Asia Enterprise Holdings (AEH) is a steel stockist listed on Singapore Stock Exchange. I first got to know it during its IPO, but I classified it with Telechoice as those Singapore smallcaps that earns 5-7% dividend yield.

The thing about these smallcaps is that you do not know whether they would stand up to the test of time.

There are many smallcaps that have been in operation for a long time despite its size. Some names are Boardroom, CEI, SinGheeHuat, Telechoice and GRP. You guys might want to take a look at them.

The business

Steel Stockist like Asia Enterprise Holdings are simply the small middleman between large companies like Keppel, Sembcorp Marine and their demand for different types of steel products. Whatever size of steel products the users look for they deliver.

It is not a very glamorous business and it is a very competitive business. Every body in the industry likely knows everybody. So do the users.

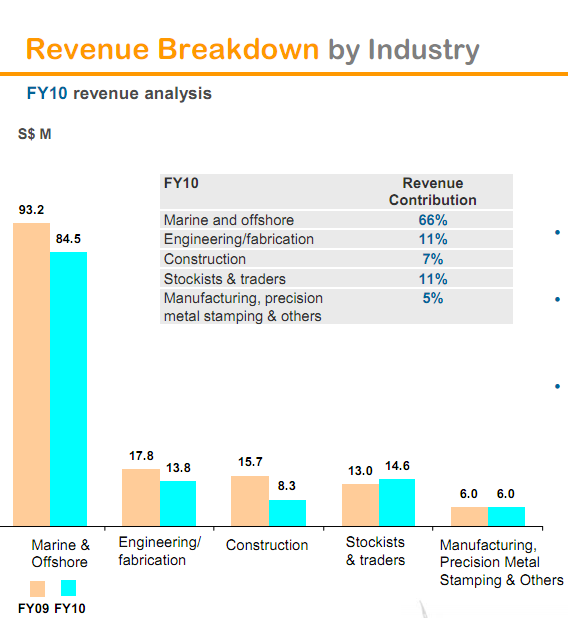

AEH serves a wide range of industry. Even their own competitors. When someone needs to make up for sudden surge in demand they are likely to cross sell to each other. But mainly they serve the marine and offshore industry.

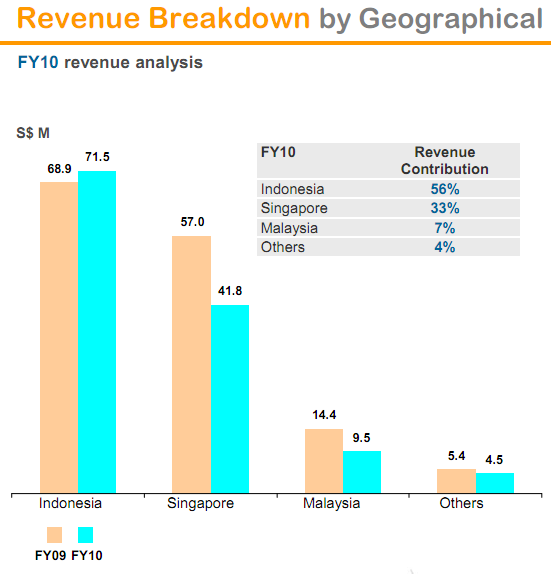

Their client based is pretty diversified, which is a good thing. Here you see that Singapore and Malaysia sales have been tapering off. Wonder how significant that is.

After taking a look at this company, I came to this conclusions:

- AEH will keep humming along if the regional economy hums along.

- A lot of how profitable or not depends on the skills and management of the manager. These guys have been in this business for 35+ years and they never had a unprofitable year. The red flag is when they have one really.

- There is nothing special about what they do. They are just more conservative with the way they manage compare to others.

- You are likely to see your profits and free cash flows fluctuate. They might not be cyclical but their clients demands are. Add to the fact that due to competition, they sell more in some years they sell less in others.

- How much their business is worth at liquidation and whether they are way overvalue can be computed because like commodities business such as Noble, their NAV is made up of 2 components- Cash and Inventories.

Profit, Cash Flow and Margins

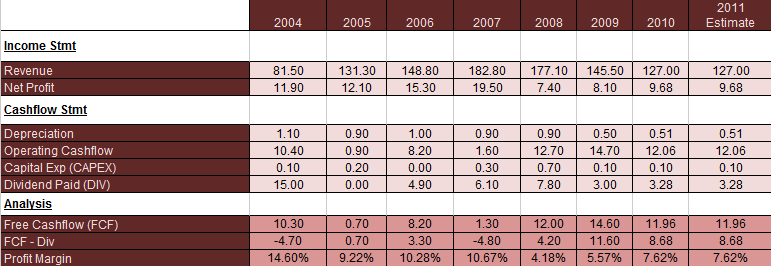

AEH is listed in 2005, but its operating history goes further back then that. They doe state that they have been profitable every year for the last 37 years. Now I am not in this industry so I am not sure how hard that is. But a look at the past 7 years of operation do tell us that they may be telling the truth.

