I attended the extra general meeting (EGM) for Frasers Logistics and Industrial Trust (FLT) yesterday to see if there is any delta differences between what I wrote about of the proposed acquisition and what the management answered.

You can read the post in the URL above.

I didn’t want to write this as I didn’t take down a lot of notes. I also couldn’t hear well since one of my ear is muffled for weeks.

I spoke to Chung Keat the investor relations and Rob Wallace the CEO in brief.

But since some friends asked about it, here it is. This will be rather short. Some of them are my views about the question and answer as well.

A few shareholders questioned why go into Europe. They cited increased currency risks. One or 2 of them question why not set up a European REIT, away from FLT’s which owns Australian properties. This totally messes up their own plans because with an Australian property REIT they can pick and choose which area they would like to be invested in.

Mr Wallace’s answer is that there was such an opportunity, they felt its good, so they went into it.

I think a few asked me about this question and I honestly do not know what surprise answer are shareholder expecting. FPL owns 22% of FLT, and we see FPL’s purchase last year.

The property will either go into FPL and stay in FPL, go into FLT or another new REIT.

Based on the speed at which this acquisition came after FPL’s purchase it is likely the plan was set in motion last year. This could indirectly be seen as FPL helping FLT purchase first, because FPL have the flexibility to do it faster.

Any other reasoning would provide an alternate view but in all honesty sugar coating it.

It is true that there will be currency risks, but this is as if we are saying that FLT, without the acquisition, do not have any currency risk. The depreciation of the AUD to SGD in recent months come to mind. If you buy in, you are contend to this.

The shareholders want FLT to hedge, but Mr Wallace highlighted they do not wish to engage in speculation. I think what the shareholders wish for is some management magic in speculative hedging here, and perhaps fail to see the purchase of hedging the currency in the first place.

The acquisition comes with little yield accretiveness yet the overall balance sheet is poorer. One gentlemen poses this question early and it is a question on our mind as well.

Mr Wallace explanation is that they believe that this gives FLT an overall stronger long term portfolio.

Where is the growth going to come from? One gentlemen highlighted that the WALE of the portfolio is long, and that annual escalation is not growth because, it only helps to keep up with operating expenses.

Mr Wallace corrects the situation and explains that these new leases are on mostly double net lease, and some are on triple net lease, so the inflation we see in operation for its tenants do not hit them.

Mr Wallace explains that most of the growth will come from tenants who are interested in redeveloping the premises, to improve or expand on them. This is highlighted in the presentation slides which could potentially bring about 2 million Euro in rent increases.

This is not part of the proforma income increases. By my own computation, with the expanded outstanding shares, will bring about 0.16 cents or 2.22% full year improvement over Annualized Q1 2018 financials.

From my conversation with Mr Wallace, they are actively engaging with some of their Australian tenants on this front as well.

This and the 5-10% annual portfolio expiry would be where the growth (negative or positive).

The average rental escalation of the portfolio could potentially go down. Overall 2 of the new properties have rental escalation of 1%, with 89% of the new portfolio have CPI based rental escalation. This is good if there is inflation. Not good if there is an absence in inflation growth.

The current existing portfolio has an average rental escalation of 3.12% per year. Thus in low inflation Europe, this will bring down the average.

In my view, with increasing interest rate environment, which usually is to combat overheating economy or later stage inflation, having CPI based escalation is better. But its not as if 2-3% annual escalation is not good.

FPL earns 1.4% or 7 million from the purchase last year and the sale to FLT. The author of the book Building Wealth Through REITs, Bobby Jayaraman was on hand to ask some good questions.

He wanted to press Panote, FPL Group CEO, on the purchase, but overall gotten no response there. Mr Wallace took on the questions.

Bobby wanted to find out the difference between FPL purchase price and the sale. Mr Wallace said its not a like for like comparison.

In the first place FPL bought Geneba’s management and a portfolio, follow by a portfolio with Alpha Investments.

The title of this bullet point illustrates Mr Wallace’s final answer how much did FPL earned from this deal.

