What is the most sensible way to get some liquid real estate exposure?

By investing through a REIT exchange-traded fund (ETF).

I have a reader who has always been interested in having a slice of REITs in her portfolio. Truthfully, she might not be able to pay attention and manage the risk in her portfolio the way a more active investor would if she manages the REITs on her own.

An ETF is a diversified portfolio of REITs. They can be different based on the geographical regions where they are listed or based on market-cap weighting or dividend weighting and rebalancing frequency.

The main advantage of a REIT over individually manage:

- Diversified. This has two advantages.

- Dramatically reduce the impairment of a large part of your capital if you concentrate on a few REITs and they turn out to be bad (because you are very unsophisticated)

- Capture the returns of the REITs that drive the long-term returns.

- The portfolio is self-rejuvenating.

- Access to risk and returns that are outside of your usual accessibility. If the REITs in a certain region perform better than Singapore REITs, you have access to that region.

The downside is that you have less control.

The REIT ETFs Listed in Singapore

We roughly have five REIT ETF listed in Singapore. The table below gives you a summary:

The Phillip SGX APAC Dividend Leaders is the oldest but it has the smallest fund size. I remember being in the cafe listening to the folks from Phillip explaining this years ago before they listed. They eventually list with 30 mil but currently, it looks like the fund size is much less.

Each ETF tracks a different index and they would probably have some style differences.

They also differ in whether they are more Singapore REIT-centric or Asia Pacific-centric.

Should she invest in the more Singapore-centric or Asia Pacific-centric?

It depends on her philosophy.

The REIT ETF allows you to express your investment philosophy such as “I believe Singapore REITs are more tax-efficient, I know the market better, and are more comfortable with them”. Or “I have no fxxking idea if Singapore REITs will do well in the future or other regions, so I want to be able to capture a wide risk set.” Or “Even the local REITs own overseas properties, and ultimately I am participating in the growth of global real estate and I think the Singapore REITs is enough.”

There is also the decision over how different REITs are managed. This is the style decision. For example, the Morningstar Singapore REIT Yield Focus index style itself as a high-quality index.

Your data and philosophy might show that a focus on higher quality REIT is better.

But it is your philosophy, but I hope your philosophy is backed by some data. As I have done little research here, you got to source out the research yourself.

Almost all the REIT ETF is very concentrated (less than 50 positions).

Given the fund size, the expense ratio, and track record, her decision would likely be either the Lion-Phillip S-REIT ETF or NikkoAM-Straits Trading Asia Ex-Japan REIT ETF.

She will have to choose between those two based on where her philosophy lean towards.

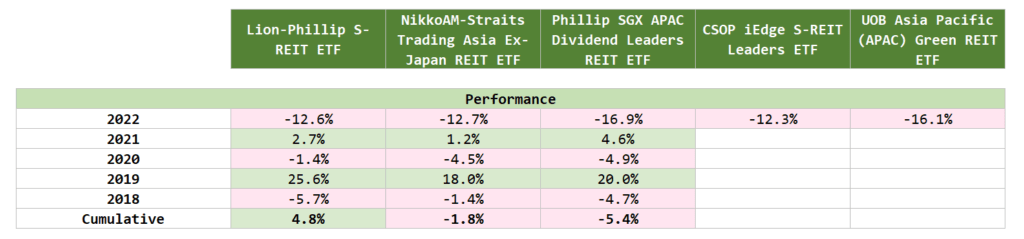

Historical Returns of the Singapore-listed REIT ETFs

We list the calendar year performance of the REIT ETF in the table above and also show the cumulative returns (we compound those five years together. not annualized).

Overall, the Singapore centric REIT ETF have done better than the more diversified one.

You will notice that whether it is Singapore or Asia-Pacific, the returns tend to move in tandem.

While they may differ in geographical exposure, overall they are still more equities-like.

Like equities, they are listed on an exchange and the value is priced every minute compare to unlisted properties.

