Yesterday, someone in my Telegram group asked a question:

Is it wise to retire before 30 years old with $1 million, or is it better to retire at 40 years old with $10 million?

I thought it was an excellent question to explore.

This is a question you will think about if, mathematically, both outcome is possible for you. As a new graduate, the person starts with a base salary of $300,000 yearly in a certain finance sub-field.

I don’t have the usually long-winded answer, but I want to think through this and provide some personal perspectives.

The Higher Earner’s Dilemma

High earners have a certain dilemma.

They faced a huge opportunity cost if they retire early. But they get to spend their money when their time & energy are at the highest.

If they retire earlier, and have not done sensible life planning, their money may exhaust.

If they retire later, of course they will accumulate more, but they might have so much sucked out of their body, they are a different person anymore.

So where is the sweet spot?

Each situation is different, and you will have to figure out.

How challenging is it to achieve $10 million at 40 years old?

Mathematically, we know that a $1 million target should be achievable for someone relatively frugal, regardless of investment performance.

Well, not really.

You can be very concentrated on something that will impair your capital for a long time, and you will miss that $1 million by the 30-year-old target.

The chart below shows the price movement of Goodman Group, a leading Australian REIT/property player:

If your history started in 2011, then Goodman Group looks like a monster, but if you got in during 2007 high, it is a different story altogether.

Whether you can achieve $ 1 million in 4-5 short years will also depend on market volatility relative to your contribution.

With a $300,000 annual income, the income tax alone will come up to $40,000 a year, and if the person is frugal and keeps within spending of $60,000 a year, the starting capital contribution can be $200,000.

I worked out how likely will the person to achieve $10 million by 40 years old with standard planning assumptions:

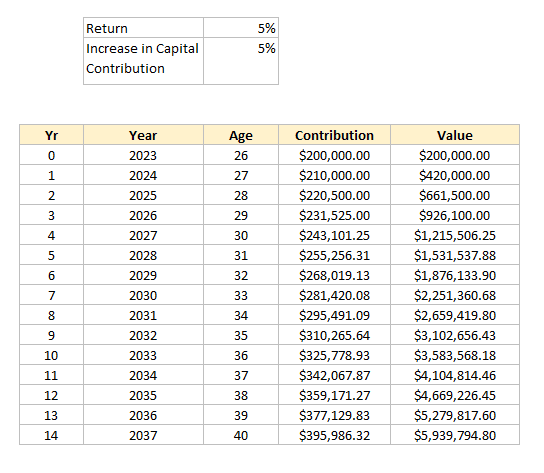

We assume a starting contribution of $200,000 a year into investments, which will be up and down but average 5% yearly. The person will have to increase his contribution to the portfolio over the 14 years.

Achieving $1 million at 30 is less complicated. But conservatively, he could hit $5.9 million at 40 years old.

He will need luck in his investments.

How can he reach $10 million?

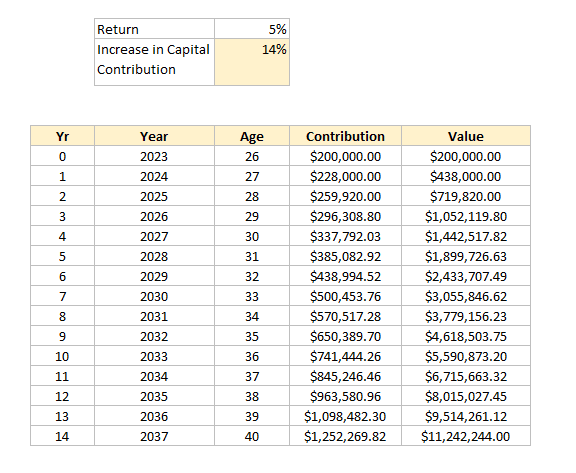

One way is to increase his contribution:

We increase the annual contribution rate from 5% to 14%. You can see last year’s annual savings rate, lol.

That is almost like the value of my portfolio.

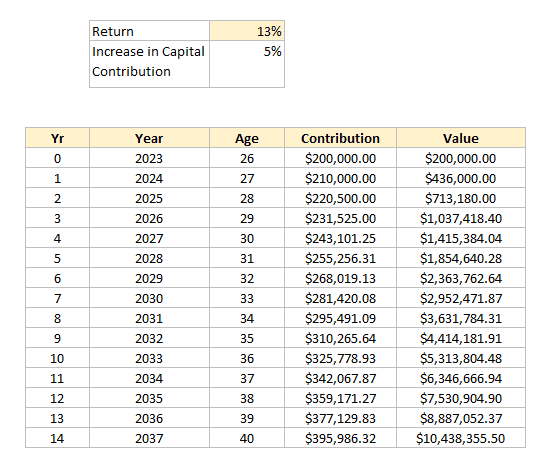

If not, the other way is to improve the average investment return:

If we bump the investment return from 5% to 13% yearly, we can reach $10 million.

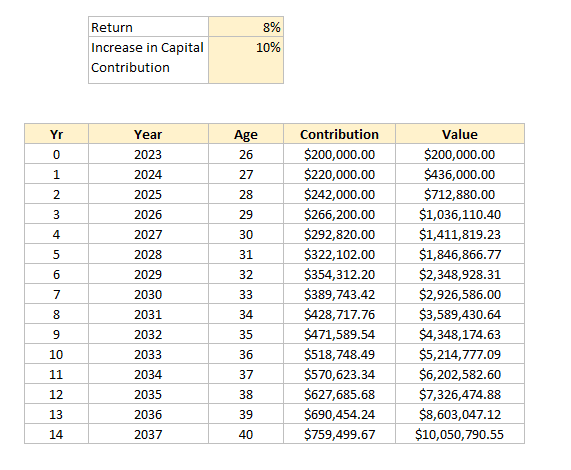

Or a combination of both:

2 Questions About the Path to $10 million

- How likely is it to increase the contribution rate like that?

