DBS came up with a novel loan that targets the older Singaporeans and permanent residents with private property so that they can have more income during retirement.

The loan is novel but limited.

But in truth, the older Singaporeans have limited choices. This loan serves a very specific niche and I get a feeling that the majority of the private property dwellers should see a limited benefit.

How does the DBS Home Equity Income Loan Work?

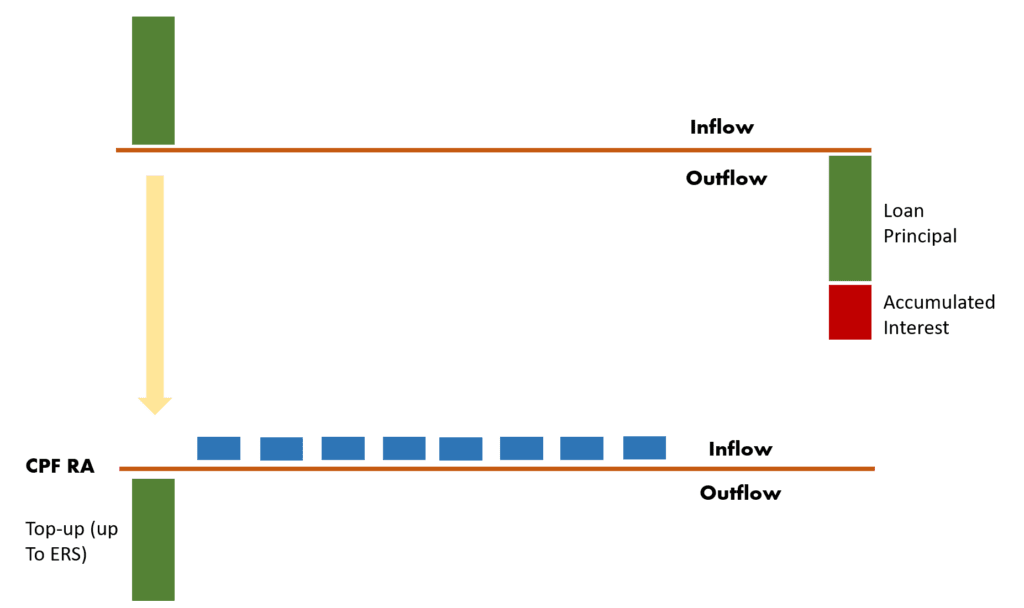

DBS provided this very nice infographic to easily explain how the home equity income loan work.

The DBS Equity Income loan serves the senior Singaporeans or PR that lives in a private property who wish to supplement and enhance their retirement income.

According to DBS’s research, the average homeowner above 50 years old here holds some 60% of their wealth in housing equity. Many homeowners also prefer to remain in their own homes and be in familiar surroundings.

As a senior, you need more income so that you have more money to meet your expenses (or just more income because more income is cool)

But you do not have any more resources that you could use to generate the income (or because you are unaware or unwilling to touch other resources)

DBS Home Equity Income loan fits your need:

- Assess the latest value of your private property.

- Determine how much your spouse and you need to top-up in your CPF Retirement Account so that it will reach the Enhanced Retirement Sum (ERS)

- Once DBS approves the loan, this lump sum will be used to top-up both your spouse and your CPF RA respectively.

- As your CPF RA is topped up, and you have reached 65 years old, your CPF LIFE annuity provides a higher income

This is my graphic representation:

This is structured more like a loan. It is less of a reverse mortgage. A reverse mortgage is also a loan but is more tightly integrated with your property. I think currently, none of the local banks offers a reverse mortgage.

From what I understand of a reverse mortgage, there are clauses in the loan tied to the maintenance and upkeep of your property condition.

There are some features of this equity income loan that is unique:

- You do not have to serve interest or principal payment during the loan tenure but only at maturity.

- Due to #1, you do not have to worry whether the increase in income will go towards covering the interest payment. The income is for you to spend on your expenses.

- The lump-sum can only be used to top up to the owner’s CPF RA and up to the Enhanced Retirement Sum. This means that the loan amount is limited.