There was no Portfolio Premium for the Purchase Price, FLT’s Management can Pick and Choose. One gentlemen pressed the management on how come one of the valuer’s value is always higher than the other, and that FLT’s purchase value is near the higher one.

Mr Wallace’s answer is that the purchase was not at the high end, but at a slight discount. I don’t think the shareholder was very satisfied with the answer.

In my conversation with Chung Keat, he explains that usually if we buy a whole portfolio directly from the market, we should be expected to pay a premium for the portfolio.

In the case of this portfolio, FLT was able to independently assess the valuation of these assets and pay the final price.

As explained by Mr Wallace, they did not take all of Geneba and Alpha Investment’s portfolio. They took 2 more property that came later than the Geneba announcement and did not take 2 properties and 2 gymnasiums that came a lot with it.

In our conversation, Mr Wallace explains that of course when FPL made the purchase, they also indicate whether the acquisition meets all the criteria.

He explains for example what came across for them was Spain and Polish portfolio, and those probably interest them less.

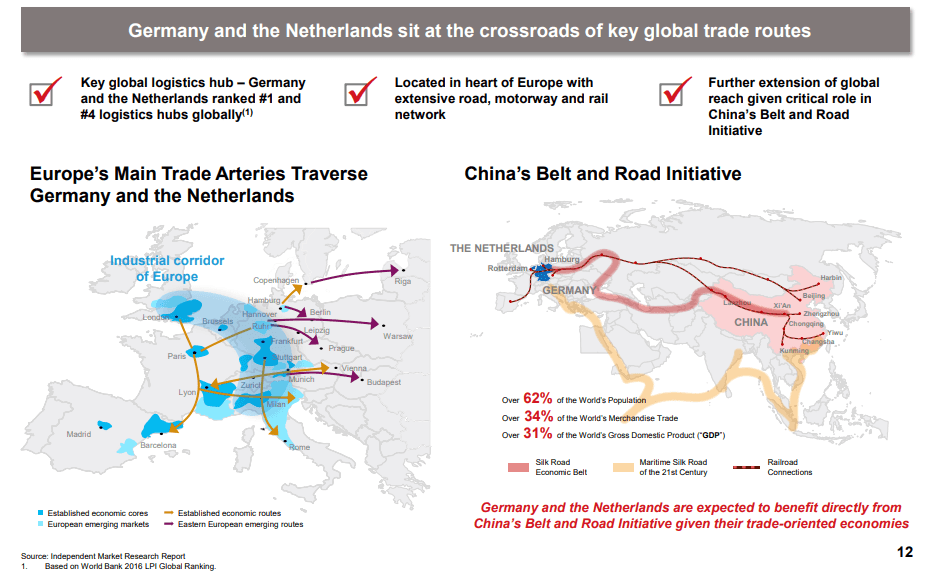

The Industrial Hub in Germany and Netherlands. To bridge with the previous point, Mr Wallace in his slides, explained that most of these properties are in the logistics hub in Germany and Netherlands.

Netherlands is a vital transport hub in Europe since very early centuries (if you play Unchartered Waters enough last time) and that in Germany, much car production and parts are moved.

Mr Wallace was able to go into some deep explanation on the vibrancy and transportation linkages between some of the towns in Germany with Asia.

Much was lost to me because, frankly, I am no traveler nor an expert in this area.

He explains that Netherlands are getting some of the spillover effects from Germany.

The slides show that while demand exceeded supply, in Netherlands you can see a drop in supply over the years.

Mr Wallace also explained that some of the vehicle manufacturers chose to have their facilities in that vicinity or in FLT’s property due to the necessity of being there.

In some case, such as Constellium’s premises, they invested like $100 mil into equipment installed on property which is doubled that of what the value of the property itself. (if I understand this part correctly)

Debt Structure. I think Bobby Jayaraman asked if they are purchasing the enterprise value. From the circular, it seems clear as unit holders, are buying the equity of the holding company. However, once it comes online, we take on the assets and the debt as well.

The CFO Susanna explains that that on the average the tenure of the debt is 5 years. The interest on the debt is 2%. They are comfortable with that.

