What are withholding tax?

As an investor, you will invest in a stock, a business, a partnership that is based overseas.

These stocks, business or partnership are incorporated or domiciled in another country. These stocks, business or partnership may declare dividends, interests or capital payments to you as a shareholder in Singapore.

Once the dividends, interest or capital payments exit a specific country there is a withholding tax on these income, dividends, interest and capital payments.

There is no running away from withholding tax. I sort of validate this when I have the privilege to meet the subject matter experts that are recommending offshore investment bonds.

These bonds fulfills a specific tax planning role for expatriates, but also Singaporeans with assets in other countries. I shall not go too much into it.

Understanding withholding tax is something you cannot run away, whether you are a

- individual stock investor

- unit trust investor

- DIY passive index portfolio investor

- Robo- investor

This is particularly confusing if you are investing in a fund that is incorporated overseas. These fund manages a portfolio of stocks or bonds, which declare dividends as well.

So how does the withholding tax picture add up? In my Dimensional Fund Advisers article, I explained in depth. However, I think not a lot of people manage to read to that portion. So in this article I will try to talk specific about this.

Many Countries Withhold Taxes When Money Leaves the Country

I think the best way I find to remember this is that every country, who choses to have a greater than 0 withholding tax, wishes to tax money when it flows out of the country.

So if you think about it this way

- When a China incorporated subsidiary declares a dividend and pays a Singapore parent, there is withholding tax (10% for China)

- A German unit trust owns a Spanish company. When the Spanish company declares a dividend to the German unit trust, there is a withholding tax when the money leaves Spain (20% for Spain)

- A Singapore investor owns a company incorporated in United States. The company pays a dividend to the Singaporean. There is a withholding tax on the dividend

As you can see whether you are an individual stock investor in Singapore, or Hong Kong, or other countries, you are affected. This is because your stock have overseas subsidiary.

As a unit trust or exchange traded fund investor you are affected as well.

Why is Dividend Withholding Tax Important?

A lot of times, the implication means is that you get a smaller dividend.

For example, you have a stock that is domiciled in Spain that is at $50 and it gives a $3 dividend. Your dividend yield would be 6%.

When the money leaves Spain and reaches you in Singapore, your dividend yield will be (1-20%) x 6% = 4.8%.

