I hope my last post address the queries of some readers.

I will try to do some of these if I can when I have. One of the main reasons I try to do that is that I can have something to refer readers next time to if they need a more detailed explanation.

The majority of the dividend investors have been supportive. They read into my points and interacted with me to better understand how to reduce blindspots in their dividend strategy.

There are some good reflective posts that were generated from this:

- Limster (who is planning his FI with a half ETF half stocks dividend-based strategy): Addressing Income Volatility and Addressing Risky Stocks

- Blade Knight (who is planning with a dividend-based portfolio) : Interesting Postings On Websites & Blogs Over the Weekend- 2nd Investment Property and Flaws in General Dividend Investing Mindset.

- My friend Thomas at 15HWW: Some Quick Thoughts On The Dividend Income Retirement Model

Limster reflected and thought it through, and he shared some similar thoughts as Thomas. The records of actual dividend investors have been good. But I feel that some of the focus has been on returns, but retirement is more than about returns. If returns is the answer, then a portfolio of small-cap value might solve all these problems.

The challenge with consistently drawing income is that you are solving a few uncertainties.

We have to recognize uncertainties as a big part of the base rate or the big gorilla in the room. The uncertainties or that we can live through a lucky or unlucky period and it is difficult to figure that part out.

A focus on returns is a symptom of the frame of mind when you are using the blueprint for accumulation in retirement income planning. While returns are important, they are less important if you don’t take care of the main thing: Respecting the income to your portfolio value.

You can have a poor investment return but have a good retirement if you plan well. But there is so much harping on returns, returns, returns. What happens if your returns fall short? Do you get a poor retirement? After blaming your adviser, the person conducting the investment course, and yourself, what do you do then? Find a new investment manager?

What if the good investment manager also fails to deliver as well as you hope during an unlucky period?

The second part is to re-emphasize that I am not beating down dividend investing as an accumulation strategy. Some of the examples brought up are people in the accumulation stage and I have no problems with that. It is not about whether they can get returns or not. Even 4% a year growth grows your wealth for FI!

But we have to recognize that what may have made the plans work for many is not due just to dividend income but that their capital base is of a size that buffers for income volatility.

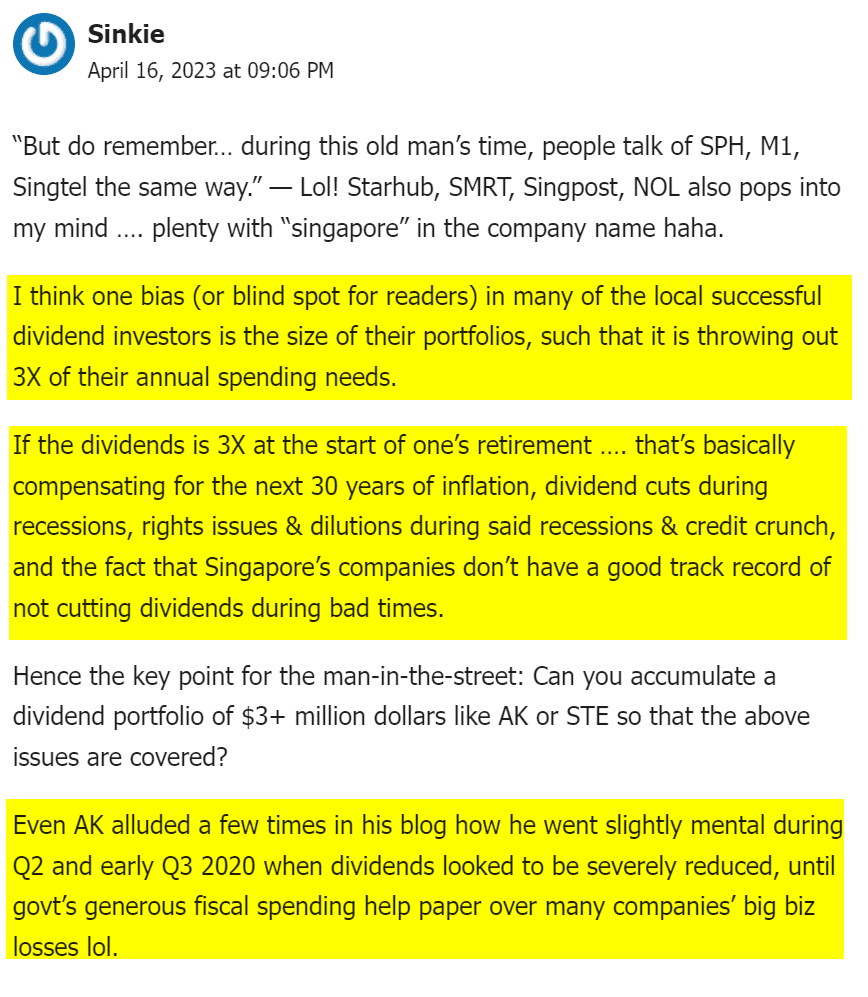

My regular commenter Sinkie brings up this point:

I seldom come across people whose income is three times their annual spending needs but in my Telegram group there is a lady whose income is twice her needs and I think the psychological safety of dividends plus the buffer gives her comfort.

But we need to recognize that what may have given a safe retirement is some buffers, or technically a larger capital relative to the income needed.

How much more buffer?

That is what sometimes we do all these safe withdrawal rate studies or Monte Carlo to try and figure out. We want to figure out if we are closer to being safer or more risky in the plan.

But yet… in the middle of all this, I get comments like this:

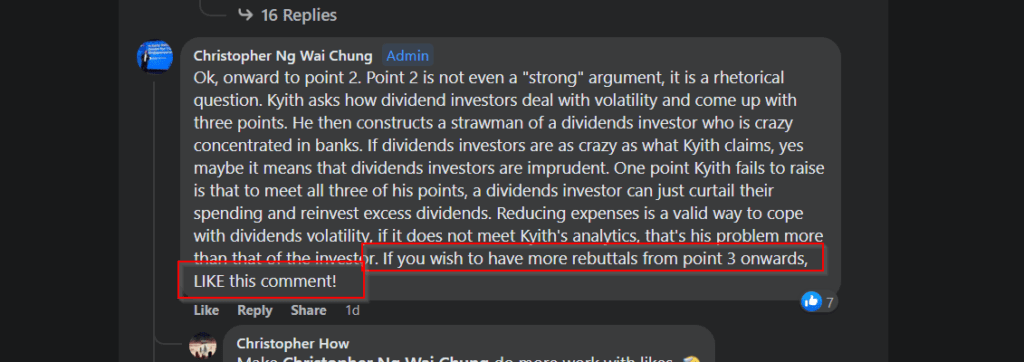

My friend Chris seems to think that I do all this thing to drive home some better retirement income model and I am doing this either because it is good content to generate traffic or that I have some incentive to sell this.

If it is not clear enough, I wrote this because enough people have asked me about it. It is not because I got all the time in the world and wish to stir some controversy like he always does.

And you can detect that some of the people who asked about the comment I made are genuinely planning for their own eventual FI.

I didn’t wake up at 6 am and spend 4 hours writing a post just because I think it is a sport for likes.

What did I do it for?

So that you can understand why I lean towards what I prefer now and away from what I used to think is good enough more clearly.

Why do we need greater clarity on this subject?

Because your retirement income is not a simulation or paper exercise to me. Some of you may be like me, who may not eventually want to wake up one day from your retirement and realize there are flaws in my retirement income plan and have to scramble to make adjustments to a plan that I thought was very sound and comforting.

By then, you will realize that you have physical frailties, and are not competitive in the job market.

The key to retirement is peace of mind and for some, the numbers need to make sense.

My colleague Chin Yu told me one of his clients is thinking about officially retiring.

He is happy for them.

He asked: “How do you feel about it?”

“Happy and scary at the same time.”

“What clouds your thoughts?”

“We are not sure if we have any blind spots in our plan.”

Planning for retirement and actually retiring are two different things. When some retire, they leave behind a very lucrative career and likely leave a lot of future human capital income on the table.

We all want to make good decisions so that our families don’t suffer from our poor decisions.

What clouds Chin Yu’s clients clouds most of our minds.

I want you, my readers, to make good decisions in your lives.

If you don’t like it, but I think that is the truth, then I think I have some duty to point things out.

I also have added burden because I work at Providend. The reason why I look into this area of finance a lot is that clients put their family’s hopes for their family on us.

I don’t know about the advisers, but I fxxking don’t like to get this wrong. Whether you are high net worth or low net worth or what, you want to make good financial decision.

And retirement is one where the base rate is very different.

When you stop having an incoming recurring income, things change.

Recurring income from work buffers & corrects ALOT of poor, erroneous decisions and blindspots.

There are things you can correct because you have income but when you don’t have it, your hands are more tied.

If you ask me, whether you are using a dividend strategy for retirement or another strategy, I want you to have peace of mind. Peace of mind is a feeling and for some, they need to be assured more about the numbers to have that.

