Elite Commercial REIT has all the right metrics you would look for in a worthy Reit to invest in. Great looking 7.1% dividend yield, long wale, low debt to asset, freehold property and a tenant that looks like someone who you expect to be the last to default on their rent.

Sometimes it is either I overthink things or that I am absolutely right to be a little more skeptical.

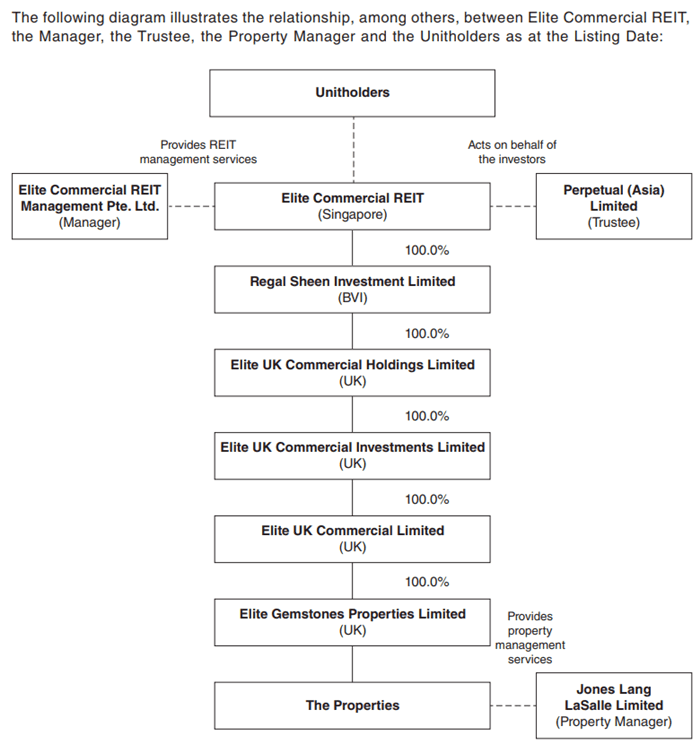

Private equity firm Elite Partners is looking to IPO Elite Commercial Reit. A lot of the context for how to look at this REIT is shaped by the people associated with supporting this REIT.

If you read the prospectus, you might pick out something you like or do not like about it. The prospectus is 750 pages at least, with half of it just valuation report. So the main bulk of it is about 300-400 pages. If you are interested in this REIT, you should read it.

The IPO just got registered on the 28th Jan 2020. I have updated the post to reflect gaps in information where I would otherwise missed out.

The IPO Offer – 0.68 Pounds per Unit with 7.1% Dividend Yield

A total of 332 million units will be on issue. Out of these 332 million units:

- Private Trust Investors, who currently are holding on to the properties will hold 139.7 million units (42%)

- Cornerstone Investors such as the private banking arm of UBS AG, Bank of Singapore and CIMB Bank will hold 77.8 million units ( 23%)

- 109 million units will be placed out in an International Placement (33%)

- You the retail public can subscribe to the 5.73 million units (2%)

This retail issue is a very small one.

The IPO is at 0.68 Pounds. At this price, the indicative dividend yield for 2020 is 7.1% and 2021 is 7.2%.

I will share more about the shareholding mix later in the article.

Elite Commercial REIT’s Demand Will Come from Private Banking Clients Looking to Leverage on REITs

From what I was told, there is a strong demand for Elite Commercial REIT from private banking clients.

This is because they can borrow in Great Britain Pounds to purchase this REIT in the same currency.

With a seemingly long WALE, reasonable leverage, government tenanted portfolio, clients are willing to boost their yield if they have access to cheap interest loans.

For example, a client has $1 million in fixed deposit, they can borrow another $1 million and invest in Elite Commercial REIT.

In another example, a client can buy $1 million worth of Elite Commercial REIT yielding 7.1%, borrow $1.5 million and invest in Elite Commercial REIT. The interest is estimated to be around 1.80% currently.

The debt to asset or loan-to-value is 60%.

Some Background on the Origins of This Property Portfolio

I managed to gather some background on what may have transpired before the IPO.

So it goes like this:

Singapore based private equity firm Elite Partners acquired a portfolio of 97 commercial properties in the UK from British developer Telereal Trillium for 282 million pounds one year ago in Nov 2018.

