If you have invested in any bond funds or products that are constructed with some bonds, you might be hurting right now.

You ought to be because you just experienced what a four-standard deviation bond return period was. In the probability spectrum, three standard deviations have a 0.1% chance of happening.

Yet here we are.

The chart above was taken from JPMorgan’s fourth-quarter guide to the markets. You can see that since the existence of the Bloomberg US Aggregate Bond index in 1976, we have never had a drawdown like this year.

But if we did not live through this year, you would understand why risk-averse investors would have more of their money in bonds. Down years were uncommon, and their magnitude was low.

The total return of bonds in circulation has an inverse relationship with interest rates. When the interest rate goes down, the price of bonds in circulation goes up. If the interest rate goes up, the price of bonds in circulation goes down.

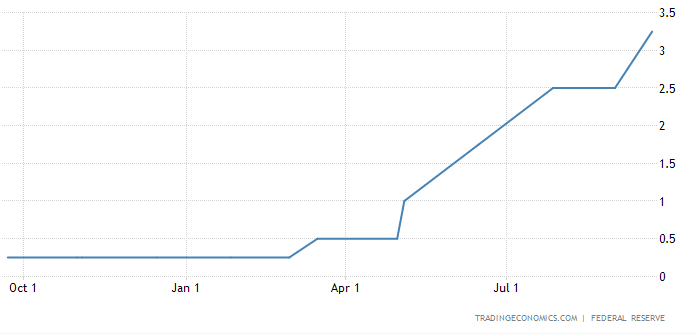

We will most likely see a 300-400% increase in interest rates in one year. I think many of us think this was plausible but didn’t think it would actually happen, until it actually did.

The magnitude of the interest rate rise/fall is essential. The interest rates have been so low for so long that a rise of such magnitude will kill bonds.

Sound bond funds are doing their job.

Despite the “carnage” in bonds, they are doing their job if you have invested in fundamentally sound bond funds. Whether the bond funds are doing their job depends on whether your investment adviser has chosen the right funds for your portfolio.

In an equity and bond portfolio, the main driver of returns is the equity portion, but the equity portion can be volatile. This year, if you are invested in an ETF that tracks the MSCI World index, you would be down 23% currently.

The bond allocation’s role is to act as a portfolio dampener so that when you view the overall portfolio, the experience is more livable.

Think about this: This is possibly the worse bond return in 47 years, and the return is only down 15%.

If you have a 60% equity and 40% bond allocation, you would be down 19.8% instead of the full force. Yes… 19.8% is still substantial, but in my opinion, your portfolio still gets the cushioning effect.

How can a Bond Index fund recover?

Maybe many investors are worried about bond funds because they are not in control. If they bought individual bonds instead, they knew that if the issuer of the bonds didn’t default on their coupon and principal payments, they wouldn’t lose money.

They have no control over the bond fund they invest in and, therefore, have to live in an anxious environment where they do not see a way out of these unprecedented bond losses.

If you have invested in an Index bond fund such as the iShares Core Global Aggregate Bond UCITS ETF (hedged to USD, ticker: AGGU), there is a clear mandate to mimic the Bloomberg Global Aggregate Bond Index, which has a clear methodology of what bonds to invest in, how they hold, rebalance and reinvest.

They will not trade their bonds in and out unless there is a mass fund liquidation exercise. When the bonds are held close to maturity, the value of the bonds returns to par, the fund does not lose money, and the bonds are typically sold off without capital loss.

The proceeds from that bond are reinvested in a bond of the same credit quality of the same duration.

Now, because interest rates are higher, the proceeds are reinvested in bonds with higher coupons, yield to maturity.

