I think some readers might just hear the news yesterday of tighter restrictions for Singaporeans to use Binance.com as a platform.

Singaporeans were given one month to withdraw their fiat assets and redeem their tokens. Earlier, Binance.com ceased Singapore dollar trading pairs and payment options.

Stopping spot trading is more drastic.

In any case, you have alternatives in:

- Gemini

- FTX Exchange

- Crypto.com

- Kucoin

Gemini remains a good platform to easily transfer money from your Singapore bank account to the platform and back. The trading cost is reasonable if you use ActiveTrader, but they say the exchange for SGD to ETH and BTC is not good (personally I cannot feel it).

The majority of the trading can take place at FTX Exchange, which has rather low trading fees and withdrawal fees (depending on network conditions).

If you transfer from these centralized exchanges to the decentralised exchanges, you can easily swap to other coins, so that is not too big of a problem.

Here is this week’s Moat Market Intel.

Rich Kiyosaki, Poor Readers

A lot of us old-timers got awaken to take care of our finances by Rich Dad Poor Dad.

Well, I read a few of his books. After the second book, I realize the content starts repeating itself.

Robert Kiyosaki’s tweets also start repeating themselves.

If you have followed the recent version of Robert Kiyosaki, you would realize he is a doom monger.

If I remember he made a prediction in the 2000s that the market will experience a crash in 2016. I think the market did OK that year.

Someone did a relationship chart of his tweet and the market performance.

I think being sceptical is good. But as Logan (in last week’s Moat Market Intel) says, we find it hard to believe these folks are not net long.

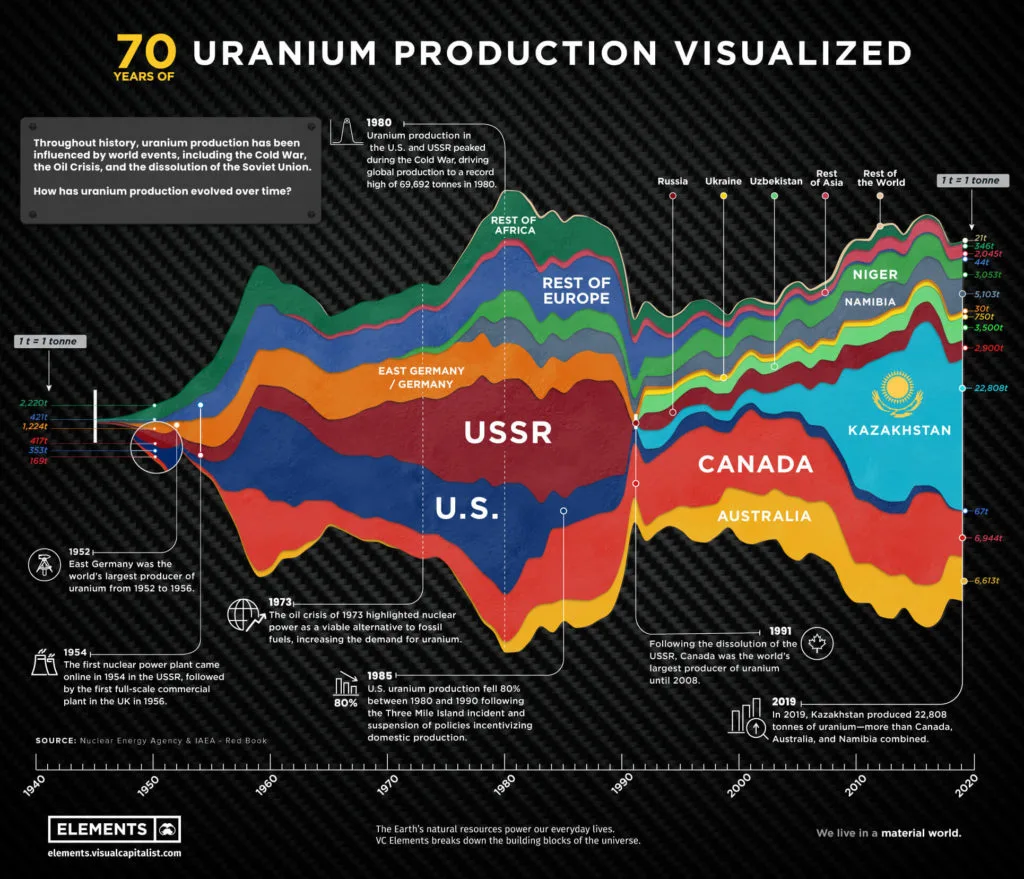

Uranium mine supply covers only 74% of world nuclear reactor requirements

The sources of uranium have changed over the decades. Visual capitalists have a short write-up on this.

Given the supply and demand dynamics, this is bullish for uranium. What could derail the uranium uptake is another Fukushima taking place and the world government having reservations again about nuclear adoption.

