Recently at work, I needed to read this research paper so as to gain additional clarity on something that I need to do.

The whole paper was some dry shit. There was a lot of math inside it and I struggled with the majority of the paper.

But there are some gems inside the paper that we may be able to apply in our own wealth planning.

The main benefit is that it expanded how we should look at financial goals, versus the kind of financial instruments or portfolios or solutions to fulfil those goals.

Let me explain how they think sound wealth allocation should be carried out.

We need to rank our financial goals in terms of priorities.

I think this is not new.

In how to match your wealth with your goals in life, I briefly touched on that at some point, we have to rank our financial goals in terms of importance.

If we do not rank our goals, we treat all of them with equal importance.

When your resources are scarce, you faced the dilemma of not knowing what to do.

This research believes that it is important for us to rank our goals as well.

What they do is to tag our goals into three types:

- Essential Goal. This is a goal that you need to achieve with 100% probability or a probability of 1. Basically, you CANNOT have a shortfall.

- Important Goal. This is a goal that is less important than essential. When you plan, this is a goal that you can accept that there is less than 1 probability that you are able to fulfil the goal. This means that in some poor economic sequence, the amount might fall short and you accept that.

- Aspirational Goal. These are goals where the probability of being fulfilled is low to very low. With your current resources, it is likely you cannot fulfil them.

Tagging our goals in any of these categories is important because each of these goals needs a strategy of a certain nature to fulfil them.

Wealth Goals versus Consumption Goals

The research also provides another dimension.

Each of your goals can be a wealth or consumption goal.

The difference is that a consumption goal is a goal where you will periodically have cash outflow from your portfolio.

A wealth goal is more of a lump sum goal where you will need say $500,000 at the end of 10 years.

I think we need this dimension because the consideration for a consumption goal may be very different from a wealth goal.

What can be considered as Essential Goals?

These are goals that you need absolute certainty of.

You do not want to leave room for error.

The most obvious is the part of your ongoing expense or retirement expenses that is essential.

Without these expenses, your life cannot survive well.

I would prefer to be more granular:

- Food for survival.

- Rent.

- Public transport for work or to find work.

- Utilities to keep home functioning.

- Home maintenance.

But if you feel that this is more anal you can lump them together.

Can you consider your child’s university cost as an essential goal?

Sure up to you to define.

What are the Ideal Portfolio Strategies for Essential Goals?

The ideal strategy needs to give you a very high degree of confidence that it can achieve the essential goals with a probability of 1.

So the typical strategies are:

- Inflation-protected bonds.

- Safe bond ladder.

Both strategies allow the cash flow to be adjusted for prevailing inflation. Their volatility is also very low.

Because you get higher-quality bonds, this greatly reduces the probability of default.

You can mathematically work out how much principal you would need to fulfil your financial goal with this.

What is the downside?

You need ample capital.

The above chart shows the yield curve for the treasury inflation-protected security. This doesn’t mean that you will lose money.

Nominal yields can still be positive and the net yield after inflation can be positive.

If you plan for one meal to be $5 today and you are satisfied with the quantity. One year, you will eat 1080 meals. So you will need $5,400.

If we plan for a 1% or 0.5% yield, and you need the money for 30 years, you will need $187,838 to $174,312.

If you have that much, you can make sure that you have a stream of inflation-adjusted income that provides you 1,080 meals a year.

What if we want to plan for perpetual inflation-adjusted income?

If you would like to do that, research shows that you get a high degree of confidence if you:

- Plan an initial withdrawal rate of 2.1%.

- Deploy in a 75% equity, 25% bond portfolio.

This means that you will need $5,400/0.021 = $257,142.

If you wonder why am I so anal to break down expenses this way, it is because if you tell me your expense needs is $60,000 a year, and you want absolute sure success, then you will need $60,000/0.021 = $2.86 million.

The sum is going to be very large.

What can be considered as Important Goals?

Important goals are something that you need less than a probability of 1.

By right, you should have enough resources to fulfil them.

These are also goals that you can accept various degrees of the shortfall from how much you intend to save up.

- Vacation expense.

- Medical expense.

- Entertainment expense.

- Child university education.

All of these can be considered important goals.

But they may differ in terms of your accepted level of the shortfall.

Suppose you need to accumulate to a certain amount.

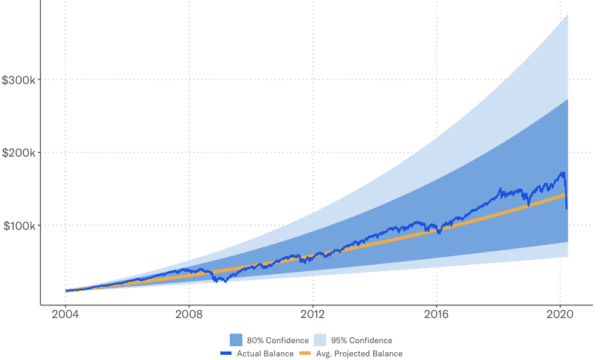

We don’t know what the future holds. Your range of return can be any part of the fan you see above. It ranges from a very optimistic $300k to a very pessimistic $50k.

You can accept differing degrees of shortfall. If you plan with 80% confidence level, you accept that there are cases where the returns fall outside of that dark blue cone.

If you are not willing to accept that the shortfall is that pessimistic, then the solution is that you need more money, perhaps a 90% degree of confidence.

So some goals are more important and you can accept less shortfall. For example how much you need for child’s university education. You can accept that you missed out on your entertainment goal.

