We have a few US REITs that is coming over to list in Singapore. ARA Hospitality Trust was the first one with lukewarm response.

And this time round we have Eagle Hospitality Trust (EHT).

The former is more well known to Singapore investors since ARA was listed here and then delisted.

I think SGX and DBS are really actively courting these REITs from overseas to list in Singapore and I am not sure this is always a good thing.

I shall not say too much but do a quick take of this IPO. I have not much value add for this article honestly.

Here it goes.

The Offer

- A total of 580 mil shares will be on offer

- 535 mil will be available for institutional and other investment in the placement tranche

- 45 mil will be available to retail investors

- The listing price to be US$0.78

- Forecast Dividend Yield in 2019 (not complete year): 8.2%

- Forecast Dividend Yield in 2020: 8.4%

- Half yearly distribution

- NAV US$0.88 (issue price below book value)

In the grand scheme of things the dividend yield, in this market looks very attractive. Majority of the hospitality REITs trade at a dividend of less than 6% (with the exception of OUE Hospitality, which is going to be merged with OUE Commercial). The hospitality REITs are also mostly very geographical diversified, so you cannot say they are Singapore centric.

Do note that for hospitality REITs, a portion of their rental income is fixed and a portion is variable. The variable component is linked to the revenue of the hospitality business.

And the hospitality business is a function of demand and supply, which tends to be volatile.

Those that are less volatile have a higher fixed component.

What this means is that don’t expect the dividend per unit to be consistent (unless USA is a unique place).

The manager IPOed the REIT below book value. This might be taking guidance from the lukewarm response for ARA Hospitality Trust

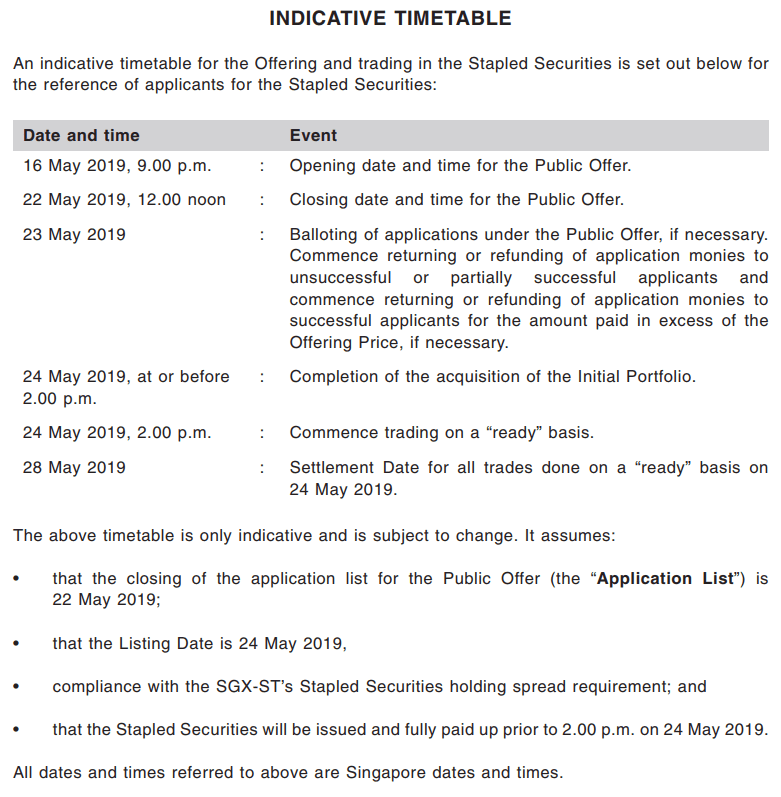

It looks like this blog post might be too late. The IPO will close on 22nd of May.