It is worth noting that SinGheeHuat and Lee Metal, which are also in this industry was profitable through this period as well.

The steel stockist enjoyed a great 2004 to 2007 before the recession. Profit was high due to the shipping boom as well. Since 2008, profit have halved and they have struggled to get back to that level.

Depreciation in this industry is low as do capital expenditure. So what it means that profits get paid out as dividends, pay down debts and keep as retain earnings for operations.

You will see that free cash flow differs from profit quite a lot, yet they have little capex. This is because when times are good inventories gets cleared, but when times are not good inventories build up. This affects free cash flow.

You need good working capital management and for AEH their working capital is funded by their cash, so they need to retain a fair bit of it for this purpose.

I would suggest since fluctuation in free cash flow is due to working capital, using net profit to measure the ability to pay dividends is more appropriate. It will take out inflated FCF due to working capital.

AEH’s dividend policy is to pay out 40% of profit to share holders. Payouts have been more than 3 million since the lowest profit hit was around 7.4 million. On a market cap of 82 million that works out to a yield of 3.6%. Not something that would appeal to a lot of income investors.

To earn a 5% yield, they would have to payout 4 million which means a profit of 10 million. That’s not been hit for some time.

The margins have dropped since the 2007 highs, but are steadily climbing back. I n such a competitive business, the growth in margins is probably where we should measure the management on.

Balance Sheet and Valuation

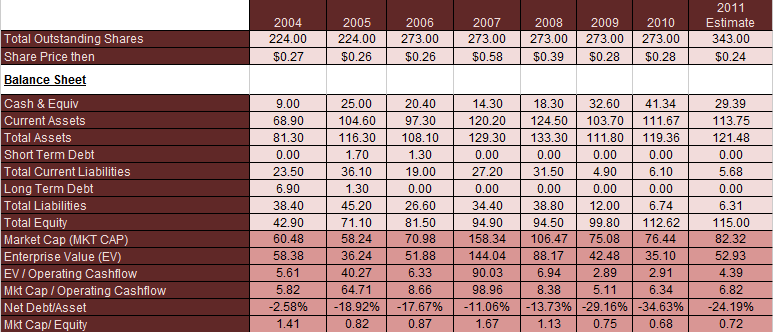

Since IPO, AEH’s balance sheet is characterize by these few traits:

- No debts

- Plenty of cash as working capital

- Inventory as other main assets.

The conservative approach have created a very clean balance sheet.

The Market Cap is around 82 million with 29 million in cash.Total equity is about 115 million. it is made up of 59 mil in inventories, which are steel inventories in various categories. So essentially you are paying 53 million in inventories and receivables.

Since market cap is below book value does that mean this is undervalued?

Not so.

We do have to remember that the book value is as valuable when their underlying assets.

Receivables will eventually be collected as cash. But what about inventories, which makes up roughly the other half?

Assuming the steel inventories are liquidated at 75% of their current price,

RNAV = (115-59) + 59 x 0.75 = 100 mil.

Assuming the steel inventories are liquidated at 50% of their current price,

RNAV = (115-59) + 59 x 0.50 = 85 mil.

Essentially this means that if AEH were to liquidate tomorrow, they are priced as if their inventory can only fetch 50% of their current value.

Where is the margin of safety? is it a 75% liquidating factor or 50%? I would think 50% is good enough margin of safety.

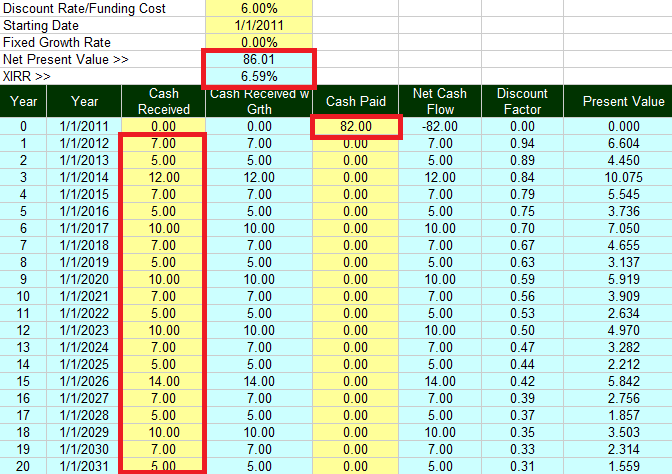

We did a simulation using discounted cash flow with a discount factor of 6% (that is, the opportunity cost of investing in AEH is a 6% REIT investment)

Assuming that net profit earned varies from 5 mil, 7mil, 10 mil and the occasional 12mil, 14 mil, our net present value comes to 86 mil.