What are the Ideal Portfolio Strategies for Important Goals?

Based on your time horizon, and your risk capacity, risk tolerance, the solution could be different combination of stocks and bonds:

- 100% bonds

- 20% equity 80% bonds

- 40% equity 60% bonds

- 60% equity 40% bonds

- 80% equity 20% bonds

- 100% equity

Based on past history, each portfolio have a certain average return.

How much you will need to accumulate to, will depend on the amount of shortfall that you are willing to accept.

Let us use the 60% equity and 40% bond portfolio as an example.

Suppose the historical average rate of return for this portfolio is 5.5% a year.

If in 15 years, you will need to accumulate to $80,000 for your child’s university education, based on this rate of return you will need $35,834 today.

If we put in $35,834, there is a 50% chance you will have at least $80,000 fifteen years from now and 50% chance you won’t.

This is something you are not willing to play.

A more conservative stance would be to use a 30% lower return rate or 3.85% return for planning. The portfolio is set up to return on average 5.5% but you are taking a more conservative stance.

You will need $45,393 today instead.

If you think this goal is not conservative, use a 50% lower return rate for planning. This to me is the equivalent of almost 90% confidence.

You will need $53,255 today instead.

In short, you over buffer enough.

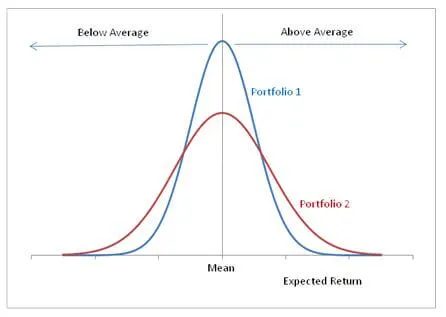

If you add equities to the portfolio, the range of returns will be wide (portfolio 2 in the diagram below).

If you wish to narrow the range of return (portfolio 1 in the diagram above), risk partiy strategies such as the all-weather portfolio may be useful.

Usually, the average return is lower but because you expect less volatility, you do not have to buffer so much. So instead of using a 50% lower planning return, an equivalent may be a 20% lower planning return.

What can be considered as Aspirational Goals?

In their dictionary, aspirational goals are goals that you will find it hard to achieve.

This means that by the end of the duration, you won’t have enough money.

The caveat is… if you based it on the traditional planning.

These goals tend to be something you feel good about.

Here are some examples:

- Long term charitable commitment.

- Buying a much larger home purely because you aspire for it.

- Expensive watches.

What are the Ideal Portfolio Strategies for Aspirational Goals?

Traditional broad based portfolios may not fulfill these goals.

This is because:

- Your capital has been allocated more towards your essential and important goals.

- The rate of return is not high enough.

The ideal portfolio is a portfolio that gives you high expected return.

The challenge for a portfolio that gives high expected return is that it typically comes with some tradeoffs:

- Very high volatility

- Entrepreneur risk

- Strategy not mature

- Need a lot of effort

The result is that you might not be able to take it or that you might lose a large chunk of it.

Hence, strategies like this is often not highly recommended for your more essential and important goals.

I think there can be a range of strategies. The most common may be concentrated, small-cap/microcap value/growth strategy.

In recent times, perhaps it is crypto strategies.

Or it could be some private equity, angel investing venture (if your capital is large enough).

How to deploy additional money?

Our experience show us that clients will often have more funds to deploy then they originally anticipated.

Traditionally, the financial adviser will tell the client:”Since your goals are already funded, we can think of whether there are new goals that you would like to pursue, and we can fund it with this additional money.”

In this planning method, they recommend:”With this additional money, let us see whether we can secure as much of your goals, starting from the high priority ones.”

With this 3 category of goals, most of your money should go towards shoring up the essential goals, then the important before the aspirational goals.

If those goals are essential, you should secure them first before you add additional funding towards your important goals.

I think that is sound rules.

Since we have a way to calculate how much you need to ensure that you fulfil your essential goals without overcommitting, then this allows us to flow additional money to the lower priority goals.

Over time, your plan becomes safer and safer.

The Last Word

I think they frame wealth planning in a very sound manner.

Wealth goals versus consumption goals have differences that if we categorize them this way, it allows us to better communicate with clients.

Not all goals have equal weightage.

Those goals that we hold with higher regards, we need more certainty with them.

The way to have greater certainty is through

- Portfolio strategy

- Funding the goal conservatively

- Designing well thought out rules to manage it.

Too often, advisers leave the probability of achieving the goals to market-based probability. They can do better.

Not all goals can be funded today.

Overtime, goals can be made safer.

I think my biggest take-away is how they frame investments that are risky. Too often, some financial planners will say secure your goals with more conservative investment strategies instead of risky investment strategies.

Leave the risk strategies as your “play money”

The researchers frame goals that are obscure to be aspirational. By doing this, they legitimize the purpose of this pool of money. It invites better conversation about how they should manage risky investments as well.

Play money feels like a way to compartmentalize client’s expectations and adviser’s responsibility from failure instead of being deliberate about it.

I write more about financial independence planning at Retirement planning below.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Sinkie

Sunday 5th of September 2021

Pretty much bucket investing meets core/satellite investing...

Sinkie

Sunday 5th of September 2021

Buckets from essential to outrageous, and everything in-between.

Tools from cash to cryptos.

Kyith

Sunday 5th of September 2021

Do you consider this as bucketing?