Well obviously not me since most readers know I am still working. I am not going to be that financial influencer who touts the virtues of retiring early, only to buffer their anxiety with blog income on the side.

One of the key risks that I bring up frequently (in my Retirement Planning Series) when it comes to planning for financial independence, is the challenge of the sequence of return risks.

In a previous article, I explained the problem of sequence of return risk and what are some of the common approaches to tackle this problem.

This post is more of a retirement, financial thought experiment now that we entered challenging market conditions. This March has been one of the longest March. A few markets are down -30%. The last few days we have a +20% bull rally.

This is probably a nasty sequence a retiree would experience. And I am interested to see how things unfold, in retirement numbers.

The year is not over yet, but since many commentators said the speed of the volatility, is similar to either the 1987 crash or 1929 Great Depression, I thought let’s do a simple thought experiment.

Let us look at your retirement experience if you have accumulated $1 million and decide to start your retirement end of last year (2019).

You have a choice of:

- Withdrawing $40,000 a year at the end of 2019 to spend for this year

- Withdrawing $3333 at the start of every month to spend for this year

How would your experience be like?

Would your portfolio be able to sustain that spending?

Would withdrawing monthly be better or withdrawing annually be better?

How did a Balanced portfolio (60/40 allocation) do versus a 100% Equity portfolio?

Our Base Case

Since I am at home, I do not have all the data with me, but I do have the rough returns of the Vanguard portfolio for the last 2 months and the returns up till the 26th of February.

This would allow us to do some simulation.

Let me explain how you will retire.

You put your $1 million in either a balanced fund or a 100% equity fund. Then, you will spend $40,000 in the first year. In subsequent years, you will adjust last year’s spending by last year’s inflation.

In this example, you will spend $40,000 a year in the first year. Since inflation last year averages 0.58%, if this continues, next year you will spend $40,232.

In this way, you will have an inflation-adjusted income for your expenses.

I want to see

- How the portfolio looks like around end March (like now)

- The current withdrawal rate now. I will explain why this data point is interesting later.

You Withdraw in 1 Lump sum Before 2020 and Slowly Spend

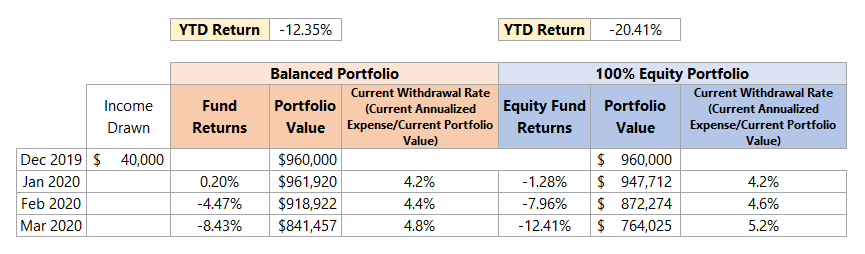

The table above shows how the portfolio value changes if you have invested in a balanced or equity portfolio.

The YTD return for the balanced portfolio is -12.35% and the equity portfolio is -20.41%.

It is not rocket science that the balanced portfolio ends up with more money than the equity portfolio.

It does not feel good seeing how much is left

We all do not like to see our portfolios go down and for this retiree that is what they are seeing. If you invest in a portfolio whose net asset value is updated frequently, you are going to experience this.

If you invest in private equity, angel investing, properties, you have less of this problem because the net asset value of the companies and properties do not get revalued frequently.

Viewing Your Portfolio in Absolute Amount Hurts More

The two portfolios are just 10% in return apart, but if you look at the absolute amount, you would feel more pain if you choose to invest in a 100% equity portfolio.

It looks like you lost 25% of your wealth, while for the balanced portfolio, it still looks “manageable”

High returns often come with higher volatility.

I came to believe this over time. This morning, I chat with someone who dabbles in these portfolio strategies on his own. He works in the finance field in his day job. He bang this into me that whatever strategies that lower the downside, it also curtail the upside.

I think the only way out of this was through rules that are more active in nature.

A 100% equity portfolio exposes you to higher returns, but you better be able to take that negative sequence risk where your portfolio gets cut 35% and you are compounding the fall by spending more through the income taken out.

Returns may not keep your portfolio alive.

The Weakness of Solely Using the Safe Withdrawal Rule as a Spending Plan

I have tabulated the current withdrawal rate so that readers can see that, if you retire today, in March this month, instead of the start of the year, your withdrawal rate will look very different.

