If you wish to retire 10 years earlier than the official retirement age of 65, how much money do you need, if you know you will be getting some CPF Life annuity income at age 65?

I think many of you would entertain the thought of retiring at age 55, especially if you think you have accumulate wealth well through the years.

55 years old is also the age wherein an equivalent amount of the CPF Full Retirement Sum (FRS), Basic Retirement Sum (BRS), or any amount if you have less than that, is transferred to your CPF Retirement Account.

Any amount greater than your FRS and BRS can be withdrawn as cash from your CPF OA and SA account if you wish. Thus, for those who have accumulated well, they would have some excess money that they can tap at age 55. Retiring between 55 to 65 years old may be a possibility.

To make things simple, and to make it conservative, I would assume my retirement income will come from our cash portfolio in the past. However, if we know that at 55 years old, we will get some cash, and at 65 years old we will get one or two annuity income stream, how much do we need from our wealth outside of CPF?

So in this article, I will present a simple flow to help you resolve how much capital you will need if you are expecting two retirement income stream (one which is from your annuity and one from your wealth accumulated)

The Retirement Planning Problem

The typical household in Singapore consists of 2 married adults. At 55, probably their children are just entering university, finishing up, or around that age.

The monthly household expense of Singaporean household could range from $4,000 a month to $9,000 a month on a pretty high end. But let us assume that the household spends $5,000 a month.

The two working adults should contribute to their CPF OA and SA after servicing their home and may eventually reach their full retirement sum. This would enable them to draw 2 CPF Life annuity streams at the age of 65 years old.

For the context of discussion, let us limit the end of retirement to 90 years old. The couple would need their money to last for 35 years. Inflation during retirement is forecast to be 2% a year.

The couple will have two income streams that come online when they turn 65 years old, but their requirement starts 10 years earlier.

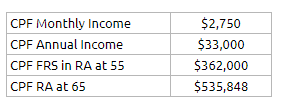

For info purpose, we use a couple who was born in 1965 (I know it might be damn rare a married couple is of the same age but for the sake of this example just take that it is true), and they have accumulated at least $181,000 in their CPF SA and CPF OA each at 55 years old.

This would fund their CPF Life at age 65.

Using CPF Life’s annuity estimator, we derive an estimated income of $1,325 a month each or a combined income of $2,750 a month based on the Basic Plan. (If you are younger, and would like to try this out, the CPF Life annuity calculator may have some limitations. I would be able to calculate how much income I could get at 65 with the help of the staff at MoneyOwl, since they have a way to estimate how much income you could get.)

This CPF Life income stream is not inflation-adjusted unless you choose the Escalating Plan (which starts off with a lower income stream, but goes up over time).

The rest of the shortfall over the next 35 years will have to be shouldered by your portfolio.

There are 2 common approaches to take:

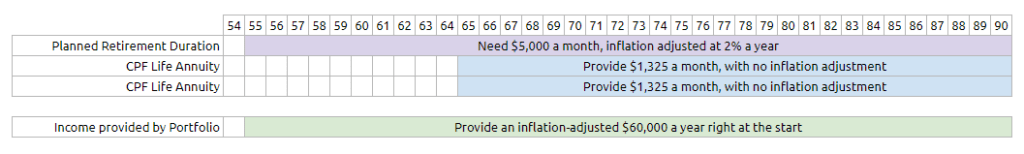

- Plan to have an income stream that provides $5,000 a month, that is inflation-adjusted outright for the 35-year duration

- Break up into 2 portions. The first portion is to provide predictable income for the first 10 years and the second portion to do #1 but over a 25-year duration

The first approach looks safer in that you are planning with the CPF Life annuity as a good to have. However, it feels like we may overestimate how much we need to accumulate for our retirement.

It seems that with the second approach the couple will need to accumulate less money. They will only need to plan for a flat spending of their expenses for the first 10 years, and not have a portfolio that could consistently provide for an income that would eventually be aided by the two annuity income stream.

The issue however with the second approach is that 10 years is a very short duration. If you deployed this first 10 years’ income into equities, the money might not be able to provide the exact amount in time for the couple to spend. So it is likely the rate of return for this portion is low and almost cash-like.

It would be better for us to see how much is needed based on these 2 approaches.

