Most of the REIT investors endure some extreme volatility in this March Madness. Their holdings have quite a good run in 2019.

Coming into 2020, investors believe that the low rate environment is here to stay. Even when the threat of Corvid-19 reaching the United States and Europe, investors rationalize that when the interest rate plunge, this must be a more conducive environment for the REITs.

What comes next is that in a span of 2 weeks, many REITs saw their stock prices plunge 50%.

Manulife US REIT and Prime US REIT both endure the same fate as their peers.

In the past 2 days, both REITs provided some updates to analysts, so as to address the potential uncertainties of investors.

Since then both REITs saw their share price go up 20-25%. Manulife’s share price held up better, probably because they are in the Index and are much more liquid.

Their transparency may have worked wonders for their share price. However, overall, a lot of the REITs managed to bounce off their lows.

Here are some updates that I have gathered.

Possible Reasons for the Sharp Price Falls

Management updated that possible reasons why the drawdown was so swift was due to

- Manulife’s entry into the index. When index funds, exchange-traded funds systematically sell down, there isn’t many fundamentals per se

- There was a lot of margin calls from the Private Banks (my friend KK from RisknReturns mentioned a few days ago that the three US Office REITs may have been removed from the list of marginable stocks on private banks)

- Funds redeeming and switching around. They are switching from smaller stocks to more liquid stocks

- Ultra-rich Chinese are facing heavy margin calls (we can guess who they are). Manulife US REIT does not have them on their register

Are Manulife US REIT’s Properties Affected?

The city of New Jersey and California have shut down. Only gas, pharmacy and grocery stores were available.

You cannot take public transport in Virginia, Washington. It is a matter of time before Atlanta shut down.

MUST’s properties are currently 20% occupied. The F&B shops were closed.

Rental Rebate Requests and Business Continuity Insurance

Rental rebates were not offered to tenants. This is even during GFC.

However, they may provide rental rebates to F&B tenants on a case by case basis. F&B tenants only make up ~1% of MUST’s portfolio by GRI.

Management highlighted that a pandemic does not qualify for business interruption insurance.

Adequate Amount of Security Deposits

The security deposits collected by MUST amounts to 0 to 4 months. This is based on the credit profile and length of relationship with the REIT.

A tenant can be considered as default if rent payments are 60 days in arrears.

The Properties’ Experience During the Great Financial Crisis (GFC)

Occupancy during GFC drop to between 80% to 90%.

Figueroa and Peachtree fell to 90% and 80% during the GFC.

One of the fears is that property value will be valued downwards, which will increase the debt to asset ratio, violating loan covenants or MAS guidelines for a maximum 45% leverage ratio.

Management update that valuers will assess value based on the intersection of a couple of different valuation method:

- Discounted cash flow of projected forward leases

- Comparable transactions

During periods like this, buyers and sellers are likely to halt their transactions. When there are fewer transactions, there are no comparables to use to value the property at a lower value.

New real estate dues will be put off until there is clarity. Nobody wants this price discovery in the short term.

Thus, valuation should be more stable.

Risk of Top 10 Tenants Right-Sizing

While there were comments of structural shifts for tenants to right-size their office space, their top 10 clients may have already the right size recently or unlikely to change as many of the corporates in the US would already have flexible work arrangements.

Still Struggling to Fill Michelson’s Space

Management update that since Covid-19 happen, a lot of the activity grind to a halt. Management was negotiating with a prospective tenant but since then, most prospects would rather adopt a wait and see attitude.

Less Liquidity and Re-financing Concerns

Manulife US REIT’s property valuations need to go down $351 million or 16% of the portfolio (24 Mar) to reach the MAS Cap of 35%.

They have $90 million in liquidity for working capital purposes and $200 million in credit facility from DBS to tap upon, should they need to make acquisitions.

They do not anticipate that there are risks. Manulife has one debt that needs refinancing this year. The current loan has a 2.46% interest. They are quietly confident that the re-finance loan could be cheaper than this. They have the option to extend the current loan for 1 year as well.

MUST’s unencumbered debt position should improve from 34% to 41%.

Low Key Tenant Risk

The top 10 tenants in their portfolios, which comprise 35% of rental income, are mostly MNCs and government agencies.

They mostly have their headquarters or key operations based out of their assets. Tenant sectors are diversified with no one sector being greater than 23% of the portfolio.

DBS also released some updates with regards to their conference call with Prime US REIT.

Here are some of the key takeaways.

Portfolio have Less Near Term Concerns

Prime’s management believes that there will be market disruptions in the next few months, however, its base case is for the economy to rebound on a very quick V-shaped recovery with the stimulus package.

