If you have been in this finance space for a while, you would realize one question that you may see often is something like this:

I have $250,000 in X, $50,000 in Y, a further $300,000 in my CPF. I would like to know whether I can retire at age K. I also wish to buy L and M at some point in my life.

Do I have enough? Am I allocating my money correctly?

How much more do I need to accumulate?

Whether you are older, or younger, you are concern mainly about whether you are making the most efficient allocation of your monetary resources.

And also if you have enough for what you want to achieve.

A large part of financial planning is… figuring out how to allocate your financial resources to fulfil your goals.

I think many are trying to figure this out on their own.

So I decided to share with everyone on a high level, how I visualize financial resource allocation.

Basically, if you ask me about a financial planning problem in the past, if you peek inside my brain, this is how I frame the allocation of your resources to fulfil the goals you want.

With this, I hope that you will be able to better allocate your financial resources.

You will not need to consult any financial planner on how to allocate your resources if you fully understand this.

The Executive Summary

The method that I use is not rocket science.

It is what actuaries in insurance see things. Basically, it is asset and liability matching.

- What you have currently and in the future is your asset or financial resources as I like to call it.

- What you “owe” to yourself or others today and in the future are your liability or goals.

If #1 is more than #2, today you have enough resources for all your future goals and liabilities.

If #2 is more than #1, you need to make adjustments in your life.