The Portfolio

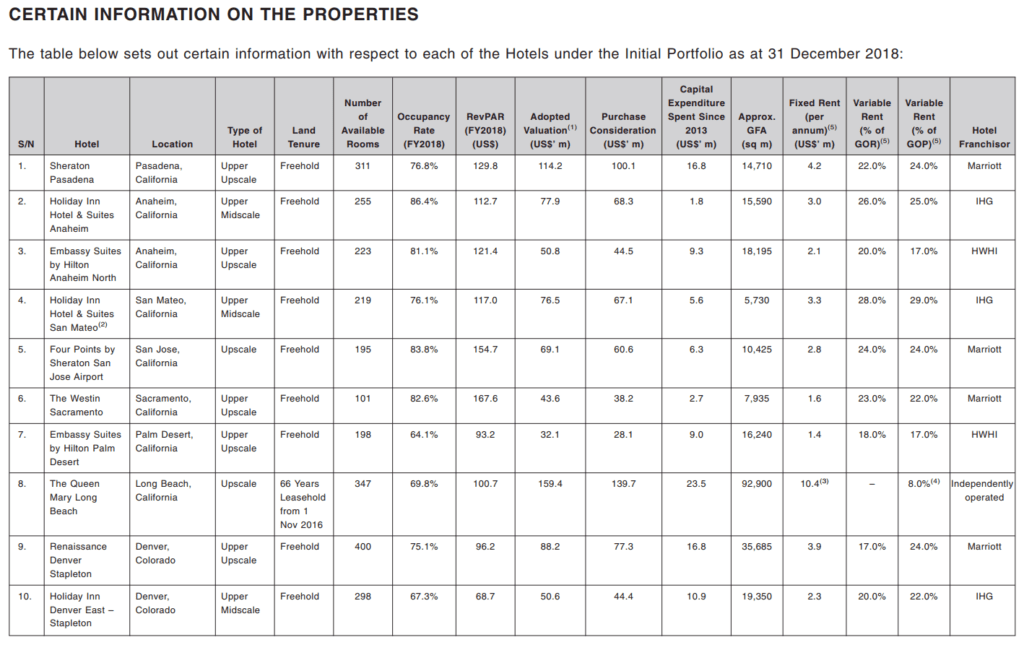

- 18 hotels valued at US$1.2 bil

- 17 of 18 assets are freehold assets

- Sponsor is Urban Commons LLC

- Predominately Full Service Hotels

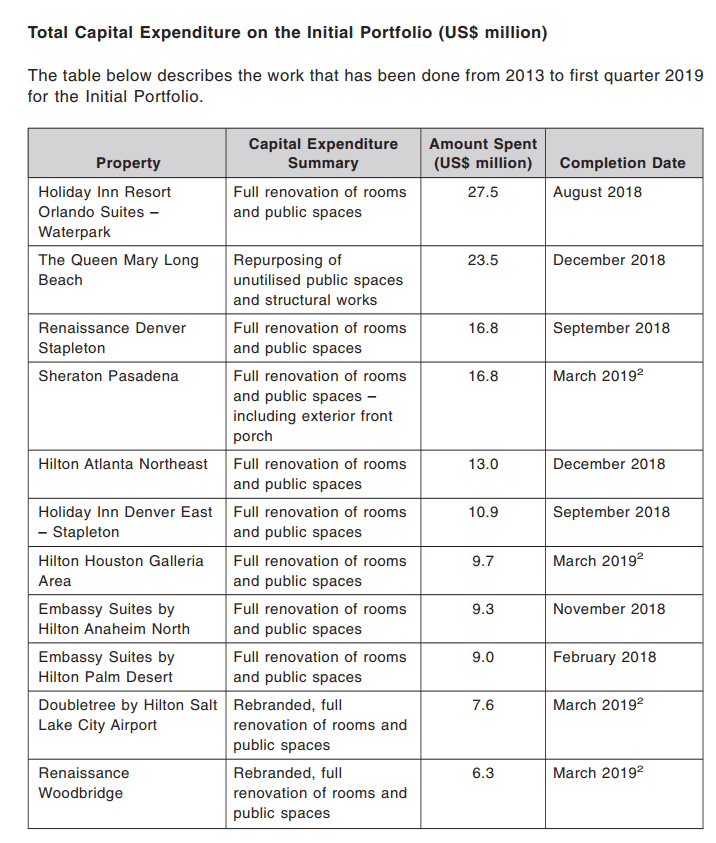

- Majority of the portfolio have just completed their renovation in 2018 to 2019

- Hotels cater to the Upper/Upscale segment

- Franchise Brands: IHG, Marriott and Hilton mainly

- Debt to Asset: 37.7%

- All in interest cost (including hedging contracts): 4.2%

- Hedging to fix rate for 75% of outstanding debt

- Each master lease have an initial term of 20 years from listing date, with an excercisable option to increase for a further 14 years for properties in California and 20 years for all other properties

Fee Structure:

- base fee of 10% Distributable Income

- performance fee of 25% of the growth in DPS over preceding financial year x number of shares issue

There are covenants to the debt:

- total indebtedness of EHT, EH-REIT, EH-BT and subsidiaries must be < 45% or < than the percentage limit corresponding to max percentage of leverage of EH-REIT deposited property

- total stapled group debt < 30% of the value of EH-REIT deposited property

- all secured recourse indebtedness of group must be <5% of the value of the EH-REIT deposited property

- NTA of group must > 75% NTA at closing and > 75% of net cash proceeds of post closign equity issuances

- ratio of adjusted EBITDA to fixed charges must < 1.5 to 1.0 times

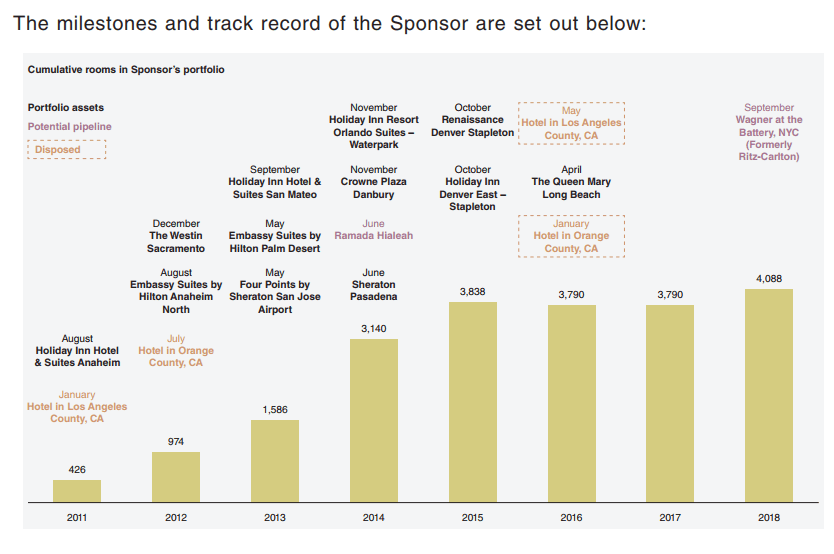

Nothing out of the ordinary. I do think that the management did one round of capital expenditure so as to make it attractive to be sold to either private investors, private equity or an initial public offering.

