Not too long ago, I recommended some of my ex-colleagues to put some of the money they wish to save up in MoneyOwl’s investment portfolio.

Majority of their money are in the more conservative portfolios and they held well through that volatile COVID period.

I had a conversation in May 2020 with one of them regarding the performance of the portfolio. During our conversation, it occurred to me that I could not comment on whether the portfolio was doing well or not, versus other comparables.

I could only comment based on what I know of MoneyOwl portfolio components because Providend used some of the same underlying funds in our own portfolio (and I was the E-Monkey that did tally all these data).

I also grow a bit tired of people asking “what do you think of X portfolio, what do you think of Y portfolio.”

So I decided to take matters into my own hands and track some of the portfolios.

The Robo Portfolios I Decided to Track

I wanted to have a certain sensing of how some of those portfolios were performing.

I also wanted to see some of the unique portfolio features the Robos advertise at work.

I chose the highest risk portfolios for the portfolios where available.

I would also include a couple of ETFs that tracked the MSCI World and Bloomberg Barclays Global Aggregate Bond Index.

So here are the portfolios I tracked:

- MoneyOwl’s Equity Portfolio: 100% Equity in Dimensional Funds, which are tilted towards value, small and profitability factors.

- Endowus’s Very Aggressive Portfolio: 100% Equity that was all in Dimensional before they moved a sizable to Infinity 500 (which is a index tracker with S&P 500)

- Stashaway’s 36.0% Risk Portfolio: This is their most aggressive portfolio based on ERAA® (Economic Regime-based Asset Allocation). If I understand this regime based asset allocation, the correlation of asset classes will keep changing, so Stashaway have a way of adjusting their allocation so that they can risk-weight the portfolio with different instruments so that yo can capture the return and only take a max downside of 36%.

- Syfe Global ARI: Syfe’s risk parity solution. A mixture of equity, bonds and gold. When the volatility rises, the portfolio should go to bonds and gold and when risk subsides, the portfolio should go back to equity. This should give you a smoother experience. I have selected the option where the portfolio will risk manage for me. Currently, the portfolio is 63% weighted to equities, with the rest bonds and gold.

- Syfe REIT portfolio with Risk Management: The much touted REIT portfolio which can risk manage when volatility picks up to both mitigate downside volatility and then capture the return when things get better.

- Syfe Equity 100: The fabled Smart Beta portfolio that can time the factors so that they can capture the factor premiums when they appear and disappear.

- IWDA: The ETF that tracks the MSCI World Index

- AGGU: The ETF that tracks the Bloomberg Barclays Global Bond Index

#1 to #6 are in SGD while #7 to #8 is in USD. USD have weakened against SGD during this period.

Measuring the Returns of these Robo Portfolios

I only managed to track the returns from July 20th 2020 thereabouts to March 22nd 2021. That is about 8 months.

Unfortunately, this avoided the period where the market plunge but it does include a fair bit of turbulance in the October period.

The chart below shows the XIRR for each of these portfolios over time:

If we compute the XIRR that is less than 1 year timeframe, it would usually be a crazy big figure. So I had to “massage” the XIRR to adjust and annualized it better.

You can look at each point as the internal rate of return from the start to that point. For example, if the XIRR plotted for Syfe Equity 100 on 6th of Feb is 14.78%, it means from start of 20th July 2020 to 6th Feb 2021, the “interest rate earned” is an annualized 14.78%.

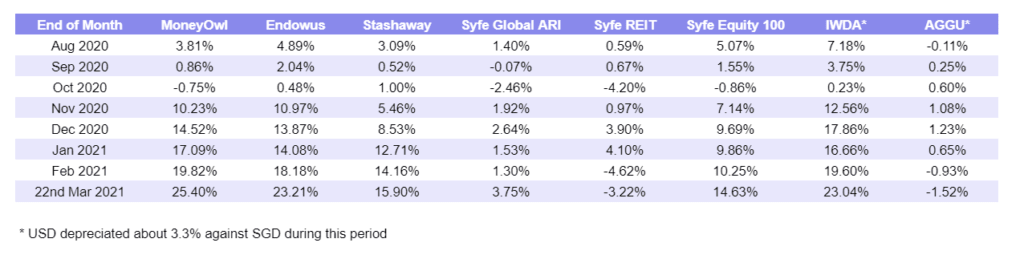

The portfolios ended with the following returns:

- MoneyOwl’s Equity Portfolio: 25.4%

- Endowus’s Very Aggressive Portfolio: 23.21%

- Stashaway’s 36.0% Risk Portfolio: 15.90%

- Syfe Global ARI: 3.75%

- Syfe REIT portfolio with Risk Management: -3.22%

- Syfe Equity 100: 14.63%

- IWDA: 23.04% (adjusted for currency, this should be 19.70%)

- AGGU: -1.52% (adjusted for currency, this should be -4.82%)

Observe that for a long time last year the returns are so clustered together. To make it easier to see, here are the figures in table form:

Here are my comments on the portfolio.