Planning Approach 1: Provide a Retirement income stream for 35 years

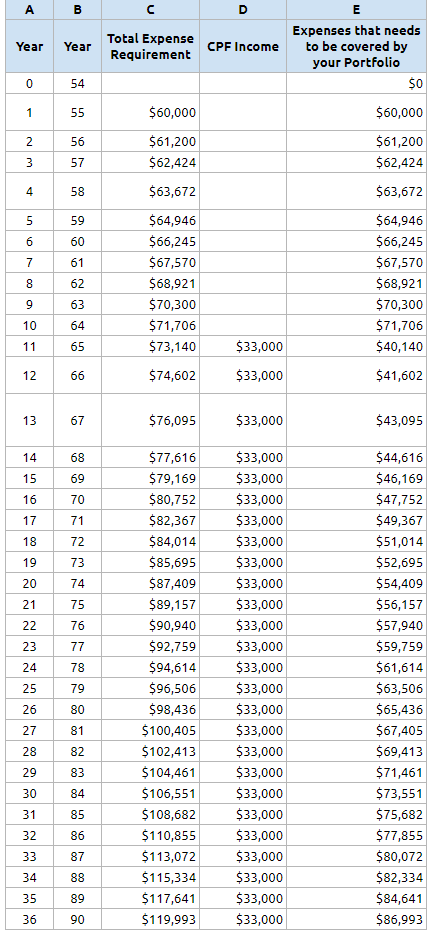

The table above shows the annual expenses of the couple that they need an income to cover. The expenses go up by 2% a year in a uniform manner. At 65 years old, $33,000 a year comes online from their CPF Life. The income from CPF Life do not adjust for inflation.

The usual way to plan for this is to prioritize the predictable income to spend first. This takes the stress away from your portfolio.

What we notice is that by having the annuity income, the growth of income that is required to come from the portfolio becomes far less. Instead of a rate of increase of 2% a year, it becomes 1% a year over the 35-year duration ( from $60k a year to $86k a year). This reduced the stress by a lot.

The first approach requires us to identify how much we need to provide

- An initial income of $5,000 a month or $60,000 a year

- Income needs to be inflation-adjusted at 2% a year on average

- Last for 35 years

There are a few ways of determining this, but I would prefer to use the safe withdrawal rate method. Some United States researchers determine that if you withdraw an initial income equivalent of 4% of your initial capital, your capital can last for 25-30 years, after simulating through past periods of normal economic scenario, inflation scenario, high inflation scenario, deflation scenarios, economic prosperities. The income is inflation-adjusted.

We called the safe withdrawal rate a rule of thumb because, for actual planning, we need to be more nuanced. But in this case, if we are to estimate how much we need fast, I think it should be enough as long as we use the same methodology throughout the article.

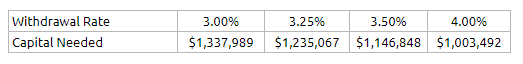

If we need the money to last for a longer duration, we might need to withdraw a smaller initial percentage than 4%. It should be between 3% to 3.5%.

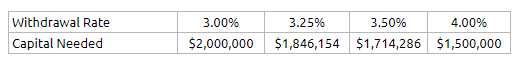

The table above shows the amount the couple will need to accumulate at different initial safe withdrawal rates to have an income of $60,000 in the first year.

The lower the withdrawal rate the more capital is needed. A safer rate that lasts for 35 years would be closer to 3.25%. This would mean the couple would need $1.85 million. The couple’s plan is made much safer due to the CPF Life annuity.

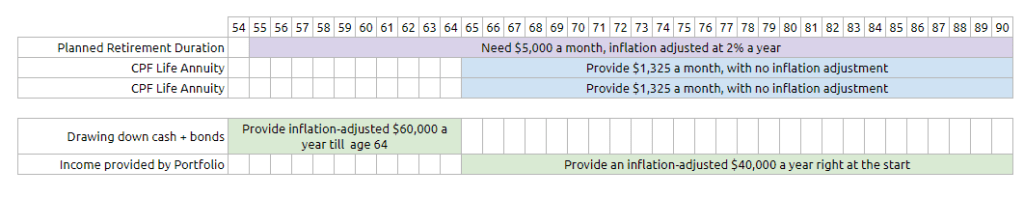

Planning Approach 2: A Cash Portion for first 10 years Plus an Income Stream from Portfolio for 25 years

The second approach breaks up your capital into a cash + bond allocation and something similar to approach 1 but with a shorter requirement.

The cash + bond allocation will provide the income from 55 to 64 years old. Due to the lower rate of return, let us assume the rate of return is 2%. Since the rate of return is equal to inflation of 2%, this basically means you need to set aside $60,000 x 10 = $600,000 for the first 10 years.

Let us go to the second portion, which is to provide the 25-years of income.

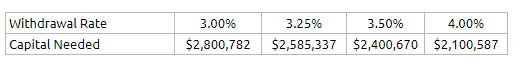

If we revisit the table, at 65 years old, the income needed after CPF Life annuity is $40,140. This will need to last till 90 years old or 25 years.

We can use a 4% initial withdrawal rate instead of 3.25%.

The table above shows the amount the couple will need to accumulate at different initial safe withdrawal rates to have an income of $40,140 in the first year.

If the initial withdrawal rate is 4%, the couple would need $1 million at the age of 65 years old. Even if you choose a safer withdrawal rate of 3.5%, the capital is 14% more or $140,000 more.

But hold on, the couple needs $1 million at 65 years old and they have 10 years to grow to that amount from 55 years old. Since they are close to retirement, we should deploy the money in a portfolio that is lower in volatility.

A sensible allocation would be a balanced allocation of 60% equities and 40% bonds.

Assuming a rate of return of 4.5% a year, at 55 years old, the couple will need $1,000,000/(1.045)^10 = $643,927. (If you want to feel safer to use a 3.5% initial withdrawal rate, then you will need $1,146,848/(1.045)^10 = $738,487)

So for Approach 2, the total amount the couple will need to provide an inflation-adjusted income of $60,000 a year is $600,000 + $643,927 = $1.24 Million.