By making use of the franchise brands of Hilton, Marriott and IHG, they sought to pay the recurring fees to a joint marketing scheme, follow the strict franchise standards and leverage on the network effect of well known hospitality brand names.

The level of leverage is not too bad. The average cost of debt looks not cheap and I suspect that the majority of it was re-finance last year when interest rate reached 4.4% for some financing (based on my Manulife US REIT analysis)

Support for the Trust

- Howard Wu and Taylor Woods, who owned the Sponsor, which managed USHI Portfolio, will roll their equity into Eagle Hospitality Trust and would own at 15.2% stake

- Howard Wu 7.6%

- Taylor Woods 7.6%

- Salvatore G Takoushian 1.2%

- If the REIT manager cease to be the REIT manager for EHT, they will lose the rights of first refusal for the properties by the Sponsor granted by Howard Wu

- DBS Bank, Wealthy clients in DBS, Gold Pot Developments and Ji Qi will own 16.7%

- Ji Qi is founder and executive chairman of hotel chain Huazhu Group. He owns 37% of the hotel chain. Huazhu Group is listed on Nasdaq

The cornerstone investors, together with Sponsors will form about 32% of the REIT. That leaves quite a fair bit for the rest. If a large portion is to be issued to the family offices and institutional investors, I wonder if the liquidity for this REIT will be good.

Let me go through some of the slides that I find more interesting.

Some data on the Hotels

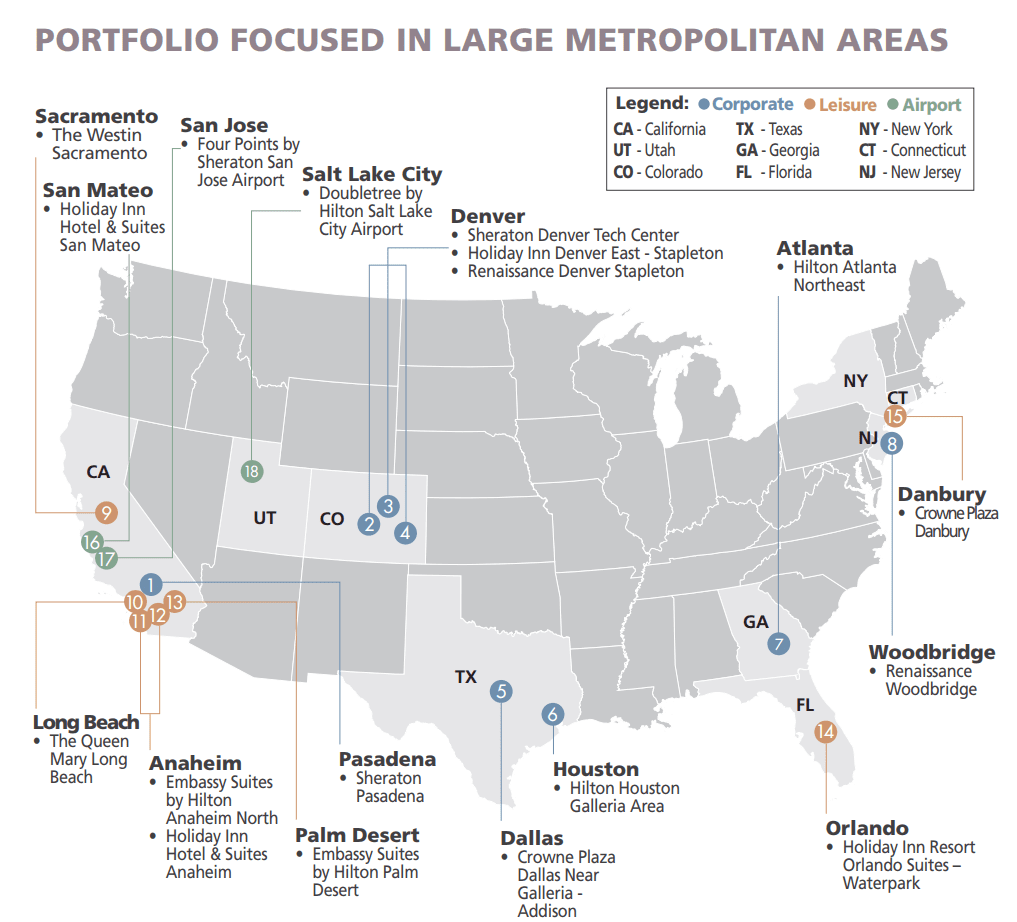

A whole bunch of properties are located in California, New York and Utah/Colorado cluster.