The safe withdrawal rate of 4% has often been popularized as a way to determine how much you need to save for your retirement, and how much you can spend so that your money will last.

In this example, you withdrew 4% at the start of the year, so we can say that you are selecting to spend your income this way.

You believe that once you accumulate wealth that allows you to spend 4% of it in the first year, your plan should be safe.

However, if you are in a 100% equity portfolio but choose to retire in April 2020 instead of the start of the year, your current spending is 5.2% of your portfolio instead of 4.0%.

It begs the question: Do you think your money will still last 25 to 30 years now versus 3 months ago?

The issue with the withdrawal rate methodology is that it places a lot of trust that your retirement will not be worse than in the past. There will be years where your current withdrawal rate is more than 4%. You have to trust that the money will last for 25-30 years.

In reality, we don’t know what the future will hold.

My conclusion is that people tend to be flexible with their spending. When they see their portfolio value go down, they will review what was recommended by the safe withdrawal rate, but they will tighten up themselves. (This is as far as I will explain on this in this article, if you have questions do comment below)

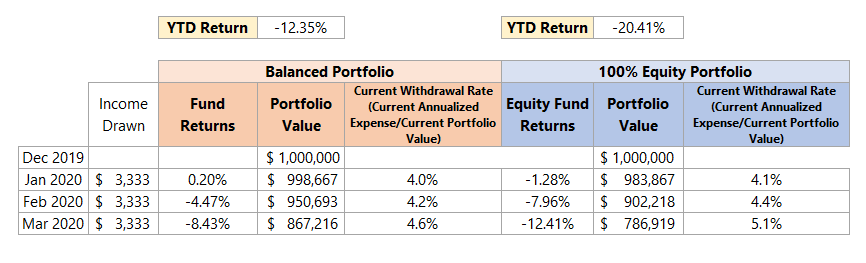

What if You Withdraw $3,333 Every Month Instead

I was curious whether instead of withdrawing a lump sum, would withdrawing every month be gentler on your portfolio.

So here are the results:

In an absolute amount sense, withdrawing month by month is definitely gentler on the portfolio. Instead of having only $764k left, monthly withdrawal will leave you with $786k left.

However, it should be noted that we just taken out 3 months of expenses. There is still $30,000 to be spent.

I think we will only know the true difference at the end of this. (Or if Kyith is less lazy and he decides to use some historical data that has 12 months instead).

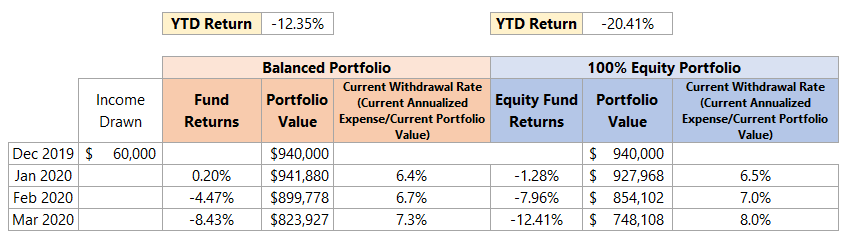

What if You Spent a Greater Starting Amount ($60,000) Instead?

I wanted to see the scenario where you believe that spending $60,000 out of your $1 million portfolio is prudent.

We all have a lot of weird theories about what is prudent and what is not.

Looks pretty OK. About $16,000 difference in portfolio value between spending $40k and $60k.

The danger to the sustainability of your portfolio are repeated spending. So this short exercise won’t show much.

If you spend too much, your portfolio has less units to recover if the next 3 months are the months where the market recovers. This will cause your wealth to last not as long.

The Beauty of Spending Less than 4% of Your Portfolio in the First Year

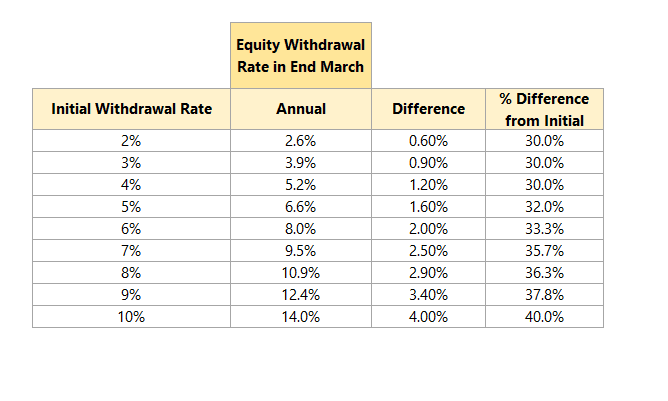

In the following table, I tabulated the current withdrawal rate in March 2020 if you spend a different percentage of your portfolio for the first year:

Observe the column name Annual. This shows us that with the drop in portfolio value, what is the current withdrawal rate.