Elite Partners have decided to IPO these 97 properties almost 1 year later in this upcoming IPO.

Telereal Trillium started its life in 1998 when the UK Government decide to shift its property strategy. Sir Malcolm Bates concluded that government bodies are moving from being owners and operators of assets into intelligent purchases of long term services. So instead of owning or leasing offices, they decide to buy property services.

In 1998, the government executed Project PRIME, which was the out-sourcing of almost all of the Department of Work and Pension (DWP) offices to the private sector.

This includes a transfer of ownership of the freehold premises, responsibility of rental costs, maintenance and cost of upgrading the buildings. DWP retains the rights to occupy the estate for 20 years. They reserve the right to reduce the payment in the event of poor performance or if the buildings become unavailable.

This is an exercise by the government to rationalize their costs.

The 20-year contract ends on March 2018.

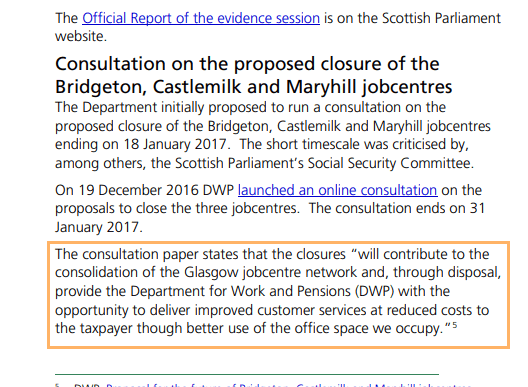

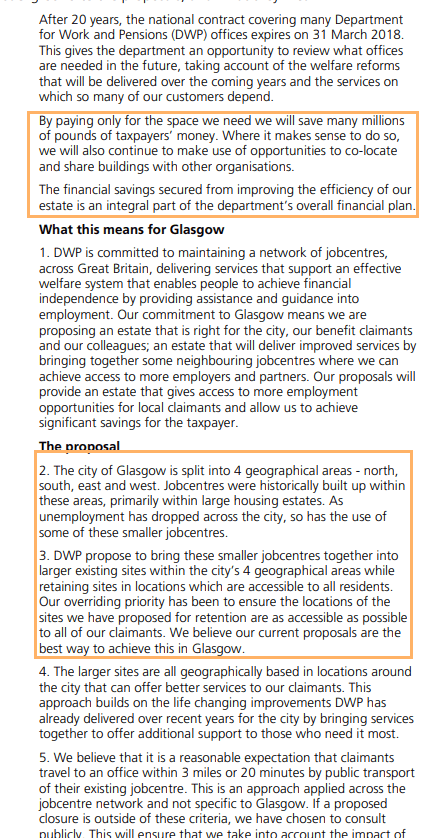

In January 2017, Minister of Parliament debated on the Future of the DWP estate. There were some details revealed in the debate.

The department is committed to reducing the size of its estate by 20% and increasing the “co-location” of Jobcentre Plus offices with other local services such as local authority benefit teams and mental health services.

The whole debate centers on the pace of the rationalization of space. Here are some interesting parts of the discussion:

Suffice to say, the government looks to have a mandate of trying to rationalize the space. In a Sunday Post, the newspaper reported that privatizing the job centers under the PRIME contract have resulted in some outlandish payouts by the government entity.

In 2018, a new 10-year, FRI lease commencing on 1st April 2018 was signed by the DWP at newly agreed market rents.

An FRI lease is one which places responsibility for all costs of repair and insurance of the property with the tenant. This new 10-year lease is also subjected to CPI-linked rent reviews.

Before the lease commerces, Telereal Trillium instructed CBRE to sell the 280 million “The Hayhill Portfolio”. The sale will put the net initial yield or net property income yield at 7.81%.

DWP’s delivery of services has changed significantly over recent years and, following a comprehensive review of its estate, through which the DWP has secured new leases across its UK portfolio to provide operational and occupational stability into the future, the DWP has committed to new leases on these 98 properties.

Graham Edwards, Chief Executive at Telereal Trillium said: “With the undoubted covenant of the DWP taking new 10 year leases on these 98 assets at current market rents, it is a good time to rebalance our portfolio. We continue to invest across the UK in the office, industrial, and strategic land sectors, where we deploy our asset management capabilities to create value. Over the last year we have invested in excess of £100m in new investment property, land, and residential development schemes.”