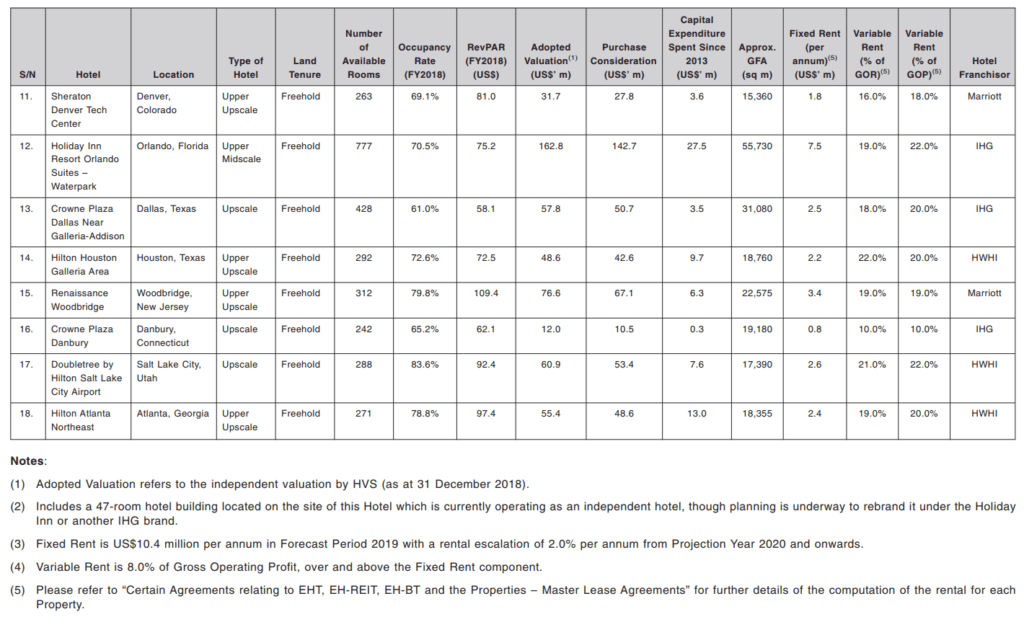

The properties have recently underwent renovation works. Here are the details.

Examining the Performance Metrics and Outlook for the Industry

Since this is a much more cyclical industry, it makes sense to see whether the sponsors are getting out at the right time, and you are getting in at the worst time.

But before we go into the data, lets take some time to refresh some metrics.

Revenue per available room (RevPar) = Hotel’s daily room rate x occupancy

- tells if you are pricing your room rates perfectly. You can price your rooms higher, with lower occupancy, and your resultant RevPar is higher than if your occupancy is 100%

- reminds you not to cut prices. Without focusing on RevPar, you might engage in price competition

- sets the baseline that your cost should not exceed. If your expenses is higher than the RevPar that you aim for, you might be spending more, so as to get to 100% occupancy. So benchmarking RevPar allows you to not blindly fulfill 100% occupancy

Average daily rate (ADR) = Revenue earned / Number of Rooms Sold

- ADR should tell the performance of the rooms sold. It tells you whether you are able to add value versus the competition. It tells you whether all the value added stuff you are adding in such as technology, facilities are having a positive impact on the rates that you can charge

- Shows your efficiency in pricing. Manage the pricing of big ticket events, seasonality, weekly fluctuations

- Benchmark against competitors’ ADR to know if you are doing better

Revenue Generation Index (RGI) = Hotel’s ReVPaR / Market RevPar

- RGI = 1: hotel rev performance equal to average

- RGI > 1: hotel rev performing better than average

- RGI < 1: hotel rev performing worse than average

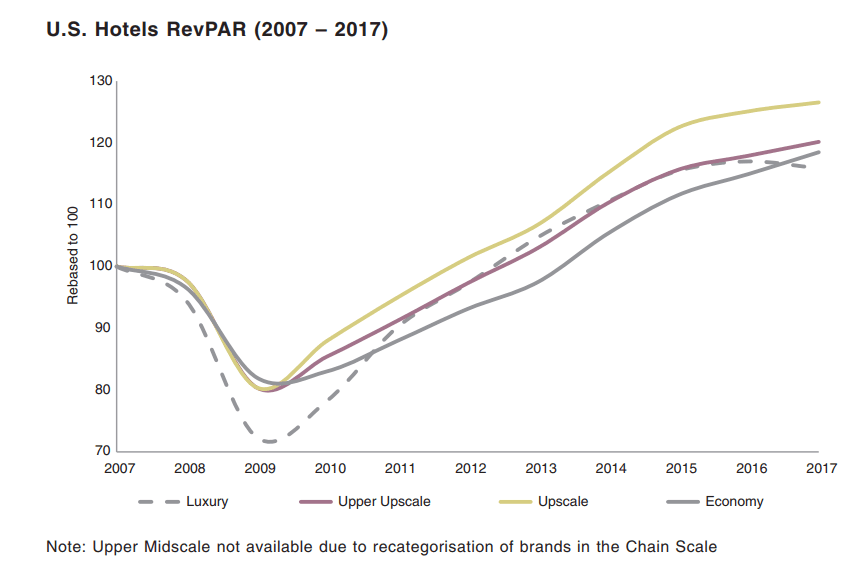

The above slide is taken from EHT prospectus. It shows a very nice growing trend in RevPar since the financial crisis for all segments. Upper Upscale rose at a higher rate than all the rest.

The RevPar for economy is still growing (perhaps take note for ARA Hospitality Trust) while the Upper Upscale, Upscale and Luxury seem to be decelerating.

The data is rather limited and I cannot find much longer term data out there.

