Shortly after Keppel Pacific Oak announced somewhat respectable half-yearly results, Prime US REIT announced a good set of results yesterday evening.

Like many other REITs, Prime’s share price took a beating recently. With this new DPU run rate announced, Prime US REIT currently trades at a 9.8% dividend yield. (Not the only high yielder in Singapore)

There was a significant improvement in dividends per unit compared to a year ago. Net income and income available for distribution are also higher.

Due to the number of units change, it may be difficult for investors to determine if their past acquisitions have been accretive to unit holders. The steady rise in DPU should hint at whether management is improving things.

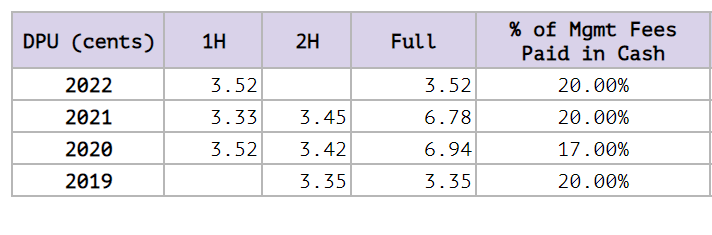

The following table summarizes Prime US REIT’s past DPU declaration:

DPU in the first half of 2021 saw a dip, and the DPU was restored to 2020 levels during this half. Generally, DPU has been growing pretty decently.

How Did Prime US REIT’s Properties Retain Their Value?

I think pretty well.

While I did not have the slides that show this, almost all the properties have been higher in value since half a year ago. It could very well be myopic as the property value dipped half a year ago as most of the country is still opening up.

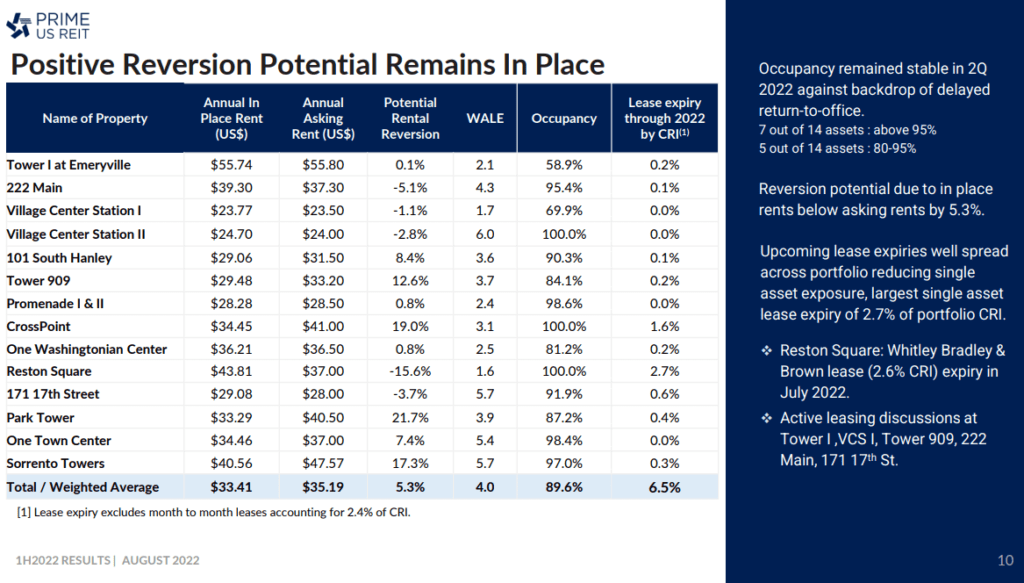

The slide above shows the potential rental reversion. The potential is there.

However, compared to a year ago (not shown here), the potential rental reversion is generally lesser, perhaps indicating the softening of the office market.

