I realize I have not written any updates on Manulife US REIT’s latest acquisition. So here it is.

Just a short update.

This year, majority of the REITs have seen their share price appreciating. With the share price appreciation, the cost of equity (which in this case, is the dividend yield the REIT pays to you) have gone down.

This makes equity raising much attractive and for them to bring acquisitions on board. This increases the AUM, the net property income and therefore the fees earned.

Manulife US REIT made the acquisition of Centerpointe in the Washington sub-market in April this year. I have a hunch that if they have the opportunity, there will be further acquisitions.

In their latest quarter results slides, there was an emphasis on how close their liquid market capitalization is from an incursion to FTSE EPRA NAREIT Developed Asia Index.

More of less, something is coming.

Sacramento as a City

Manulife US REIT’s latest acquisition is in Sacramento, California.

Out of the 10 largest city in California, Sacramento are sixth largest and growing the fastest in 2019. (Top 10: Los Angeles, San Diego, San Jose, San Francisco, Fresno, Long Beach, Oakland, Bakersfield, Anaheim)

The appeal of Sacramento could be that housing in LA, San Diego, San Jose, San Francisco are getting too expensive.

On average, the price of a home in San Francisco is about US$1.25 mil while the average price of similar home in Sacramento is only around US$310,000.

Sacramento is still very close to San Francisco but housing is much cheaper.. for now.

Sacramento as a city, have not been doing well from 2006 to 2016. Perhaps they are currently enjoying the spill over from the tech companies around the region.

If you would like to read a little about the economic history and the future prospects of Sacramento, you can read this article here.

The Acquisition of 400 Capitol Mall

This acquisition will cost roughly US$206 million and will be funded by a mixture of debt, share placement and preferential offering.

I think from this point forward there will be less rights issue, and I do agree preferential offering is the way to go.

Starwood Capital Group decided to sell 400 Capitol to Manulife US REIT. Starwood Capital Group bought this building in 2016 for US$175.5 million.

Back then, the occupancy was 85% and the average rent ranges from $2.95 psf to $3.5 psf.