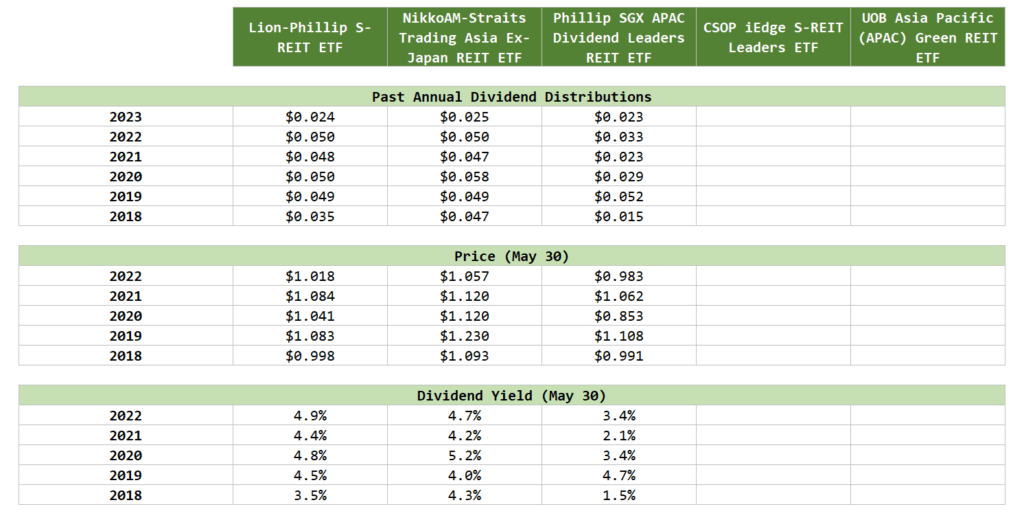

Dividend Yield History of the Singapore-listed REIT ETFs

I think income investors may be interested in the dividend yield. We list the past dividend distributions from the REIT, grouped by calendar year, the price at 30th May of every calendar year and the dividend yield at 30th May in the table below:

The amount of dividend distribution tends to be overweight to the distribution of the larger components, which tend to be the larger REITs.

The larger REITs are relatively less risky, valued higher and thus lower in dividend yield.

Thus, the average yield tends to be lower.

The Phillip SGX APAC ETF is in USD. I am not sure if I get my information correct. The yield looks low.

But given her choice may be narrowed to the first two, in terms of the dividend yield she would buy into may not be all too different.

The Lion-Phillip S-REIT ETF should trade at a dividend yield of 5.3% (15 Apr 2023) and the NikkoAM-Straits Trading Asia Ex-Japan REIT ETF trade at a dividend yield of 5.4%.

With the struggles of real estate, I do expect the earnings and cash flow to be lower, so the dividend payout she would buy into might be lower, and that will not look too different from the prevailing average dividend yield that I list in the table above.

34 Years of Long-term REIT Returns

Now, she might be wondering about the returns she could capture, if she invest 100% in REITs.

We have no idea about the future, but we can learn from how REITs perform in the past.

S&P has a set of REIT index for various regions such as global, Asia-pacific (includes Japan), Developed markets, Europe, Australia and United States from 1989 till today.

So we have 34 years of REIT data. (some of the charts I will show you are label 1989 to 2013. They are wrongly labelled. The Data is from 1989 to Mar 2023)

During this period, the interest rate has been falling, real estate did well, and not so well, we have war, a global financial crisis and a pandemic.

We can learn a little about the total returns of REITs.