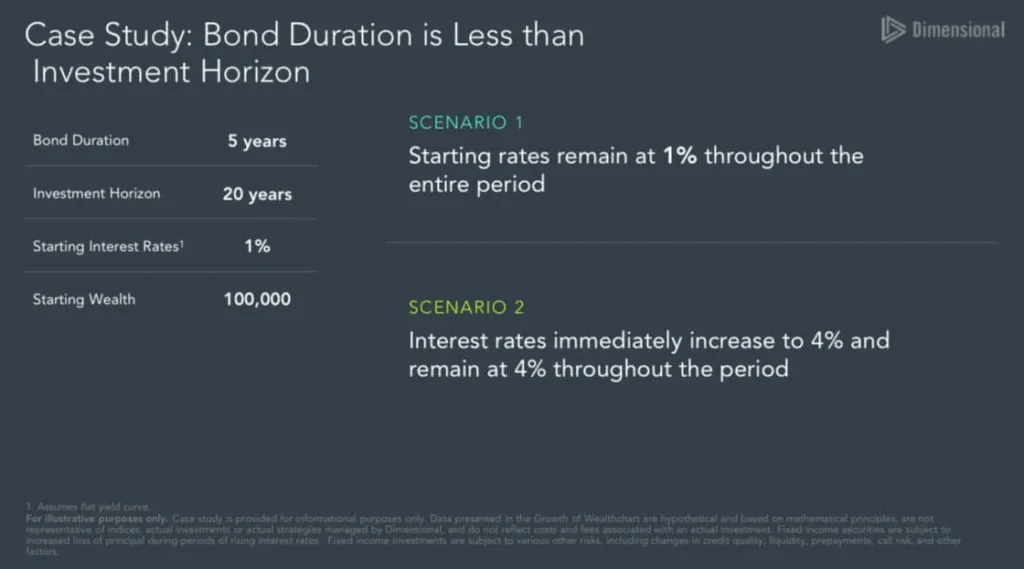

Dimensional presented the following case study to illustrate how a rise in interest rate can be very beneficial to the bond fund investor:

In the case study, the bond’s effective duration is five years. The investor has an investment time horizon of twenty years. At the start of the case study, the prevailing interest rate is 1%, and the portfolio is worth $100,000.

Dimensional simulated two scenarios. In the first scenario, the prevailing interest rate remains at 1% throughout the entire period.

In the second scenario, the interest rates immediately increase to 4% and remain at 4% throughout the period. Interestingly, this is almost like what we are currently going through.

The table above shows the growth of $100,000 over the twenty years investment horizon of the investor based on the two scenarios.

In scenario 1, the investor never lost money and ended with $122,019.

In scenario 2, the investor’s portfolio dropped by nearly $14,000 to $86,385 (similar to the JPMorgan first chart!). Within five years (almost equivalent to the bond’s duration), the bond fund recovers back to $100,000.

But because the bonds that matured were reinvested at 4% instead of 1%, the bond fund eventually ended with $189,281, which is vastly higher than scenario 1.

The Important Financial Planning Consideration: Bond Duration Should not Exceed the Investment Time Horizon

There are index bond funds of different durations and credit quality.

Dimensional’s example shows that to risk manage your portfolio, you cannot anyhow choose a bond fund just because that is the portfolio standard.

In our low-risk and conservative portfolios, the two bond funds used have an effective duration of 2.2 years and 2.9 years, respectively. This gives the bond funds a greater chance to recover should the portfolio encounter a big drawdown (like now).

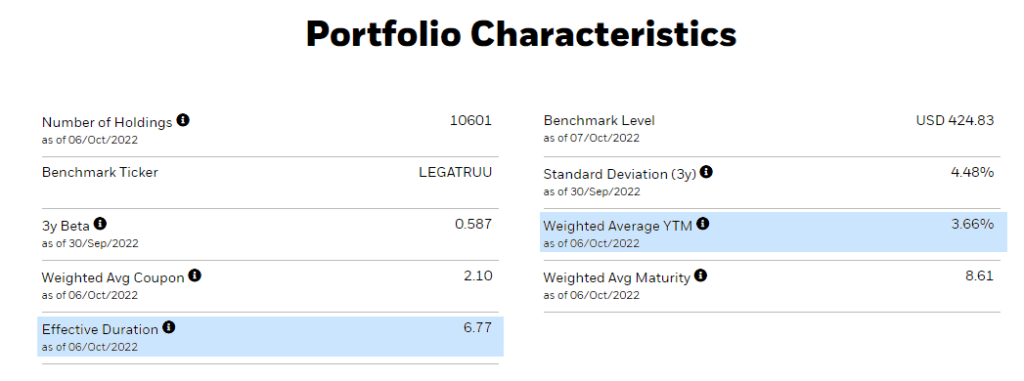

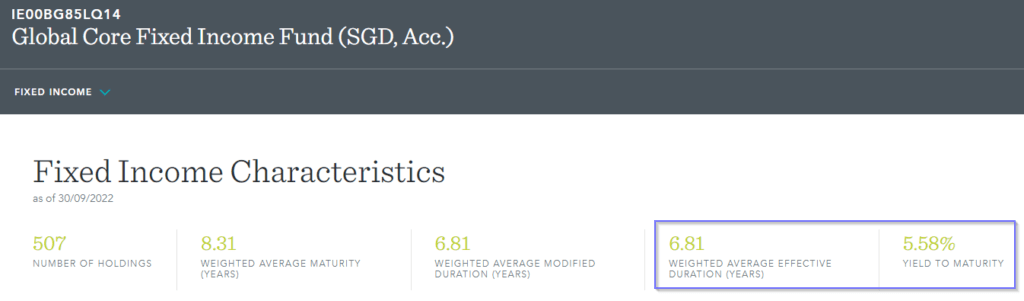

Here are the portfolio characteristics of the AGGU:

This would mean that if you have an investment time horizon that is shorter than seven years, perhaps the AGGU might not be ideal.