I probably spend enough time thinking about the subject of retirement income or passive income needed for different timeframes. Not investing but retirement income.

Deep down, I am so serious about it that I wonder how many in Providend know how serious this subject is to me. The comments I sometimes get are how “Kyith likes all this investing stuff” and I go home thinking how well they really know what I am most concerned about at Providend.

I can let a lot of things slip by such as Legacy planning and Children’s education if we don’t have a solution that leans towards great.

Why?

I know the base rate. People can adjust. The model is such that people can adjust.

Passive income for financial independence? The challenges are different man.

And if I don’t think about this, who is supposed to think about this?

I think I am done thinking about the passive income models more or less at this point. I will still be open and pay attention but I think its unproductive to continue. Knowing what I know, it also allows me to assess who really understands these retirement income problems, who are genuinely interested to know more and who are the people who consistently refuse to understand better but focus on arguing for the sake of arguing.

If you see me give you a long reply, it is because I detect you genuinely want to figure these things out or you matter enough to me to give you that. If I don’t, it means I have given up on you.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

- The LionGlobal APAC Financials Dividend Plus ETF Won’t Give Singapore Investors 5% Dividend Yield Always. Further personal thoughts (with some data). - April 13, 2024

KY

Friday 28th of April 2023

Hi Kyith, thanks for sharing all these articles about dividend investing, and why you do what you do in blogging these thoughts. I can really feel your passion in sharing about these topics, and I also sense that there is some disappointment in how some people have reacted. For my own thoughts about this topic, I really like the ideas you have brought up; I myself have also dabbled in dividend investing early on, but have gradually leaned primarily towards broader diversified investments like you, and some of your reasons I resonate with. On the reactions of others, I think this is part and parcel of sharing opinions on the internet. Furthermore, I feel that investing styles can be very divisive, maybe because money is so close to everyone’s heart. People might have reacted strongly because the arguments you use against dividend investing are worded strongly, and your blogging style has never been to mince words. I think the reactions are just standard fare for being part of an online community. In fact I think some of your commenters have been very humble to acknowledge your points, even if they belong to a different school of thought, which is more than what can be said for many other communities! I think it’s great you have such passion and I often learn a lot from reading your sharings, just try to disregard the nastier side of things if you can...

revhappy

Thursday 20th of April 2023

Wow! So much discussion on dividend investing. I have argued enough on Money Mind forum on this topic. My conclusion is that; Dividend investing is a legit strategy, but it is not for everyone. Index investing is something most laymen can pickup, without having to understand much about markets and sectors and stocks. So Index investing should be the preferred strategy to prescribe when some layman comes to you ask for help.

Dividend investing on the other hand is very different. There are very successful dividend investors, like Limster mentions, Dividend warriors, GlobalIncome50 blogspot etc and Limster himself is very good dividend investor. But the common theme among all 3 is that they are extremely good at picking good dividend yield stocks. They are very active investors. They will all do pretty well with this strategy. However if a layman wants to embrace dividend investing just based on attractive dividend yields, then they must learn that there is more to it and involves skill, research and a certain bent of mind to become successful.

I think this topic for some reason brings a lot of heated arguments from both sides of the fence. Why cant we just agree that there are many ways to skin the cat. I respect both strategies, I also acknowledge my own short comings with lack of conviction and I am very fickle minded, that I will never be a good individual stock picker, so I will always lean towards index investing.

Kyith

Monday 1st of May 2023

HI revhappy, no disagreement with what you said. Thanks for flushing it out that well.

lim

Friday 21st of April 2023

@revhappy, as I have mentioned, I actually feel that Kyith's points are all valid. However, I feel that while one has to pay attention to the points he raised (like avoiding portfolio overconcentration which to me is common sense and applicable to investing in general, not just dividends), this is not so hard to do. Therefore, the concerns while valid may actually be overstated.

If one believes that investing is 95% psychology and 5% skill/effort, then dividend investors may have a psychological advantage because dividend investing is easy to understand and implement, and therefore the investor is more likely to stay the course... and in the end, "staying the course" which results in "time in market" is the winning formula (together with the power of CD! of course :) )

BFIRE

Thursday 20th of April 2023

Correct me if I'm wrong, but isn't lowering the portfolio withdrawal rate from 4% to 3%, or even lower, to adjust for uncertainties and errors, similar to accumulating a larger than required portfolio (maybe by 20% or 25%) that churns a dividend sufficient to cover expenses?

