2021 is coming to an end in a couple of weeks time. You may wish to look forward and anticipate how the stock market will perform in 2022.

This morning, I watched Tom Lee’s chat with the folks at Ritholtz Wealth Management.

Tom pretty much got a lot of things right about 2021, including how positive 2021 will be, oil and gas. Perhaps where he got it less right is where Bitcoin will be by the end of 2021.

If you have paid attention to Tom’s commentary here and there in the media, you would realize he has been rather bullish when everyone was sending mixed signals.

Even when he was less bullish, he has strangely been on point. Recall in an interview earlier in September where he said that if there is a correction, it should be in November (largely correct).

Anyway, there were some interesting data charts that they discussed during the interview.

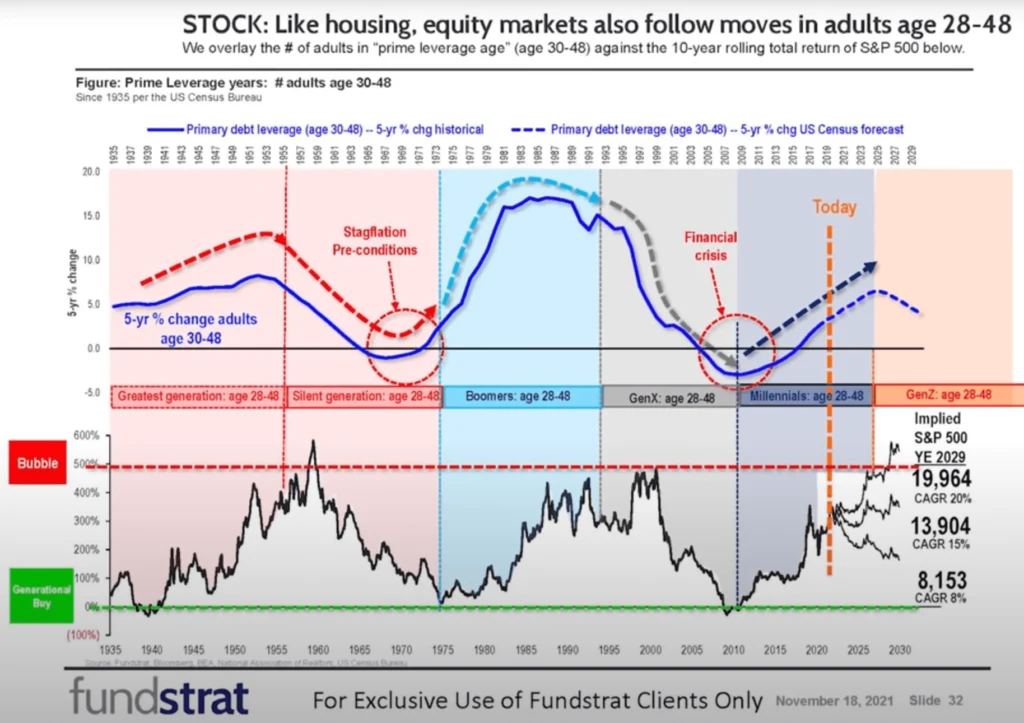

Equity has a strong correlation with the cohort of productive working adults

Fundstrat’s Tom Lee has some really weird data work.

Tom explains that a lot of great businesses was started by people in their 30s, who have a long runway to develop the business. There is also a strong correlation between the cohort of adults age 30-50 and the number of patents filed.

For this reason, the United States are in a unique position where a large percentage of Americans, the millennials are entering the 30-50 range.

This peak productivity would last till 2029.

If we correlate this to the market, you can see where Tom’s optimism lies. Depending on other factors, the compounded growth from now till 2029 could be 8% to 20%.

A lot will depend on other factors such as profit margins, earnings growth.

2022 Mid-Term Stock Market Predictions

2022 happens to be the middle year of the US Presidential Cycle.

Tom’s estimation of the 2021 return was based on a prediction of a lower volatility environment. This would bring a 20% return.

Tom estimation for 2022 is based on an intersection of returns after a 20% year and a mid-term year. This will give an estimation of 11% for the year.

He did make a comment that usually, the first half or the run-up towards the election is messy.

And upon research, the mid-term year is really messy:

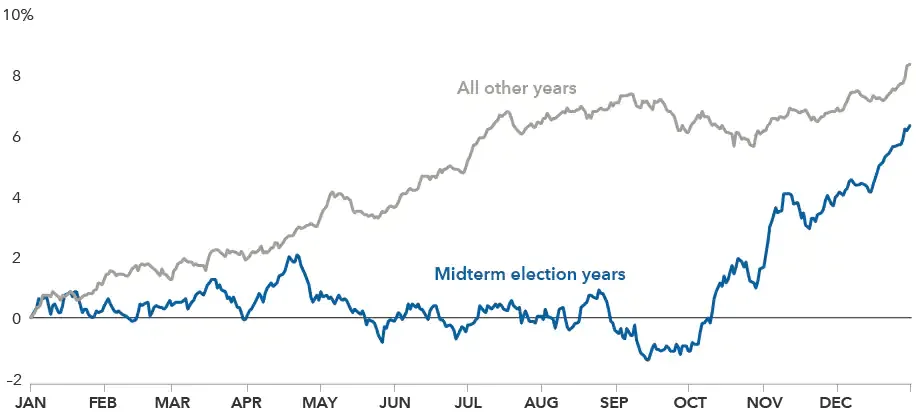

This chart shows the difference in the monthly average performance of midterm election years versus other years courtesy of Capital Group.