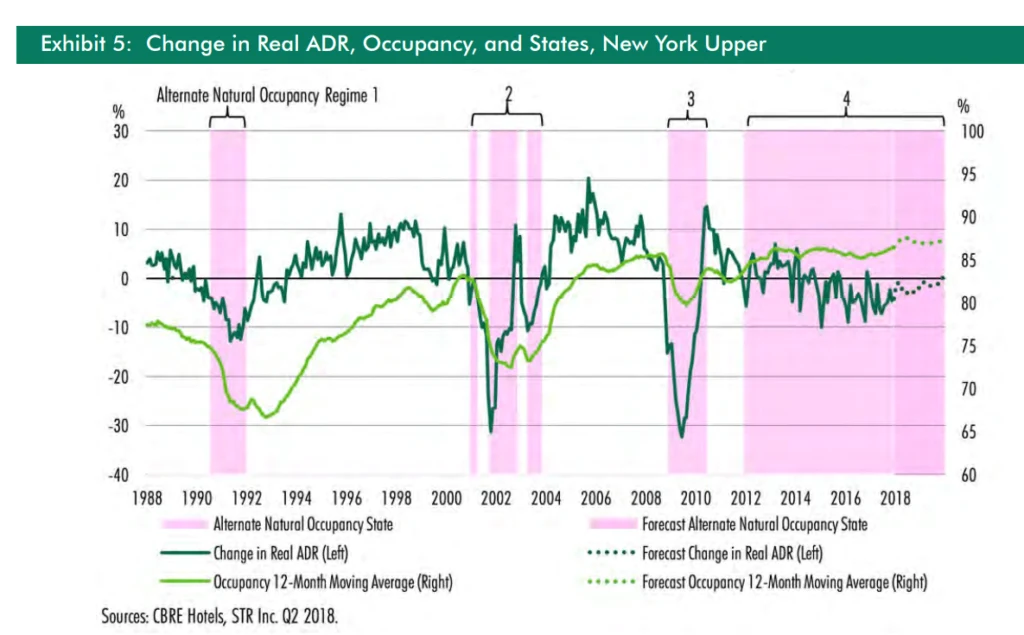

The above chart is taken from CBRE Hotel report for the New York region. By no means is this 100% reflective of the whole region but we can see the variability in ADR rates over the past 20 years. During various times in history, occupancy rates tend to take a dip, together with ADR.

Right now occupancy have been doing well these past years.

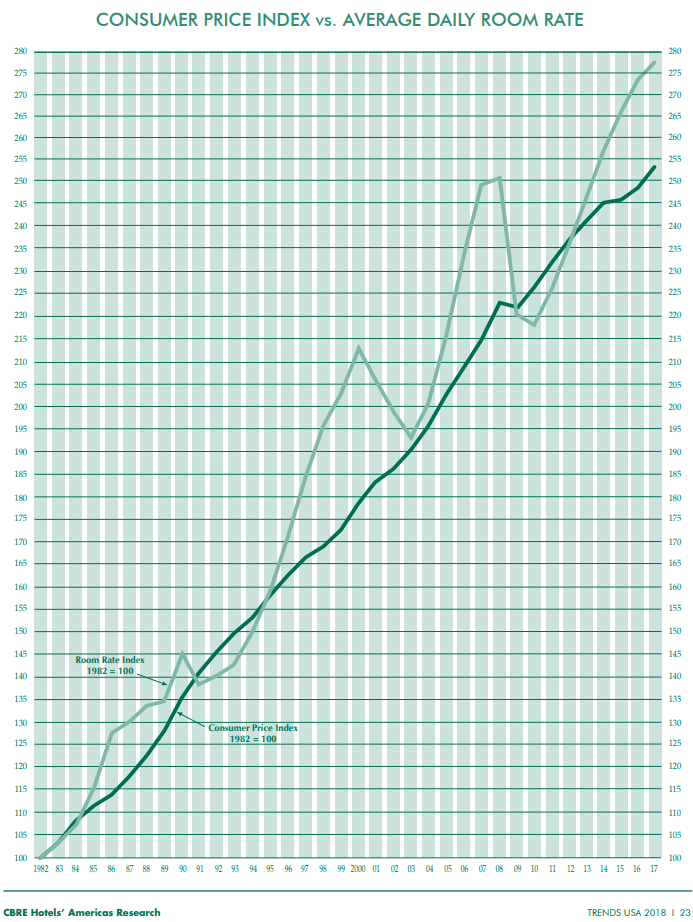

On a longer term chart the ADR do seemed to keep pace with the consumer price index, which is increasing over time. Right now the ADR has far exceeded the CPI.

