By now, some of you might have read Channel News Asia’s piece on financial independence, retire early – how the FIRE movement goes beyond extreme sacrifice written by Grace Yeoh.

It is a rather lengthy piece but… It is a more authentic reflection of what we want people to know about financial independence or retiring early. I gave enough of my thoughts at work to the media, both with Providend and as a blogger, and we often don’t know how it will turn out.

But when I read Grace’s past work, I was quietly confident that despite how it will turn out, it would not be bad. Not everything needs to be lengthy, but the unique thing about FIRE is that there are many things the movement is linked to many perspectives, lifestyle choices, and trade-offs.

If you write a short one, people come to idiotic conclusions.

My comments revolve around more people looking for financial planning during the last couple of years, more robust views about coast or barista FI, and what most people genuinely want.

In the last couple of years, people have gone through a weird period where they experienced and saw many different things. As they have more time to work from home, they could reflect on what may be missing in their lives and specific deficiencies, so they approach Providend to have more conversations.

This is regardless of whether they want to FI or not.

After doing this piece, I think the big theme Grace heard from many of us is optionality, which is what people are looking for. With the uncertainty in our lives and the money trauma we grew up with, the giant monster we want to slay by accumulating wealth is not getting rid of our jobs but to create stability, security and control in our lives.

Stability, security and control are very mental. It is not an arbitrary sum such as $300,000, $1 million or $4 million. If someone cannot tell you what that money buys you, you think less of that sum of money in your life. If you cannot internalize the stability, security and control of having $1 million, then even if you have the money, mentally, you are also not FI, and you won’t feel ready for FIRE.

Money fxxking buy you varying degrees of mental and physical stability, security and control.

Among all the stories, I enjoy Kit’s one the most. You can follow Kit @centsofindependence over on Instagram. She has a perspective that I hope to hear more of, and I give Grace a lot of credit for letting Kit speak.

“It’s not that I didn’t enjoy my previous job, but it took up a lot of time. Working is not really 9-to-5. In order to reach your workplace by about 9am, you need to wake up quite early. And by the time you get home after dinner, it’s already 9pm. You’re literally spending most of your time working,” she said.

We all experienced this, but when you read it this way… it feels a little different.

“After so many years of working, I asked myself, how do I see myself? What do I identify with? What do I enjoy or feel that I’m good at? And I feel like I identified primarily with my job and not much else. I didn’t really spend much time pursuing a lot of other passions or pursuits which were equally important to try.”

“If I invest, the outcome should be that I am able to change my life. Like change jobs, stop working, have more free time, do what I enjoy.”

“Because I’ve been so prudent my whole life, this is one of the biggest things that I have done. It’s more about trying to justify to myself that I did the correct thing. It’s about living up to my own standards. It’s about trying to live up to these goals that I set up for myself. Because if I don’t go about trying to achieve these goals, then what did I quit my job for?”

Money & investing is a big part of things but sometimes, what pushes us over is the opportunity cost of time to live life.