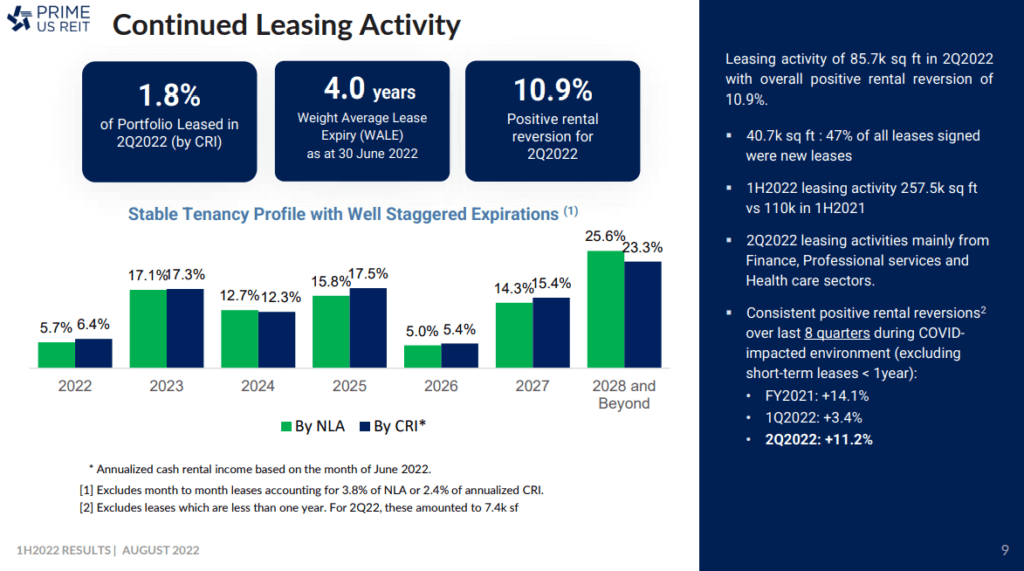

The slide below shows the leasing activity for the past half year:

At the bottom of the right column, you can observe the rental reversion trend. The rental reversion compared better to Keppel Pacific Oak during the same period.

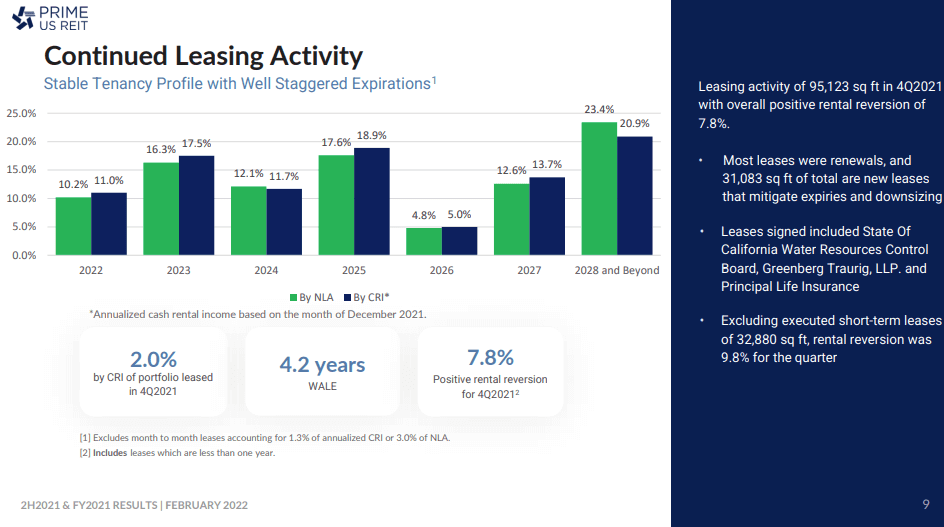

This chart shows us the leasing activity reported six months ago. In the 4th quarter, they did a 7.8% rental reversion, so generally, they are securing positive rental growth, but it will not be a straight line. I noticed that the WALE is shorter, which seems to indicate that tenants either renewed in 2027 and beyond or just renewed only for the next two years.