We can see that leading up to the mid-term years is really messy.

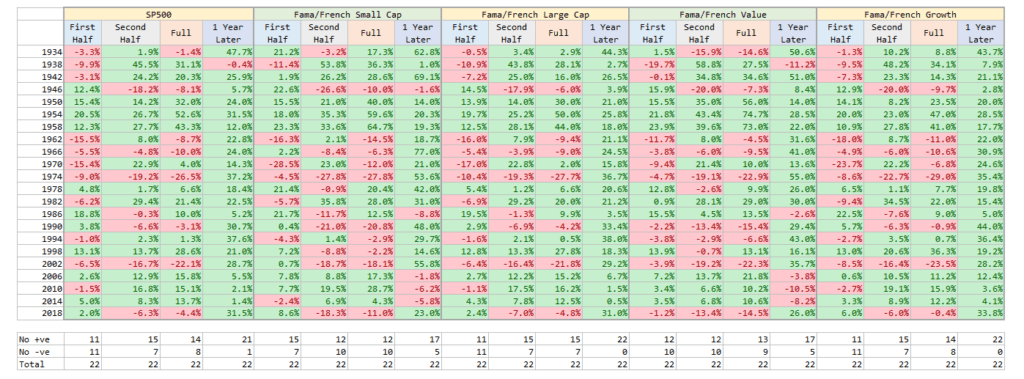

I decided to tally up the performance of some indices during midterm years and after:

I tallied S&P 500 performance as well as the performance of Fama and French Small Cap, Large Cap, Value and Growth research index to give you an idea of how other slices of the US market do during the mid-term years.

I split the midterm years to the first half and second half as well as show the performance of the year after the midterm years.

You would observe that over the 22 midterm years since 1934, 11 of them are positive for the first half and 11 are negative for the first half. In the second half of midterm years, there were more positives.

So there are no clear trends.

But what is most obvious is: The performance of the S&P 500, Large Cap and Growth during the year after midterm is crazy good. There were almost no negative years!

The performances of Fama and French Small Cap and Value is less bright but then you can take a look at some of the 1 year later or full-year small-cap returns.

50% returns are not uncommon for small-cap and value.

This means we cannot miss out on investing in 2023!

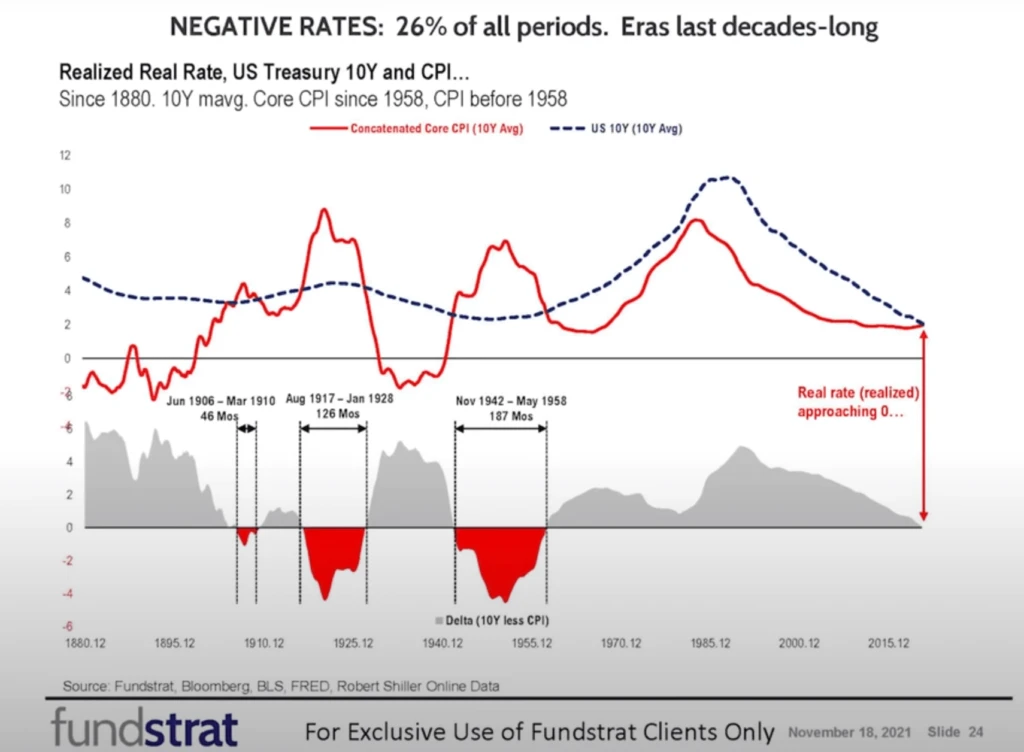

How does the Stock Market Perform During Negatively Yield Years?

