There was some confusion about whether Singapore-listed U.S. office REIT operator Keppel Pacific Oak (KORE) did reduce its dividend per unit in its latest first-half financial results.

Here is a summary of their latest results:

There are two DPU line items. One is a DPU, and another is an adjusted DPU. The adjusted DPU was present because KORE’s number of units outstanding expanded from 947 mil units to 1.04 bil units.

The adjusted DPU is a better like-for-like number to compare against. If we go by that, KORE did not reduce their DPU from a year ago.

Still, there seems to be something missing because the revenue and net property income did go up, but distributable income is still quite close to last year. Why is that?

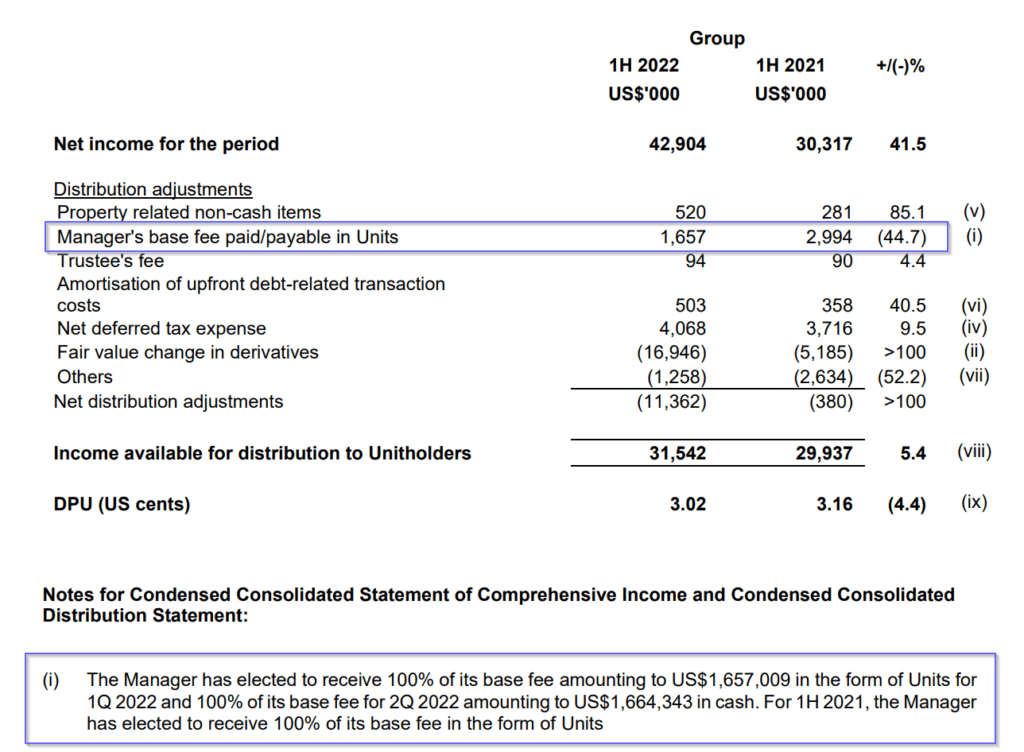

Here is a table KORE showed to explain the adjustment of their net income to come up with the final distributable income:

For the first time in a long time, KORE’s management decides to pay their management fee in cash instead of units. They have elected to receive their pay in units in the past.

If we adjust to this, the amount available for distributable income is lower. Should management pay themselves in units or cash? I think there are trade-offs. If they pay in units, existing shareholders will get diluted, and if they pay in cash, your DPU is lower. However, the optics, if they get pay in units, are better because most won’t notice the dilution effect that well.

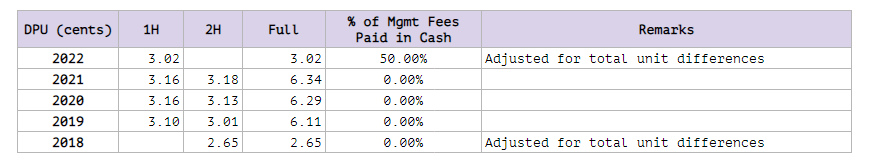

Just to recap, this table summarizes KORE’s historical DPU:

A few years ago, the DPU needed to adjust for a change in the number of outstanding units. Aside from that, DPU has been growing well.

I don’t think you could fault them for the performance.

What investors find challenging is figuring out if the addition of new properties were additive to shareholders over the long term. The adjustments make it difficult to assess.

Based on the current share price of $0.69, Keppel Pacific Oak has a dividend yield of 8.7%. (You can review how this dividend yield compares against other Singapore dividend stocks on my dividend stock tracker)

How Was Keppel Pacific Oak’s First Half 2022 Results?

KORE results were pretty decent.

The rent reversion has slowed down. Rent reversion in the year’s first half was 1.6%, which is lower than the 6% rent reversion for 2021.

- Revenue and net property income is higher than a year ago

- The dividend per unit maintains

- The occupancy maintains

The average cost of debt inched up from 2.8% to 2.88%. If the debt that is due in 2022 and 2023 is successfully pushed to 2027, the weight average term to maturity will be lengthened from 2.8 years to 4.1 years.