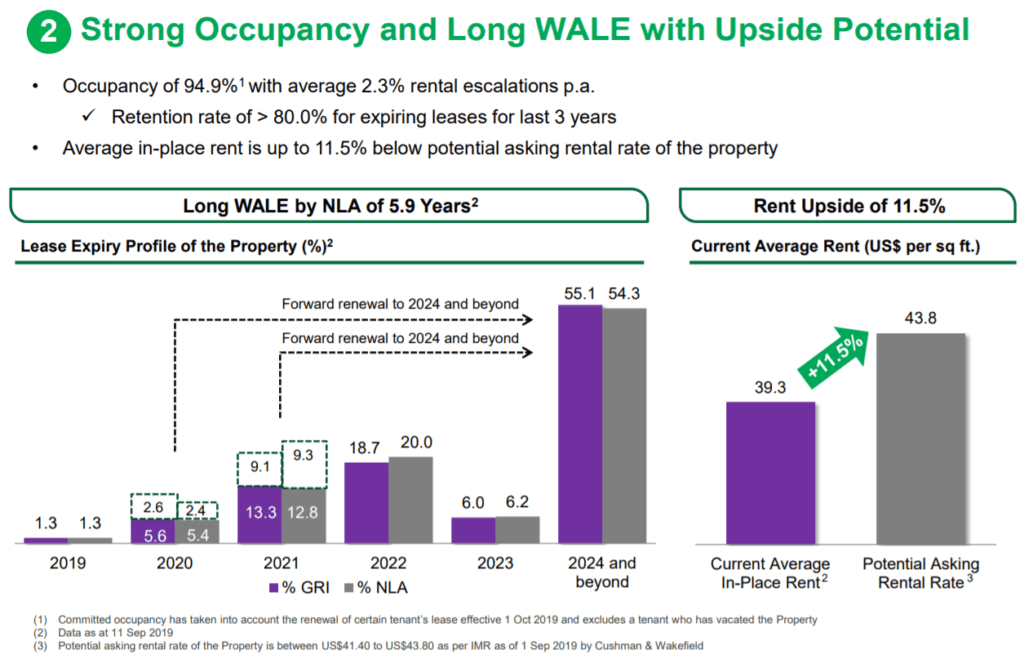

This acquisition does not look so different from the management’s other proposals. The WALE is relatively long at 5.9 years, with built in 2.3% rental escalations. The property’s occupancy is rather high. This is likely because recently, they managed to secure some large leases.

The first thing that shout to me was the Platinum LEED Status. LEED, from what I understand, is a grading of how environmentally friendly and energy efficient it is. Out of all their current buildings, most are either Gold or Silver. Thus, 400 Capitol stands out. What stood out further is that this build is at least 27 years old. I have no idea how that work.

Other than being the tallest building in the city, 400 Capitol is also closed to the Golden 1 Center. Golden 1 Center is the home of NBA team Sacramento Kings.

There was quite a bit of controversy as well because the Maloof family, who used to own the Kings, lost much of their fortune and was no longer able to run the NBA franchise. They were shopping the team around to other cities such as Seattle, Virginia, Anaheim.

Sacramento Mayor Kevin Johnson, with the help of local business owners and a rabid fan base, was successful in saving the franchise and persuading the NBA to force the Maloofs to sell the team to the Vivek Ranadivé group.

Sacramento have always not been a big market but in order for things to be a success, both the Kings and the city need to rejuvenate. I kind of like the team they have with De’Aaron Fox, Buddy Hield, Marvin Bagley, Bogdan Bogdanovic and Harrison Barnes. Last season was a surprise. Let us see what next season brings.

Under their existing portfolio, Michelson is the unique one where the market rent is on par if not lower than passing rent. 400 Capitol’s passing rent looks lower than the market rent.

The previous owners Starwood Group managed to renew some leases to beyond 2024 so that they can sell it off.

The Sacramento Office Market

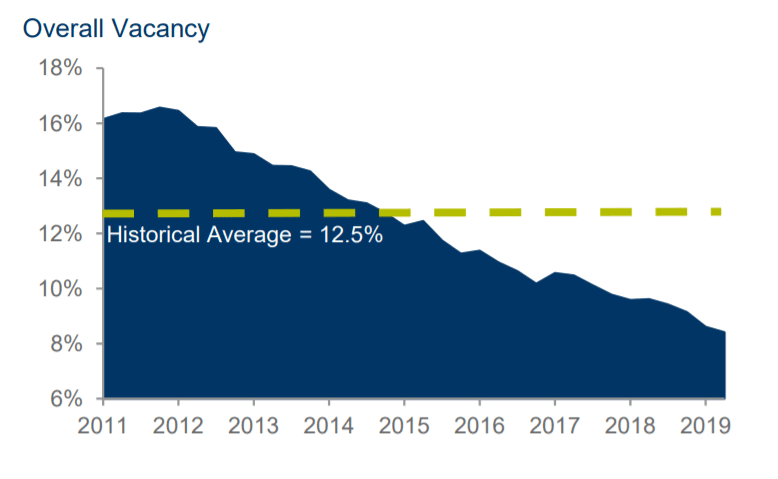

Based on the little I know, the office supply of Sacramento is currently rather tight. Landlords are still able to take advantage and get some pricing power.