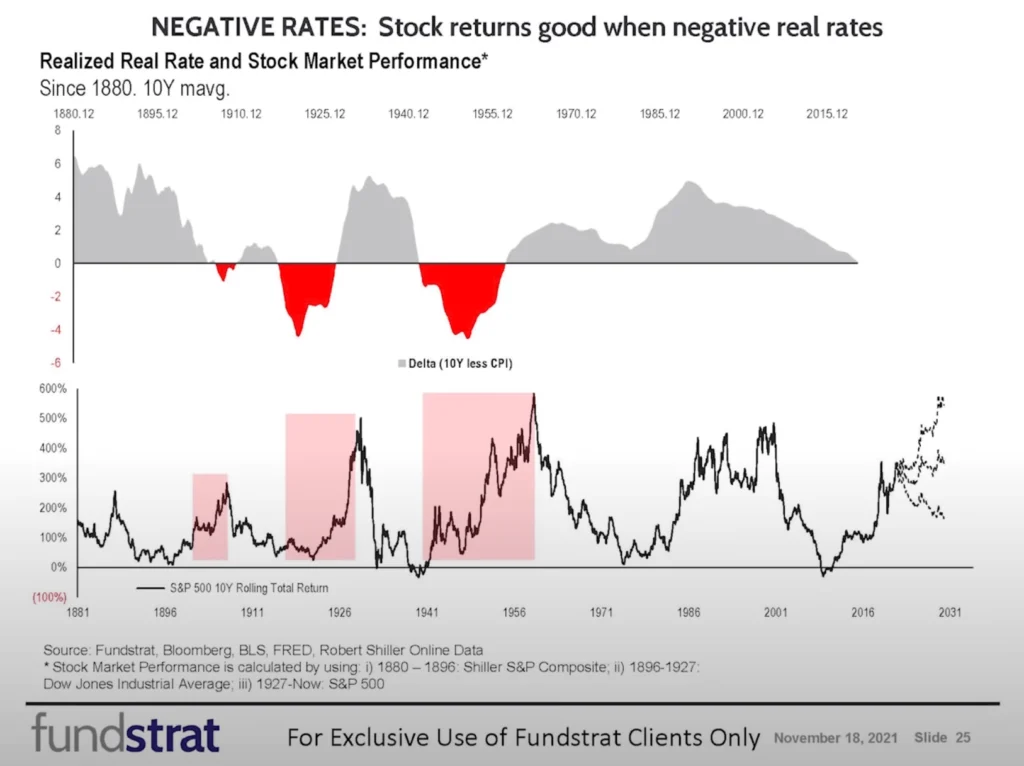

Tom explain that many people didn’t realize that years, where the real 10-year treasury rate is negative, is more common than we think:

This chart shows that we may have reached a point where the real rates are turning negative.

The last time that happen was from 1942 to 1958, which was during world war 2 and where another QE took place.

Here is the 10-year rolling equity return overlayed with the negative real interest period:

Holy shit. The 10-year rolling returns look quite good. The strange thing is that when the real yield became positive, the 10-year rolling returns start going lower haha.

These charts probably assure us that equities are the right asset class to hedge against this level of inflation risks.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Revhappy

Saturday 25th of December 2021

Hi Kyith,

I just looked at your portfolio and I had lasted looked at your portfolio on 12th Dec and I see that on 12th your US portfolio was 765k and today is it 1m! Wow! That was a big jump in your asset allocation to equities. I have noticed you have always been conservative in your allocation and you have kept high levels of cash. Would be interested in thought process behind going almost all in, in one shot. How did you convince yourself?

I am asking because I am in a similar situation, I am only 42% allocated in equities and I need to get to 60% but I plan to do it over a 2 year period rather than 1 shot.

Revhappy

Friday 31st of December 2021

@Kyith,

Very well said :) I am more on the path of regret minimization. I am currently at 45% allocation and my plan is to get to 60% allocation, over a period of 1 year, using value averaging strategy. If markets rally another 50% from here, my current allocation(which is 45% to equities) also goes up 50% so that is not a bad thing. Although I will be deploying my money also at higher levels, this is the worst case scenario.

But if I put everything in now, and then market crashes, that will cause me to regret a lot.

Kyith

Thursday 30th of December 2021

Understand things more to develop conviction. Sometimes you need to take the plunge. Building wealth requires living with enough uncomfortableness.

Sinkie

Sunday 19th of December 2021

The demographics story again. If history rhymes, zillennials will be in a world of pain just when they start to have serious money in stocks. Cryptos will likely follow similar pain path.

Millennials are lucky, but will need to control greed & have lots of risk mgmt. Just like how boomers fared during the go-go 90s and then the lost decade 2000s.

Ditto for Gen X; their last chance to make their FO money before hitting 60 or 65.