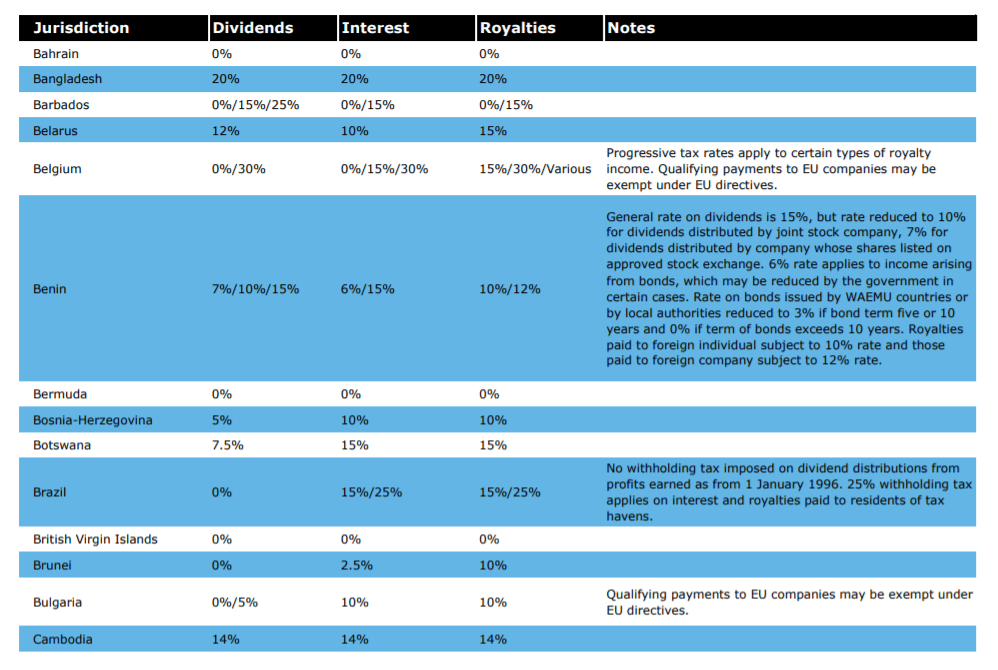

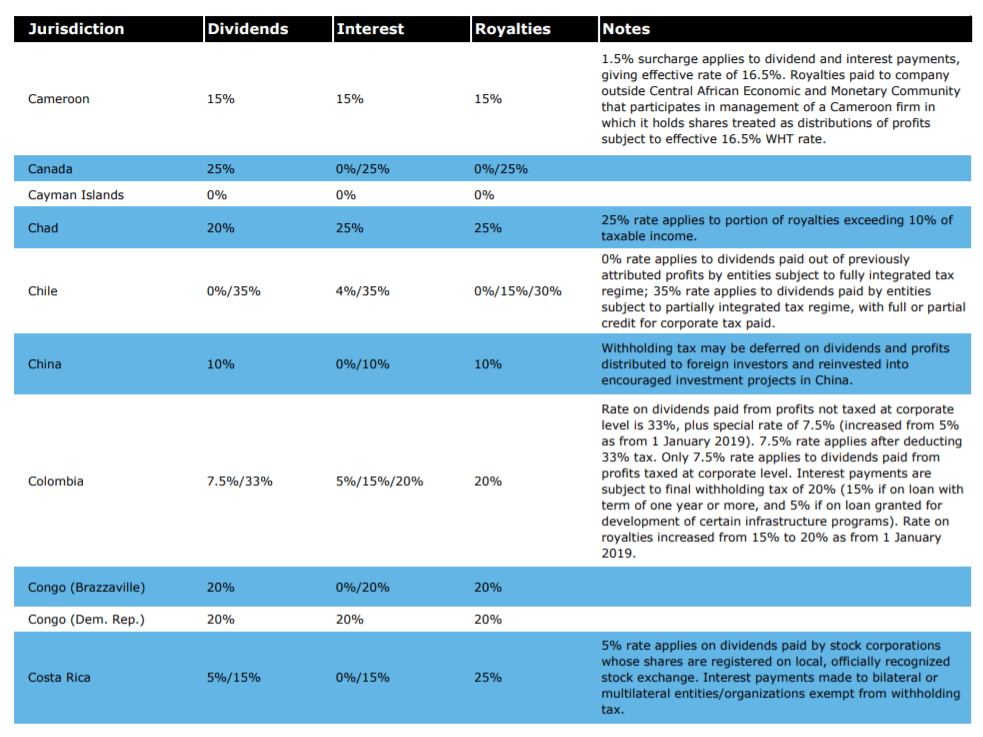

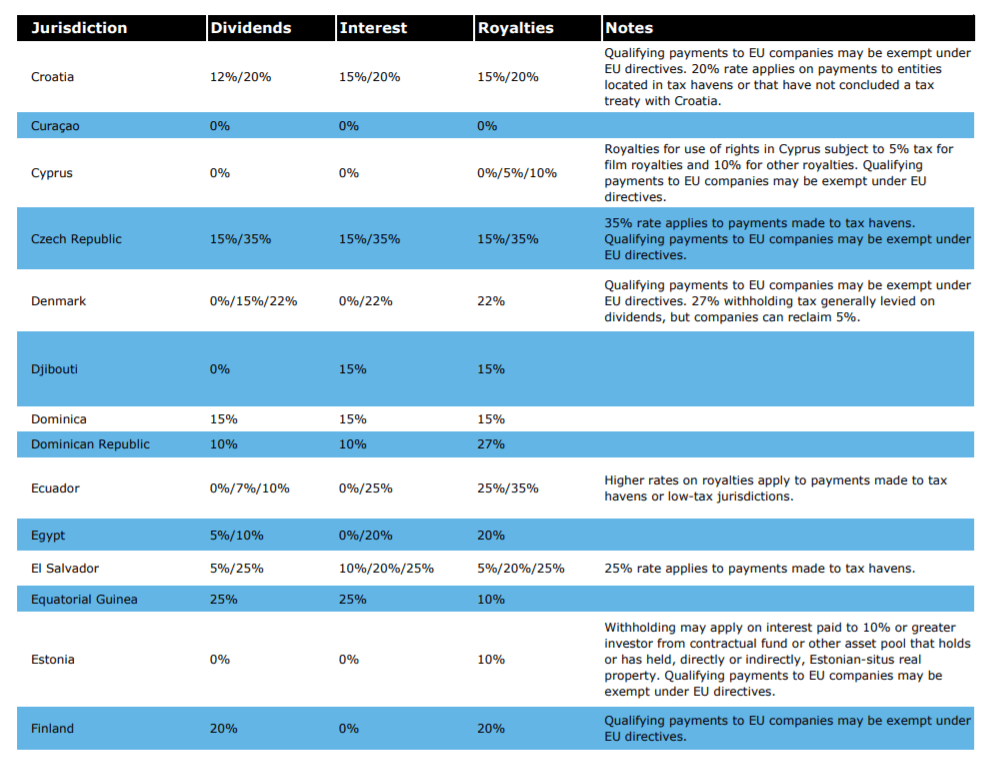

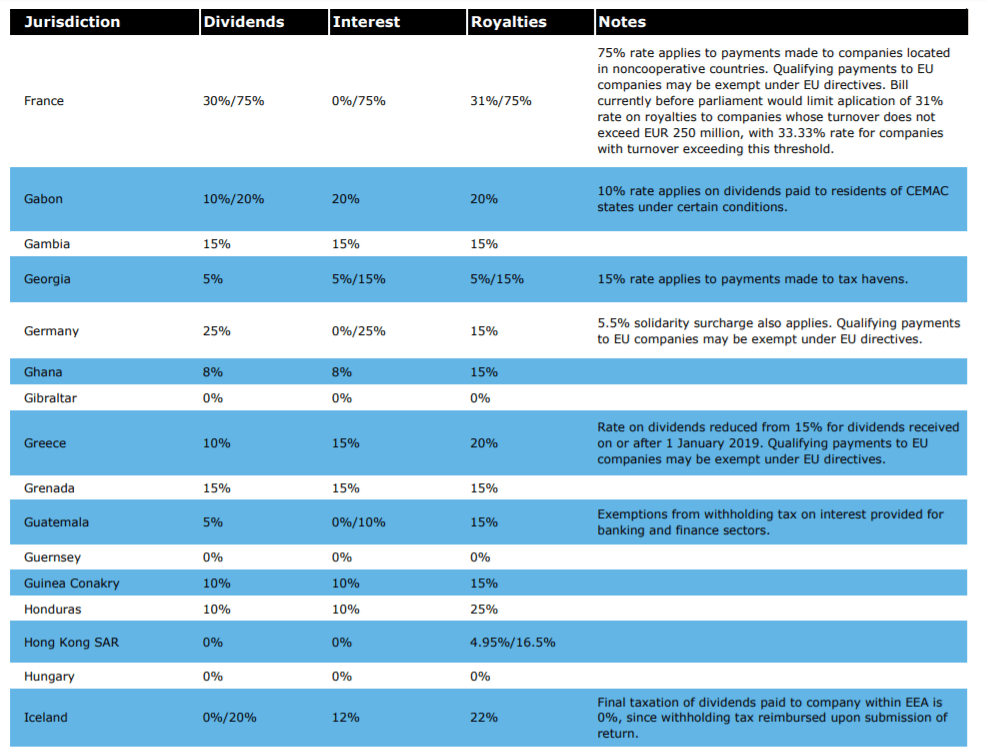

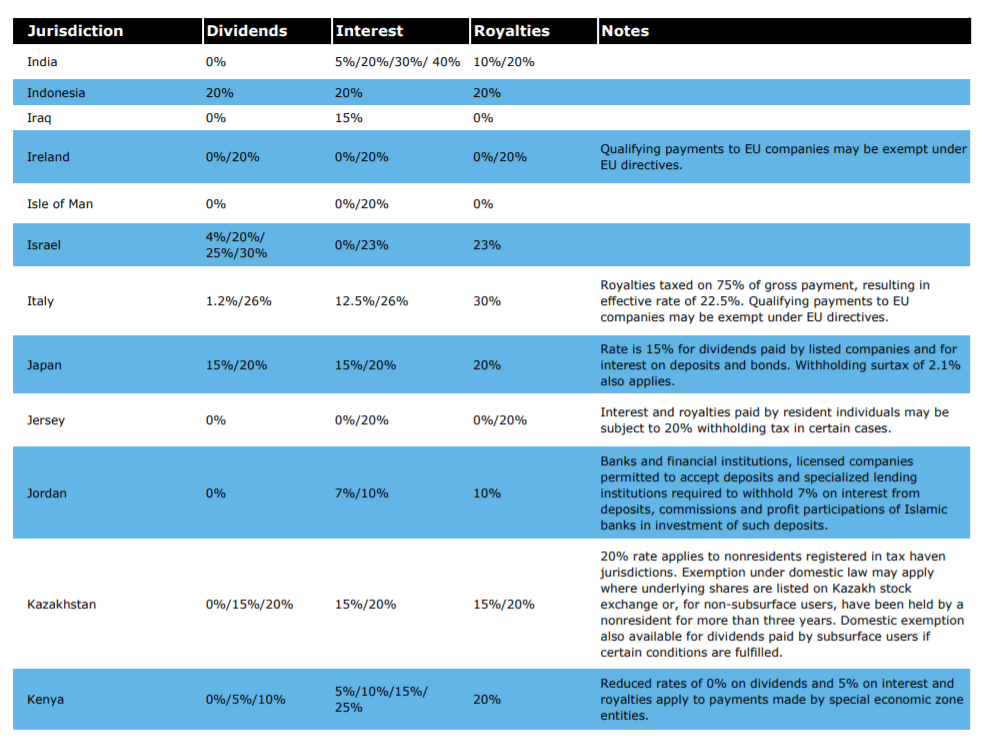

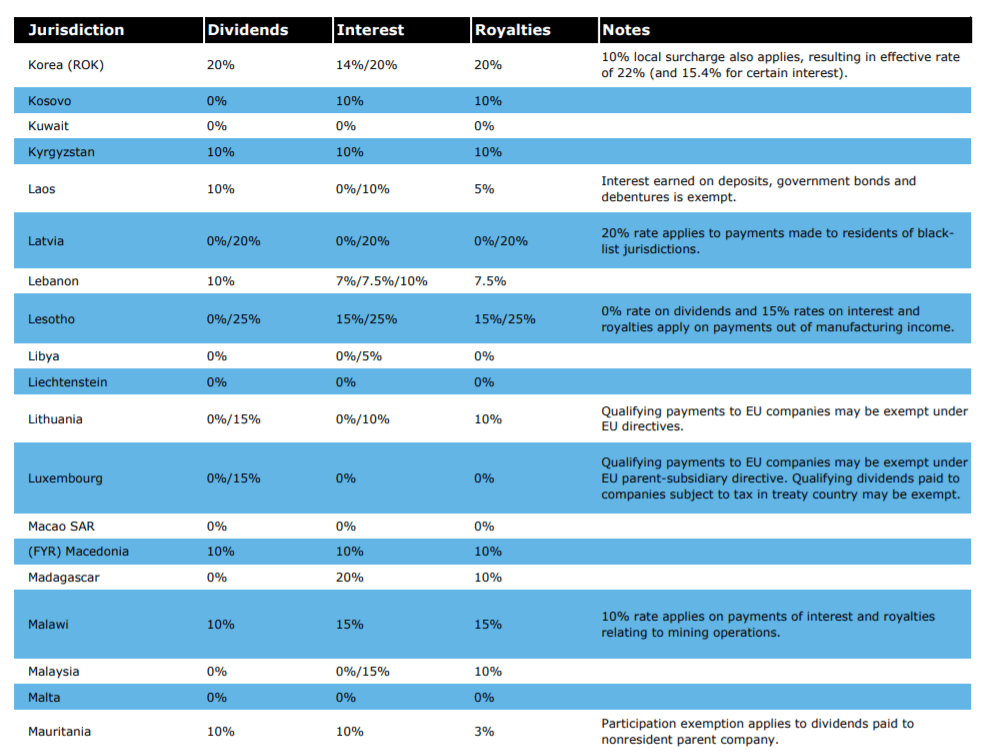

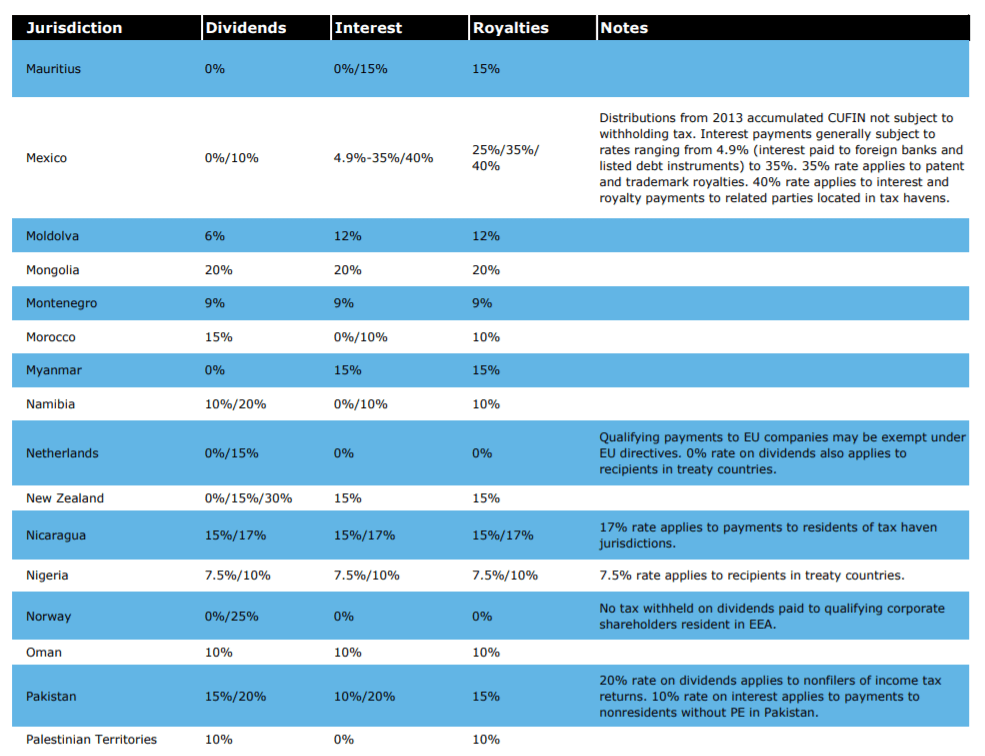

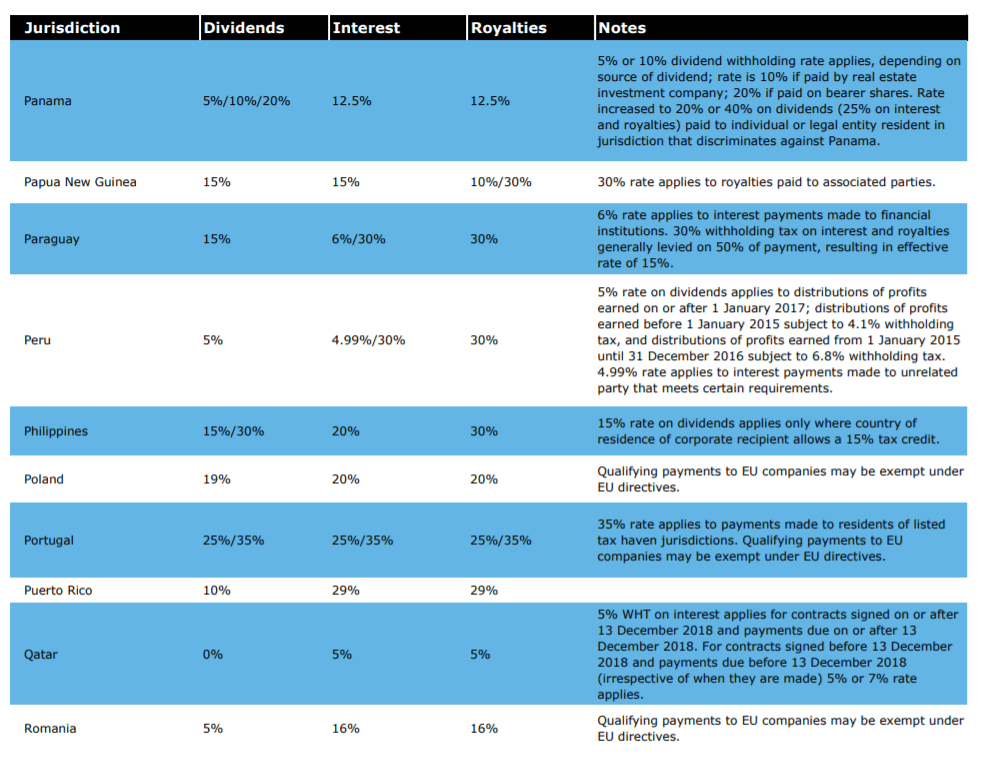

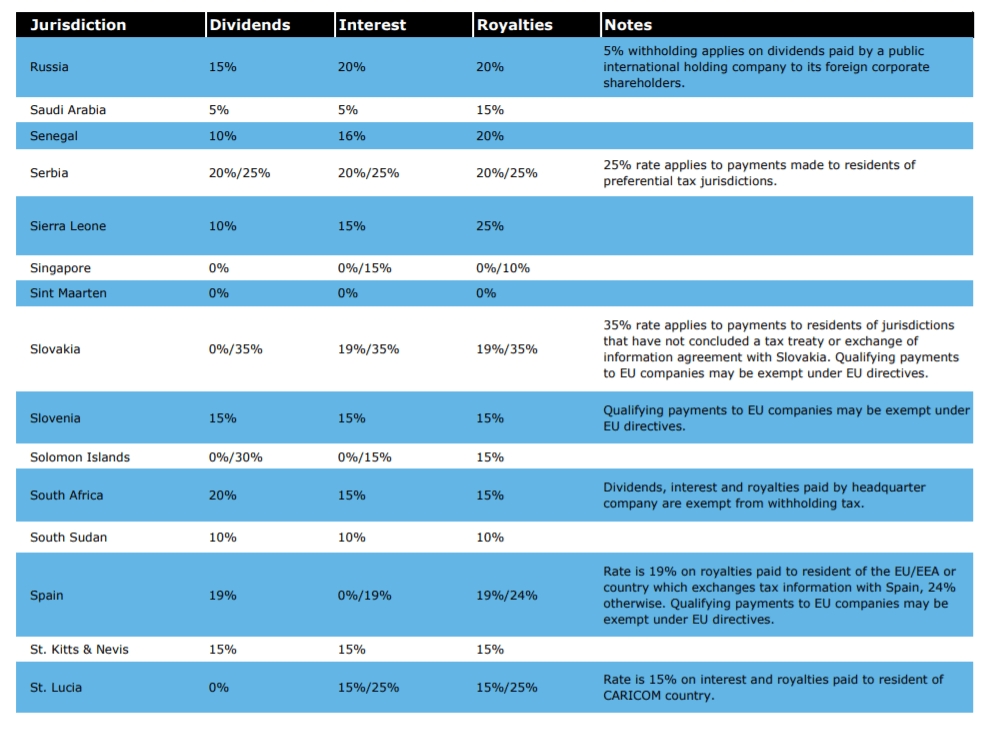

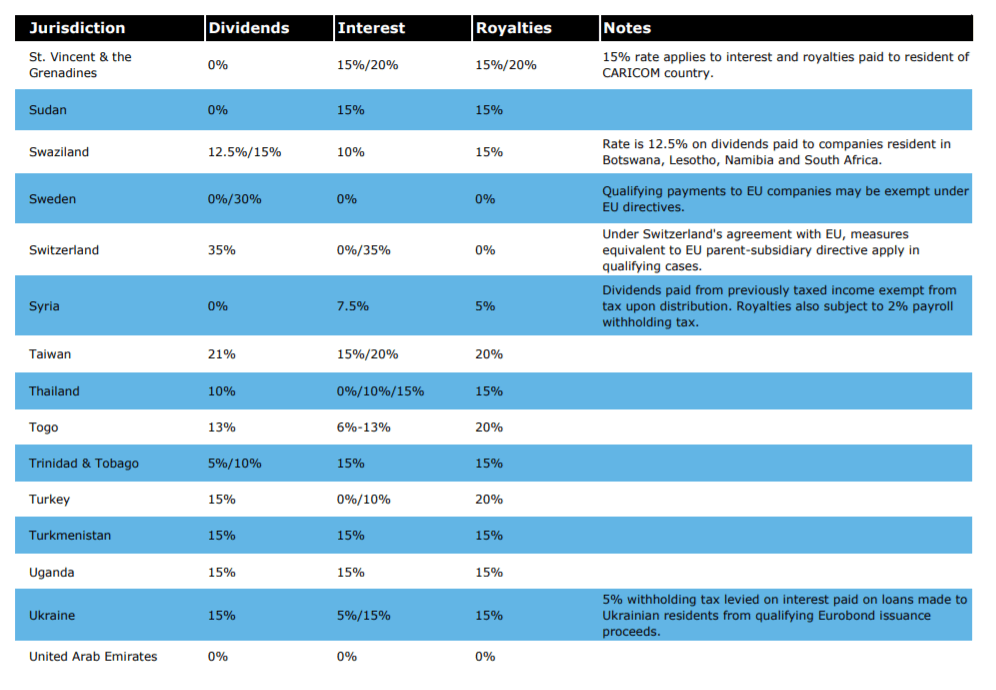

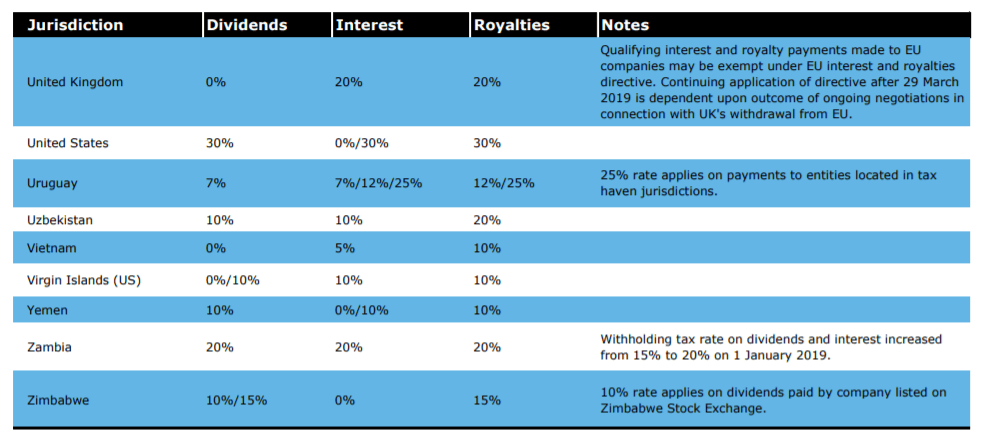

Here is a List of Countries and their Respective Withholding Tax Rates

Each country do change their tax rates from time to time. So as an investor, you can check with the company you are interested to invest in, or you can download the latest withholding tax table.

I find that it is better to check with the company you are interested in.

To help with today’s discussion, here are the latest withholding tax as current as 2019 from Deloitte:

You realize countries have different withholding tax for different kind of payments. There are also different rates if you belong to different country unions or two countries have a dual taxation agreement.

Bermuda is like one of the tax haven. You will realize a lot of listed company are incorporated in Bermuda. Their withholding tax is so friendly (0% for all). Barbados is also one.

Recall the USA REITs Manulife US REIT and Keppel KBS all switched to a Barbados based structure when the 2017 Tax and Jobs act was announced. (Explained more in detail here)

Singapore is pretty friendly as well.

Switzerland’s withholding tax is obscene.

The Domicile of the Company Determines the Dividend Withholding Tax Rate. Not Where the Company is Listed. Same for Unit Trust and ETF

One thing that bamboozled a lot of investor is that they think that all the stocks listed in the United States are automatically subjected to a 30% withholding tax (which is the withholding tax for United States)

The way to remember is where the company is domiciled or incorporated.

It means where this company calls its home.

A good example is Royal Dutch Shell ADR. The American Depository Receipts (ADR for short) is a scheme that can easily allow an American to own a foreign stock like Royal Dutch Shell.

The US investor can buy this Royal Dutch Shell ADR listed in a United States stock exchange.

As a Singaporean, you can also invest in Royal Dutch Shell ADR listed on the United States stock exchange. So how much withholding tax do you have to pay?

Royal Dutch Shell is incorporated in UK but is a tax resident of Netherlands. You can check out the company website to find out more.

Based on this the withholding tax you pay is 15%, and not the United States withholding tax.

How do we tell where a Stock or Fund is Domiciled or Incorporated?

In the section before, Royal Dutch Shell ADR is incorporated in UK but calls Netherlands a tax resident.

The best way is to check with the company you are interested in, browse the website.