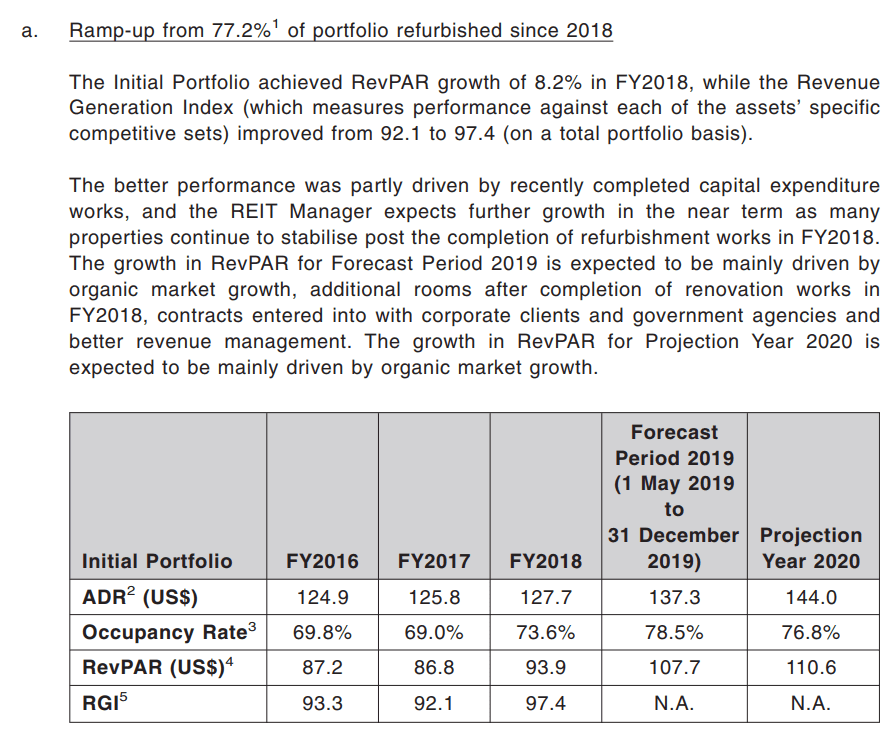

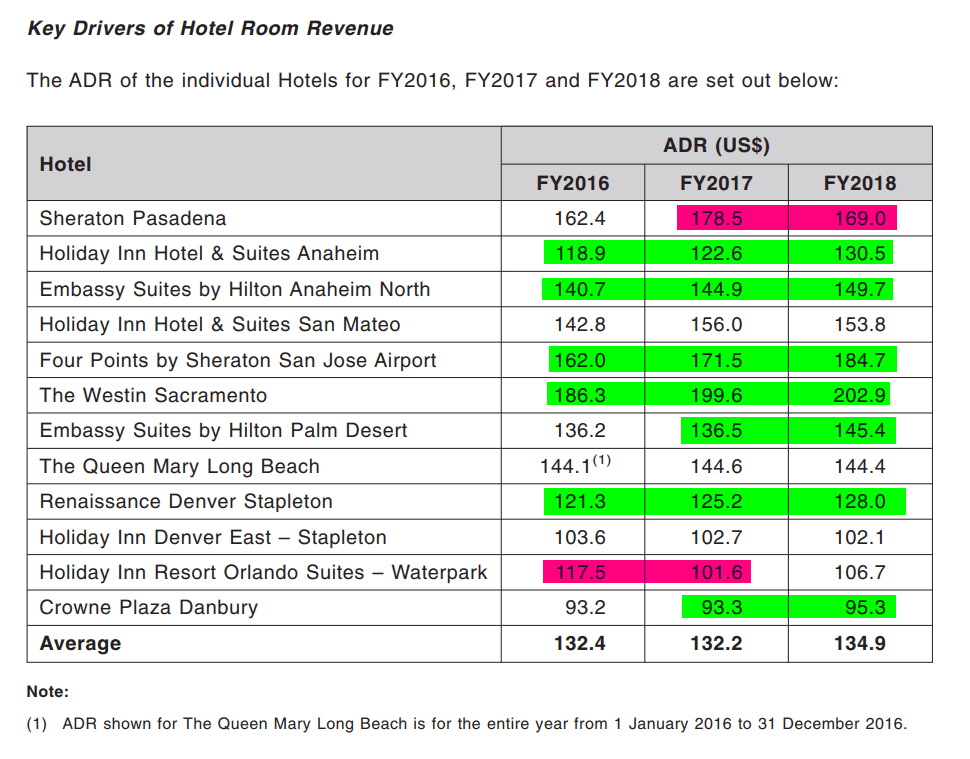

The illustration above shows the 3 year ADR, Occupancy Rate , RevPar and RGI. ADR have been improving over the three years, as do the occupancy rate from 2017 to 2018. This might be due to the end of AEI works in a lot of the hotel.

Rather interesting is that the RGI for all three years is less than 1, which indicates their RevPar to be less than the market average.