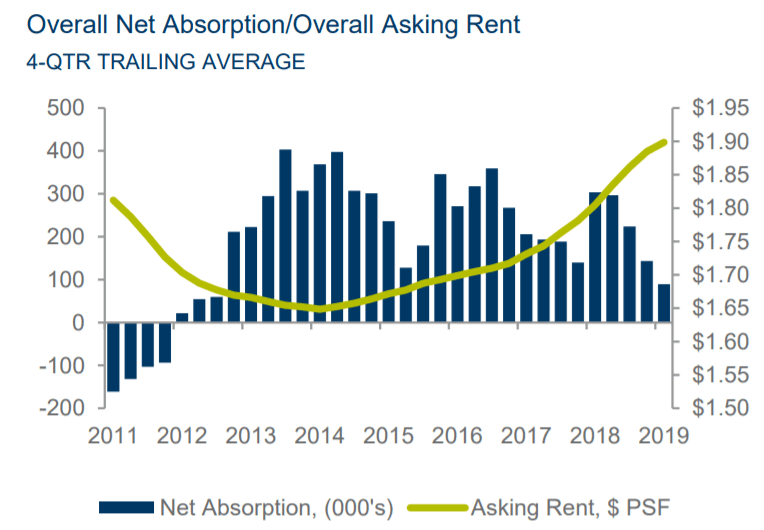

Per Cushman and Wakefield, net absorption for the past years have been positive. The asking rent is trending up. However, the average rent looks comparatively low versus 400 Capitol’s average rent.

There were some crazy vacancy last time.

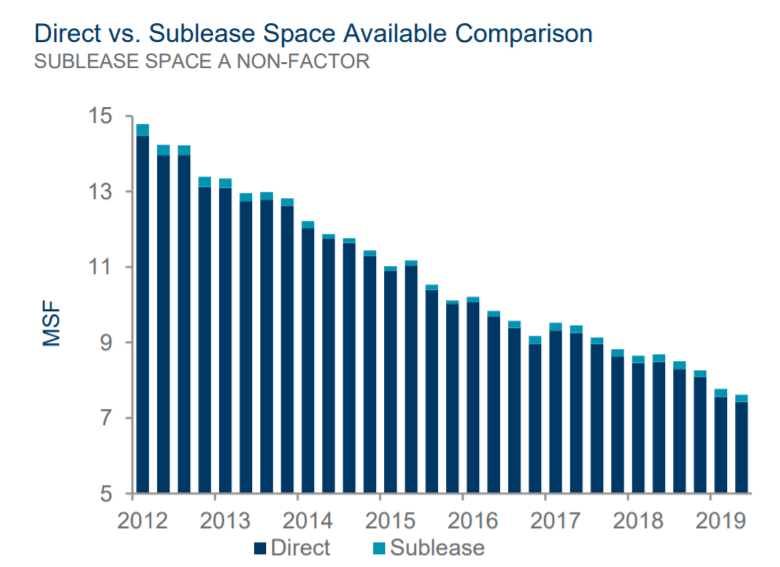

Space available have also come down.

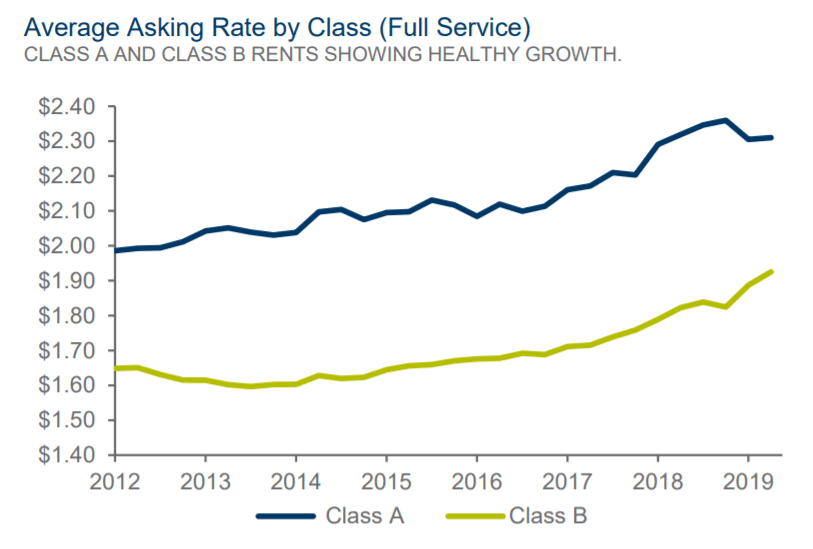

Again, the average asking rent by Class A and Class B are trending up, but I suspect that the asking rents are much lower than what 400 Capitol could command.