The loan, as explain in my article referencing The Edge interview is an amortizing loan instead of a bullet loan.

They believe that they can refinance at 1.5%.

Amortizing loan is like your housing loan. By right over these 5 years, FLT should build up equity and be deleveraging.

This is what shareholder wants.

Mr Wallace explains that what they intend to do is to replace those principal with debt. I dunno how that is going to work, but I suppose every year the debt shrinks by A$87 mil. They will take this A$87 mil to put inside bullet loan of 1.5%.

The amortizing nature should mean we see reducing interest expense over the 5 years. When they take on more debts to replace the principal, this should be mixed with more debts.

The simple way to look is a movement from 2% average debt to 1.5% over the 5 years. on $463 mil that is A$2.3 mil.

At the expanded units, this is 0.11 cents or 1.6% of annualized Q1 2018 DPU.

Breaking the Long Lease. Bobby Jayaraman asked deeper about the nature of the lease, specifically under what circumstances can they break the lease.

Mr Wallace updated that the tenants cannot break the lease easily. Bobby eventually asked if the manager will get compensated adequately if the tenant decide to break the lease pre-maturely. Mr Wallace replied yes.

FPL’s shareholding in FLT is controlled. One shareholder asked why does FPL hold such a small stake in FLT. Panote updated that they have to maintain an efficient structure for FLT, so the ownership cannot easily go above or below this amount.

Unit Holders wanted to know the nature of the un-renounceable rights issue. At the tail end, one lady, who I have seen in a lot of these AGMs asked how can the unit holders approve for the placement and rights issue if they do not know whether the terms are attractive enough.

Mr Wallace’s answer is that they cannot announced the terms as it is dictated by market forces.

I don’t think the shareholders are very satisfied with this answer.

I have one chat group member blasting them that they should have announced the nature of the rights issue to remove the uncertainty and they only have themselves to blame.

I got no comments on this except that usually you announce it if your rights is heavily discounted. If you look at the MCT preferential offering, this FLT, Manulife and MLT’s upcoming one, they weren’t made known as well.

It is likely they do not wish to have it heavily discount and are banking on good support from the market.

Taking More Cash Compared to Units as Management Fee. I asked offline that in this past year they have taken less than 100% of the management fees in units so what is their direction here.

Mr Wallace updated that they have some internal metrics they work within as to whether to take more fees as units.

My inference of this is that they probably will use the units as fee to buffer for some volatility due to particular execution. I am not sure if they would do this when it comes to the depreciating currency situation.

Passing Rent Outrunning Market Rent. I asked offline that the nature of the business is that 45% of the initial IPO portfolio have passing rent higher than market rent. Mr Wallace explain that there will be some time before the leases expire so there will be time for the market rent to narrow.

In the upcoming renewals the tenant is Coles, and Mr Wallace isn’t expecting a negative reversion there.

Recent Portfolio Renewals. The recent quarter’s renewal have been mixed with a short lease and 2 long lease. I asked about the nature of the short lease, whether that is prevalent in the Australia context.

Mr Wallace explained that the tenants are unwilling to renew possibly a larger premise, so they didn’t get a favorable lease term.

The 2 longer ones ( 7 and 10 years) were the result of the team working the ground to provide their tenant with another property that they can lease.

If the tenant signed up a longer lease with them, they will allow them to rent that premises.

I asked about incentive for those properties and Mr Wallace updated its 10%, which we both agree is good for an area like Sydney.

Overall the rent is signed close to market rent, which means there is a negative rental revision of 7%. with the incentives, it might take 3-4 year of the lease to break even before we see the growth in the rent in these 2 properties.

I shared more about stuff on REITs like this in my section on REIT where I go deep into the weeds of investing in REIT. It is FREE and available:

If you like this do check out the FREE Stock Portfolio Tracker and FREE Dividend Stock Tracker today

Want to read the best articles on Investment Moats? You can read them here >

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Alan

Wednesday 9th of May 2018

Hi Kyith,

Just curious. After the EGM. How do you feel about the impact of the deal on Fraser L&I.