Mapletree North Asia Commercial Trust has gone through some tough months. Their main revenue-generating asset, Festive Walk, was caught in the middle of the Hong Kong unrest and was damaged to a certain extent.

This uncertainty, have corrected its share price to as low as $1.12 from a high of $1.46.

2 days ago, the REIT announced its 3rd quarter results. There were no surprises that the revenue and income was down.

Festive Walk had to close for 48 days in total and the office have to close for 13 days. The mall and the office has since reopened, and by all reports, the first few days were rather busy.

The dividend per unit this quarter was 1.67 cents, which is 13.3% lower than the 3rd quarter last year.

The management decided to top up the distribution from Mapletree North Asia Commercial Trust’s capital base (likely the cash). This makeup partly of the loss of Festive Walk office revenue and retail revenue. It is to mitigate the impact as rental from tenants is not collectible over these periods. If I am right, this 1.67 cents to be distributed in the recent quarter factors in this top-up.

The loss of revenue is covered under insurance and claims will be filed and recovered in due time.

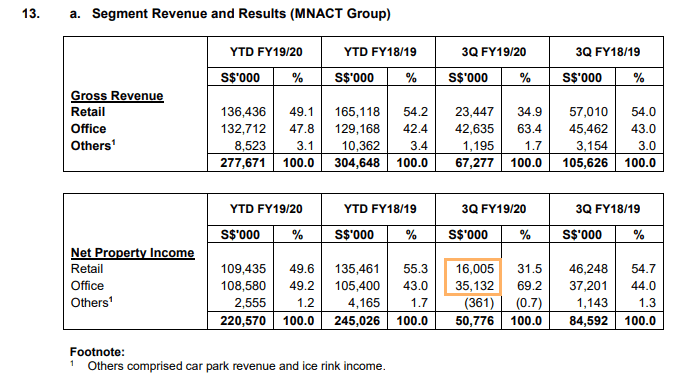

The table above was taken from their 3rd quarter results. We can observe the extent of the reduction. There are probably 92 days in the last quarter. So a 48 days impact on retail would be roughly 52% of their revenue or their income. 13 days impact on office will be 14% of their revenue or income.

If we compute 48% of 3Q FY18/19 revenue, we will come up with $27 million. This is more than the $23 million in gross revenue this Q3. If we look at the net property income, the result is coherent ($16 mil this quarter versus $22 mil if we take 48% of 3Q FY18/19 net property income)

This is a bit puzzling because the only major retail asset would be Festive Walk. The rest of the REIT’s assets were mainly commercial offices.

Shareholders may enquire with the management whether there is a good reason for this. Here is my suspicion: A part of the rent is as a percentage of retail revenue, and December, is a traditional festive period that brings in a larger proportion of income.

The following slide shows the rental reversion year to date for Festive Walk:

The occupancy looks splendid and the average rental reversion year to date looks just as good. However, this figure includes all the reversion carried out in the financial year.

This unrest have lasted for months, so could we find out whether there were new renewals?

The slide above is taken from the Q2 result. The reversion for both retail and office looks similar to Q3. The % of leases is lower, indicating that there were some renewals or new leases.

It is great that the renewals did not bring down the rental reversion.

At this point, the strong assets for the REIT is Festive Walk and Sandhill’s strong rental growth. Gateway in China and the Japanese properties are not measuring up.

Mapletree North Asia Commercial trades at about 6.2% dividend yield, with a net debt to asset of 35%. This unrest should be an opportunity but the issue with investing is that when it is dark you do not know if it will get darker or it will turn bright. For a lot of investments, it is not easy to discern if the problem is a long term problem or this is just a short term issue.

For me, I do think that a lot of its assets have a land lease that may expire in 2047. That will prevent me from having it as a long term hold. As an investment, I may not hold it for more than 2 years so why worry!

Lastly, if we do away with quarterly reporting, this would be a good case study of what we will missed out. If there is quarterly reporting, it allows us to glimpse at certain metrics that would show us if the business is doing well or not.

You can read the rest of my REIT write-ups and free REIT learning articles below.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

- The LionGlobal APAC Financials Dividend Plus ETF Won’t Give Singapore Investors 5% Dividend Yield Always. Further personal thoughts (with some data). - April 13, 2024

assiak71

Monday 20th of January 2020

Quarterly dividend for this reit so there should still be quarterly reporting?

Kyith

Thursday 23rd of January 2020

We will not be sure about that. from the ground i know almost all the reits 2 years ago indicated they want to go semi annual. now... the word is that these managers are freaking out.