Trump said something. Then China did something.

So what we have is the DOW, S&P 500 and Nasdaq down 3%. But they been falling for a few days.

It gets even worse for me considering a large part of my equity holdings is in Hong Kong. And you know what is going on there.

This article is taking a look at what goes on in my brain. You might have some takeaway from this.

An Eye on the 10 Year US Treasury

Honestly, I can be rather myopic on things. Since Manulife US REIT is a rather large holding, I do keep an eye once in a while on some things relating to it.

They are likely to refinance their Figueroa loan (quite sizable based on their loan portfolio) in July. We just do not know when.

There was even a spike up above 2.10%.

So they are rather unlucky in that, if it is a refinance in August, they could refinance, for 5 years at a much better rate! A 30 basis point fall is not very small here.

But you got to practice some gratitude because 1 year ago people are worried about the DPU when they are refinancing at 3.10%.

So it is a matter of perspective.

Anyway, this is the monkey brain. Focus so much on something, that I totally missed my Hong Kong holdings.

Now I am getting a spanking there.

You can look upon it as a Curse or an Opportunity

When there is an uptick of volatility, it tends to send your heart beating faster.

For some wealth builders, this is an opportunity to collect the financial assets such as stocks, unit trust that they been interested in but could not bear to buy at “expensive prices”.

For others, they just made their purchases not too long ago. Some have even invested in a lump sum, made a specific individual stock purchases and are cursing their luck.

Either way, it is how you frame things. Some see this as an opportunity, some see it as a curse.

But it is more than that.

In a behavioral manner, you are affected by how much currently your net wealth is subjected to this “crazy downside”. And this might make it difficult for you to think.

Think about Your System of Building Wealth

Quietly ask yourself if you still remember what kind of game you are playing here:

- Are you a low cost, passive portfolio investor? What is the system you are playing at here? What is the appropriate thing to do in this system at this trigger moment?

- Are you a medium term speculator? What is the system you are playing at here? What is the appropriate thing to do in this system at this trigger moment ?

- Are you a dividend investor? What is the system you are playing at here? What is the appropriate thing to do in this system at this trigger moment ?

- Are you the so-call value investor? What is the system you are playing at here? What is the appropriate thing to do in this system at this trigger moment ?

If you have no idea what you should do at this trigger moment, then you are the game here. Regardless of which wealth building system you choose, there are a few appropriate things to do and not to do.

I tend to run through my head what the hell I am trying to do. Why it should give a good positive risk adjusted return. These days I tend to do that less. This is because I am pretty clear about things.

I have 2 systems mainly

- Core Equity Holdings: Identifying financial assets that gives a positive expected return in the long run

- These are financial assets that I am comfortable in holding

- I purchase at fair value and below if the asset is higher quality

- I purchase at below fair value if the asset is lower quality

- They give a sustainable dividend

- Sell when you realize they are not resilient, or sit on them if there is a good story / momentum to it and watch them closely

- Sell when there is something that is even more core than this asset

- Speculative Holdings: Identifying financial assets that gives a positive expected return in the short run

- They are special situation. You think there is a catalyst soon. For example, a fundamental sound company that have some insider buying or based on the news, some things might be on the move

- Stupidly cheap companies that has no quality. You do not wish to hold them for long. This is because at certain point you can see it turning in the opposite direction. Convert to longer term hold if you realize you made an error in your prospecting

- Earnings and market sentiments

Run this through in your head.

Think about your Net Wealth Allocation

Ultimately, you are putting your wealth in risky assets because for the market risk, you wish to be compensated with higher positive expected return.

This is so that you can build wealth.

Building wealth to achieve certain financial goal.

Be it saving for

- Financial security

- Financial independence

- Your children’s education fund

- Traditional retirement

- Sabbatical in 5 years time

Be aware of that.

In financial planning we call this knowing your time horizon and knowing the amount you need.

How far away from these there are appropriate things to do. For some, just plonk in 100% of all the pay check if you can. For others, you should be de-risking and selling. You may not have taken care of these well.

Some articles to help:

- The Expected Return Model – How You can Refine Investment Decisions, Prospect Stocks Clearly, and Sleep Better at Night

- You Not Only Have Downside Risks. You have Upside Risks as Well

- My Definitive Guide to How Much Active Stock Portfolio Diversification and Concentration You Need

- Taming Portfolio Size Risk

- Execution, Position Sizing and Financially Irresponsible Stock Positions

- How Traditional Portfolio Allocation Strategies Can Alleviate Large Market Plunge Fears

If you have not thought about this, do consider it.

Many folks just look at what I do and think I am incredibly bearish. They failed to put on the financial planning hat and think about why my allocation is this way. (Those seasoned readers would know where I show my portfolio. I will not comment much)

And this is my gripe with the individual stock investor. They tend to think they are know-it-all.

But in truth, they only see the forest most of the time. You cannot blame the individual stock investor. You need a lot of time to get good so that you can have sustainable compounded growth.

However, most of the time, you tend to not take care of the portfolio allocation, or even the financial planning section.

I am almost a near retiree.

And if you understand what a retiree needs at different phase of retirement, you should have an understanding why the portfolio leans closer to the way it is.

I practically wrote a whole section here on what a person planning for retirement should consider. So the answer is deep in there somewhere.

Have that goal in mind. And what are fundamentally sound strategies to reach there. If you have no idea, man I think you need a good financial planner that is competent, have integrity and watch out for your interest

- Low net wealth: MoneyOwl

- High net wealth: Providend (disclosure: I work for Providend)

- Somewhere in between: Wilfred Ling (disclosure: affiliate link)

Think about Past Mistakes

I tend to review in my head some of the things I think I did poorly in the past. I ran through why I did it.

