Keppel Pacific Oak US REIT (KORE) still spots a pretty attractive dividend.

They just announced their first quarter 2021 update and this update provides us a glimpse of their projected income available for distribution.

If we annualized the dividend per unit of 6.26 cents, KORE currently trades at an attractive 8.5% dividend yield (You can review how this 8.5% measure up against other high yielding dividend stocks in Singapore).

KORE operates in an area that is pretty far from Singapore and investors might discount its share price due to their unfamiliarity with the region and it can be challenging not having the boots on the ground effect.

The future of office is a hot topic among investors. Every one is trying to size-up how technology and work-from-home will change office leasing in the short-term and long-term.

KORE’s first quarter result might give us a glimpse of how well they have done.

In the image above, we can compare the leasing performance versus last quarter.

This quarter rental reversion is a healthy +5.7% versus 10.2% for the whole of last year. We are not so sure if the rental reversion came down specifically from last quarter but this is still very healthy, driven by the growth in Seattle and Austin.

The nature of the lease signed looking pretty healthy.

What we notice is also some expansion from existing tenants versus the whole of last year (14.7% versus 11.2%)

Build in rental escalation has coem down a little.

If we review the lease expiry profile, we observe that the leases signed recently seem to spread over 2022 and 2024.

KORE’s managers believe that the sensible thing is to keep the lease short in markets where the markets show strong potential for good reversion. The 2024 leases should be evidence of that.

The 2022 renewed leases points to some tenants adopting a wait-see-attitude.

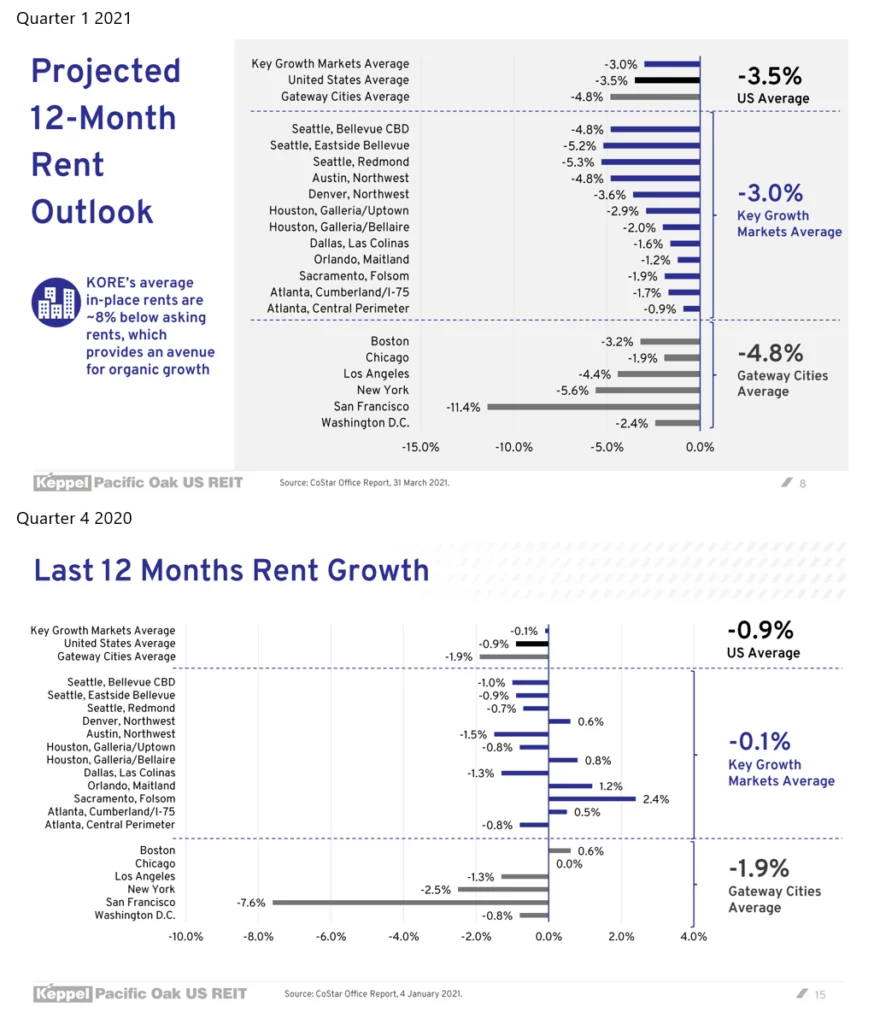

The following graphic shows the rental growth in fourth quarter 2020 and the rental outlook going forward:

The rental growth projection worsen quite a fair bit.

KORE did quite a splendid job signing on the leases at +5.7% rental reversion despite the average rent growth in Seatle and Austin being negative.

The next 12-months will really give us a glimpse of the strength of KROE’s leasing team. If they manage to achieve positive rental reversion, then it will be splendid.