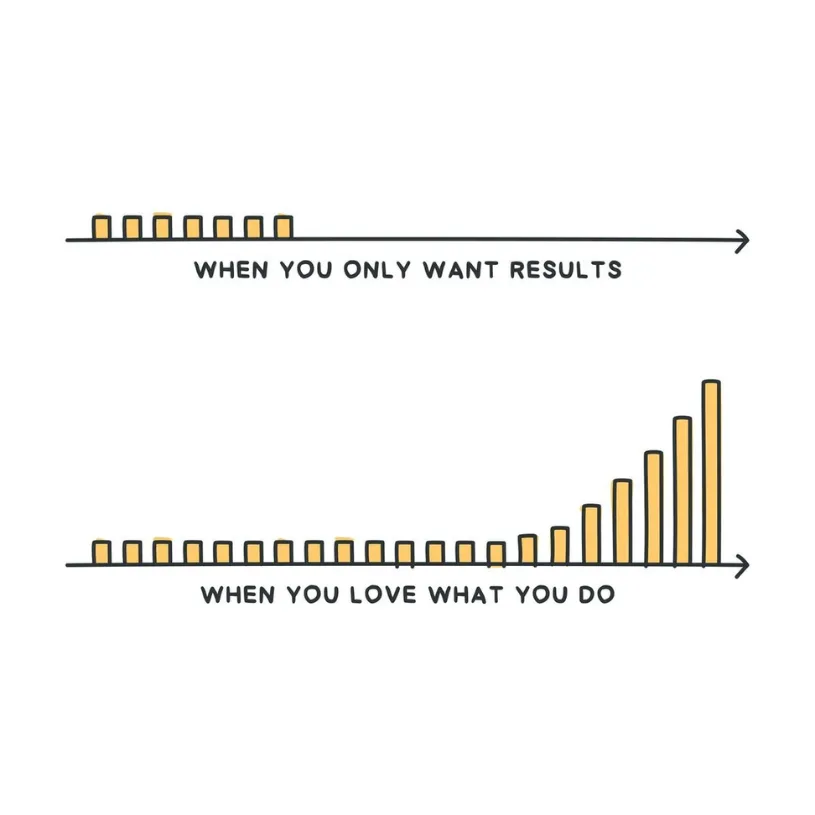

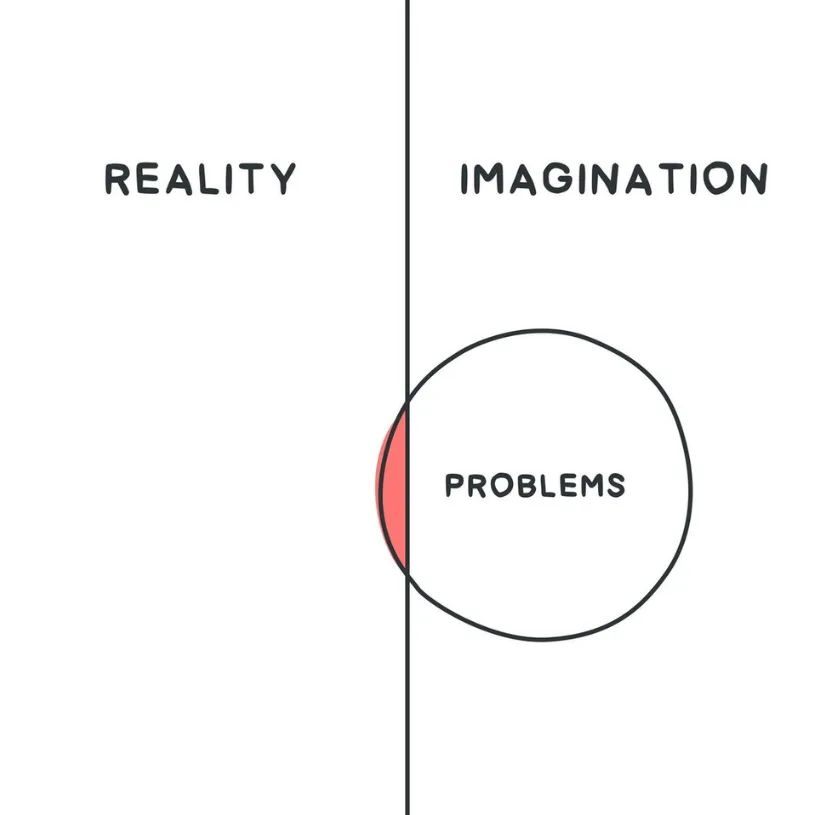

A couple of days ago, I came across a few images from this Twitter account and identified with a couple of them.

Most want high pay and work you love. But high pay sometimes doesn’t afford you time unless you buy time in the future. What you love or identify with might not create a financial cushion in the future. Still, if you can save up and match significant future liabilities such as your retirement, then this is possible.

Eventually, doing what you feel motivated about may eventually get you decent money again.

We would consider all sorts of things before we think we are ready to take the plunge. And we should. But eventually, a lot of people told me it matters less in reality.

This one… is less about FI but all things we want to do.