- You will still retain the equity of the home.

- There must not be an existing mortgage tied to the property.

- The interest accrued is fixed at 2.88% a year.

- Only private property owners are eligible for this loan.

- The borrower needs to set up a Lasting Power of Attorney (LPA) if they have not set up one to qualify for the loan. There was not too much explanation here. I suspect that in the event that the donor (the owner) is mentally incapacitated, the donee appointed have the power to make the financial decision to service and pay off the loan. This protects the lender’s interests.

- Only Singaporeans and Permanent Residents need to apply.

- At the end of the loan tenure, the property must still have 30 years of lease left (this means that when you apply, the lease left must be {loan tenure + 30 years})

With those things out of the way, let us think deeper about this loan.

Equity Income Loan Unlocks a “Third” Stream of Income for the Asset Rich, Cash Poor

This solution is less for us but for immediate seniors.

Many of the seniors grew up in a situation where there are limited investment options and the safest wealth-building way is through holding multiple properties or scaling up properties.

Eventually, they end up with their property and CPF being a large part of their assets.

The problem is that they would still need to live on their property. There are other options out there, but for some reason, they seem unappealing to retirees.

This is not a problem unique to Singapore. In the United States, this is also a problem.

Retirement researcher Dr Wade Pfau recommends that reverse mortgage greatly enhance a retiree’s income.

If they unlock their property, this together with their social security, private pension may be adequate to provide stable, visible income.

A loan structure in such a way as the Equity Income is a way to provide a third income stream.

Technically, this is not a third income stream as it tops up your mandatory CPF LIFE annuity income.

CPF LIFE Provides Retirees with the Most Predictable Income that Hedges Their Longevity

Some of you might contrast the 2.88% a year interest against the 4% interest that we can currently get from our CPF RA account.

I think that may be the wrong way to look at it.

Technically, you are spending part of that 4% and it doesn’t go towards eventually paying off the 2.88% interest. It is likely the private property’s equity will go towards paying off the interest.

Instead of asking the retiree to put their money in some DBS income product, DBS did the right thing by structuring the loan to be only used with CPF LIFE.

This transfers the risk of providing predictable income to the government program.

There are two parts to structuring a product like this. It can be a big ask to ask seniors to borrow a large sum of money at their age. They are likely to be apprehensive about this.

You got to make sure that the income portion lives up to the expectation.

The income has to be predictable, safe and hedges their longevity risk.

The best way is to transfer the risk to the government program. If the program fxxks up, you draw less flak next time.

Due to how the loan is structured, if we are to compare other options to the DBS Home Equity Income, we have to hold the income structure fix. This means any loan alternatives need to be structured in such a way that they top up the CPF to the ERS as well.

How does the DBS Equity Income Loan Stack up Against Other Options?

The best way to see whether the Equity Income Loan shine or not is to compare against some possible alternatives.

I can think of three alternatives:

- The typical cash-out refinancing. This can be a term loan or equity loan on an existing private property. Once you get the lump sum you can use the money in any way you like.

- HDB Enhanced Lease Buyback Scheme. This is the closest to a reverse mortgage. The government started this scheme so that homeowners can sell the remaining lease of their property back to top up their CPF RA up to FRS and BRS.

- Lombard Lending. Another kind of private lending is where you can borrow up a certain loan to value based on the collateral value. Essentially, you can collateralize a group of investments such as stocks, bonds, funds and borrow from them. If the value of the investments goes down, you may face different levels of margin calls.

