Manulife US REIT this morning announced their 1st half 2021 results.

They also declared a half-yearly dividend per unit of $0.027. This brings the annualized dividend yield based on the current share price of $0.765 to 7.1% a year. (You can compare this dividend yield to other REIT and high yielding dividend stocks in my Dividend Stock Tracker)

This dividend per unit decreased by 11.5% compared to a year ago.

Manulife US REIT is not the only office REIT to announced that they decreased the dividend declared for the half-year. Prime US REIT also decreased their dividend per unit.

If you review my dividend stock tracker, you would be able to observe that both peers Keppel Pacific Oak and Prime US REIT trade at 8.4% and 8.0% respectively.

What caused Manulife US REIT’s dividend to fall?

Gross profit for the first half of the year fell by 7.9%. The main reason was that overall occupancy dipped from 96.2% to 91.7%.

I think there is some transitory lease expiry at Michelson. Occupancy declined by 10% in that property alone.

However, Manulife provided some colour in that they managed to successfully lease 70% of those vacancies lost which is accounted for in third quarter 2021.

For many months, the office properties were operating at 20% capacity. Since the car park was not utilized, the revenue from car park was affected.

This update is not too surprising as in my May update on Manulife US, Prime and Keppel Pacific Oak, I highlighted that the updates showed possible signs that rental outlook will impact the financials going forward.

Leasing during this post-covid period has proved challenging as tenants and prospective tenants adopted a wait-and-see attitude.

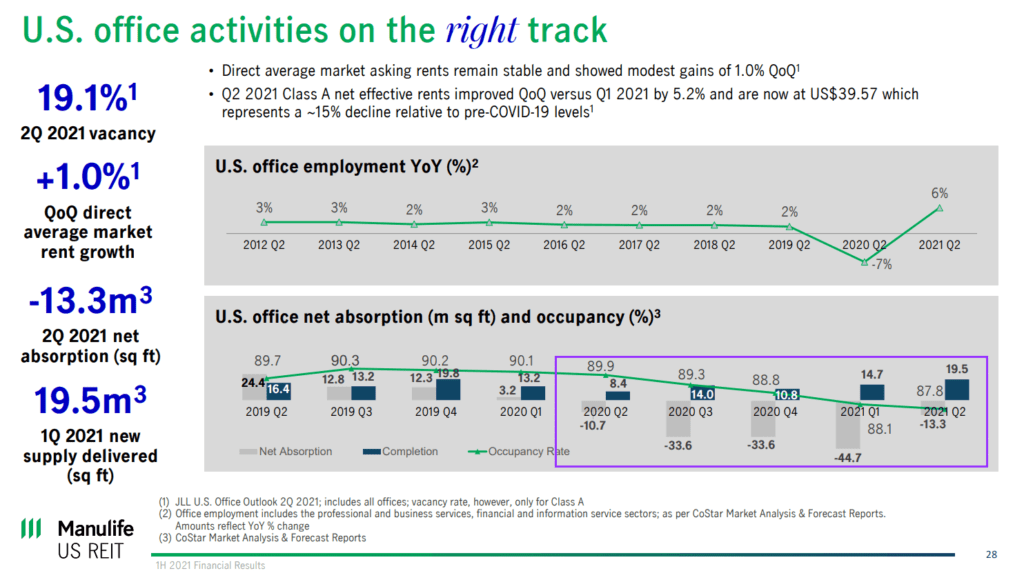

Thus we see that net absorption, which measures how fast available office space is taken off the market, is still negative.

But as the United States starts opening up, and companies get more adjusted to work from home, more companies may gain clarity that they need office space that is closer to the sub-urban and occupancy may pick up.

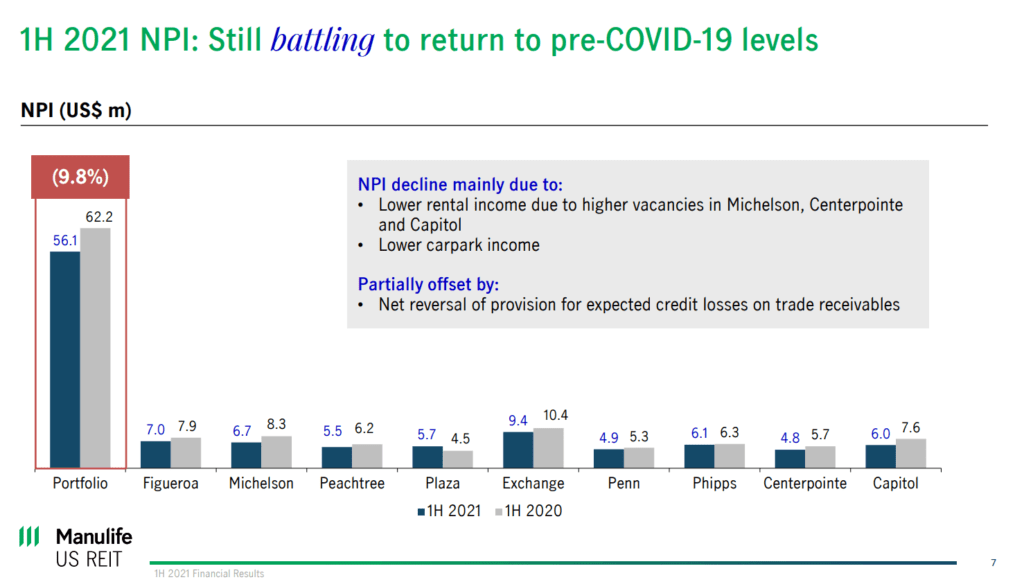

From my observation, almost all but one property saw their net property income fall versus a year ago.

Net property income probably includes straight-lining, thus the annual rental escalation should be factored in. I am quite startled how come almost all the properties (except Plaza) faced some sort of falling NPI from a year ago.

Summary

I always think back to the investors who had invested prior to COVID-19 when the US office REITs were trading at US$1.00.

If we have invested then, we would have invested with a dividend yield of 6-6.5%.

The investor would see their dividend yield fall to 5.4% today.

Manulife could not catch a break since its IPO. So do their investors. They are waiting for the REIT to show a rising dividend per unit quarter on quarter.

So far, the REIT has struggled to show that.

COVID was a bad break for them and going forward, they have to show their ability to improve the occupancy.

To some opportunistic investors, Manulife US REIT may present an opportunity at a 7.1% dividend yield.

If this is the worse it gets, and they are able to improve their occupancy by 5 percentage points, that will provide a healthy rental reversion.

Their share price may re-rate accordingly.

You can read my in-depth deep dives on all aspects of REIT investing in Learning about REITs below.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024