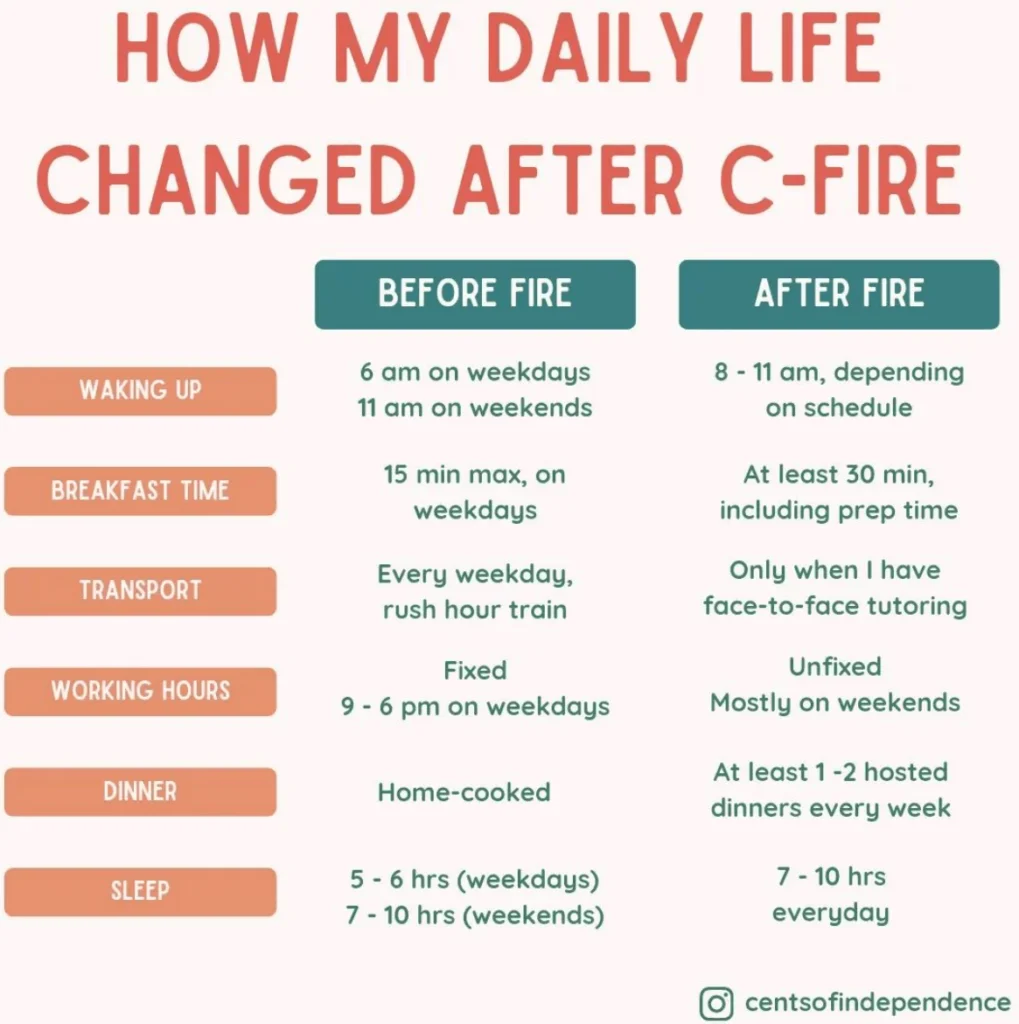

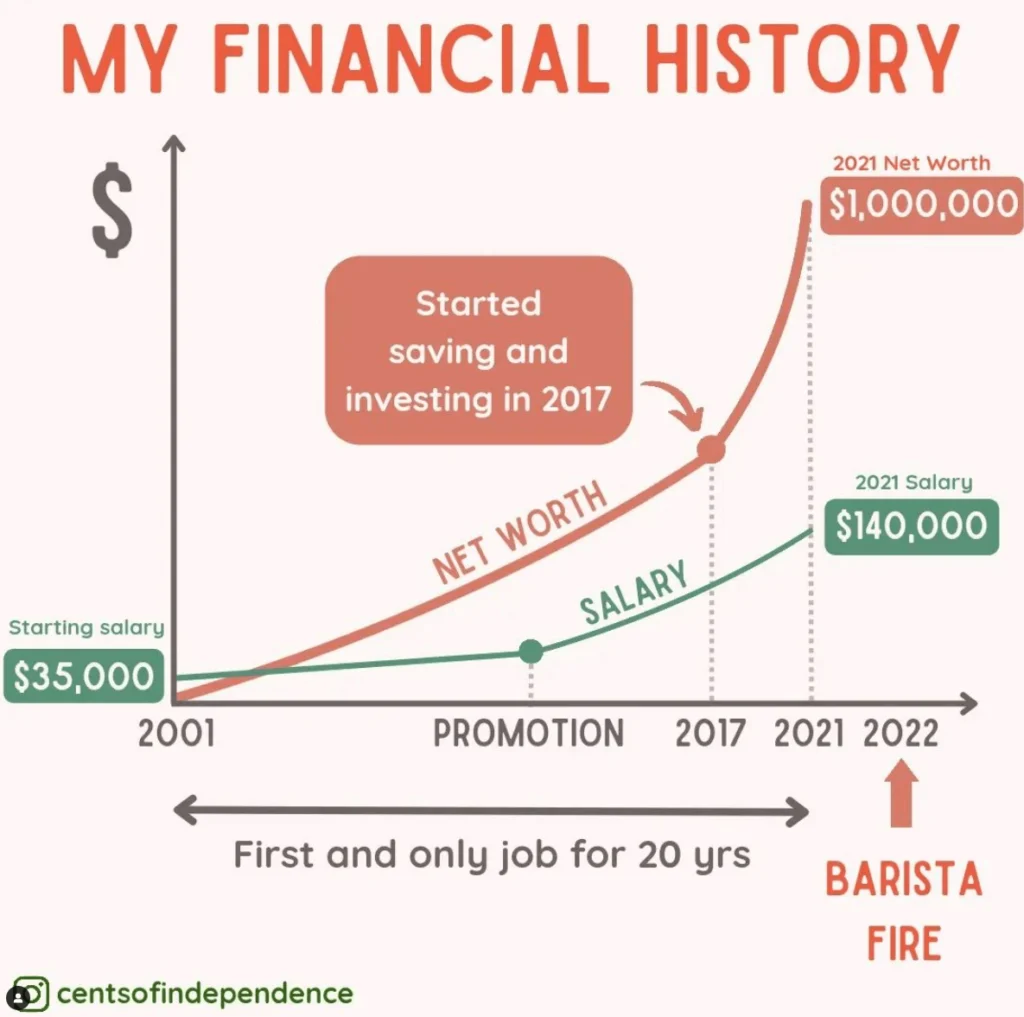

I leave you with some of the excellent graphics Kit came up with that I Identify with the most.

She explains in these two graphics her definition of Coast and Barista FIRE.

I like these two because it gives you a glimpse of whether life changes a lot or not. The first one links money and time together.

Everyone should draw their personal financial history. I think our chart tells our version of the story.

And that home in the pic is not my house.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Revhappy

Tuesday 23rd of August 2022

Wish it was as black and white. I dont really love my job. Best days my job is neutral. Worst days, it is an irritation. If I retire early, I wont be able to fill my time because there is nothing that I am very passionate and skilled at the same time. Most of my free time, I just browse forums, watch netflix. I cant do this full time. So work is like the necessary distraction.

I think majority people are like me, so for us, the best case is to find a relaxed low stress job, which gives you some people interaction, no matter how shallow those workplace colleague relationships are. They serve the purpose of the necessary social interaction. We are forced to step out of the house, travel in the MRT and see some people etc. If not, there is really no need for me to step out of the house at all. The monthly paycheck which comes in is the icing on the cake. I can watch my portfolio growth every month and that is my only hobby.

So I would say I am coast FIRE, except that the job is full time but it is quite relaxed and I am not ambitious for promotions. Most of my colleagues are 8-10 years younger than me and my manager is also 8 years younger than me. They all know, I am just cruising :)