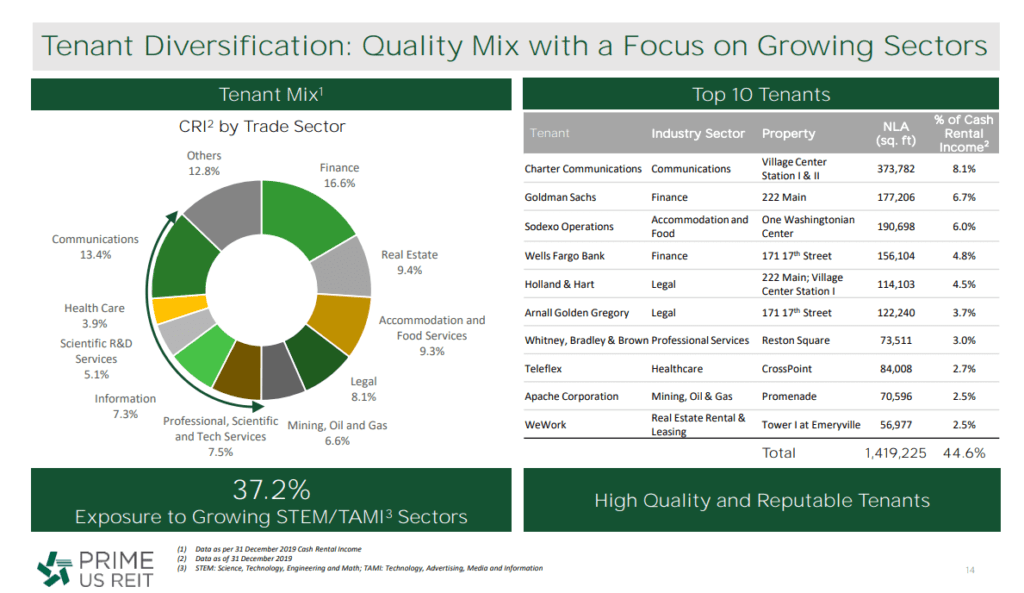

The key attributes of Prime’s portfolio

- Long WALE of 5.1 years

- Low lease expiries (<10% in the next 2 years)

- High committed occupancy of 96%

- No debt refinancing in FY2020/21- augurs well as it navigates near-term disruptions.

- Management expects more tenants to renew their leases in times of uncertainty which bodes well for Prime.

Prime has limited lease expiries in the near term with only less than 7% and less than 10% (estimated after Park Tower’s acquisition) of cash rental income (CRI) expiring in FY2020 and FY2021 respectively.

While there are termination rights on some leases expiring in FY2021, management does not expect to exercise this especially for a lease to a government entity.

On Tenant Defaults and Rent Rebates

There are currently no tenant defaults and rental rebates are given to F&B tenants which contribute less than 1% of total income.

Nature of Security Deposits and Guarantees

While there are concerns about the WeWork operations, WeWork as a tenant will drop off the top 10 tenants list and is estimated to contribute less than 2% of CRI post the acquisition of Park Tower.

In addition, WeWork’s lease provides corporate guarantees / LCs which covers 2 years of income. Sodexo, one of the top 10 tenants which contributes c.5% of CRI (estimated after Part Tower acquisition), provides corporate guarantees for all remaining obligations.

The lease is expiring in 2023.

Oil & Gas Tenants Lease Expires 2 Years Later

While mining and O&G tenants contribute some 6.6% of CRI, the major O&G tenants’ leases are only expiring from 2022 onwards with a larger lease only expiring in 2024.

Sponsor KBS Experience during GFC

Management believed that in times of crisis, occupancies could fall to 80% which is still decent, and rental rates and valuation may fall by 20%.

During GFC, KBS’ (Prime’s sponsor) portfolio continues to generate good returns (c.11% in 3 years) a testament of a strong team and good quality assets.

Conclusion

I do not think that one of the contributing factors for the price fall is due to these two REITs being based in the United States, which is the epicenter of where the number of new detections are ramping up.

The price fall was across the board.

There are adequate uncertainties for properties based in the United States. billionaire investor Carl Icahn biggest position by far is a short on the US commercial mortgage-backed securities. His take is that banks, instead of securitizing residential loans are now securitizing commercial loans on office and shopping malls and selling them away.

Tom Barrack, another billionaire real estate investor, believes that commercial mortgages are on the brink of collapse.

At this point, I would not dismiss this risk yet. I would only comment that I do not know if the commercial loans they are referring to is similar to the same pool of commercial loans Prime and Manulife use.

