Starhub, First REIT and Aims Amp Industrial Trust on my portfolio (view my current holdings here) have been on a tear. To be honest I thought they would under perform the market but the rise is nice.

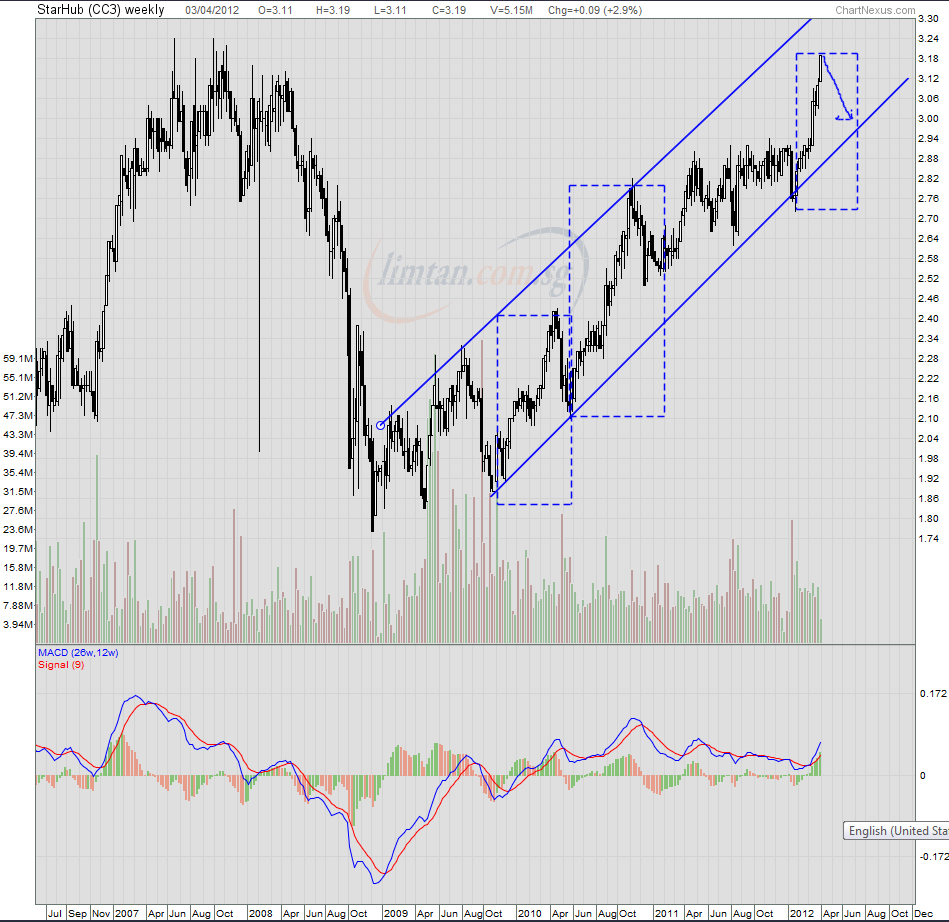

Starhub is in a very nice upward channel long term wise. It has now breached its 2008 highs of 3.13. In this channel, there are corrections almost half the size of the climb. If you want to get invested at lease wait for the pull back.

The same can be said of First REIT as well. Clear pullbacks to the 43 week moving average, which will bring it back to my purchase price (gasp! think of the profits that I would have missed out)

However I believe my average price isn’t terribly cheap, the value is fair. Now with the run up the dividend yields do not look as good. In fact most of the stocks on my dividend stock tracker have yield compression since they all run up.

In the case of Starhub the yield is just 6.27% which still beats fixed deposits by a lot. For First REIT it was compressed from 8.2% to 7.2%.

We don’t see a rise in volume or that any substantial shareholders getting invested so I don’t feel a strong justification of the overseas fund flows injection theory.

Do we expect to see any earnings upgrade? I don’t think so as well. We won’t be expecting large earnings changes.

I run a free Singapore Dividend Stock Tracker . It contains Singapore’s top dividend stocks both blue chip and high yield stock that are great for high yield investing. Do follow my Dividend Stock Tracker which is updated nightly here.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

SnOOpy168

Wednesday 11th of April 2012

Both I will be holding as the yield are fantastic. Just that couldn't add more at these prices and that I hoped Starhub won't buy back my shares in CDP a/c leaving me with some odd numbers (ending with 580 shares).

Drizzt

Wednesday 11th of April 2012

hi snoopy, there were indeed good but i think the price have overrun. what is the alternative here? finding it difficult to discover attractive shares that have low risk.

Derek

Thursday 5th of April 2012

Drizzt,

That's my worry too. Mr. Greed is really evil. I guess I will remain steadfast and ignore the market sentiments unless First REIT rises to $2! hahaha.. I need to wake up.

Drizzt

Wednesday 4th of April 2012

hi abc, i was talking about compressing current yield not my yield on cost haha.

Drizzt

Wednesday 4th of April 2012

The last time i let go of something good like starhub i end up being a fool not being able to buy it back.

Conviction plays a key role here. Why? If you have a good conviction you would have accumulate large number of these stocks. when it break trend or top of channel sell a portion of it. if it never comes back at least u have a portion that is still riding if it comes back you can buy back again.

the problem is my position still very small. if you guys position is bigger than mine u can do something like this.

abc

Wednesday 4th of April 2012

Dividend yield can be computed based on the original share price you bought. If you do that, it is likely you will see yield has improved and not compressed.