Katie Gatti Tassin, the lady behind Money with Katie, recently wrote something helpful to contextualize our spending as a proportion of our goal to become free that I find it good to share.

Whether we can be financially independent is linked inexplicably to our spending.

If we spend more, less money flows to our financially independent resources, among resources for other goals. Not everyone wishes to be financially independent on the outside, but most secretly would prefer to be independent of needing their jobs.

But why do people who come across these financial independence resources less motivated to double down and pursue it (that is, if they really like the idea)?

She thinks that this may be because of how our brain reacts to numbers.

Your Brain Struggles to Comprehend Large Numbers

Katie thinks that one of the main reasons many may feel less motivated to walk over the line to the side of trying to accumulate money for financial independence passive income is because the numbers we are dealing with are too big.

Most of us deal with dollars in the “tens of thousands” realm and only occasionally in the “hundreds of thousands” realm (like if we’re buying a home or negotiating a new high salary). Annual spending of [insert large number like $90K here] * 25?! We’re now dealing with dollars in the millions, which is—likely—a lot more money than most of us can actually fathom.

It’s hard to understand how we could go from a few thousand bucks in our savings account to a 401(k) worth $3mm. Exponential compounding defies conventional intuition. Some of us feel so discouraged by it that we just check out entirely; we assume the goal is unreachable and swipe, tap, and insert our way through town (that’s a credit card reference; get your mind out of the gutter).

Now… I need to explain why times 25 to some that may not be so familiar.

Katie multiplied by 25 based indirectly on the 4% safe withdrawal rate (You can read my comprehensive article about why the safe withdrawal rate is essential to your financial independence).

Suppose you need $50,000 of income a year, so you wonder how much you need to accumulate in your portfolio or nest egg.

Based on the 4% safe withdrawal rate, you will need {Portfolio Value} x 4% = $50,000.

Your portfolio value is $50,000 / 4%.

Which is $1.25 million.

Now, if you need $1 a year, the portfolio value you need is $1/ 0.04 = $25.

So for $1 of monthly spending, you can determine the portfolio value you need to multiply by 25.

Here is how I would frame what Katie said.

If you are 25 year old and earns $3,000 a month, a sum of $200,000 looks daunting. But if you are 35 years old, earning $12,000 a month, the same $200,000 looks less daunting because that is less than two years of your annual income.

But as someone earning $12,000 a month, you will feel it’s daunting if I tell you that you need $4 million.

Our brain struggles to comprehend large numbers we have not experienced before.

But Katie may be right that we struggled to comprehend large numbers in general.

My brain usually freaks out when my boss dumps a multi-month mini-project with unclear outcomes. If I broke it down into smaller pieces, my brain settled down.

I think how we look at these FI numbers is similar.

What if We Look at How Much We Need In Terms of $100?

Katie suggested that you consider your needs in terms of $100 monthly.

For each $100 you need, it is $1,200 a year.

For each $1,200 yearly need, you need $1,200 x 25 = $30,000.

To a person that earns $3,600 monthly, that looks like a year of wages.

It is more relatable, except you will think: “What good is $100 a month??”

The beauty of using $100 monthly is that both $100 and $30,000 may look small enough for you to be motivated enough to consider further.

It gets you down the rabbit hole to ask the question, “What good is $100 a month??”. Your friend may chime in and say, actually, $100 is more than my monthly utility expense.

And the conversation can develop further.

You will think less about “It will take me very long to get $1.25 million” to talk more about the spending and concentrate on the spending.

The Motivation Increases Massively for High Earning Frugal People

Katie’s suggestion brings down the number to $30,000 so that most can relate.

But those who take home $10,000 a month and spend $2,000 a month might realize it takes them only 3.5 months to secure $100 monthly in passive income.

Because they are frugal and work in the realm of small numbers, they will become more motivated.

