflation but ambition. Ambition to him, is a good thing for all of us and in order to get forward, inevitably you need more. It doesn't have to be money but you always want something more.