There is hardly any safety if we value this way. Now of course we know that out of the 82 million paid almost 35-40 mil is cash and receivables. We could essentially be paying 40-50 million for AEH, in that scenario, the XIRR becomes 13%.

Conclusion

I believe this business is not very sexy, but it is somewhat necessary to the regional economy. The problem is that it is a very commodity based business and the one with the best contacts and lowest cost wins.

I will keep watch on this. If it gets cheaper, I wouldn’t hesitate to get it. Do let me know what you think of this

For those interested in tracking my most current holdings, you can review my portfolio over here. Learn to use our Free Stock Portfolio Tracking Google Spreadsheet to track stock transactions.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

JackNguyen

Saturday 2nd of March 2013

Hi Drizzt,

AEH is one of the first stocks showed up on my value screen when I came over to Singapore last August, so I'd like to make some comment on this stocks.

Using data from Bloomberg, I've collected 10 years financial results of the company to determine it's sustainable free cash flow to calculate an intrinsic value. As reported and adjusted, the FCF for the company is

TTM 2012 (End June): -2.753 mil 2011 : 5.742 2010 : 12.036 2009 : 14.457 2008 : 11.767

Avg : 8.0498

For me I used my unique way to estimated WACC. For the last 4 years, the interest rate on the company's bank debt is 5.35% (median). I assume that cost of equity should be twice this as 10.7% as investors demand higher premium than bank. Given the company's structure, I ended up with a WACC of 10.34%. It is quite an aggressive discount rate, so I think if you apply your generic rate of 6% will give a higher intrinsic value.

My reasoning is that if the company can make to perpetuity this sustainable cash flow, what would be the DCF for it. Coupled with the balance sheet data of how much cash and debt the company currently have, I would say the company is worth around 97.892 mil. This is translated to 0.2863 SGD per share intrinsic value (with 341.917 mil shares)

As of the time analyzed, the share price was about average of 0.2225, which gives you a margin of safety of 22.28%, not an very large discount. At today's price of 0.26, I too believe the share price is around intrinsic value, hence there wouldn't be much upsides.

Thumbs up for your timely divest.

Cheers

Kyith

Sunday 3rd of March 2013

Wow Jack some post. I feel the WACC shows a discount rate of a stock that is risky. I believe there is a certain level of riskiness in this so its almost correct.

Was the bank interest rate that high???

jo

Monday 25th of February 2013

hi drizzt, followed your stock tracker and realised you sold off ur stake in AEH. any reasons for this?

Drizzt

Monday 25th of February 2013

wow, jo you are fast, i just wrote why i sold it. don't worry its portfolio stream lining. I just wanna consolidate some of the lower performing or less sanguine stocks.

Noobie

Thursday 4th of August 2011

Thanks for the info guys, good diversification also IMO, seems like this biz is going to last quite some time too. :)

Drizzt

Saturday 6th of August 2011

Hi Noobie, this business is subjected to rise and fall in profits but we think it will work out in the long run.

GF

Tuesday 2nd of August 2011

I own Boustead as well. Think it has a fantastic moat, great track record and at a fairly reasonable price.

BTW, thanks for this great blog, I get a lot of my data from your research actually.

I'm sitting on a fair amt of Pertama stock, waiting for the delisting to be finalised.

Cheers

Drizzt

Saturday 6th of August 2011

HI GF, i have taken a look at Boustead, its the kind of sleeper stock that I seem to think you will like. Very well diversified and very very clean balance sheet.

I learn alot from readers like yourself but the sad thing is that you have higher conviction in Pertama than i have =(

Should have not wait for a lower price.

GF

Monday 1st of August 2011

Hi Drizzt, IMHO, AEH is a stable good dividend yielding stock. Don't expect any major surprises on the upside, but the fact that they continue to show profitability every year is impressive. i.e. in certain years where the shipping industry was greatly affected (2007). They derive the bulk of their profits from the marine industry, specifically from the indonesian market, yet can manage to stay in the black even in years that are bad for their major clients.

Just 1 more little additional point: the chairman's daughter is the MD. So family members' careers are vested, makes me feel safer.

Recently they declared a stock split, think trying to increase liquidity. I don't agree with that, think its just a waste of good money gone to handle all the administrative issues etc.

Hoping to accumulate further, but only <0.225 My 2 cents worth.

Drizzt

Monday 1st of August 2011

GF, i think they are just good risk managers and traders. I will keep an eye for it to be below 0.225. Thanks for your advice. what other similar stocks can you find that are like AEH?