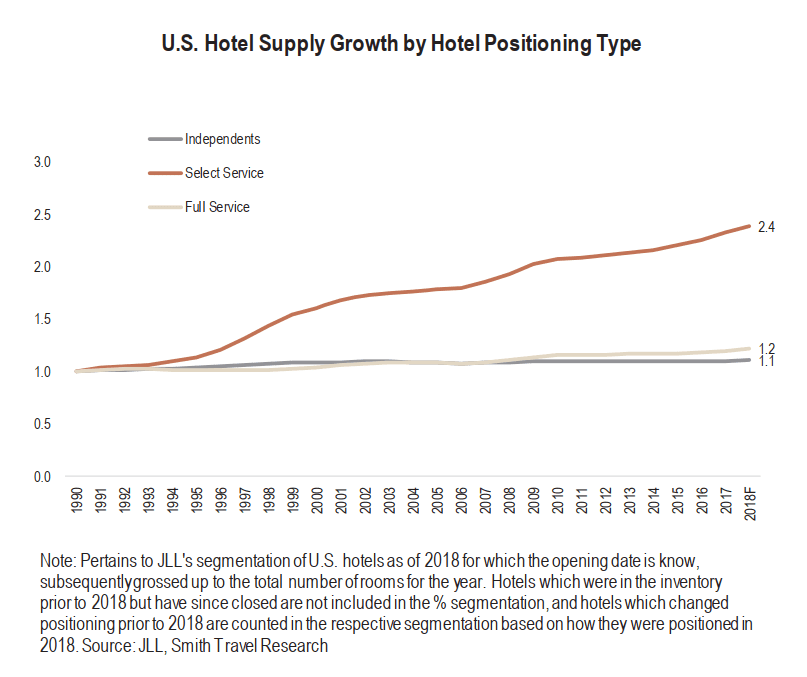

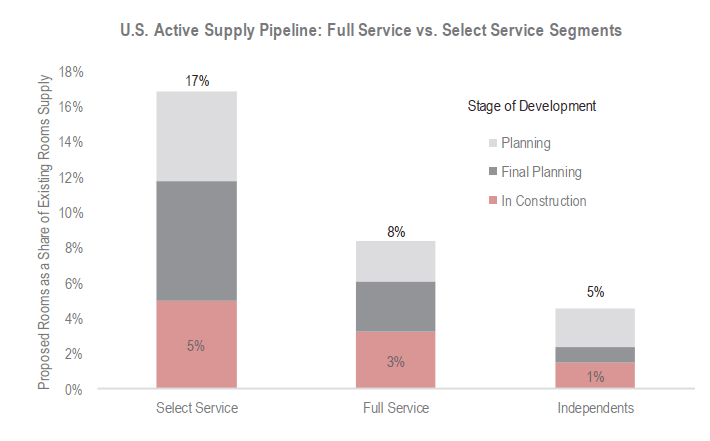

Supply growth for the full service hotel segment have been limited as compared to the select service (take note ARA Hospitality Trust investors)

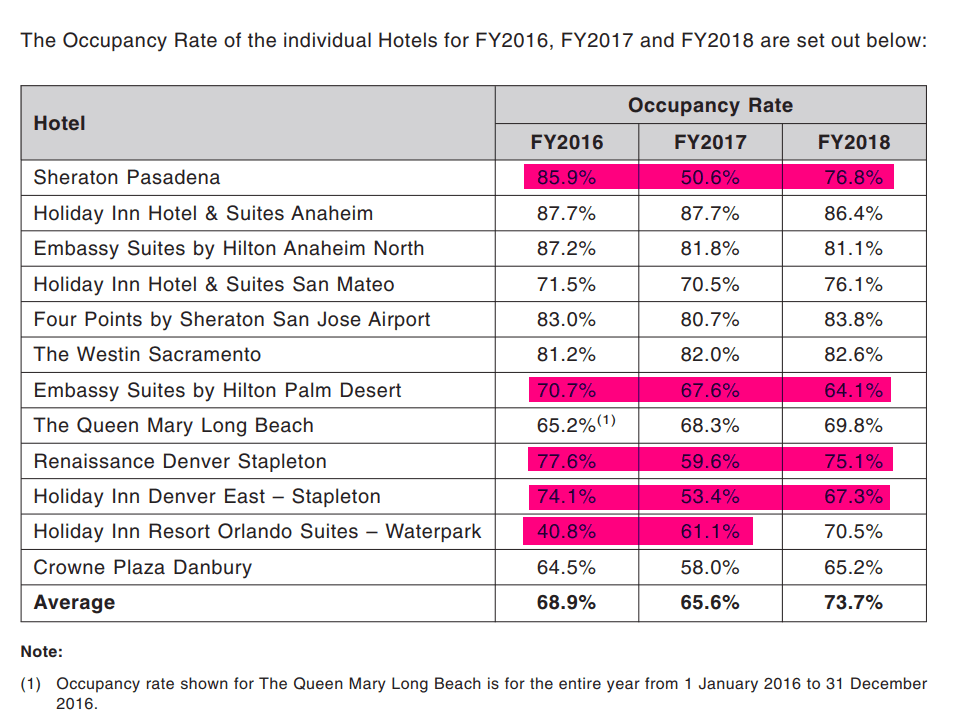

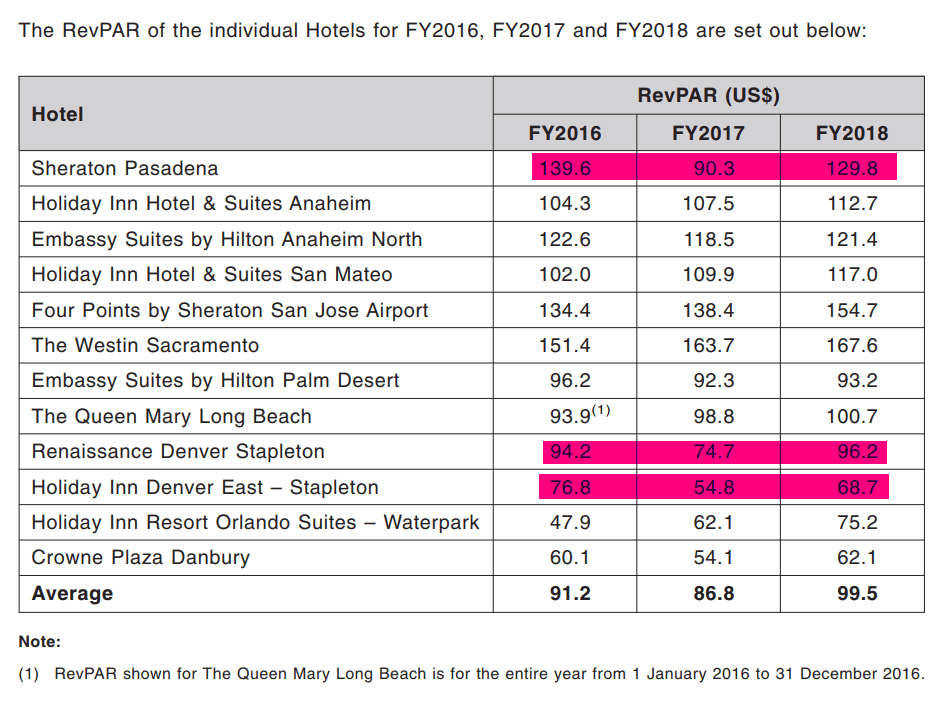

For a few hotels, we see a big drop in occupancy rate in 2017. If we examine the prospectus, most of them have justifiable reasons due to undergoing renovations and thus the occupancy was lowered.