The objectives of most of these portfolios are to be broadly diversified, form the core of your portfolio, so that you can be comfortable to hold the majority of your assets (except for the REIT portfolio perhaps).

They are not geared for you to take specific bets. So don’t come here and say my so and so fund perform like this and that. You took on more risks or market time. That is a whole different story altogether.

MoneyOwl’s Equity, Endowus’s Very Aggressive Portfolio, Stashaway’s 36% Risk Portfolio, Syfe Equity 100 portfolio should be compared as the same animals with IWDA.

Syfe REIT and Global ARI should be more boutique solutions. Both should be evaluated against a 60/40 portfolio as the risk level is about the same. If you take 60% IWDA and 40% AGGU, a 60/40 portfolio in SGD should be roughly 9.89%. So it seems both of them did relatively worse.

I am quite satisfied that my colleagues MO experience is decent. MoneyOwl was lucky in that the small or size premium showed up from July 28 onwards. The value premium also started showing up near the end of the month. The value and small companies were not doing so well during the pandemic.

However, my data at work will show that even if we measure from the start of 2020 till 23rd March 2021, the MO portfolio should be more or less near the IWDA return.

The IWDA return looked like the best for a long time, until I remember that if we convert the return to SGD (you have to eventually spend in SGD), the returns might not be as good.

Bonds did well during the pandemic, but subsequently did not do well.

Endowus portfolio kept pace with MoneyOwl but they basically capitulated to overweight Infinity 500 at the wrong time.

Stashaway portfolio insulated their client during the pandemic and unfortunately my data do not showed this. Their overweight on China internet stocks, gold, and consumer discretionary helped for sometime. But ultimate the overweight to China internet stocks and gold worked against them.

Syfe’s REIT portfolio didn’t make any headway and eventually suffer recently when the long term interest rate rose.

Syfe’s Global ARI portfolio did its job of being very non-volatile. However, their clients didn’t benefit from the subsequent run-up. The experience may be pleasant but clients need to know what they are buying into. They might grow impatient over it.

In the end, Syfe’s Equity 100 couldn’t time the factors as they said they could. There was a shift towards value, small size premiums in the second half of the year, and a shift away from small, unprofitable and growth stocks in recent months. Yet the portfolio could not capture it.

Perhaps these factor premiums are not so easily timed.

Actually, the whole Syfe strategy is damn befuddling. They started with the Global ARI, then they introduce the REIT and then the Equity 100. Now they introduce Core portfolios, which is similar to what MoneyOwl and Endowus have.

I always thought that their best idea for the investors were the Global ARI which is a risk parity portfolio. That should give clients the best experience because the draw down would be low.

Then they go and introduce a highly volatile and risky portfolio in Equity 100 that I can confirm have a higher standard deviation than MSCI World.

If there are flaws to those portfolios, maybe you should improve upon them rather than just keep coming up with more and more portfolios.

Anyway, 8 months is a pretty poor time-frame to form your opinion about your investments. I can still remember in end 2017, I talked a few people to give their investments in Stashaway more time as a few months is really not the best timeframe to evaluate things. I hope they had stay vested.

Let me see if I got the energy to do a update some months later.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

komatineni

Wednesday 16th of March 2022

Hi Keith, wondering how diff robo advisors performed during the recent china downturn or tech downturn. Possible to post an update? or google chart :)

Kyith

Friday 18th of March 2022

Hi komatineni, wanted to update but no time! Will try to do it soon.

Raul

Saturday 7th of August 2021

Hi Kyith, Always appreciate your articles. Do you think you could include Autowealth portfolios in any future comparison of SG Robos?

Kyith

Sunday 8th of August 2021

Hi Raul,

I can't but if they are a 60/40 portfolio you can take that as an average of IWDA and AGGU return.

Jacu

Sunday 11th of July 2021

Hi Kitty, Great job! I’ve been looking around precisely for robo returns analysis and yours is the only one so far. Looking forward to your update over a longer period.

FYI, I have stashaway 18 and Syfe reits 100%. Both are doing well although stash has a much better return so far.

Kyith

Sunday 11th of July 2021

Hi Jacu, thanks for sharing. How have the REITS 100% results be for you. I have to declare that for this benchmark I am using the one that auto balance between bonds and REITs.

Pot

Thursday 6th of May 2021

Have you tried DBS's digiPortfolio?

Kyith

Friday 7th of May 2021

nope i have not tried it.

Muhammad Sufi

Saturday 27th of March 2021

Hi.. do you have any shariah compliant investment to recommend..? Doesn’t matter if robo advisory or not.. anything would be greatly appreciated