While both management paints a picture that everything is OK, it really depends on how much the mainstream economy suffers. If it is a long-suffering, I cannot imagine a scenario where commercial real estate will not be affected.

Carl and Tom’s scenarios will work out if this situation prolongs and there are more rental revenue arrears. Like what the management updated, most tenants would have put a few months of security deposits.

However, if this situation persists everyone does not have enough cash flow, sooner or later the landlords will run into issue. The billionaire’s opinion will prove to be correct in some ways.

Prime US REIT does not have any debt renewal risk. Manulife US REIT does. But I believe at this point, Manulife US REIT should not have a problem refinancing their debt. The unique thing is both REITs should have access to USD denominated loans in the United States and Singapore.

Both REITs have 14-15% of their leases expiring in 2020 and 2021. Prime US REIT may have more risks with their exposure to Apache Corporation. However, even then, at this share price, it bakes in the risk if Apache does not renew their lease in 2 years time. There is enough time for oil prices to normalize (if it ever does). The bigger threat is when companies other than the usual suspects start not renewing or right sizing.

What I am more concerned about is more of the risk of property revaluations. This affects potential forced, dilutive, and non-income generating rights issues. Manulife provided some sensitivity analysis on how much property valuation have to fall to reach 45%. While Prime did not provide a sensitivity analysis, they are 4% lower in terms of their net debt to asset.

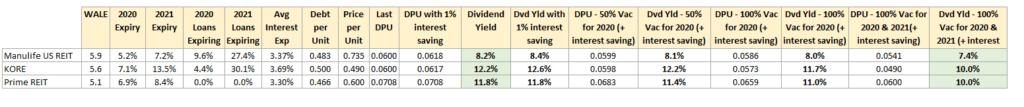

I leave you with my own sensitivity analysis. It lists the potential interest savings. It also lists potential non-renewal of 50% or 100% of their 2020 & 2021 expiring leases.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Sunny

Tuesday 31st of March 2020

On another note, Residential REIT is in big big trouble with zero travelers and also Airbnb operators, many held multiple properties , scrambling to take anything to cover their mortgage.

Sunny

Monday 30th of March 2020

Work from home is great up to a certain point. Those with kids at home are difficult to WFH. Collaboration is not as smooth as f2f and you always wonder whether half of the participants fall asleep in larger calls coz they have no recollection what were discussed. Those people who can work from home would still go into office may be twice a week min? They would require desk and seat. So to a certain extent the office space can be reduced but I imagine won't be alot.

Kyith

Monday 30th of March 2020

hi Sunny, i think so too. But i think with the cash flow crunch some bosses might bite the bullet and be more severe in reducing spaces. What does not make sense might not mean they wont do it.

Thinknotleft

Saturday 28th of March 2020

Josh Brown (a US blogger) mentioned in podcast, somewhere along the line, that this coronavirus will change how we work. More people may work from home after the virus has died down, since people have started working from home now and the workplace may get used to some people working out-of-office.

I was thinking that arising from the above, perhaps this coronavirus will change or lower the demand for offices in the future. While the office reits looked stable currently, the growth for office reits may be less favourable in the long run.

Kyith

Saturday 28th of March 2020

Hi Thinknotleft, this might speed things up. But we won't really know in the future. This is going to affect the whole industry, perhaps in a way the malls are. However, these REITs have moved into a lot of the suburban office concept where the offices are close to where people lived. there will be some moderation. Would there be a drastic change? I don't know. I would like to think that most of us need a separate space to work.

BlackCat

Saturday 28th of March 2020

Thanks for the update. The nightmare scenario for REIT holders is that properties get devalued, either due to tenants leaving or fire sales (in the surrounding area).

On the bright side, once the virus is dealt with, everyone will want to party. With zero interest rates, fistfuls of govt money in all our hands, and oil under $30, there is going to be a massive boom. I just don't know how long it takes to get from here to there.

Kyith

Saturday 28th of March 2020

Hi BlackCat, thanks for the contribution (and your write up on IBKR as an investment). There are always risks, it is just whether it is real or not. When Manulife was having those supposed tax issues, it eventually became a non event. Is this a non-event? I am not so sure. I have friends telling me the response after this is that many CEO will realize that it is possible to have teams working from home, half in office half at home and they can cut down on space massively. I for one do not like to always work at home. I have read of bloggers in the USA finding it always more conducive to rent a space to work. Yet at the same time, this is like a massive tryout for a lot of companies, so some space rationalization may take place. at the end of the day we wont really know.

If we take a page out of the retail book, usually the result is somewhere in the middle.