Troubled Startup WeWork is a Large Tenant in 400 Capitol Mall

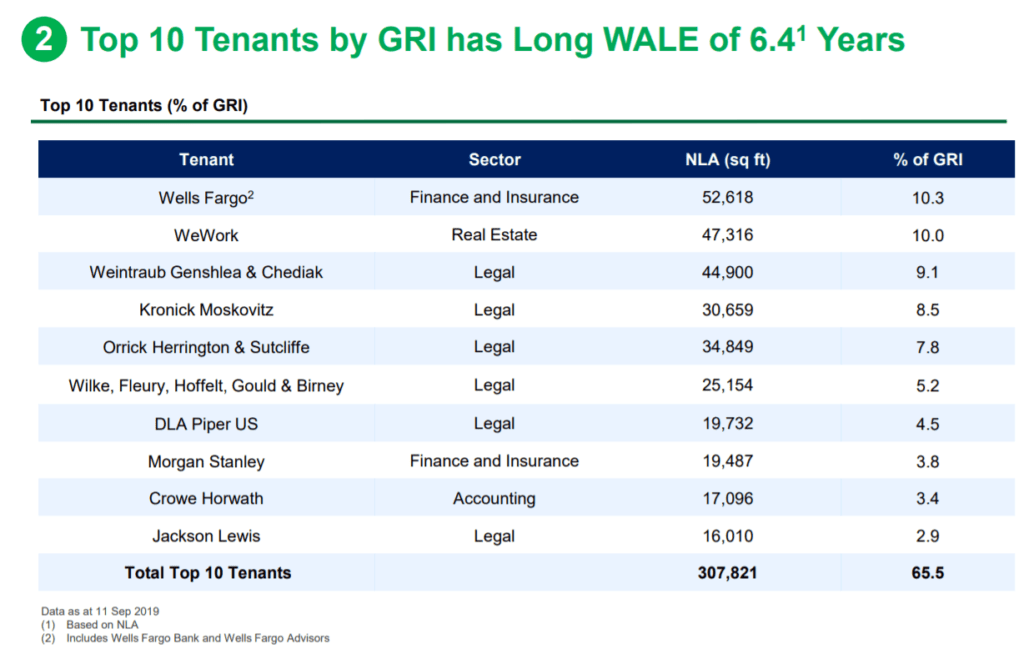

If you review 400 Capitol’s tenant base, you observe that majority of the tenants are in sectors that Manulife US REIT is familiar with.

Perhaps due to recent news, their tenant, WeWork sticks out prominently here.

WeWork was going to be listed in an IPO at US$47 billion valuation but possibly have to settled for as low as US$10 billion in valuation. This puts both landlords in an uneasy position because it calls to question whether they are going to have a lot of vacancies on their hands.

Financial Times wrote that “a large Singaporean investment firm has walked away from an £850 million ($1.04 billion) deal to buy Southbank Place, an office building near London’s Waterloo Station that boasts one of the largest WeWork spaces in the world.”

Landlords are beginning to see this master lessor to be more risk than opportunity.

Manulife US REIT’s management knows all about the co-working space. They were the one who educated yours truly on the relationship between property valuation and the amount of co-working space within the building.

It is a question you may have for them if they see this as a risk.

When taken alone, this tenant represents almost 1-1.5% of the whole REIT’s gross rental income.

At this moment, I do not wish to go too much into this. This article is starting to get long.

The Capital Financing for the Acquisition

Ok, now we are at the fun part.