Suppose KORE spaced out its lease expiry and debt like a ladder. In that case, it will function like a financing company earning the spread between the premium of the properties over the risk-free rate versus the premium of their interest borrowed over the risk-free rate.

In a current rising rate climate, the REITs with shorter or well-spaced out leases are more favourable to the REITs that lock in very long leases.

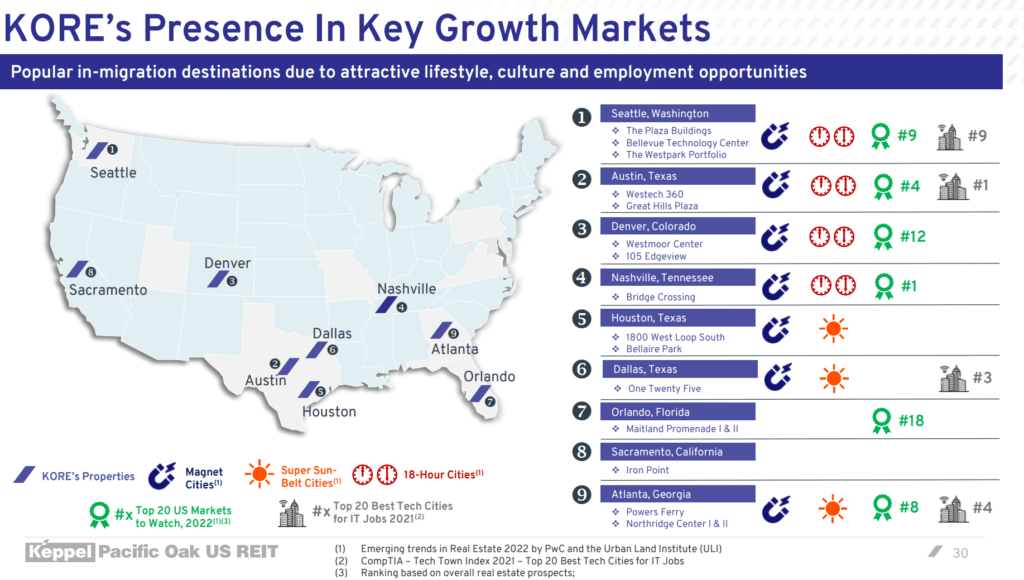

KORE provided an excellent summary of the appeal of their property’s location.

Everyone is still waiting on their Houston bet turning around soon.

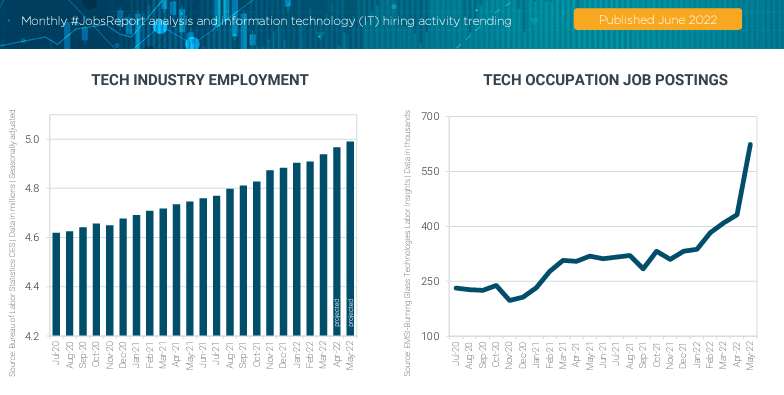

The bigger danger to KORE is its focus on the tech space. If there is a near-term recession, with the layoffs and the changing office landscape post-COVID, we might see a shift in the office demand and supply dynamics.

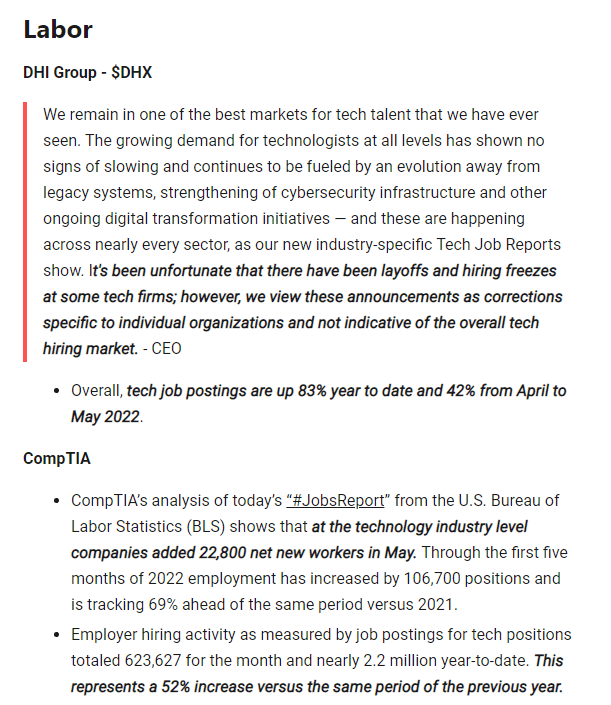

We have started to hear various larger technology companies slowing the pace of their hiring or retrenching 10% of their workforce.

Here are some commentary in June about tech job hiring:

It feels like things are still OK.

If you wish to learn more about investing in REITs, you can browse my free Learning about REITs section below.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024