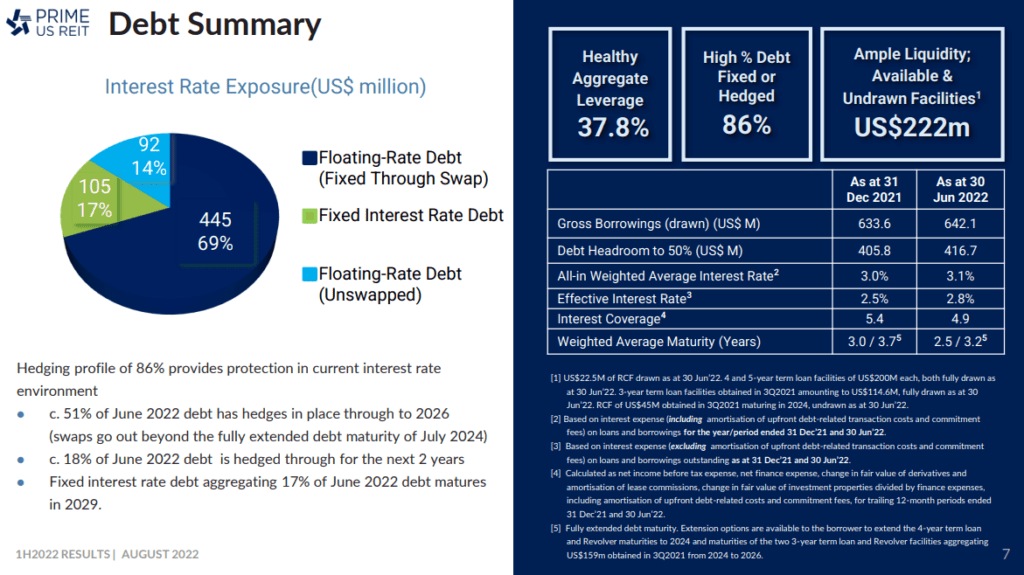

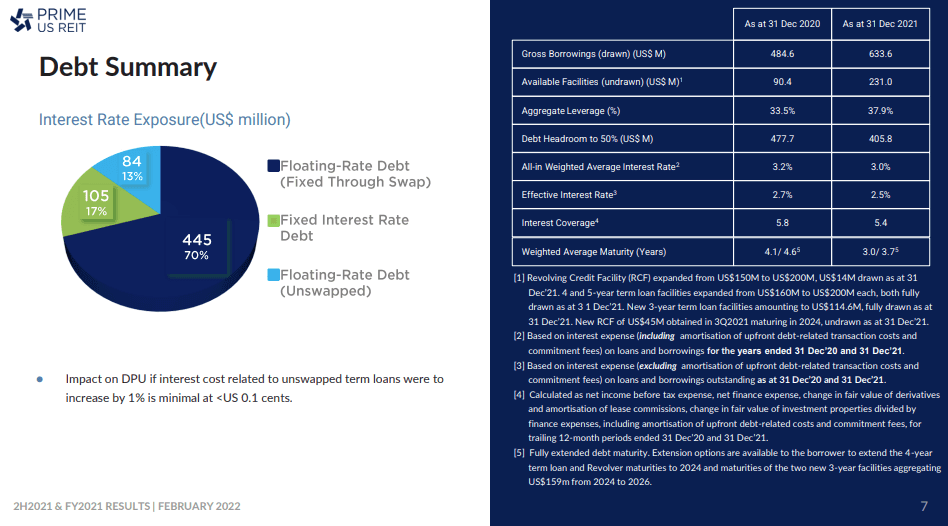

Majority of Prime US REIT’s Debt Are Hedged

The slide below shows Prime US REIT’s debt summary:

Prime US REIT’s debt to the asset is a healthy 37.8%, with most of their debt either hedged with Swaps or fixed interest rates. The effective interest rate, which represents the compounded interest rate paid, is higher than six months ago, just as the gross borrowing.

But if you compare the effective interest rate to Dec 2020, 1.5 years ago, it’s not too far off.

As long as the REIT create a well-distributed debt interest ladder, it should be able to smooth out the interest rate volatility. If we have a persistently high-interest rate environment that equals their weighted average interest rate plus 2%, then I think this will place a headwind on the US office REIT’s share price performance.

Summary

I reflected upon Prime US REIT’s result and decided to go through a thought experiment.

If we are in a persistently higher inflation environment (not short term as the rates could be volatile in the short run), the cost of debt could wipe out the build-in rental escalation of the US office REIT portfolio. But there may still be some positive rental reversion. Let us assume this positive rental reversion from manager value-add to be 1% in the long term.

So we will have:

- +2% build-in rental escalation

- -2% higher long-term interest rate

- +1% long-term manager value-add

We should see if Prime US REIT trades at an attractive valuation versus its current net asset value per unit. Prime US REIT’s net asset value per unit is $0.86, and the annualized dividend per unit is $0.0702. This gives us a yield of 8.1% against the net asset value.

What is not factored into the 8.1% is the currency risk. Is the currency risk worth the 3% spread difference between Prime and the local office REITs?

End of the day, a simpler way is to know that Prime US REIT trades at a 21% discount to its net asset value per unit.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024