If not most of the time finding out where the company is incorporated or domiciled. Usually, the annual report or financial statements will show it.

Ping An Insurance is a Chinese stock listed in Hong Kong Stock Exchange. The withholding tax in Hong Kong is 0%. In China it is 10%.

A look at Ping An’s financials will show us that this company is incorporated in China. There is likely a 10% withholding tax on Ping an’s dividend.

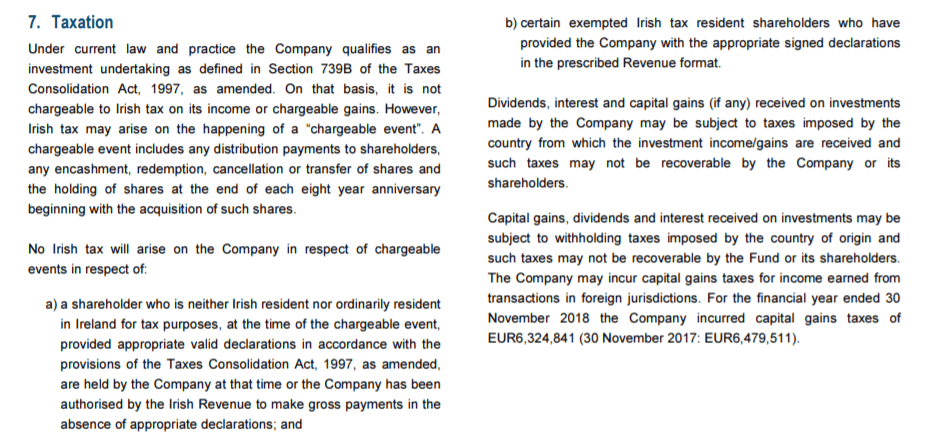

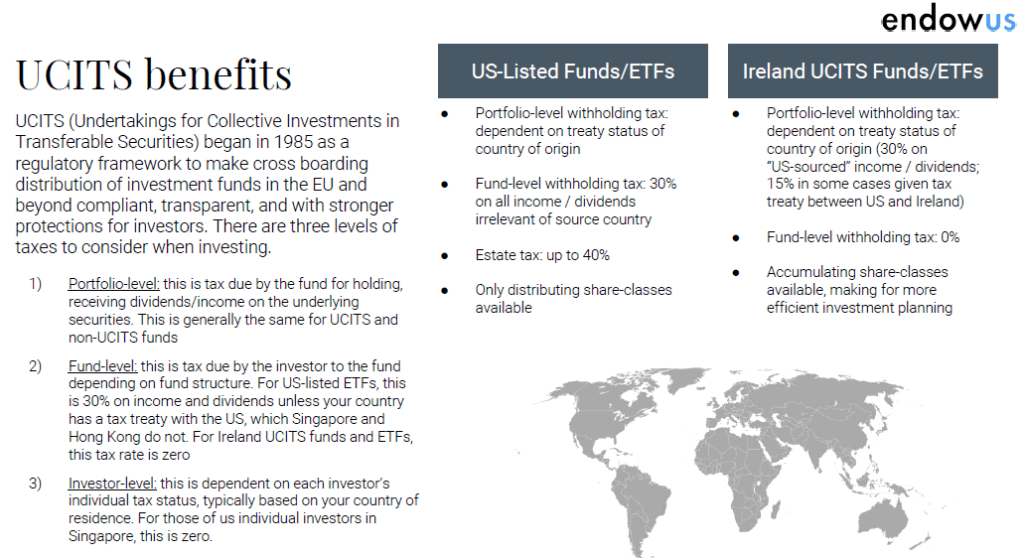

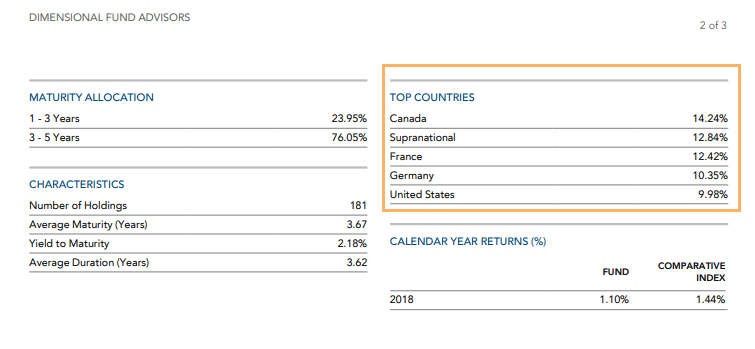

The above is extracted from Dimensional’s annual report for their funds. Dimensional funds invest in stocks and bonds from all over the world but they are incorporated in Ireland.

A review of their annual reports will show you where they are incorporated in and whether there are any withholding taxes.

Does Dual Taxation Treaties Change the Amount of Dividend Withholding Tax Charged??

You will observe that for some countries, there exist a dual taxation treaty. This enable you to enjoy a relief from getting tax in both countries.

The common ones that I encounter that affects some of the investors here are:

- For those investors with ETF or unit trust domiciled in Ireland. These ETF and unit trust would own a basket of stocks, with some stocks in the United States. There is a dual taxation agreement between United States and Ireland. Thus, the dividends withheld is 15% instead of 30% when the dividend exit United States to Ireland

- For those who purchase unfranked stocks in Australia, they are taxed at 15% instead of 30% due to a dual taxation agreement between Australia and Singapore

Unpacking the Withholding Tax on Exchange Traded Funds and Unit Trust

One of the reason I wrote the original post is to illustrate the advantage of Dimensional funds that are domiciled in Ireland. They are more tax efficient, when it comes to dividend withholding tax and estate duty/inheritance tax.

This fund dividend tax thing can be rather confusing and in this section I will try to explain it.

The investors who are affected are:

- If you purchase an exchange traded fund (ETF) that is listed and domiciled in the United States. This ETF pays out a dividend. We know that United States have a withholding tax of 30%

- If you purchase an ETF that is listed in UK and domiciled in Ireland. This ETF pays out a dividend or accumulates the dividend within the fund. Ireland has a 0% withholding tax

- If you purchase an unit trust like Dimensional funds that is listed in UK and domiciled in Ireland. This ETF pays out a dividend or accumulates the dividend within the fund. Ireland has a 0% withholding tax

How much withholding tax in total do you pay?

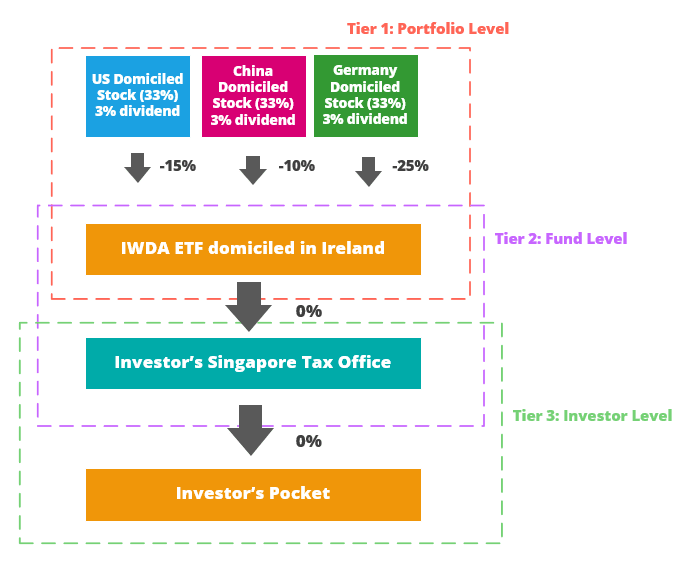

There are many layers of withholding tax. I think it is better to explain in a diagram.