Kyith

Monday 1st of May 2023

Hi BFIRE, you are thinking the right way. I prefer that safe withdrawal rate method because it gives me a better appreciation of the extreme upper and lower bounds since it factors in periods of depression and high inflation and whether the plan will work. If one wants a dividend stock portfolio to have more consistent income and be more anti-fragile, they may need to buffer but how much buffer? A 2-3% safe withdrawal rate is buffer infused already. So we have a bound to work with. But what is the bound for dividend investing? It is less clear. You can use 20% more income or 30% more or some crazy one is 100% more. Is that over-buffering? I don't know. And hence why I lean more closer to the SWR.

BlackCat

Thursday 20th of April 2023

I think there's a false sense of security from dividends. They are not an annuity, and sometimes they mask a company levering up or paying out it's capital.

SGX REITs did great in a falling rate environment (2009-2021). Not so great with rising rates.

I like companies that pay *some* of their profits out, and have low or fixed rate debt. Delfi, boustead and KMI:NYSE are examples. I've done a lot better when I see dividends as the icing on the cake, rather than the reason for investing.

Kyith

Monday 1st of May 2023

Hi BlackCat, thanks for lending your experience on that subject. I think underneath what you said, there is an element of value investing in the dividend approach you suggested. When we decide to invest in REITs, there is also a value investing layer as much as we tried. But sometimes we get things wrong or we are too optimistic.

When we go down this path of discussion, we are practically saying that not all dividend stocks are the same and only a subset of it works better. A finer discussion might be the retirement model with high dividend stocks, or the retirement model with low payout good ROE stocks. I think whichever way, some of my points may still be valid about consistency of income, which will very much tied to peace of mind.

Shao K

Wednesday 19th of April 2023

Hi Kyith

Indeed, it might be better for local dividends investors to just buy some etf like s&p500. I have been reading your posts and I know you are definitely a very technically competent person. I hate to debate online nor attract any attention so I haven't been sharing despite reading your posts for years. Plus, it will be very tiring and difficult when I have to pinpoint details.

No doubts, there are risks when we become too reliance on just 1 source of income, and it is not exaggerating to say it is life and death matters since it involved bread and butter.

Probably, I can list down some reasons why it is probably better to do some of each approach, so we can cover our own blind spots. Here:

1) currency exchange. SGD, USD, yen, etc may be priced differently. However, unless one decided to leave Singapore, it is more likely that SGD will be more reliable due to home ground advantage. Also, changing to and fro still lose some value, no matter how small they are.

2) it is very hard to trigger sell orders for many people. You don't have to do any selling for dividends. Especially if you intended not to time the market.

3) when market is down, you lose the psychological effect of income because you are going to sell at market lows, compared to receiving dividends even if it is cut.

Of course, your points on the dangers of concentration in Singapore stocks and reits are valid. Although, the reits are international though but foreign reits are not well received here. And banks, we don't know when it will be disrupted to what extent.

So, my suggestion is to do a comprehensive planning, receive some dividends to a comfortable extend, and grow money with ETFs for a long period, while having some cash buffer enough to tide through cycles, can be in the form of ssb etc. Also, can consider building income ladder with a bit of annuity like CPF and private ones. Some, they may even diversified into property, if they are rich enough.

I think retirement is not that difficult, it is how much one needs and wants that making it difficult. People for centuries have retired earlier, e.g. many house makers. It is just not the glamorous way of saying I am FIRE.

You are not wrong to zoom into all the returns of sequences risk, concentration risk etc, but most people will be doing fine to retire "eventually", just how much peace of mind they have, plus how well they can live their life in view of how well they planned their financial.

I may have simplified things, because I don't like complications to begin with 😊

Thanks for all your sharings 👍

Kyith

Monday 1st of May 2023

Hi Shao K! Thanks for visiting my blog and hope you and your family are doing well!

Point 1 is what many brought up. It is a bit give and take and ultimately, I hope people focus upon that we hope we can have a more well rounded portfolio whether we venture overseas or stay locally.

The psychological benefit of dividends is big but when I talked about local dividend stocks and concentration, I think it Is because that is how local does dividend investing. There are some downsides but if they live through a positive sequence, then perhaps there is too much caution on my part really.

I think I will give more weight when you say "retiring is not too difficult" because you went through this earlier than us.

But i think what needs to emphasize more is the peace of mind part.

You can have peace of mind for a while and then have fear creep in. How long is a while will depend.

I would like to believe that many will start agreeing with me if they have more experience and also understand what I have to say better.