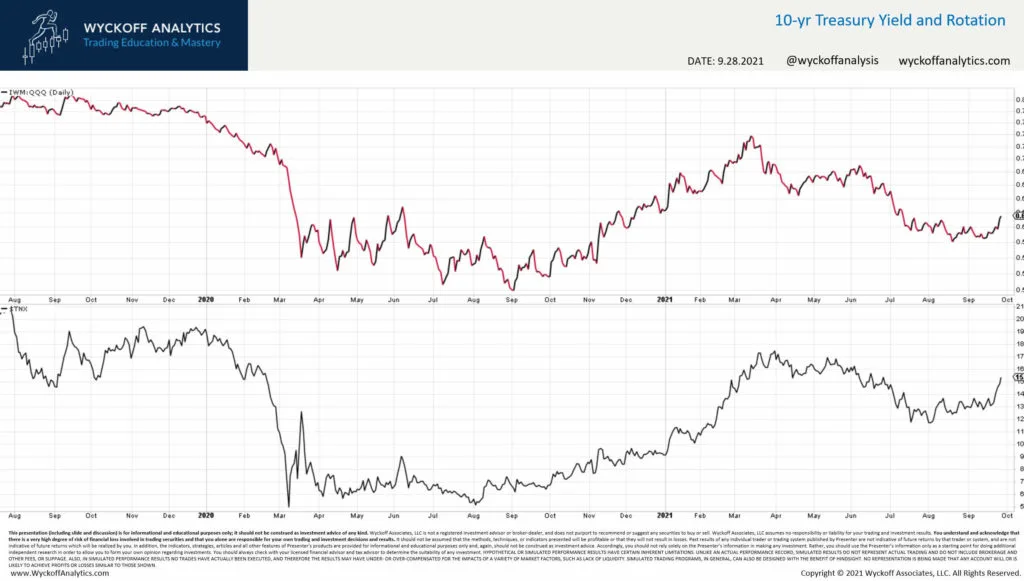

The Eerie relationship between the 10-year treasury yield and Small-cap-to-Nasdaq price.

Wyckoff Analytics have this great relationship chart:

The chart on top shows the Russell 2000 ETF vs. the Nasdaq ETF over the past two years. This chart was overlayed with the 10-year treasury yield.

This spike in yields has been driving a lot of the action we’re seeing in the major equity indices this week. Over the past 5-days, the Russell 2000 is up 1.73%, while the Nasdaq 100 is down 1.71%. As you can see, $IWM/$QQQ moves nearly in lockstep with the 10-year yield.

The composition of Nasdaq top stocks tend not to do so well when there are rates uncertain but the thing I do not get is why to smallcap will do well.

Anyway, I struggled to create a chart of longer time comparison.

Tom Bowley at StockCharts.com did a chart on a longer time frame:

This isn’t a Russell 2000 to Nasdaq relationship but a small-caps ($SML) versus S&P 500 ($SPX). Looks like the pattern is not just a two-year phenomenon.

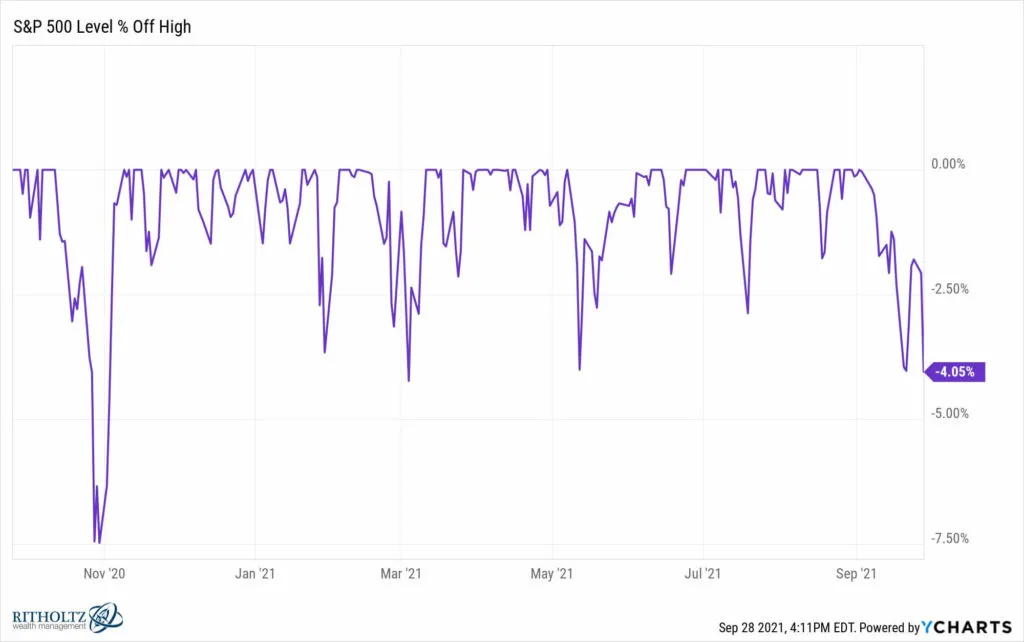

The Price Drawdowns this year…

Have been small.