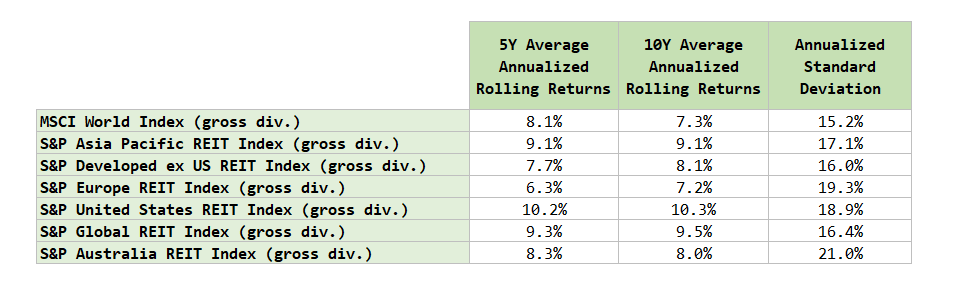

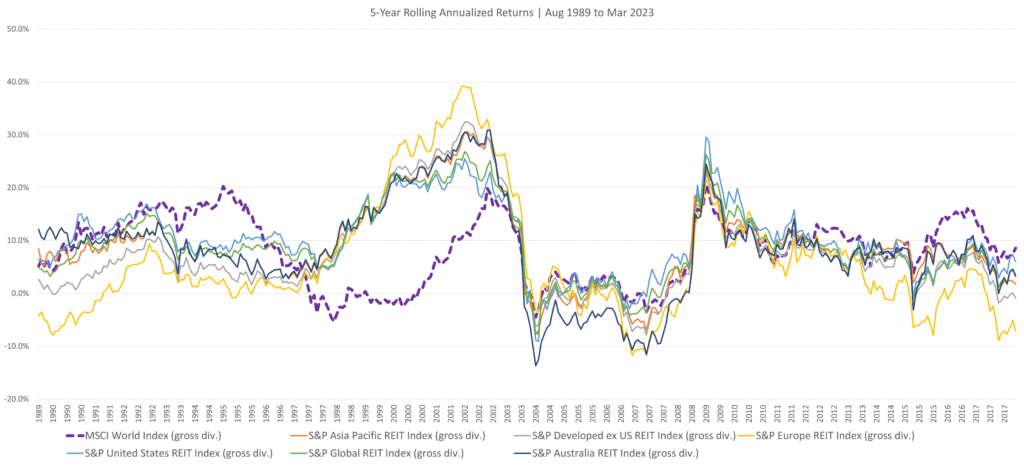

We show the average 5-year and 10-year annualized rolling returns as well as the standard deviation of the various REIT index and MSCI World index below:

The indexes includes dividend, but gross div means it does not include taxes withheld. I have included the performance of MSCI World in the comparison so that you can compare and contrast how well REIT does against general equities.

We roll by 5 and 10 year to see the longer term performance over many periods you might find challenging or optimistic.

Generally, REITs in various regions except Europe did better than the MSCI World index. The long term returns measure up against the global blended, broad-based equities.

But the REIT indexes have higher standard deviations than the MSCI World, which tells us REITs are more volatile (not less like many believe!).

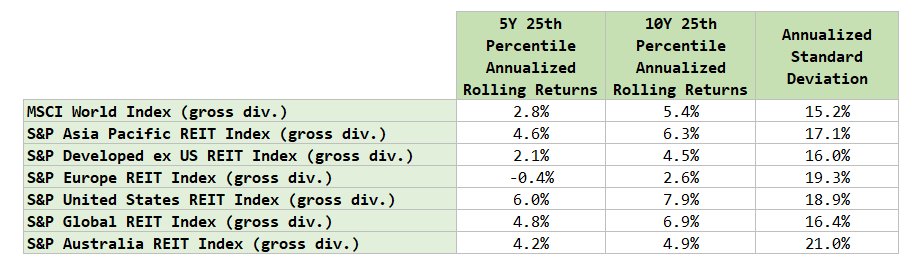

I want to take a look at the returns if we focus on the 25th percentile mark, which shows those more pessimistic historical periods.

The MSCI world did 2.8% a year for five years, but there are some regions such as Europe and Developed ex US which did worse. At the more pessimistic, Asia-Pacific, United States, Australia did much better.

On a longer, ten-year term, all the indexes show positive returns, and Asia Pacific and United States do better than MSCI World.

While the returns look better than the MSCI World, let us appreciate the rolling periods better by looking at the annualized returns over that 34 years:

Europe REITs went from not so good to the best, to the worse again.

There are periods where the five-year returns of REITs flow in tandem to the MSCI World but there are periods such as those five-year periods that start in the 1999 and 2000 where the REITs did much better compare to the poor MSCI World.

All of them struggle in the GFC.

If you invest during those period, the five year return would be 0 to negative.

We are currently back to the point where the MSCI World did well and the REITs not so well.

A key takeaway is: While one index did better, there is always a period where it will underperform relative to other asset class or region.

That is the way it is.

There is no top dog in this intermediate term.