The most prevalent investing method for funds are:

- DIY Investing: Buy 1 to 4 Low Expense Ratio ETF listed in United States

- ETF is domiciled or incorporated in United States (30% withholding tax)

- Both Equity and Bonds

- Covers the whole world

- DIY Investing: Buy 1 to 4 Low Expense Ratio ETF listed in London

- ETF is domiciled or incorporated in Ireland (0% withholding tax)

- Both Equity and Bonds

- Covers the whole world

Based on the withholding tax, you would think that #2 is a better choice than #1. I think it is. But it is important that you understand the mechanics involved.

Let us use 2 prevalent ETF to illustrate:

- Vanguard Total World Stock ETF (VT) listed in United States

- iShares Core MSCI World UCITS ETF (IWDA) listed in London

#1 matches #1 in the DIY Investing I mentioned in the previous list. #2 matches #2 in the previous list. These two funds are equity funds that seeks to cover the large cap stocks in the world. So you will get a very diversified portfolio.

Suppose we take it that for these 2 funds they are made up of 3 stocks domiciled in 3 different countries. These 3 stocks all give a dividend of 3% before withholding taxes:

- US Domiciled Stock – 3% dividend – 33% of fund

- China Domiciled Stock – 3% dividend – 33% of fund

- Germany Domiciled Stock – 3% dividend – 33% of fund

How to think about the different layers of withholding taxes considerations

There are many layers of withholding taxes considerations.

In the eyes of the professionals they look at it in 3 different layers:

- Tier 1: Portfolio Level

- Tier 2: Fund Level

- Tier 3: Investor Level

You will hear them say they are taxed at Tier 1 and not taxed at Tier 2. To me that sounds all that confusing.

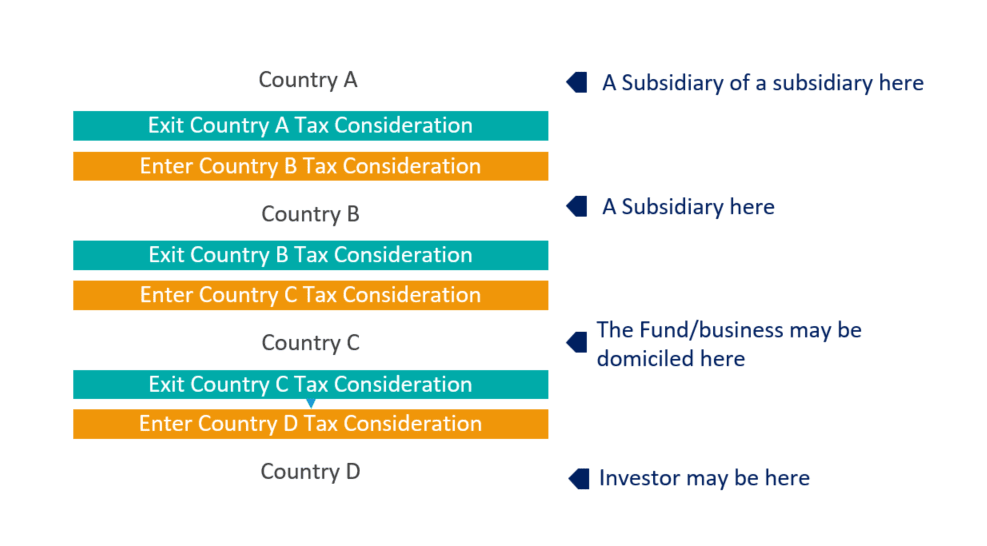

The idea is to think in terms of gateways. Every time when money leaves a country, there is a withholding tax consideration. Also when money enters a country, there is a certain tax consideration (this is probably not withholding tax but how your country chooses to tax foreign sourced income)

It would look something like this:

As an investor you may live or domiciled in Country D. suppose you own a stock listed in Country C with a subsidiary in Country B, which owns another subsidiary in Country A.

At every point there is an exit withholding tax consideration. At every point when cash flow is coming in, there may be a foreign sourced income consideration.

Typically, foreign sourced income entering a country is less of an issue. The focus tends to be on money leaving. Government are more concern about ensuring money just don’t flow out like that without some form of “control”

Let us go through the two examples with VT and IWDA.

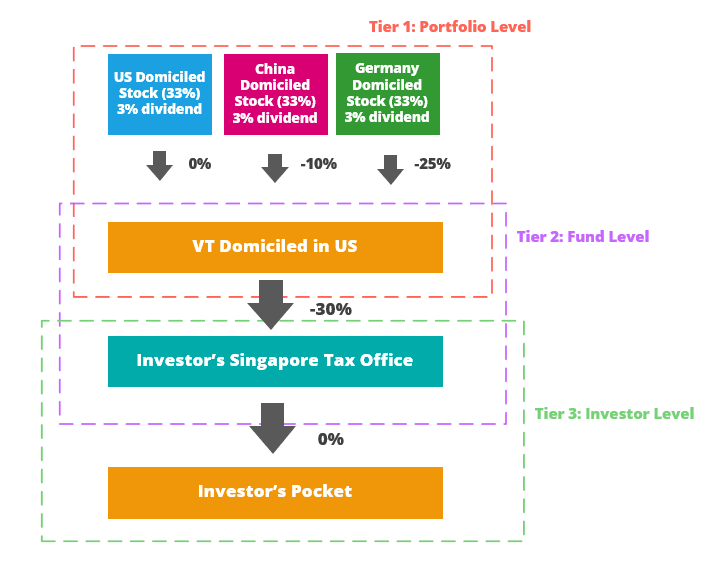

Vanguard Total World Stock ETF (VT) Case Study

The illustration above shows the taxation at different levels.

Since VT is domiciled in US, when the dividends from the US stock is paid to the fund, there is 0% withholding tax. There are however 10% and 25% withholding taxes for the China and Germany stock.

At the fund level to the investor’s tax office in Singapore, there is a 30% withholding tax.

Since Singapore currently do not tax on investor’s foreign sourced income, there is 0% tax when the investor receives the dividend finally.

So this works out to:

- US dividend: 3% x (1- 0.0) x (1-0.30) x (1 – 0.0) = 2.1%

- China dividend: 3% x (1- 0.10) x (1-0.30) x (1 – 0.0) = 1.89%

- Germany dividend: 3% x (1- 0.25) x (1-0.30) x (1 – 0.0) = 1.575%

- Overall dividend: 1.836%

- Dividend withholding tax cost: 3%-1.836% = 1.163%

The mileage would vary depending on the size of the average dividend, and the composition.