As stated earlier, Manulife US REIT was intending to fund the US$206 mil acquisition with a mixture of debt, preferential offering and placement. US$142 should come from the equity raising (preferential and placement).

This will give the acquisition a debt to asset of 31%.

An advanced dividend distribution was also paid to existing shareholders. At this current point of writing, Manulife US REIT have already gone Ex Dividend, which means those that are eligible for the advanced dividend distribution have been recorded.

The placement have already been carried out, which was rather oversubscribed. It was priced at US$0.876. 91.3 million units is placed out.

The preferential offering will come next.

The management wanted to placed out 73.3 million units via preferential offering. The offering price is currently fixed at US$0.86, which represents a 4% discount to last traded price. 4% is a rather competitive discount.

How Accretive is this Acquisition?

The challenging thing about computing this acquisition is that Manulife US REIT made another acquisition in April.

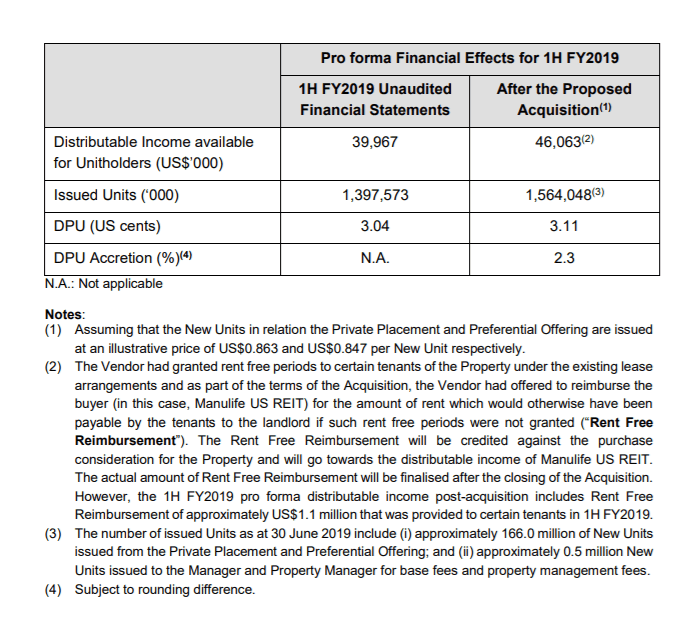

The acquisition, according to management is 2.3% accretive over the pro-forma 1H 2019 financials.

If we annualized the difference in Distributable income available for unit holders, it works out to be US$12 mil. I am not sure how tainted is this but I think it should be correct to assume this.

Let me layered on another check. The CAP rate of this property is 7.2% so the Net Property Income works out to be 206 x 7.2% = US$14.8 million.

If we assume a debt cost of 3.5%, the interest expense will be 64 mil in debt x 3.5% = US$2.24 mil. If we assume an AUM fee of 0.4% on the new asset, this takes away US$0.8 mil.

This works out to 14.8 – 2.24 – 0.8 = US$11.76 mil.

Looks like I am pretty close.