This probably coincides with a re-organization within Telereal Trillium where there are a number of high profile changes including the CEO.

This may highlight the shift in strategic direction:

The changes coincide with the conclusion of Telereal Trillium’s 20-year PRIME property outsourcing contract with the Department for Work and Pensions (DWP) on the 31st March 2018. They are in line with the company’s increased appetite to find and complete on new investment opportunities, to invest in its own estate, particularly in the areas of strategic land and residential development, and to continue the effective management of its existing £6.5bn property assets, and strategic property partnerships with BT, Aviva, DVLA and Royal Mail.

On top of the Hayhill Portfolio, Telereal Trillium is also putting other government outsourced portfolios such as the Bruton and Stratton Portfolio up for sale.

We can read this Hayhill portfolio in a few ways but I think Telereal Trillium may think this isn’t the future direction of how the firm is going.

It may very well be that they see the government’s direction to be constantly optimizing this portfolio and downsizing it. The WALE of this portfolio is rather long at 8.6 years. However, if the government is going to rationalize the portfolio, what happens after the lease ends?

- They do not renew the lease

- The Manager will need to lease to someone else

- The place is hard to lease out and stays vacant. The property value drops since the majority of the property value is tied to the strength of the tenant lease

- The new tenant moved in could not pay as high of a rent as a government with deeper pockets

These are some of the risks that I do foresee. There are a few properties in the portfolio that may be able to break their lease within 3.6 years so we may see some actions before this.

Some Details of the Portfolio

The portfolio consists of 97 properties that are distributed across the United Kingdom. Except for one, the rest of the properties are freehold.

The appraised value is about 319 million pounds. At an exchange rate of 1 GBP to 1.75 SGD, this portfolio is valued at S$558 mil. The expected debt on the balance sheet should be approximately 97.5 million pounds. This bring the debt to asset to roughly 30%.

One of the unique nature of this portfolio is that 99% of the gross rental income is derived from UK Government as tenants. There are rental escalation yearly based on consumer price index (CPI) adjustments.

The portfolio is basically very close to triple-net lease in that the maintenance, insurance costs are borne by the tenant.

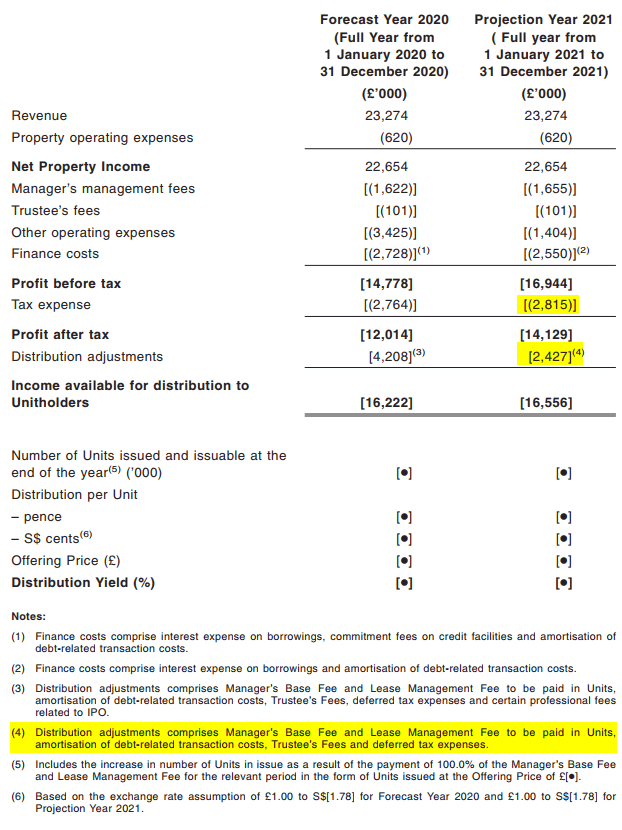

The manager describes this portfolio has “stable, recession-proof and Brexit-proof cash flows”. The manager forecast that in 2020 the net property income (NPI) yield is 7.1%.