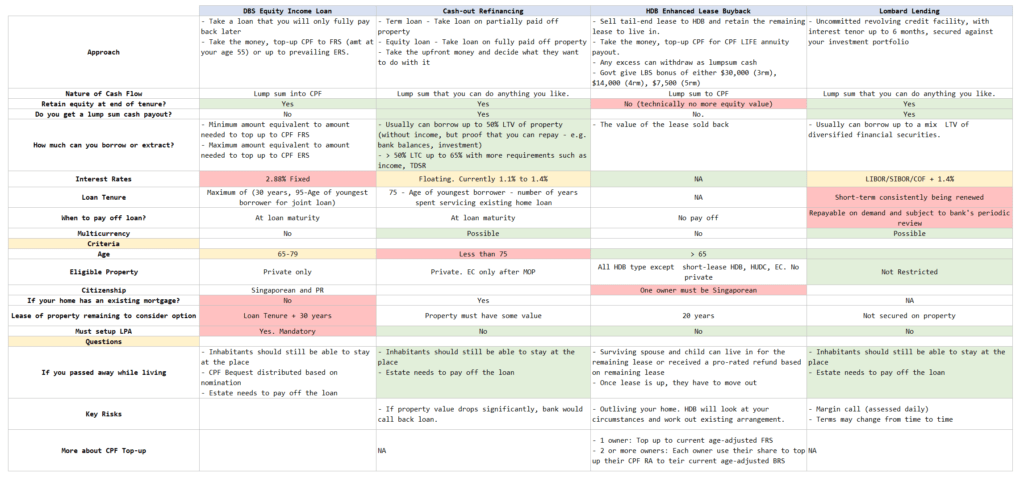

In the table above, you can see how the different features stack against each other.

Let me try to make it easier by bringing your attention to some of the notable ones.

Perhaps the best way to back out the most money from your home equity is through term or equity loans. If you have valuable private property, you can back out 50% of the loan to value without income proof.

The second-biggest loan harvest is through Lombard lending if the majority of your wealth is in a portfolio of investments in a private bank.

The problem with cash-out refinance is that the maximum age that you can take the loan up to is 75 years old.

This is where you see the use-case of the DBS Equity Income Loan and HDB Enhanced Lease buyback.

They are suitable solutions for seniors as traditionally finance institutions see them as too much of a risk.

The middle-ground seems to be Lombard lending but I suspect even if the loan is backed by assets, there is an age limit.

Hence… there is a use case for the DBS Equity Income Loan.

The downside of both the DBS Equity Income Loan and HDB Lease buyback is that the loan quantum is limited to the difference between your CPF ERS, FRS and what you have in your CPF RA.

You are also limited in your income options.

If you require a tailored income solution, you are out of luck with the DBS Equity Income loan and HDB Lease buyback.

The HDB Enhanced Lease buyback is the only option that you do not retain equity control at the end of the tenure. But technically, your equity value at the end of the tenure should equal your loan. There should not be much upside. Retaining equity control is important if you believe that the equity value will outpace the accumulated interest of the loan.

Out of the 4 structures, Lombard lending is the loan that may be most tied to the volatility in collateral value. However, I can see someone investing in bonds or bond funds. This will dramatically reduce the volatility of the mark-to-market value of the collateral, reducing the probability the loans get called.

For both HDB Lease buyback and DBS Home Equity Income, you need to ensure that there is some value left in the property at the end of the loan tenure.

HDB lease buyback is the only option that the inhabitants may officially run the risk of outliving the property. The rest officially retain some control over the ownership of the property.

However, if limited resources force you to take a DBS Equity Income Loan to give you income, the main way to pay off the loan eventually may be to sell off your property (of course, your children can help you pay off the loan instead).

The HDB Lease buyback is better than the DBS Home Equity Loan in that there are some bonuses given by the government and that the capital only needs to top-up up to FRS (instead of ERS for the DBS Home Equity Income Loan). Any excess from the HDB Lease buyback can

To summarize, the DBS Home Equity Income:

- Is currently the rare option to provide lump-sum for seniors to monetize base on their home equity to increase their income.

- The home needs to be fully paid up with no loans.

- The interest rate is probably the highest out of all the options.

- Limited in income option.

- Limited in the maximum loan amount.

- Limited to private property.

- Still retain equity at the end of the tenure.

What Happens if the Owner Passes away while the loan is outstanding?

The short answer is that the estate of the deceased owner will have to pay off the loan before the heirs have access to the estate.