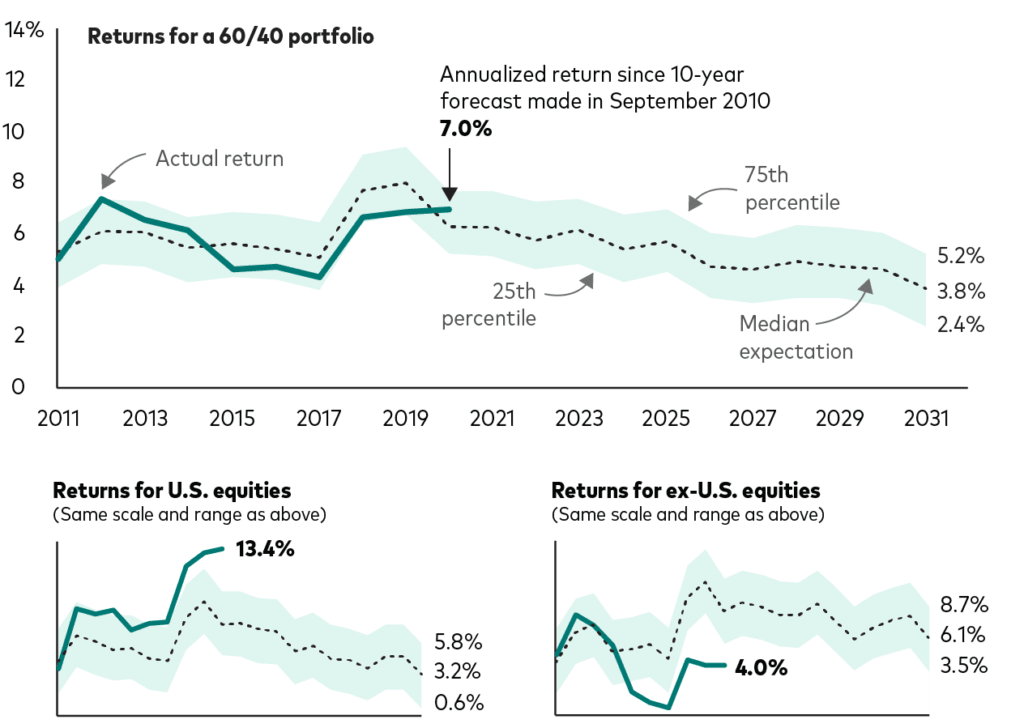

Vanguard Predicts Much Lower Long Term Returns for the 60/40 portfolio

Guiding investors to invest for the long term also requires Vanguard to be able to make sense of forward market returns.

Their Vanguard Capital Markets Model (VCMM) is a model that they have refined over the years.

Based on their model, the annualized return going forward is going to be much lower than we expect. This is not constrained to the 60% equity 40% bond portfolio but also the equity portfolio.

One of the main reasons is that a key component for our great growth the past decade was due to price-earnings expansion out from a low valuation. That has pretty much expanded enough.

If we take out price-multiple expansion, then what will drive earnings is growth in a low growth environment. That is not going to be good.

The expected return for ex-US equities is slightly more optimistic.

Cem Karsan and his recent update on the probability of weakness

You can check this tweet out. I am not going to interpret it.

Reading this previous article might help a bit.

Software Stack Investing on Twilio’s Q2 Results (TWLO)

Software stack investing takes time to go through some of the companies he owns or that he is interested in.

In last week’s update, he deep dives on Twilio’s second-quarter results, the capabilities they added recently and what he gathers from management.

It is always nice to have a Chief Technology Officer to explain some of this stuff to us.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Sinkie

Wednesday 29th of September 2021

For the US at least, rising periods in 10-yr yields indicate improving real-world economic conditions. US small caps are rather sensitive to the man-in-the-street real economy, and hence the correlation.

I'd bet there's also strong correlation between treasury yields & US bank stocks or index.

Famous bearish investors like GMO and John Hussman have also been calling for -ve real returns in most stock markets over the next 7 to 10 yrs.

Lots of contradicting signals & prognostications.

So maybe we'll see another huge melt up like 1999 in the next 2 years followed by a -70% bear market. Who knows?

Lol, Cem Karsson sure didn't see the -2% bear claw on 28 Sep. There's a difference between approaching the 20 dma & actually crossing it.

Btw I can't recall ever seeing an episode of the 1970s Hulk tv series where he threw an oversized teddy bear?? Lots of fun tv shows then, but tough living for most of the actors in those years (including the 2 main actors of the Hulk tv series).

Ben

Wednesday 29th of September 2021

Like this new segment of bite-sized and broad articles!

Kyith

Friday 1st of October 2021

Thanks. Hope I got good value to add here and there.