The Sponsors, Managers, and Cornerstone Investors and Lock-up Periods

There are likely to have 95 million units in issue.

Out of these, UBS AG’ Singapore and Hong Kong Branch, Bank of Singapore and CIMB’s Singapore branch have agreed to subscribe for about 77.83 million units at the offer price on behalf of their private banking clients.

So this REIT IPO would likely be heavily tilted towards the private banking clients of these cornerstone investors (UBS, Bank of Singapore and CIMB).

From what I read, there are no lock-up periods for the cornerstone investors.

The REIT will be managed by Elite Commercial REIT Management.

The sponsors for the REIT are:

- Elite Partners Holdings (EPH)

- Ho Lee Group, which is a property and construction firm

- Sunway Group, a Malaysian conglomerate group

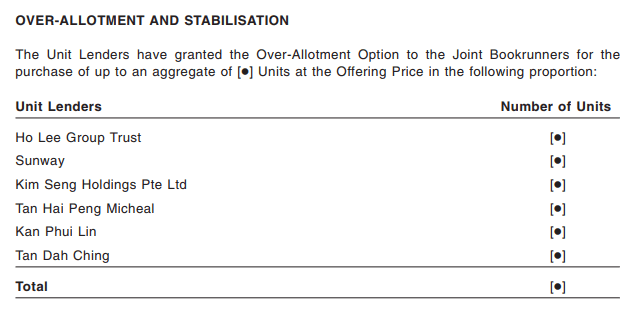

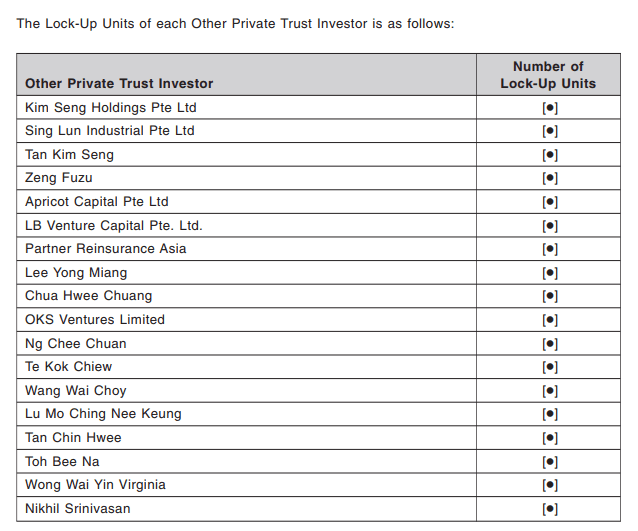

There are also a few characters associated with this IPO if we take a look at the unit lenders and those who would eventually be the substantial shareholders:

It feels very different from the REIT IPO that usually get a lot of good fanfare, where they garner the support from major institutional investors, fund houses or banks.

The prominent name here is Tan Kim Seng, who over the years have put together a few other IPO. It feels that there was a massive support gather exercise to find enough interest parties to roll out this IPO.

Together with a push to private banking clients tells me in the future, the REIT would have a lot of major shareholding volatility.

Details of Taxation

Whether we are dealing with overseas properties or local, we have to accept that there is always some risks when it comes to changes in existing taxation policies.

A REIT with overseas properties will be more complex because we have to navigate a few layers of country taxation, tax shielding.

There are a few layers of possible taxes:

- Taxes on Income in the UK

- Withholding taxes when money flows from UK to SG entity

- Capital gains tax during disposal in the UK

- Using interest expenses as a tax shield to reduce the taxable amount

- Withholding taxes when money flows from SG tax offices to the REIT

- Taxes on Income in Singapore

- Taxes to shareholders

#1 – UK companies will be subjected to UK corporate tax on their worldwide income at the prevailing rate of 19%. Dividends received by another UK entity is exempted from UK corporate tax.

#2 – There is no withholding tax flow for UK Companies to other UK companies whether it is a dividend or interest income.

#3 – There are corporate taxes on capital gains made by non-residents in the UK. However, if unitholders are tax-resident of Singapore and a few more countries, they are exempted from this tax.