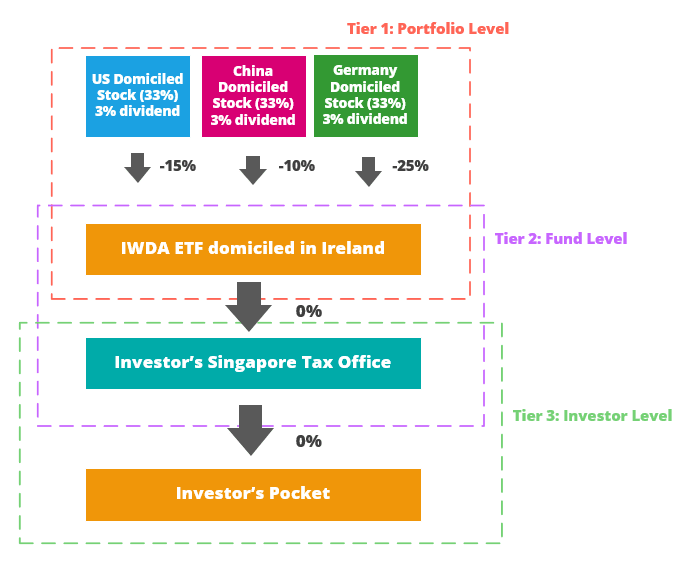

New let us look at IWDA’s situation

iShares Core MSCI World UCITS ETF (IWDA) Case Study

IWDA is domiciled in Ireland, when the dividends from the US stock is paid to the fund, there is 15% withholding tax. Withholding tax on dividends in China is 10% and withholding tax on dividends in Germany is 25%.

Typical dividend withholding tax for United States domiciled companies is 30%, so why is the withholding tax only 15%?

This is because there is a dual taxation treaty between United States and Ireland.

Thus on US, they only withheld 15% of the dividends for taxes.

So this works out to:

- US dividend: 3% x (1- 0.15) x (1-0.0) x (1 – 0.0) = 2.55%

- China dividend: 3% x (1- 0.10) x (1-0.0) x (1 – 0.0) = 2.7%

- Germany dividend: 3% x (1- 0.25) x (1-0.0) x (1 – 0.0) = 2.25%

- Overall dividend: 2.475%

- Dividend withholding tax cost: 3%-2.475% = 0.525%

IWDA in this regard, and for the Irish domiciled ETFs, should be the most tax efficient.

Dividend Withholding Tax is just One Evaluation

It is important to realize that optimizing the withholding tax you will need to pay is important. However, you have to weigh other considerations as well:

- The expense ratio (while US may be withholding tax inefficient, their ETF, due to their size may have lower expense ratio)

- Tracking error to the index (Some more liquid ETF and exchanges may have lower tracking errors

- The difference in the funds you are going for. You may lean towards certain investing philosophy

- Dividends, might be a small proportion of the overall total return for the fund!

- You have to consider the estate duty/inheritance/ death tax should you passed away

#5 tends to be a major component to think about and not easily bypass (But there are ways. Shall not discuss too much here)

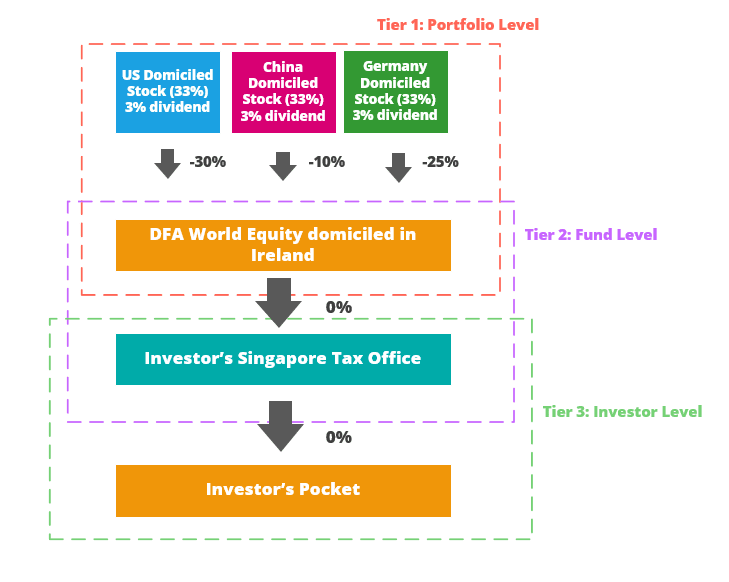

Dimensional World Equity Fund Case Study

This is not in the realm of discussion but since I already done the work, I might as well put it here.

The local Dimensional funds you can purchase through MoneyOwl, Providend, iFast and GYC financial are domiciled in Ireland.

In a way, their withholding tax treatment is pretty similar to IWDA since both are domiciled in Ireland and their portfolio covers the world.

The illustration above shows the taxation at different levels. Since DFA funds available for Singaporeans is domiciled in Ireland, US withheld 30% of the dividend, China withheld 10% of the dividend, Germany withheld 25% of the dividend.

At the fund level to the investor’s tax office in Singapore, there is 0% withholding tax, since Ireland currently do not have withholding taxes.

Since Singapore currently do not tax on investor’s foreign sourced income, there is 0% tax when the investor receives the dividend finally.

So this works out to:

- US dividend: 3% x (1- 0.30) x (1-0.0) x (1 – 0.0) = 2.1%

- China dividend: 3% x (1- 0.10) x (1-0.0) x (1 – 0.0) = 2.7%

- Germany dividend: 3% x (1- 0.25) x (1-0.0) x (1 – 0.0) = 2.25%

- Overall dividend: 2.326%

- Dividend withholding tax cost: 3%-2.326% = 0.6735%

You will notice a difference between IWDA and the Dimensional fund. The United States withholding tax is 30% instead of IWDA’s 15%.

But both are domiciled in Ireland.

Why is there such a difference? I have no idea. I guess that is how its treated because the structure of ETF and unit trust in Ireland is different. One is a fund while the other is business.

This is why these tax stuff can drive you up the wall.

DFA funds available to investors are UCITS funds and they have certain advantages to guard investors interest.

The Handling of Withholding Tax on Interest Income – Prevalent in Bond Funds

How much interest income withholding tax the fund is subjected to depends on the withholding tax on interest income in each country.

In the early section, you can see for each country there are different treatments to dividends, interest and royalties possibly.

In the USA, exchange traded funds that generate qualified interest income and short-term capital gains, may be exempted from United States withholding tax when distributed to non-US holders.

The US Tax law permits a regulated investment company (“RIC”) to designate the portion of distributions paid that represent interest related dividends (normally known as qualified interest income) and short term gain dividends as exempted.

- you need to be a regulated investment company and provide proper documentation to qualify. Thus, DIY investors would not be exempted

- bond interest income from USA bond generally are exempted from dividend withholding tax

Here are some examples:

- for US Government Bond ETFs, typically 100% of the interest income qualify as Qualified Interest Income. One example is the iShares 10-20 year Treasury Bond ETF (TLH) used by Stashaway

- for US Corporate Bond ETFs, perhaps only 70-80% of interest income qualifies as Qualified Interest Income. One example is the iShares IBOXX Investment Grade Corporate bond ETF (LQD)

- for international bond ETF domiciled in USA, the Qualified Interest Income may not be applied at all. One example is the iShares International Treasury Bond ETF (IGOV) used by AutoWealth

For those funds or ETF domiciled in Ireland, the USA bonds are subjected to withholding tax and that could be 30% or 15% depending on whether it is a fund or ETF.

Do remember, while USA have been a popular discussion, the withholding tax treatment for other countries will mean that there may be withholding tax incurred there, which might be more or less than the United States withholding taxes.

The above is taken from Dimensional Global Short Term Fixed Income fund. The United States portion constitute 10% of the fund. You would have to contend with the interest income withholding for Canada, France and Germany as well for example.

What if your Fund is an Accumulating Fund? An Accumulating Fund does not Pay Dividend to You. So do You have to Pay Dividend Withholding Tax on it?

The fund might not pay out a dividend to you. However, the underlying companies, owned by the fund, still pay a withholding.