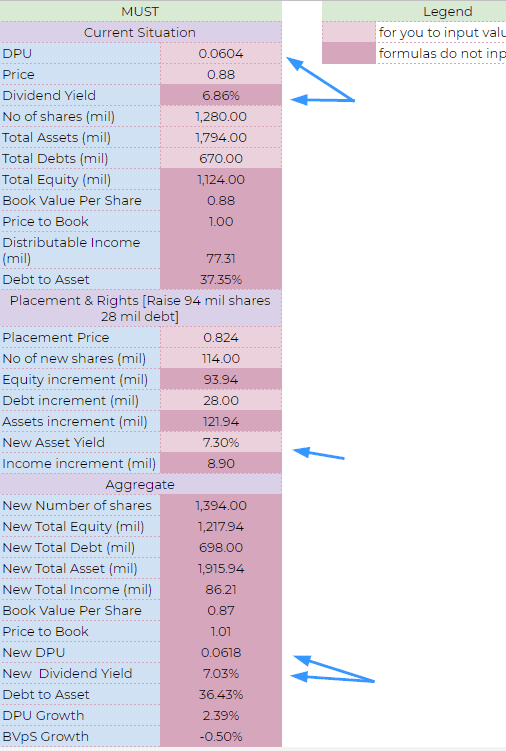

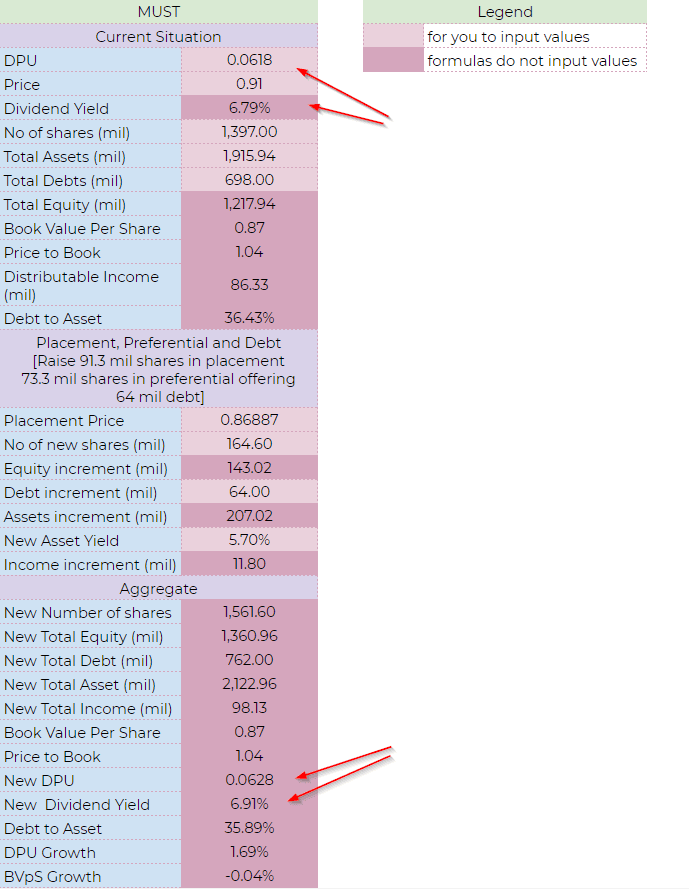

The following table shows my computation in April after the acquisition of Centerpointe:

What we can do is build on the estimated full year data here and add on the placement, preferential offering and debt financing.

I will take the Aggregate section and put it as the new Current Section:

The new dividend per unit should come up to 6.28 cents. This represents a DPU growth of 1.69% from Manulife US REIT, with Centerpointe’s acquisition. Centerpointe’s growth is higher at 2.3%.

With these 2 acquisition, the estimated DPU should grow from 6.04 cents to 6.18 cents to 6.28 cents.

The leverage will fall from 37.35% to 36.43% to 35.89%.

At current share price near US$0.90, this represents a dividend yield of 6.97%.

I am done with my analysis.

If you wish to learn more about REITS, for free, just go to the REIT section below:

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

lifestylecreep

Saturday 28th of September 2019

Hi Kyith, on the topic of WeWork, how do you feel about CCT leasing 21 Collyer Quay to WeWork for the next 7 years? Do you think they'll still be around 10 years from now?

https://www.channelnewsasia.com/news/business/wework-to-take-over-21-storey-hsbc-building-in-collyer-quay-11727562

21 Collyer Quay is 5% of their income from 2019 1Q results (page 13) https://links.sgx.com/FileOpen/CCT%201Q%202019%20investor%20presentation_18%20Apr%202019.ashx?App=Announcement&FileID=553880

Kyith

Saturday 28th of September 2019

Hi lifestylecreep, i am not sure. I will probably try and address my thoughts on a monday article.