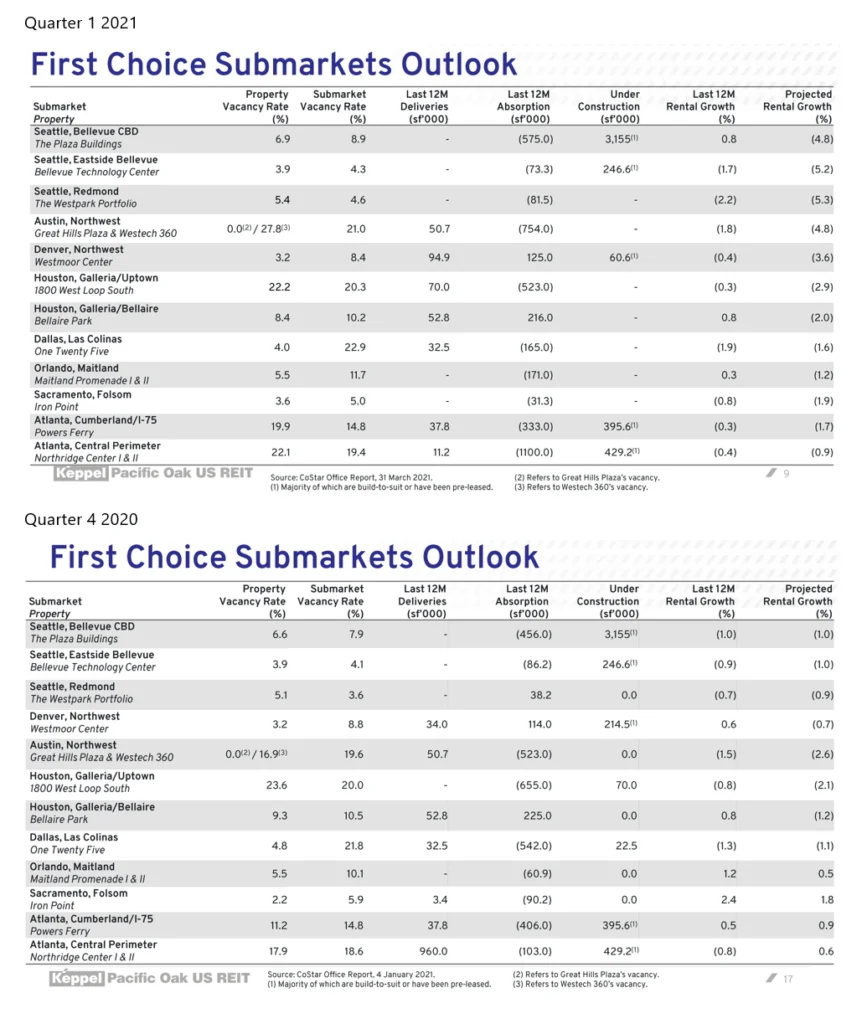

Let us zoom in and take a look at vacancies versus the markets:

We can compare the Property Vacancy Rate in quarter 1 versus quarter 4. We see higher vacancy in KORE’s Seattle, Austin, Sacramento and Atlanta offices.

We see lower vacancy in KORE’s Houston and Dallas office.

It seems that we are seeing signs of companies shifting to states with lower taxes thus benefiting areas like Houston and Dallas.

Based on the construction and absorption figures, I wonder is Atlanta that power to absorb the upcoming construction given how challenging it has been.

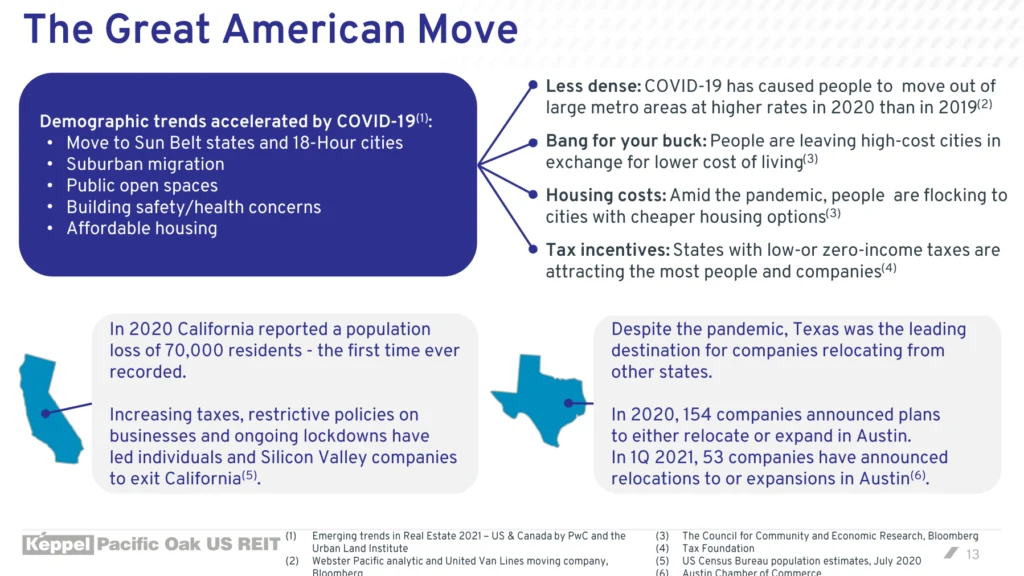

The way to think about large countries like the United States is that there is no United States real estate market but that it is made up a lot of Singapore and Kuala Lumpurs.

Each of them have their own real estate dynamics.

We have always wondered if the high taxes in California will become a bigger considerations for corporates currently residing there. This pandemic might be the catalyst for shifts away from these places where the taxes are higher.

They would have to go somewhere and Texas may be the benefactor.

KORE’s management have proven themselves for some time and 8.5% dividend yield is attractive. However, do note that since the share price and dividend is in a foreign currency, we are taking on currency risks when we invest in it.

You should also factor in the trend of the US dollar in your analysis.

Given how low the yield is, KORE should normally trade at a dividend yield of 6%.

Market might be pricing in the uncertainty of rent renewal for the next 12-months (that rent will reduce) and a foreign-currency discount.

If you are new to REITs, you can read my free REIT “course” in the third link below.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024