- How likely is it to bump investment planning returns from 5% to 13%?

The contribution rate looks a little crazy and hard for us to gauge if we are not in the industry. However, based on what I came across, I don’t think it is outlandish.

I think it is doable base on what I know.

Depending on luck in employment, and technical competency, this may be the easiest path to $10 million.

Achieving a 13% a year return over 15 years is possible, but that will also need luck and strong behavioural fortitude.

The last factor cannot be underestimated.

To achieve this, various attributes are needed:

- Understanding the points of the wealthy formula

- An orientation towards frugality

- Being good in your profession

- Know how to build wealth machines well

What is Your Desired Lifestyle? Have You Found that Desired Lifestyle yet?

You will entertain the thought of retiring at 30 with $1 million because you think that $1 million is all you need.

It is essential to realize that money is used to fund what you want, and what you can differ from person to person.

Your lifestyle today is different from your peers. Or your parents.

Here is something that you may not consider:

The desired lifestyle for you today, or you had in mind at 26 years old, might be very different if you ask your 45-year-old self.

Do you know the possible lifestyle spectrum if you have just entered the workforce? We are not asking you to inflation your lifestyle, but experience tells us you might not want to short-change yourself and experience a lifestyle you have not considered.

Here is how I visualize your experience:

At 26 years old, your desired lifestyle is picked from the lifestyle you came across from age 1 to 26. It is possible that you have experienced a wide range of lifestyles, depending on your curiosity and what is available to you.

But likely, as you live and work longer, you be poisoned by stuff your peers like. You will also realize that there are some necessities in life that you have not experienced or considered.

As a more experienced person, here is a short list to think about:

- Most will get married and need to form a separate family nucleus away from their current family.

- Kids have their own costs.

- Eventually, some of you need to take greater care of your parents at a certain point.

Some have already told me that they don’t want to have kids. Firmly believe that.

I had friends like that, and they eventually had kids.

This is how things are.

If you are a university student, $2,500 a month‘s income feels like a lot. Then $1 million may be able to give you that income.

If your eventual desired lifestyle cost $7,000 a month, then using the same safe withdrawal methodology, you will need $2.8 million to generate that income.

Therefore, your lifestyle determines a lot of things.

Practicalities Tell Me $1 million is Not Quite Enough for Most of Your Lifestyles.

If you wish to fully fund a desired lifestyle while having such a substantial income stream, then $1 million might not be enough.

If you ask whether $1 million is adequate to generate a stream of income for your needs, that is different from whether you can retire with $1 million.

The most desired lifestyle that is funded with a solid income stream includes paying off a residential property at some point. We know that you don’t have to pay off your entire mortgage at one shot, but a desirable lifestyle may be one where you can pay off the mortgage.

You may choose to:

- Place a downpayment on a private condo today.

- Save up enough for a resale HDB in the future at age 35, if you are still single or when you are married.

The criterion is you desire peace of mind.

With this in mind, you might need to apportion $400 to $1 million of that $1 million for the residential property.

That will eat up everything.

You might not need $10 million for Your Desired Lifestyle as well.

I am a 42-43-year-old whose lifestyle can be funded with 20% of that.

You might not need $10 million even if you expand your lifestyle.

Here are some rough calculations:

- Private 1000 sqft 3BR condo: $2 million

- Vehicle: $200k

- Children’s Education for 2: $400k

- $10,000 monthly income based on a 2.5% initial withdrawal rate: $4.8 million.

This adds up to $7.4 million.

But okay, you add a few things in, and it might need $10 million.

Here are some lifestyle modifications:

- You don’t want to think about your $ 10,000-a-month income and want to spend more freely, care less about the downsides. Use a 2% initial withdrawal rate instead of 2.5%. You need $6 million instead of $4.8 million.

- You wish to do something nice for your parents, maybe buy them a place or create an income fund for their old age.

These two modifications might take the need up to $10 million.

I think with this example, you may have some handles whether $1 million at 30 years old is good enough. You have an opportunity to make some substantial money that not many people can, and you may want to take advantage of it.

In Conclusion

The best way to view your decision is to reflect upon it, but most likely your constant reflection will tell you:

- What you might not considered in the desired lifestyle

- More clarity on how much it will cost you and how much income flexibility you will have

- Are you more ready at this point of net worth

I feel that the sweet spot for most above middle income might be at $4-6 million range. It still doesn’t buy you everything. $4-6 million might buy a good residential, and provide a high enough income, but its not the “won’t-run-out-for-certain” money that you need (due to your high income requirement).

If you have similar planning dilemma, do write to me, and see if I can exercise some brain juice.

More planning ideas at my Planning for Retirement Section below.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

lim

Monday 30th of January 2023

Regarding your calculation that $7.4m is enough for a family with 2 kids, that figure seems to be the household networth rather than your individual networth, in which case, you would need to add your spouse's wealth/income. So if you earn $300k a year, might as well assume your spouse earns more or equal to that, which makes $7.4m not so hard to achieve, since a double income family usually has a higher savings/investment rate than a single income family.

Finally, the thing about earning $300k in your 30s is that it is probably a job with high risk of burn out, so you need to be strategic and build networks that will enable you to move to an equally good job with far better hours, because you are doing more of the 'leadership' stuff. Too many just burn the candle both ends and then declare FIRE, instead of being strategic about their careers. When you get to a certain level of seniority and can work from home, its almost like living a FIRE lifestyle except your company pays you....