#4 – This one concerns whether the UK entities can use interest expense to reduce taxable income. Like the Singapore REITs with USA assets such as Keppel Pacific Oak, Manulife US REIT, the government wants to prevent UK companies from headquartering overseas so as to gain tax advantages. To not be considered as a hybrid entity, Elite Commercial REIT or RSIL will need to sufficiently held by an entity with at least 10% of the entity’s units.

The independent tax adviser assessed and believes that Elite Commercial REIT is not a relevant entity, and RSIL is treated as the ultimate parent.

#6 – Elite Commercial REIT has received exemption of a 17% corporate tax on income accrual in Singapore, income derive from overseas received in Singapore. Their income includes interest income on bonds issued by Elite UK Commercial Holdings Limited (ECHL) to Elite REIT, dividend income from Regal Sheen Investment Limited (RSIL) and any proceeds from the redemption of bonds.

RSIL also received an exemption of taxes on dividend income it will received from ECHL. Singapore does not impose capital gains taxes.

#7 – The tax-exempted dividend, after-tax income, capital distributions unitholders will receive from Elite Commercial Trust will be exempted from taxes.

Singapore GST on Elite Commercial REIT and RSIL can be claimed back.

RSIL is incorporated in the British Virgin Islands (BVI). There are no BVI income tax and withholding tax applicable here.

Properties in UK are subjected to Value added tax (VAT), Stamp duty land tax (SDLT) and Land and Buildings Transaction Taxes.

As a summary of this taxation section, we do see that in the proforma statements, there were tax expense charged. This is a mixture of deferred taxes and current taxes.

Deferred taxes were recognized as temporary differences between carrying amounts of assets and liabilities for financial reporting purposes and the amount used for taxation purposes.

The current tax refers to the corporate taxes incurred at the current tax rate of 19% (mentioned in #1) as well as deferred taxes

If we look at the distribution adjustments, which is made up of 100% management and trustee fee paid in units, Elite Commercial REIT is likely subjected to some form of taxes.

The important one is that it is likely there are no withholding taxes when the income flows from UK to BVI to Singapore.

The Buildings

Majority of the portfolio builds are old.

Like the 1960s, 1970s, and 1980s old. This is not new as in the United States, we will also have a lot of very old properties that are still around today. I could not find much information when these older buildings have been improved upon.

You can read more about them in the second half of the prospectus.