IWDA is an accumulating ETF, which does not distribute dividends. But the underlying companies owned by the ETF will still get their dividends reduced.

Conclusion

Lastly, do not treat what I wrote as gospel.

A lot of work went into this through

- What I researched myself

- What others who are interested in investing researched

- Other investors’ experiences

- My experiences

- What I can find out from my peers in the industry who I am grateful for to share

Let me just say…. even those in the investing industry… they are also trying to figure this out.

And your own personal situation may be different from mine or the general public.

This is why you would never get very clear cut answers about these stuff. The motherhood statement is Consult your Tax Adviser.

But to get started, you got to have a blue print to start going down the rabbit hole. So I hope this is enough.

If you have more to volunteer, do let me know.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

- The LionGlobal APAC Financials Dividend Plus ETF Won’t Give Singapore Investors 5% Dividend Yield Always. Further personal thoughts (with some data). - April 13, 2024

ry

Thursday 11th of February 2021

hi Keith,

Thank you so much for writing this. Currently, as non-us investor, im stuck btw choosing between 2 funds, USSC and AVUV. This is because of the tax benefits vs TER difference. How would you suggest i estimate this....? In short, would the tax benefits outweigh the TER...?

AVUV TER 0.25% US domiciled

USSC TER 0.30% Ireland domiciled

ry

Tuesday 16th of February 2021

sorry, edited for clarity

@Kyith, Hi Kyith!! your response means a lot, thanks for this haha. Yes! More of your thoughts on UCITS funds would be awesome due to the tax advantages for non-us residents. Currently i’ve been looking at SWRD/EIMI/ZPRX/USSC/IWVL/WSML/JPGL. These are UCITS funds with factor tilts and TER <0.50%).

Thanks for raising estate tax; something i have not considered… Perhaps, this could be resolved with a trusted friend/spouse/family member maybe…?

Yah, thanks to your blog, i deployed the swrd+eimi combo approx Aug 2020. Now, i realize i want some small cap/value tilts hence this dilemma….

Yes what I’ve read agrees with your graph. Avantis execution is different which results stronger value tilts vs USSC and possibly explains the outperformance even with WHT gaps.

Since we know the div yield, USSC = 1.55% and AVUV = 1.92% (link below)…. How unreasonable would it be to add 0.28 bps (15%*1.92) to AVUV’s TER so we could better compare as below…?

AVUV TER 0.53% (0.25+0.28) 30% wht US domiciled

USSC TER 0.30% 15% wht Ireland domiciled

Russell 2000 value below https://research.ftserussell.com/Analytics/Factsheets/Home/DownloadSingleIssue?issueName=US2002USD&IsManual=true

Kyith

Saturday 13th of February 2021

Hi ry, nice to see a fan of small cap value! I should do more work on the SPDR UCITS etf. there are 2 levels of withholding tax. for the first level, the stocks should not pay a dividend withholding tax to AVUV since it is US to US. the stocks should pay a 15% dividend withholding tax to USSC since it is domciled in Ireland and Ireland and US have a double taxation treaty. On the second level which is from the ETF to you, there should be a 30% withholding tax on AVUV to you, but no withholding tax from USSC to you.

I am not sure about the impact but the yield on USSC is 1.55%. I suspect this is after the 15% withholding tax on the first level. I am not sure Avantis dividend yield. Overall 5 basis points may not be that big of a difference such that it is a deal breaker. perhaps more important is the execution difference between avantis and SPDR's MSCI methodology that will be a bigger difference.

The bigger risk is that your assets in US is subjected to US estate tax laws which could be up to 40% of the US assets. This is a bigger uncertainty which made me favor the UCITS one despite higher cost.

Lastly here is a chart of the performance difference between the two

Feels like the difference will be more than the methdology

John Smith

Sunday 7th of June 2020

Hi Kyith, as long as the company is incorporated in a tax-free country (eg Bermuda), does that mean all dividends are not subject to dividend withholding tax?

I'm am looking at Brookfield Infrastructure Partners and it seems like the dividends are taxed even it is incorporated n Bermuda. https://bip.brookfield.com/en/stock-and-distribution/tax-information

For Australians and Europeans they state the following - Historically, our partnership’s income has included Canadian and US source interest and dividends earned from subsidiaries that, when paid to a European unitholder, are subject to varying rates of U.S. and Canadian withholding taxes ranging from nil to 30%.

Does that mean Singaporeans will get taxed as well?

Kyith

Sunday 7th of June 2020

HI John, there are a few parts to the dividends. I have not gotten my dividend yet but i suspect it will not be tax. We are just not sure about the leakage there. And the problem is a lot of these companies, they do not wish to venture into explaining the tax implication to specific people. This means it is messy enough. Brookfield Infrastructure have recently incorporated a corporation. That will most likely pay a 15% dividend withholding tax.

>or Australians and Europeans they state the following – Historically, our partnership’s income has included Canadian and US source interest and dividends earned from subsidiaries that, when paid to a European unitholder, are subject to varying rates of U.S. and Canadian withholding taxes ranging from nil to 30%.

This most likely means some of the taxes cannot be avoided.

Marco

Friday 5th of June 2020

Hi Kyith, Great article, I finally found some good information about this topic for which I dug around internet a lot. I have a question that I still cannot find an answer, and is, does the stock exchange where the ETF is traded makes a difference in taxation for dividends? And if i can ask also, does it impact instead on the taxation when ETFs or stoks are sold for a profit. Thank you Mark

Kyith

Sunday 6th of September 2020

Hi Mark, the taxation follows where the fund is domiciled. If the fund is listed in the London Stock Exchange yet the fund is domiciled in Ireland, it follows the Irish tax codes for UCITS funds. As for the second question, I think there should not be capital gains tax but if you are living in Europe as a European, what I understand is that the situation may differ. This is because certain European countries have foreign-sourced income taxes.

Adrian

Sunday 10th of May 2020

Hi Kyith

Just wondering why the overall dividend in all your examples are not the average of the 3 dividends? Since all 3 has equal weighting of 33%, the dividend should be average right? So for the below example in your article, isn't it 1.855% instead?

US dividend: 3% x (1- 0.0) x (1-0.30) x (1 – 0.0) = 2.1% China dividend: 3% x (1- 0.10) x (1-0.30) x (1 – 0.0) = 1.89% Germany dividend: 3% x (1- 0.25) x (1-0.30) x (1 – 0.0) = 1.575% Overall dividend: 1.836%

Kyith

Sunday 10th of May 2020

I just use 2.1 x 0.33 + 1.89 x 0.33 + 1.575 x 0.33

Pietro

Monday 13th of April 2020

Hi Kyith, Thanks for the article. When investing in us equities etfs, wouldn't it be ideal in terms of dividend taxation for foreign investors to invest in US domiciled accumulating etfs (since at the fund level no dividend taxation would occur)? Do such etfs exist?

Kyith

Monday 13th of April 2020

HI Pietro, there is no difference between accumulating and distributing funds. imagine that we have both the accumulating and distributing version each with 50% in USA stocks and 50% in China stocks. When the USA and China companies pay dividend to the accumulating and distributing funds, the united states stocks are subjected to 30% withholding tax and China 10% withholding tax.

It is just that the accumulating funds do not pay out a dividend to you.

so when you sell it, you do not pay taxes.

In a way you are right. I have not pay attention to this. There are a lot of ETF out there. There would be those that do not distribute dividend on the ETF levels.