You can imagine that if you didn’t choose to retire in Dec 2019 but Apr 2020, what is your withdrawal rate and whether you think your financial independence plan is safe or not.

It is a given with a fall in portfolio value, that the withdrawal rate will go up. That is just math.

But if your withdrawal rate is high, you will realize that you would be placing quite a bit of stress on your portfolio.

Conversely, if you spend between 2% to 4% of your portfolio in the first year, even with the lower portfolio value, your spending would just reach a withdrawal rate that many think is still relatively safe.

My Last Word

At Investment Moats, I always shared that if there is a less effort way of accumulating wealth or spending down in retirement, it is by way of funds.

What kind of funds you choose is another matter.

The popular ones are the exchange-traded funds, the funds via a Robo-adviser platform, the unit trust, and ILPs that you can purchase from banks and other distributors. There are also the boutique funds, hedge funds and the scams that masquerade as a legitimate fund.

Whichever fund you choose, in a period like this, you have to endure the pain that your portfolio value will go down. Some of us are confident that despite the fall in portfolio value, our portfolio will still last for the duration we need.

For others, they grow anxious about it. You could find an expert opinion to validate if your plan is sound enough. But sometimes, if you are anxious, despite what we tell you, you are not going to be assured.

If you are near retirement and planning for it, you should think about 2 main aspects:

- Your portfolio structure

- How much wealth versus your income needed

Portfolio Structure is Important

There are going to be funds that going to tout great returns, but a lot of the times, they are going to come with some greater volatility. I think funds can give great returns, but I do wonder how many investors can base the majority of their portfolio in high volatile funds.

An MSCI World Small Cap fund at one point was down 40% year to date. If you belong to the camp where smallcap can give you above-average return and decide to put 100% of your allocation into it, thinking you can endure the volatility, you would see your $1 million become $600k at this point.

And next year you need to spend $40,000 more on that $600,000.

The current result of the balanced fund shows the right posture going into retirement. If you have accumulated well the past 5 years and needed the money in the next 3 to 5 years, it might be great that you de-risk the portfolio.

Had you done that, instead of still chasing performance, you might not have so many sleepless nights over whether you are doing the right thing now.

Knowing How Much You Can Spend is Important as Well

Just as important to the portfolio structure is knowing whether your portfolio value is enough going into financial independence.

If do not have enough, spending what you think is modest, is also spending too much.

If you have enough, spending a lot is also modest spending.

A good situation is one where you decide to start withdrawing from your portfolio at the end of 2019 and after experiencing this market fall, your current withdrawal rate hits at most 4% to 4.5%.

Why is that?

A negative sequence of returns may result in your portfolio running out faster than you plan for.

However, after your portfolio has been ravaged, and your current withdrawal rate is still around 4% to 4.5%, that means your original portfolio value versus your expenses is conservative enough.

Going forward after this point of portfolio ravage, the expected return of your portfolio should be much better than when you start your retirement.

I came to this conclusion over time that you should base the withdrawal rate at your retirement based on the valuation of the equity market (assuming you are investing in a diversified global diversified portfolio):

- If the market value based on CAPE (cyclical adjusted price-earnings) is below 20 times, a higher withdrawal rate is fine (perhaps 4-5%). The expected returns going forward should be higher than average

- If the market value based on CAPE is above 30 times, you should plan with a lower withdrawal rate (perhaps 3.3% or less). The odds of near term volatility is high. You may have accumulated well for the past few years, but a bear might be on the horizon and your portfolio is going to be cut. The alternative is that you have built your wealth, control your portfolio allocation by de-risking

- If the market value based on CAPE is between 20 to 30 times, your withdrawal rate should be average

The above serves more as a rule of thumb. The short summary is that if you retire in a bear, you can use a higher withdrawal rate (which means you need less money). If you retire after a good bull run, use a lower withdrawal rate (which means you need to accumulate more).

We are 3 months into this, and I am not sure whether we will end the year positive or worse than this. I intend to revisit this exercise probably at the end of the year.

Two articles that I read on the money math in financial independence during this period that I would like to recommend:

- Coronavirus Course Correction by Go Curry Cracker.

- Dealing with a Bear Market in Retirement – SWR Series Part 37 by Early Retirement Now

My retirement section is below

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024