Comparing the Two Retirement Income Planning Approaches

- Approach 1 needs $1.85 million

- Approach 2 needs $1.24 million

The difference is about $600,000 or 48% more.

Approach 1 is safer since after 65 years old, you may have buffer more than adequate to what you need. However, you will need to exchange a few years of working life in the office to accumulate this amount.

Approach 2 is not riskier. They are planned with conservative assumptions as well. If you are retiring at the same age, you need less money.

Those that are more savvy towards investments would tend to prefer Approach 1 but I feel if CPF Life is going to be there Approach 2 does make more sense.

Your mileage may vary and you can use this flow to estimate how much you need if you are retiring a few years earlier:

- Just replace your income/expenses needs with your own

- Calculate the CPF Life income that you will get at 65 with CPF Life calculator or engage the folks at MoneyOwl to help

Let me go through some nuances.

What if Your Retirement Income Requirement is Higher?

The difference between the two approaches narrow if your income requirement increases.

Remember that I mention the typical expenditures can range from $4k a month to $9k a month? Suppose that for the same couple, they need $8k a month. That will be $96,000 a year.

Their income from CPF Life annuity remains at $33,000 a year. This means that at 65 years old, they would need their portfolio to contribute the majority of it.

Let us compare the 2 approaches again.

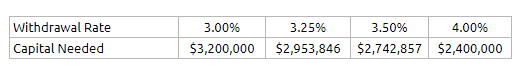

Approach 1 at 3.25% initial withdrawal rate will mean the couple needs $2.95 million.

In Approach 2, at 65 years old, after CPF Life, the couple would need $84,000 a year still.

At an initial withdrawal rate of 4%, the couple would need $2.1 million at 65 years old. If they grow their wealth at 55 years old in a balanced portfolio, they will need $1.35 mil at 55 years old.

Between 55 to 64 years old, the couple would need $96,000 x 10 = $960,000.

So for Approach 2, they would need $1.35 mil + $0.96 mil = $2.31 million.

- Approach 1: $2.95 million

- Approach 2: $2.31 million

The difference is still $600,000, but this is just 26% more than Approach 1, compare to previously being 48% more.

As your needs increase, your income requirement increases. This $600,000 becomes less of a difference. But that will always mean that in a way, Approach 2 will always have a leg up over Approach 1.

Income Can Come From Excess CPF in OA and SA

Your income at 55 years old could come from drawing down the excess money above your Full Retirement Sum in your OA and SA.

For some, they have so much in their CPF OA + SA that they might be able to fully pay for the first 10 years of retirement with their CPF money.

In that case, they might just need $643k in the first example ($5000 a month income) and $1.35 mil in the second example ($8000 a month income although in reality, I think for this example, not many people have $800,000 in their OA and SA in excess of CPF FRS).

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

- The LionGlobal APAC Financials Dividend Plus ETF Won’t Give Singapore Investors 5% Dividend Yield Always. Further personal thoughts (with some data). - April 13, 2024

Kay

Monday 20th of January 2020

Interestingly I have the same model that I used for my planning. The small difference is that my annual expenses are planned to taper off as I get older. For first 20 years, we will spend $6,000 a month, as we grow older, the amount is adjusted to $5,500 when we're 75 and $5,000 eventually when we're 90.

Do you feel that this is a realistic model?

My other challenge is that since almost all of my assets are currently liquid. They are either left in OA/SA or cash. I am not sure how to invest to keep up with the 2.5% inflation that I have projected.

Kyith

Monday 20th of January 2020

Hi Kay, you are not wrong about the way you are planning. However, the thing to watch out for is that there were research that show expenses typically resembles a smile. This means that it starts off high, then it goes down, only to be taken over by healthcare. You can Google Blanchett Retirement Smile. You will reach a lot of helpful articles. The main paper is this: https://www.morningstar.com/content/dam/marketing/shared/research/foundational/677785-EstimatingTrueCostRetirement.pdf

I think we can also model this in our planning where i work (Providend). But the difficulty we faced is we do not know how each of us will be. For some their retirement lifestyle needs more lavish spending than others.

Another way to plan is to break up the spending to two portions: the Essential and the Other Expenses. the Essential should stay the same throughout the 30-35 years. The other expenses will go down over time. The idea is that you estimate whether at the bare minimum, you can have the assets to produce cash flow for your Essential expenses. When the times are good, spend the Other expenses.

Finally, even in retirement, it is 30-35 years. We have to invest but for those that are weary can take a more measured approach with a balanced allocation.

Oken

Sunday 19th of January 2020

To max out CPF life, they would also need to have an additional lump sum to increase FRS to ERS for both of them. This is an additional sum that they would need at 55, which makes the overall sum a few hundred thousand higher.

Kyith

Monday 20th of January 2020

Hi Oken, I think the ERS option will help a lot. I wanted to add on this permutation but my article will be too long. Perhaps it will be next week.