What about Actively-Managed Bond Funds? Can they Recover?

The honest answer is: We don’t know.

Every active manager has a different investment philosophy; most likely, they are paid to find sections of the bond market that are mispriced and active.

Dimensional’s case study is less applicable for actively-managed bond funds. They may still do well because, in this market, they might find better opportunities to find higher-yielding bonds while maintaining the credit rating and duration.

There is also the old wives tale that to make their portfolio returns look good at quarter end, active managers would sell the bonds (most likely at the worst times) to reduce the drawdowns.

You tell me how true this is.

The Silver Lining: Bond Returns Finally Look Decent

Many of us have wondered for the last few years why do we even look at bonds.

The forward total returns of bonds have a very strong correlation with current yields. With current yields at 0-1%, many have strong reservations about adding bond funds as a reluctant cushion to their portfolio.

With the rise in rates, at least that complaint is gone.

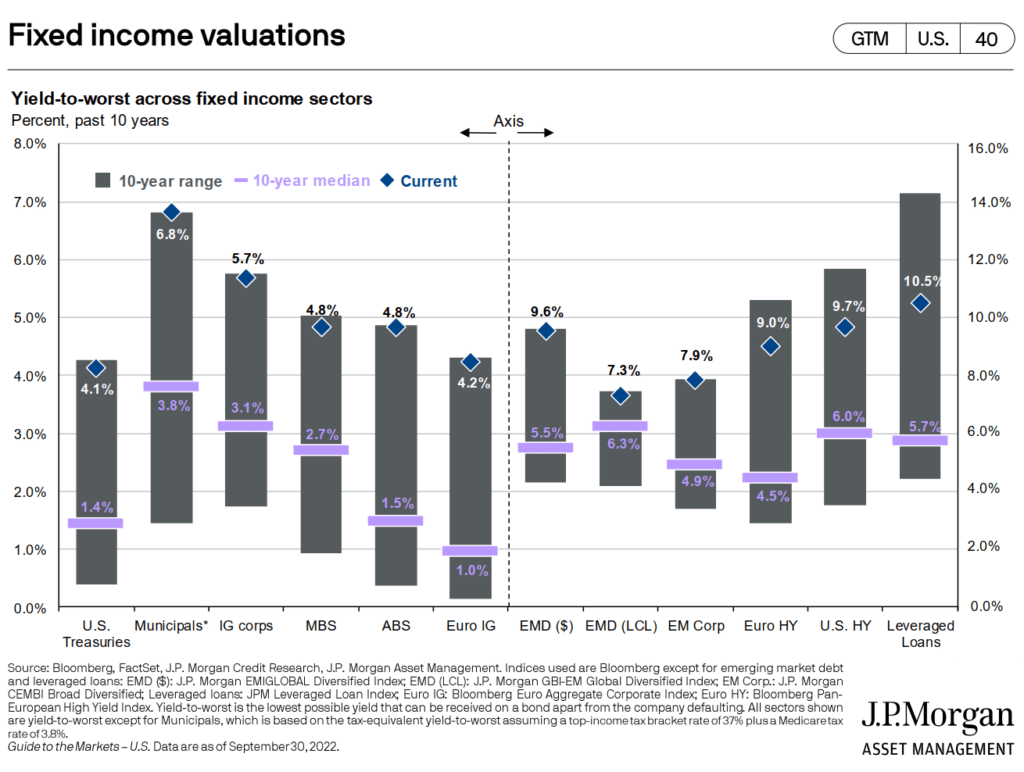

The chart below shows the prevailing yield-to-worst in the fixed-income sector:

Notice that the blue diamond, which shows the current yield, is almost at the top end of the 10-year range.

If you are forming a balanced portfolio, you may be glad that your bond allocation may not be that big of a drag on your returns as it also delivers some decent yields.

I took a look at the latest average yield to maturity of the Dimensional funds:

As the bonds mature or as part of Dimensional’s quant strategy, the bonds are reinvested in bonds with a yield to maturity that is much higher.

When I first saw the factsheets at work almost three years ago, the average yield to maturity was closer to 1%.

The core fixed income fund goes up against the Bloomberg global aggregate bond index, which is why the average maturity and duration are similar to the AGGU. The yields look similar to the shorter tenor bond funds and will make some of you wonder why to invest in a longer duration fund when you can get that yield on a shorter term basis.

The shorter tenor bonds yield so well because the bond curve is relatively flat. The curve does not always stay flat, and a longer-duration bond fund may eventually show a relatively higher yield to maturity, reflecting its term risk, versus the shorter-duration bond fund.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Aaron

Sunday 9th of October 2022

Good article. Cheers