But I think the situation becomes complicated if there is a surviving spouse. I think if it is joint tenancy, the surviving spouse can still live in the property and at the end of the tenure, the surviving spouse can pay off the loan (be it selling off the property or some other way).

But I wonder how a tenancy-in-common will be handled.

Possible Estate Leakage

We know that the loan is secured against the value of the property. As long as the property value is intact, the estate should not be at risk of ruin.

However, it would be great that the executor of the estate have other means to pay off the loan without having to sell off the property if the owner passes away.

As the loan is used to fund CPF and the monies in CPF is not part of the estate, and are dictated by the owner’s CPF nomination, the owner’s love ones, who may be the executors in some situations may not be the benefactors of the owner’s CPF monies.

This means money has flowed out of the family circle and this may give the family less flexibility.

This Loan is Far Too Secured for DBS

The way I see this loan, DBS cannot lose much:

- It is secured against private property.

- The lease at the end of the loan period has to be at least 30 years. If you read my article on the HDB Voluntary Early Redevelopment Scheme (VERS), the estimated point where the property depreciation outweigh the capital appreciation was near the 75-year mark. Having at least 30 years of lease left ensures that their property is at least at peak valuation.

- The amount loan in practice may likely be less than 25% of the value of the private property unless the property is a very small shoebox.

- The high interest.

While it may benefit the seniors, I feel that DBS does not lose money on this deal. Given how secured it is, I wonder whether it made sense for the interest rate to be lower.

The Most Suitable Target Audience

Many may be thinking…. if someone can afford the private property, He should have no issues having ample money in their CPF SA right?

I think in most cases that is true.

Without doing much, I would at least have enough in my CPF to reach ERS if I need to, and I am not a high-income earner.

But I can think of a certain group of people that they would need a loan to top up their CPF RA:

- A housewife who does not work. Usually, the working spouse will top up for her. If the family is asset-rich cash poor, this may be applicable.

- Asset-rich cash-poor person who has worked overseas and does not contribute to their CPF for a long time.

- Asset-rich folks who fell on hard times in their career and have not to build up adequate alternative retirement savings.

Is the DBS Home Equity Loan Suitable for You?

This loan might not be your only alternative.

There may be other ways for you to manoeuvre to top up your CPF RA to get more income.

Due to the limit on how much you can extract out, and the limited income alternatives, perhaps right-sizing your property may allow you to garner a larger residual value to top-up your CPF RA, while your property can remain unsecured.

Different people have different financial profiles and different income requirements. Thus, what may work for others may not work for you.

Two of my colleagues yesterday did some radio interviews on this topic.

The first one is in Chinese on Capital 958

The following one is in English.

Monetising your home and business for retirement: What are your options?

Both of them answer questions from listeners on the topic.

This may help you figure out your suitability for this home equity loan and may give you other ideas as well.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

retirewithfi

Tuesday 24th of August 2021

There's another subtlety I don't see mentioned in the marketing collateral: difference in treatment of interest earned among the CPF LIFE plans. Given the home equity is used to fund the payout, the loanee may not be aware that choice of LIFE plans affect where the interest earned on the LIFE premium is added to: the risk pool or RA. This has downstream impact on bequest and payout amount.

Kyith

Wednesday 25th of August 2021

good point. it depends on how well the dbs folks advice those who are less clear about the policies.

Sinkie

Monday 23rd of August 2021

This seems like a half-hearted attempt at doing NS lol. The relatively high interest rate & the loan cap is a turn off.

But in a way the high interest is similar to HDB lease buyback where HDB uses a high discount rate on the sell back of lease.

HDB lease buyback is technically not a loan or reverse mortgage -- you're upfront selling a portion of the lease. You don't have to payback. But yeah it's for people who are prepared for equity destruction in their property as upfront, 25-30 years of leasehold is gone.

Bottom line, both DBS home equity loan & HDB lease buyback can do better on their interest / discount rates.

Kyith

Tuesday 24th of August 2021

i didn't think of the lease and buy back as high discount rate, but now that you mentioned it you may be right.