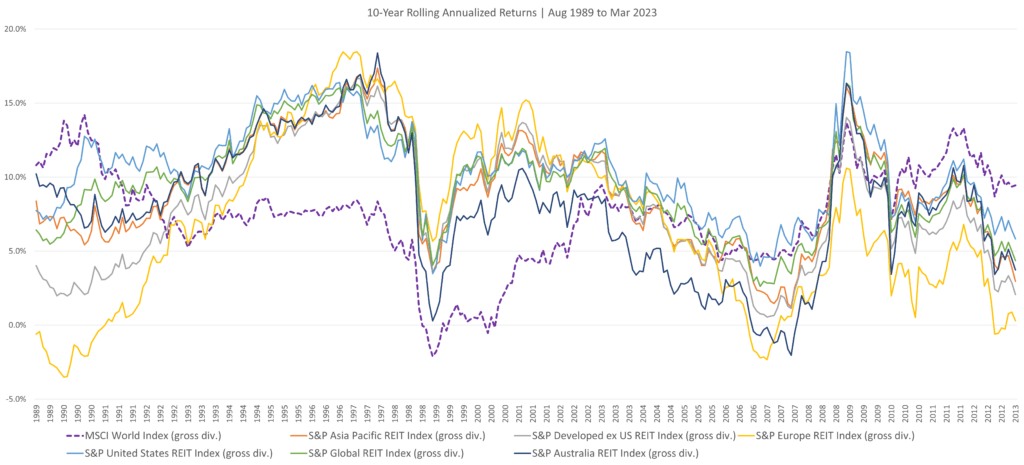

Now let us take a look at the ten-year rolling returns:

Most of the annualized returns are above zero but you can still observe that if you invest in Europe REIT in the 1990, MSCI World in the 1999 and Europe or Australia REIT in the 2007, your ten-year annualized returns is zero to negative.

That must be hard to stomach.

But that is the reality if you invest in equities.

I am not here to tell you that you will get the average 8-9% a year return by investing in REIT.

Some of your ten-year experience will be different.

In some years you will earn 5% a year in REITs while you earn -2% in MSCI World.

How would you feel?

My reader should note that these data is more applicable if she has $1 million lump-sum, which is a large part of her net worth and she decides to plonk them down at one shot.

The experience of dollar-cost averaging might be different and I think will be better.

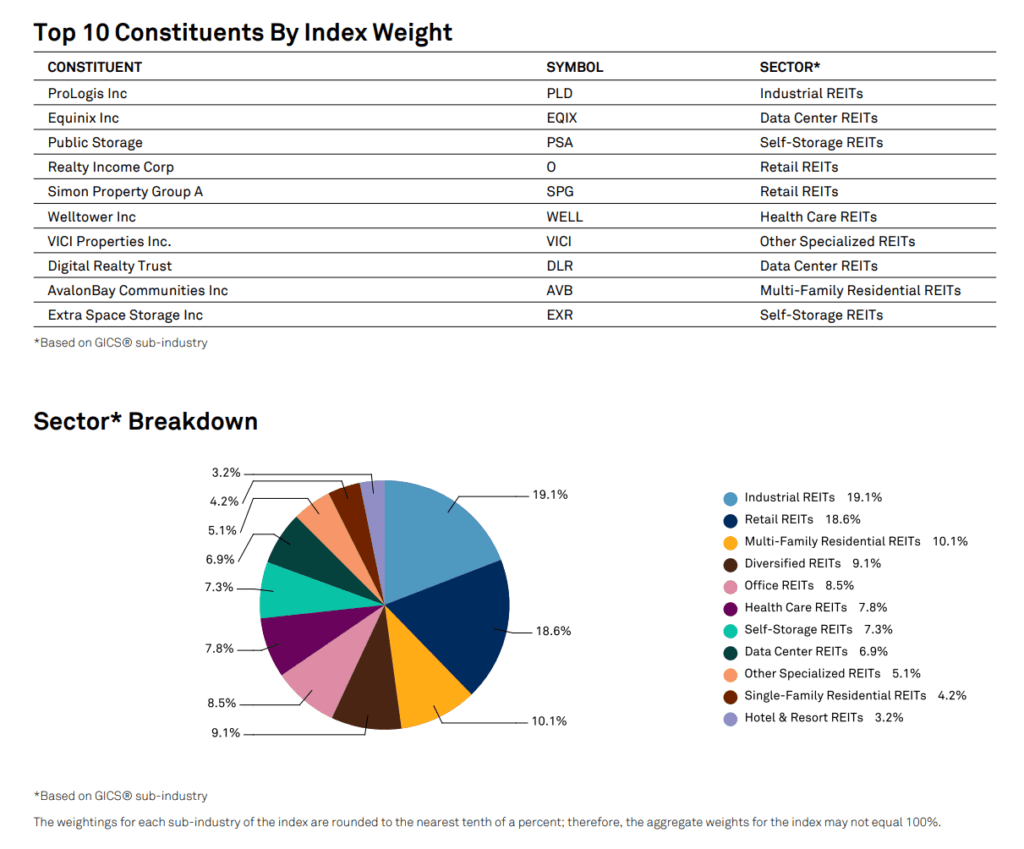

To give you a better idea of what makes up some of these indexes, here is the constituents taken from the S&P Global REIT factsheet:

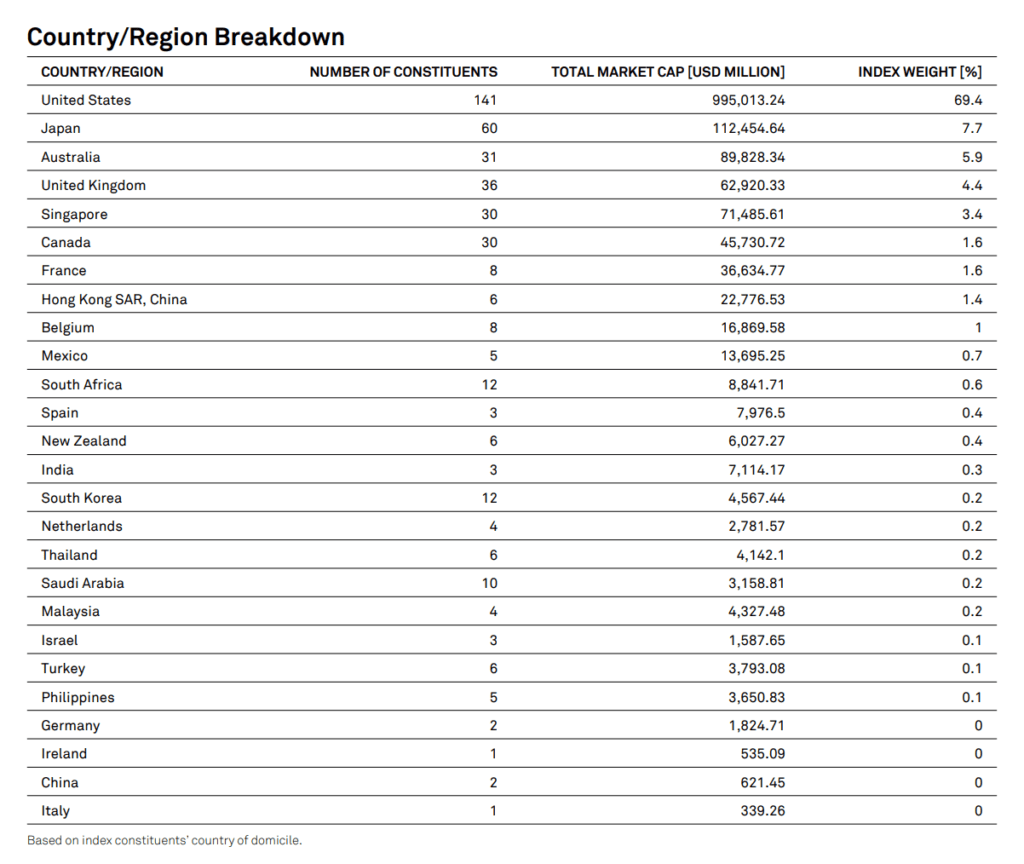

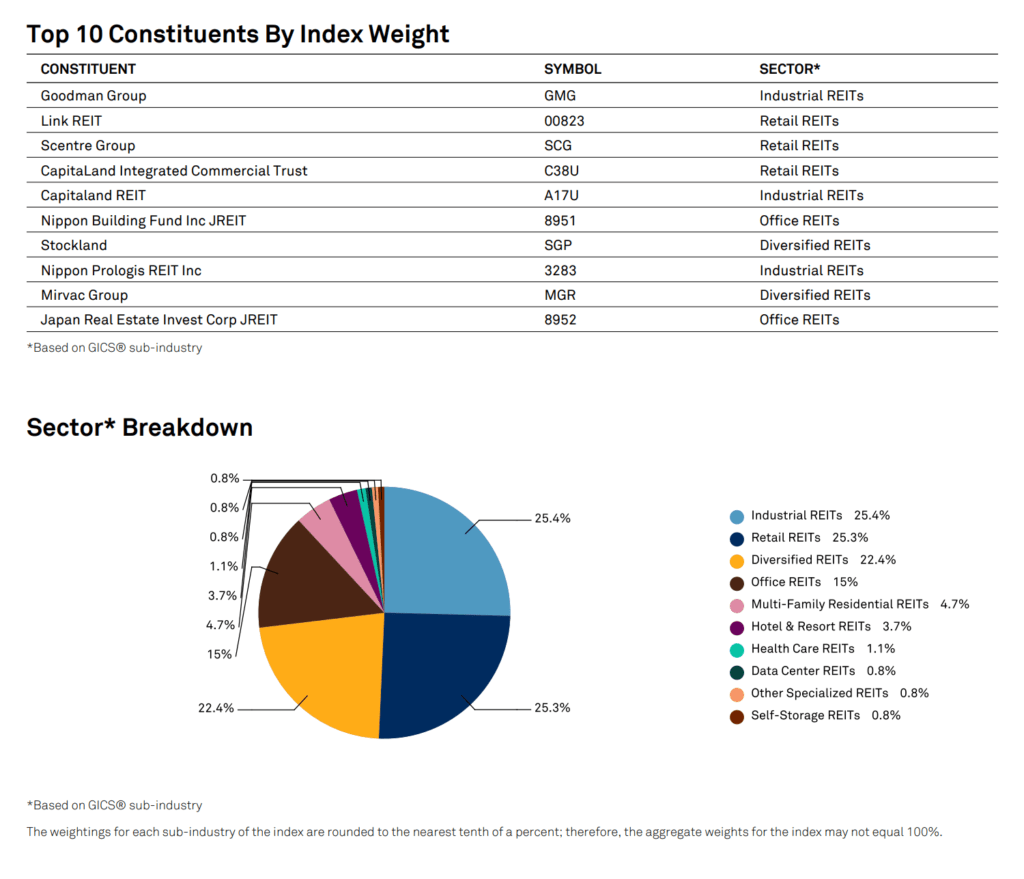

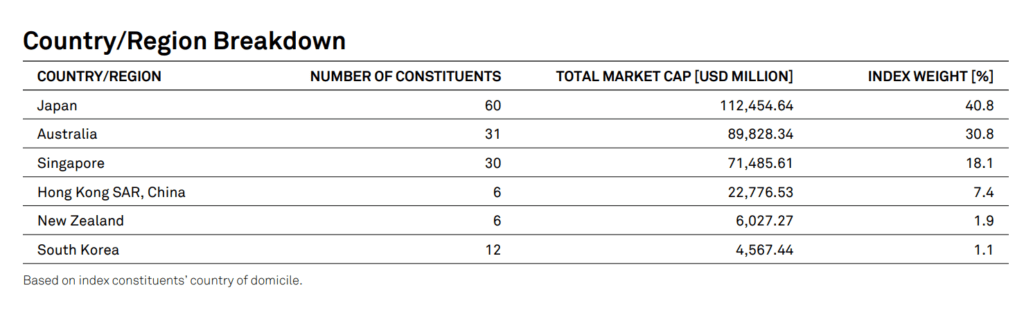

And here is from the S&P Asia Pacific REIT factsheet:

Conclusion

The long-term returns of the REIT sector, in some regions, are better than the broad-based, equity index (MSCI World).

But REITs are volatile animals, even as a group.

If my reader wishes to use a planning number to estimate the growth of her capital, 5% a year is pretty good. The average 10-year annualized return is above 7% and the 25th percentile is above 5% except in Europe.

It does not mean she will get it but if that is her time horizon, then that will give a good gauge. Shorter than 10 years, you could easily get negative returns.

Should we look in terms of dividend yield or total returns?

If you wish to see which security segment does better, it is always total returns.

What is her success rate if she plan to spend only the dividends?

I have no idea there. I lean further and further away from this dividend income retirement mindset because I think it is not such a good retirement risk management model.

But if I have the time, I might do some 20 or 25-year safe withdrawal rate on the REIT data.

Can she have an allocation to REITs in her portfolio?

The research today emphasize that REITs are very equity like. You get drawdowns and growth the way global equity does. But with 34 years of history, it does show positive expected returns and if she sizes her portfolio well, why not?

Academically, there may be less reasons to add REIT to your portfolio as a global equity allocation should contain a small slice of REITs. But if your philosophy towards REIT investing is strong, the data today might help you make decisions better.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024