Majority of those that underwent renovations, have their RevPar movement mirroring that of their occupancy rates. This might show the lack of ability for the hotel to raise prices in the face of lower supply in the hotel.

Finally the ADR does show that majority of the hotels were able to improve their ADR over the three year period, indicating healthy pricing power.

Taxation

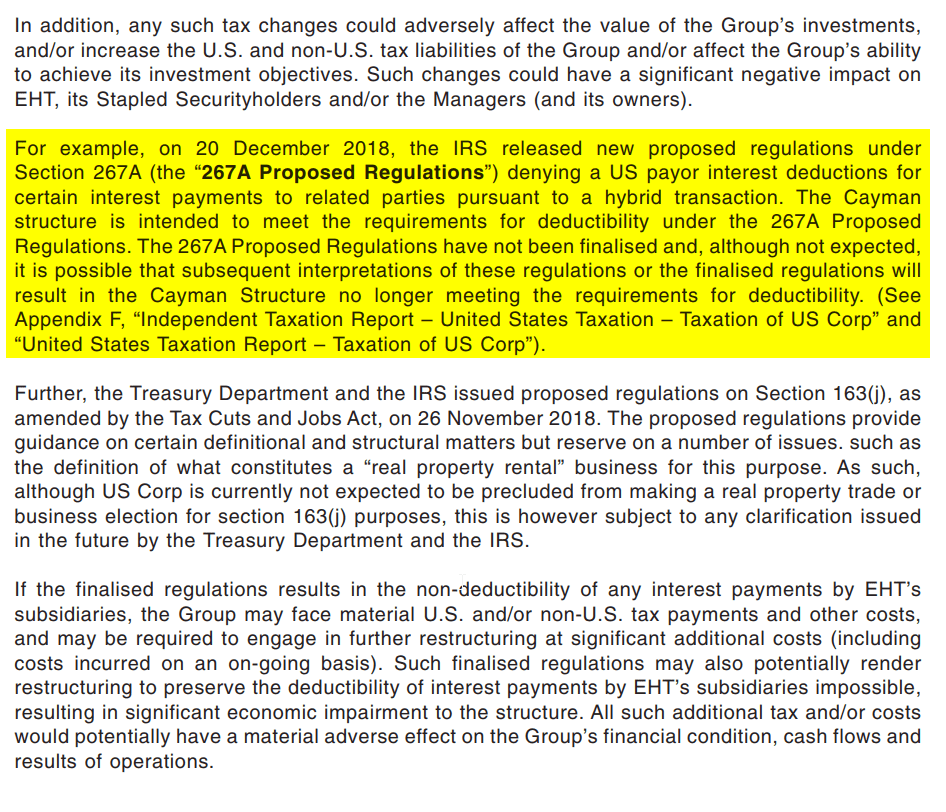

A company that has assets operating in USA is likely the subject to 30% withholding taxes. From the prospectus, it seems that I only see taxes being paid in the income statement in 2016. For the proforma one, it seem to indicate that the shareholders would not be subjected to withholding taxes.

The above section explains the tax situation.

So instead of Barbados (which is used by Keppel KBS and Manulife US REIT), Eagle Hospitality chose to use Cayman. If I am right Cayman have zero percent corporate tax or income tax. You pay a licensing fee instead. The Cayman entity will receive a loan from Singapore entity. The Cayman entity will then lend the money to the US entity and likely the US entity pays Portfolio Interest (likely to abide to the Portfolio Interest Rule (PIR).

For them to boldly use a country with zero corporate tax, they must have been rather confident that they will not violate the Section 163(j), which would then classify them as a hybrid entity. When you are a hybrid entity, you cannot use interest expense to reduce your overall taxable income.

Their US structure is not very flat as well, as compared to Manulife, who had to flatten their structure due to the 2017 Tax Cuts and Jobs Act changes.

Summary

There are some angles that I cannot go into but I do urge you to read the different angles (particularly the awesome ship Queen Mary!) by 2 of my friends:

What might be missing from most of our analysis is the pipeline and the history of the sponsor Urban Commons LLC and the people that owned them. This is perhaps where you would explore more.

Let me know if you have found out other angles about Eagle Hospitality Trust that I have not thought about.

Do Like Me on Facebook. I share some tidbits that is not on the blog post there often. You can also choose to subscribe to my content via email below.

Here are My Topical Resources on:

- Building Your Wealth Foundation – You know this baseline, your long term wealth should be pretty well managed

- Active Investing – For the active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

SgBuffett

Tuesday 5th of November 2019

Hi I am sgbuffett from sgtalk forum.

I have issued warning to sell and get out.

This EHT asset valuation is heavily inflated and with. $465M in debt …my assessment is the stock is not a buy at any price level.

Detail analysis is found in my thread.

https://sgtalk.org/mybb/Thread-Eagle-REITs-5-months-after-IPO-be-warned-GET-OUT

Plse be warned. I am a deep value investor and typically do forensic analysis before risking my money my various stock picks and warnings can be found in sgtalk forum.

Brandon Wong

Monday 2nd of September 2019

Price has dropped to 0.67 now. Is it attractive now in your opinion?

Matthew

Sunday 14th of July 2019

fyi, Eagle Hospitality Trust has launched their website at https://eagleht.com/. Thanks.