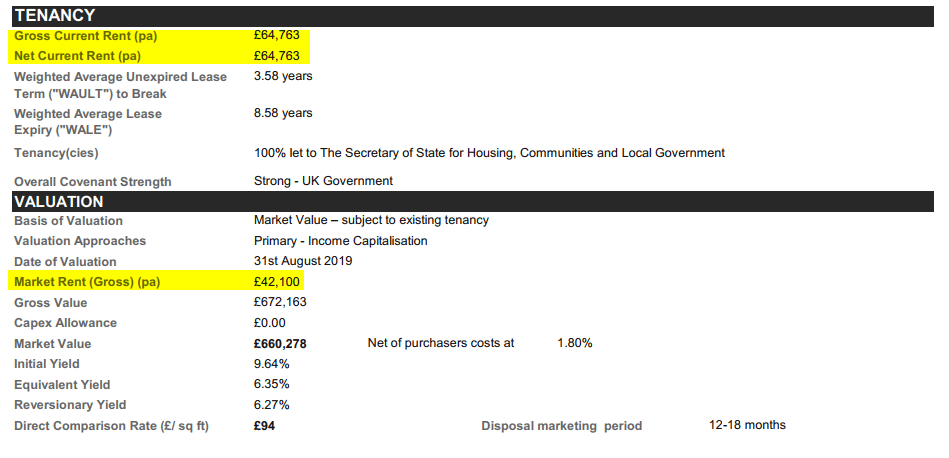

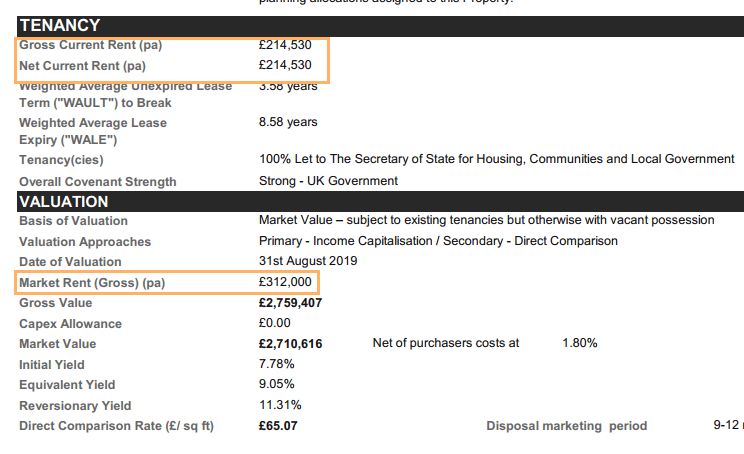

Pay attention to the valuation section. In that section, you can find information about the Initial Yield, Equivalent Yield, and Reversionary Yield.

- The Initial Yield will show the yield based on first-year rent

- The Reversionary Yield will show the yield of the property it will eventually rose and fall to

- The Equivalent Yield will be somewhere in between these two and show probably the average yield you will get overtime

By reviewing these three figures, we can have a direction of whether the market rent Telereal renewed in 2018 is above, below or roughly similar to the market rent now.

If Initial Yield is higher than Reversionary Yield, the current rent is higher than market rent. A worrying sign.

If it is the other way, then there may be a higher potential for higher rental reversion when the rent gets renewed in the future.

This property shows the current rent is vastly above the market rent. The initial yield is much higher than the equivalent and reversionary yield.

This property shows current rent vastly below-market rent.

I tried to categorize the properties based on whether the current rent is above or below the current rent.

- Number of properties where current rent is greater than market rent: 76

- Number of properties where current rent is below the market rent:19

- Almost the same: 2

78% of the properties have current rent higher than market rent. It does indicate to me that the properties are being rented above their current potential rent as assessed by the valuer.

If the properties do not get renewed, re-leased rent might be lower. For some, you could see a 2-3% yield gap.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Chua TC

Monday 10th of February 2020

Thanks for your analysis. I have a few questions: 1.Am I right to say an overseas investor domiciled in Singapore do not have to psy withholding tax on UK income or distribution. 2. What is the lock up period for the owner investors? 3.What would be a good price range to enter? Thank you TC

Kyith

Monday 10th of February 2020

Hi Tc, whether you pay withholding tax depends on which countries it enters. So in this case, it will be UK to Singapore. The lock up period can be found in the prospectus. When the yield is closer to 8%

john furlong

Thursday 30th of January 2020

fantastic detailed analysis job..........with the uk exiting the eu will throw up some currency fluctuations but hard to define .....at this juncture the bet is the uk will reduce its interest rate .......so would appreciate your view good / bad / investment for small punters...

Sinkie

Thursday 23rd of January 2020

I'm always skeptical of overseas properties being marketed locally in S'pore. If it's so good, their home market investors will have grabbed it already.

And UK investors are as (or even more!!) property-crazy AND income/yield-crazy as Sinkies. Yes, hard to imagine but quite true.

This looks pretty much like an exit plan for private & HNW investors.

If you're positive about UK property, a better bet will be British Land --- it owns over 100 acres of trophy assets in London & it focuses on big integrated campus-like mixed-use developments in London catering to new demographics & new trends in modern living --- work, live, play, grow, mixed residential & commercial, restaurants, shops, bars, offices, millennials, high-tech growth companies, urban living.

Brexit issue has suppressed it to a 20-yr low valuation & 5+% dividend yield over the last 2+ years. It has formed a base & has been rising in the last few months.

BTW, GIC has co-invested with British Land into 1 of its integrated mixed-use central London campus. Very successful .... 97% occupancy rate & US$173M in rents every year.

Sunny

Friday 24th of January 2020

They have 40% retail exposure and going thru years of write down.

Sunny

Thursday 23rd of January 2020

I believe there is 20pct WHT buying UK REIT directly.

Kyith

Thursday 23rd of January 2020

Hi Sinkie, thanks for the valuable knowledge. I think I must developed the skills to evaluate comprehensively in a fast manner so that eventually I will develop that gut feel to know fast if something is good or not good.

Sunny

Thursday 23rd of January 2020

HI Kyith,

How did you find out the current market rate on current properties in UK?

Kyith

Thursday 23rd of January 2020

Hi Sunny,

It is stated in the prospectus the Colliers valuation.