Let’s Revisit My Urban Survival Expenses in My Financial Security Plan

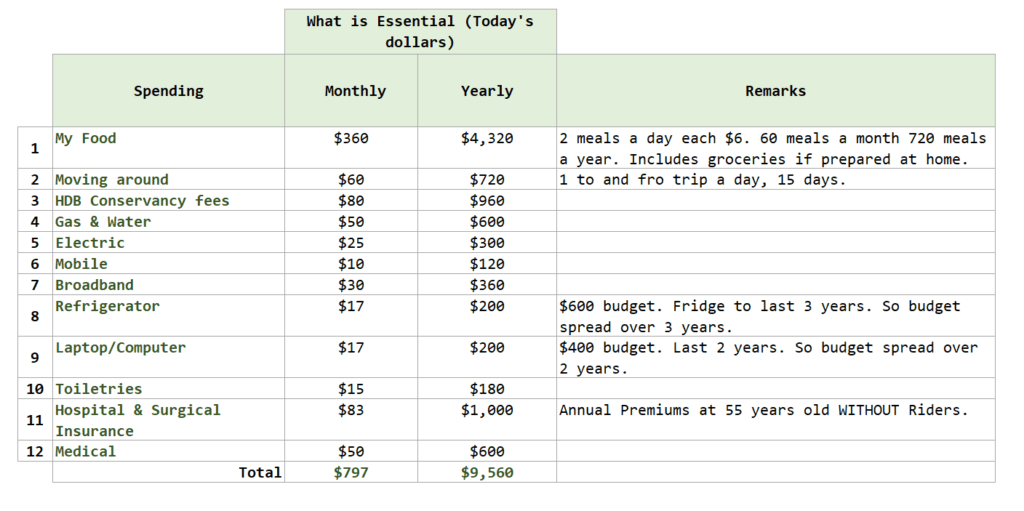

Some might remember the notes taken down on the subsection of my expenses that I am more concerned about securing. (Read Buying my financial security part 1 – What kind of lifestyle am I buying?)

I posted this table of the subsection expenses:

Much of the spending line items are less than $100 monthly.

So the question becomes, how much $30,000 do I need to achieve financial security?

Probably 8 x $30,000.

What if You Feel That a 4% Safe Withdrawal Rate is Not Safe Enough?

Now, if you are wondering after reading my safe withdrawal rate article if 4% is safe enough, I would say that 4% already factors in that you lived through some unlucky economic sequences, such as inflation and Great Depression and did well.

But if you are 25 and feel you need to feel connected to a stream of income that would last longer than 30 years, then you might want to be more conservative.

In my opinion, 3% is a good rule of thumb.

And based on Katie’s suggestion, instead of $30,000, the number becomes $40,000 (($100 x 12)/0.03 = $40,000).

$40,000 is more considerable and needs more, but this sum addresses your concerns better.

If you have reservations about using a 4% withdrawal rate, why would you still use $30,000? The hard truth is that to have a safer passive income, you need to have a plan that considers very unlucky market and economic sequences, which usually means you need more capital.

If you have relatively high earnings power and want to explore a perpetual stream of passive income, you can use a 2.4% initial withdrawal rate. This means you need closer to $50,000 (($100 x 12) / 0.024 = $50,000)

Here is the past research gone through on perpetual income:

| Research | Safe Initial Withdrawal Rate | By | Source | |

| 1 | Ultimate guide to safe withdrawal rates - Part 2: Capital preservation vs Capital depletion | Less than 3% to 3.25% | Early Retirement Now | Link |

| 2 | Sustainable spending rates for Single Family Office | Less than 1.3% | Wade Pfau | Link |

| 3 | Fecuntity of Endowments and Long-duration Trusts | Less than 2.7% | James Garland, Northwood Family Office | Link |

| 4 | Perpetual Spending Rate for Foundations, Endowment and Charitable Trusts | Less than 2.3% | Jim Otar | Link |

| 5 | Income planning in the most expensive market conditions - Greater than 35 times Shiller CAPE | Less than 2.8% | Robert Shiller | |

| 6 | Rivershedge Research | Less than 2% to 2.5% | Rivers Hedge | Link |

| Average Less than 2.4% | ||||

| Generating perpetual passive income | Investment Moats | Link |

Recognize the Trade-Off Of Spending On Something

Each $100 monthly spending does a few things:

- You may build a spending habit that you may struggle to change, even going as deep as into your retirement years.

- Is the money you cannot contribute to building up your resources for financial independence.

This exercise also forces introspection on each spending.

It forces you to make stern money judgements.

Perhaps the message that is more important to Katie is that if you spend unconsciously, it will bite a huge amount.

After going through that financial exercise of mine, it made me think hard about each $1 of long-term spending. Spending $1 monthly may make me need $500 in a sinking fund or some savings.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Kevin

Thursday 8th of December 2022

Time to show your blog post to my friends! I agree that our brain struggles to comprehend large numbers, which in turn paralyze people and stops them from making any significant progress in personal finance.

Kyith

Friday 16th of December 2022

Thanks Kevin, I got Katie to thank for reminding me that unconscious spending can be twice as problematic.