Do I have a fundamentally sound solution to it? If I do not have, that is a grave problem. If I have, think about what I tell myself last time. Is it still valid?

The idea is to have positive expected return over the long run, make more good decisions than poor decisions.

It also means make more fundamentally sound decisions than unsound ones.

One of my past mistake is immobility. This is behavioral.

The solution is to feel the pain. Feel the uncomfortable nature. Be very sure what you are doing is fundamentally sound. Then just keep doing it.

Think about the Lock Step of Investing

This is in the context of individual stock investing.

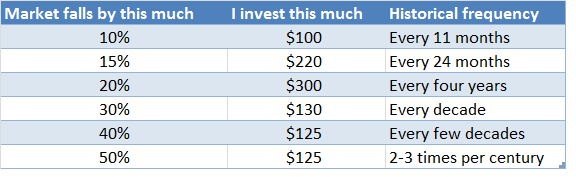

Morgan Housel used to provide this table during his Motley Fool days. It shows an investor how much to invest based on the frequency of market draw downs.

Some frequency of draw down is very long. Some folks spend forever waiting for them. Keep this in mind.

Tend to the Garden

This is in the context of individual stock investing.

Look less upon the gains and the losses.

Frame it as how I can position your portfolio in the best way going forward.

Prevent sunk cost fallacy from setting in.

If my portfolio fall from $1 mil to $700,000, don’t think about the $300,000 realized or unrealized losses.

I only have $700,000. The $300,000 is gone.

But if you don’t position the $700,000 in a way that going forward, it give you a positive risk adjusted expected return, that is even worse.

If based on your wealth building method, these are just volatility, your financial assets is really diversified, then this is nothing.

So I do look at what I wish to be Core and what are Special Situations. What looks more attractive. Then I just sell and buy them. It is hard but try to look less of the losses. It means nothing (unless to evaluate your performance). Just think in terms of tending to the garden, sniping away the weeds, watering the plants.

Review Opportunities

The job of identifying the fundamentals of businesses has to take place before the opportunity arises.

During this period is to find out which is the ones you deploy to and how much. Perhaps also to review if going forward, the fundamentals are intact.

But we are always prospecting, so just keep prospecting, be it good times or bad times.

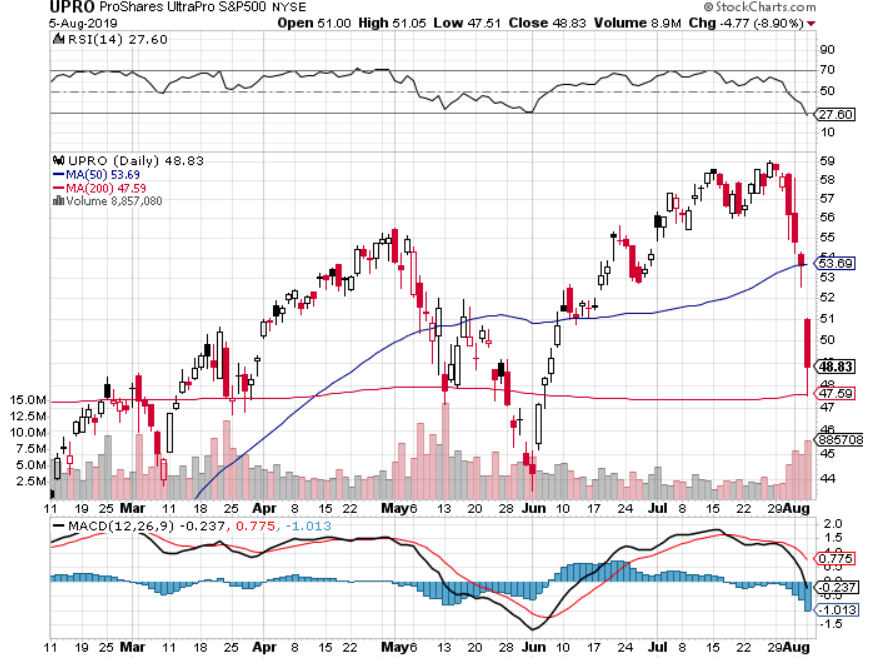

Look at Beautiful Charts

I tend to have an interest now to see what are the instruments that really do well when there is a draw down.

So it is good to indulge in a little side hobby.

So here are some charts.

Ok. Time for work. You can ask questions. I will not comment on my portfolio holdings. Better to ask about portfolio management and financial planning.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

- The LionGlobal APAC Financials Dividend Plus ETF Won’t Give Singapore Investors 5% Dividend Yield Always. Further personal thoughts (with some data). - April 13, 2024

Dirl

Monday 30th of December 2019

Hi Kyith, What do you have in mind to classify for low\high net worth? Low net wealth: $1mil or $2mil? Looking for where do i fall under. ~Dirl

Kyith

Monday 30th of December 2019

Hi Dirl, If your investable assets is 1 mil and above it is considered as high net wealth in my dictionary. Let me know if you need help.

Sinkie

Tuesday 6th of August 2019

USD got a boost on 31st Jul after Fed projected more hawkish that what markets expected. Some are even thinking it's a one & done thing.

Then with Trump trade war tweets on 2nd Aug (Asian time) & CNY devaluation on 5th Aug --- that really whacked USD hard as markets now pricing in greater than expected cuts by Fed in the months ahead.

That's why USD dropped so much in last 3 trading days.