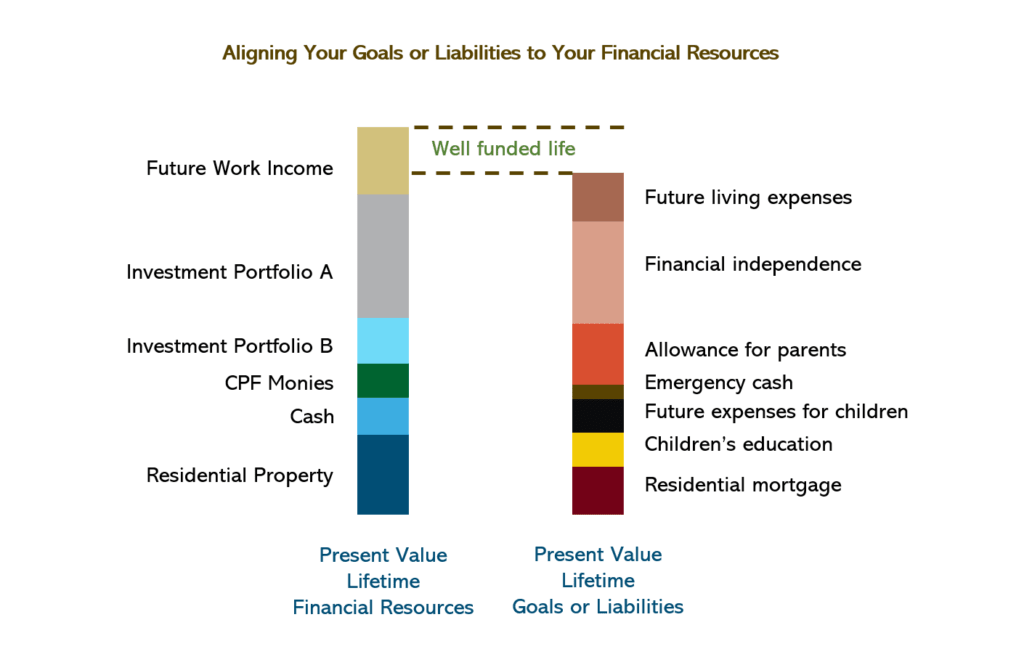

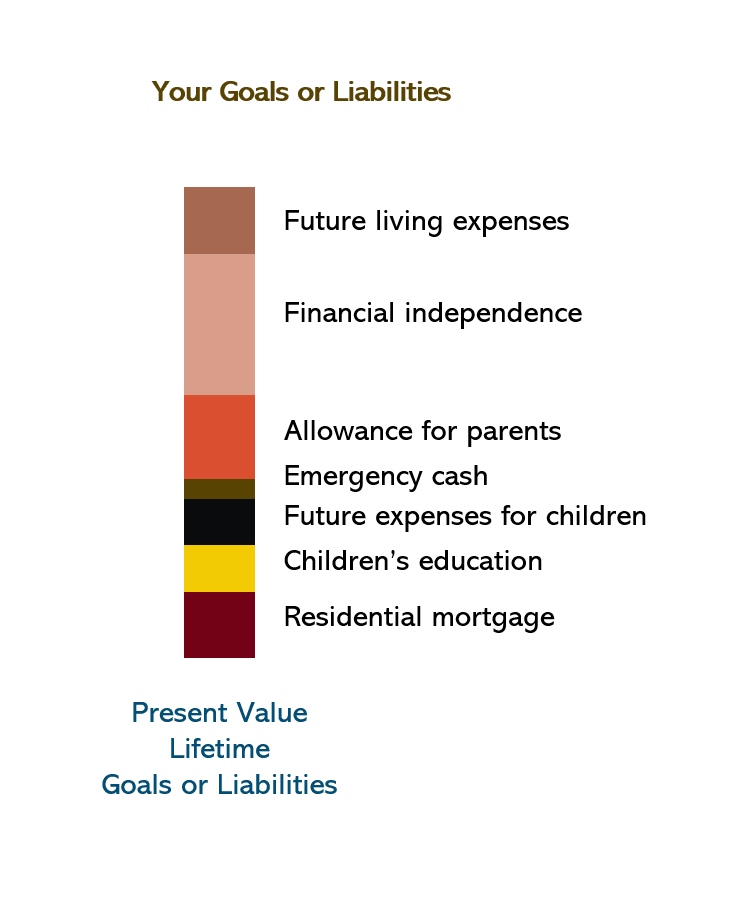

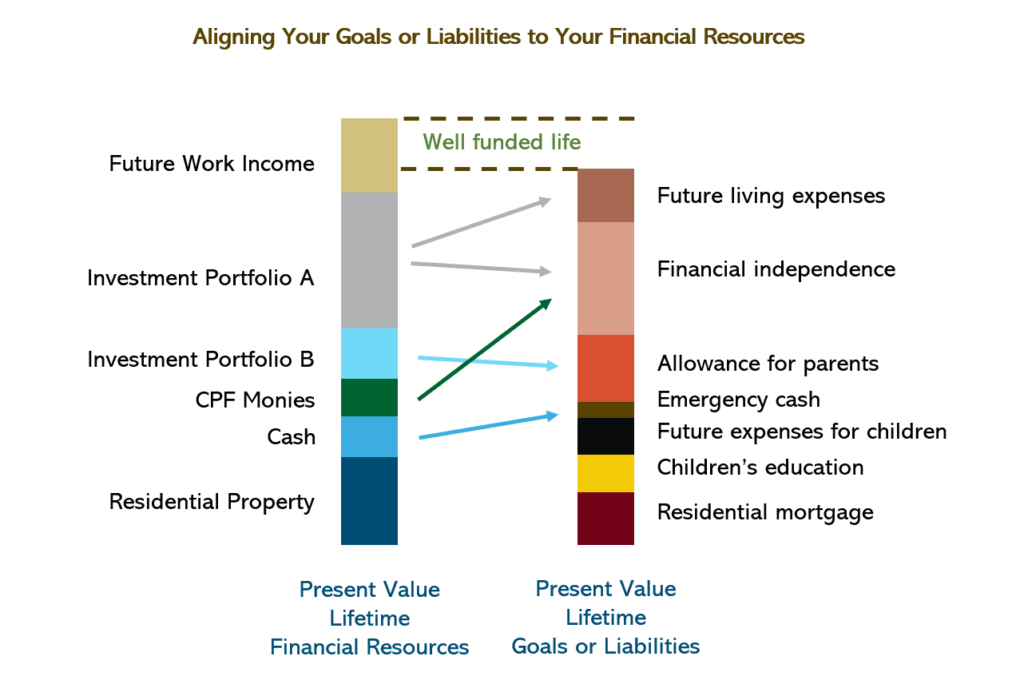

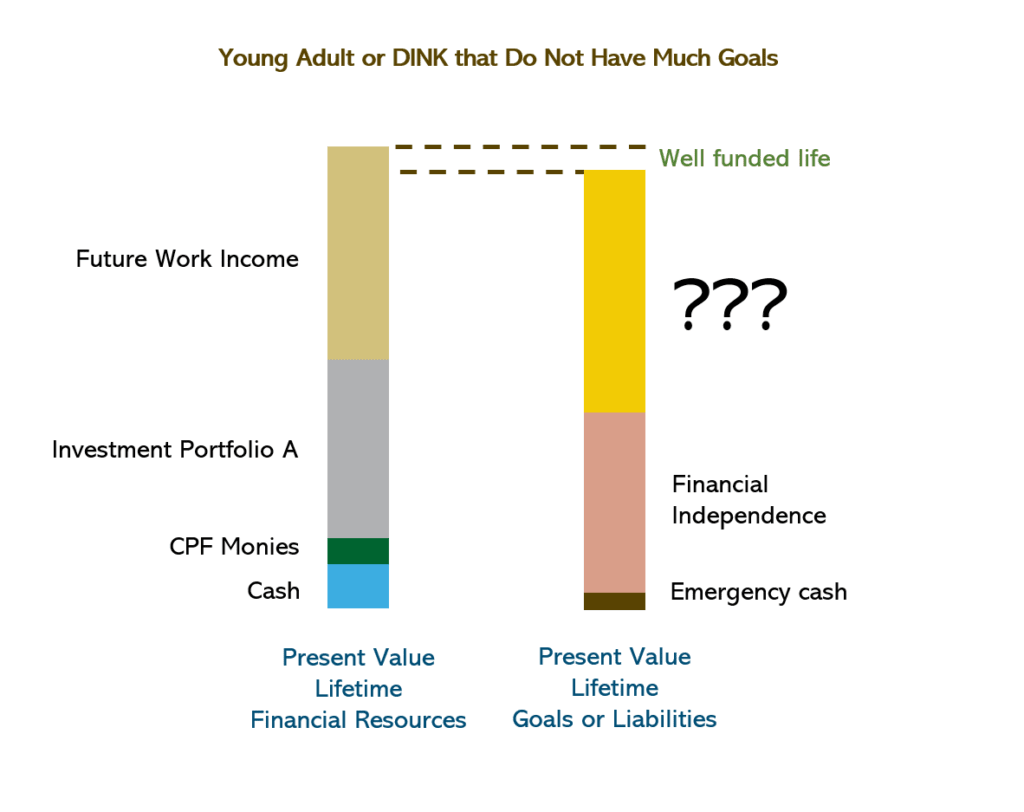

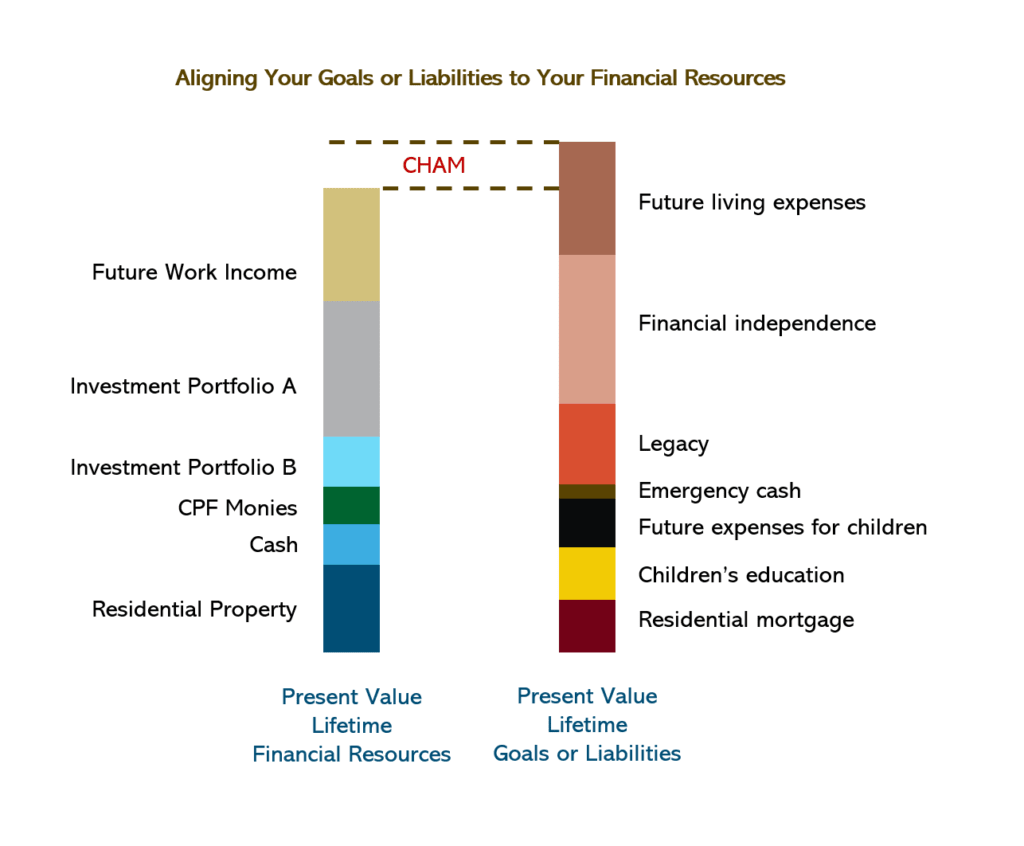

Your financial resources can be visualized as adding up two vertical bars like the diagram.

If your goals or liabilities bar is taller than your financial resources, you have too many goals or not enough resources. There is a mismatch.

You do not have enough.

Because you have identified your current and future goals and liabilities, you can better allocate your assets/financial resources to better fund your goals and liabilities.

What you need to do:

- Identify and add up your current and future financial resources.

- Identify and add up your current and future goals and liabilities.

- See whether the present value of your resources can fund your goals or liabilities well.

- Rank and arrange your current and future goals to determine which one is more important than the other. This is to allow you to make resource allocation decisions in the future.

- Reallocate your financial resources so that you can better target the uniqueness of each goal and liability

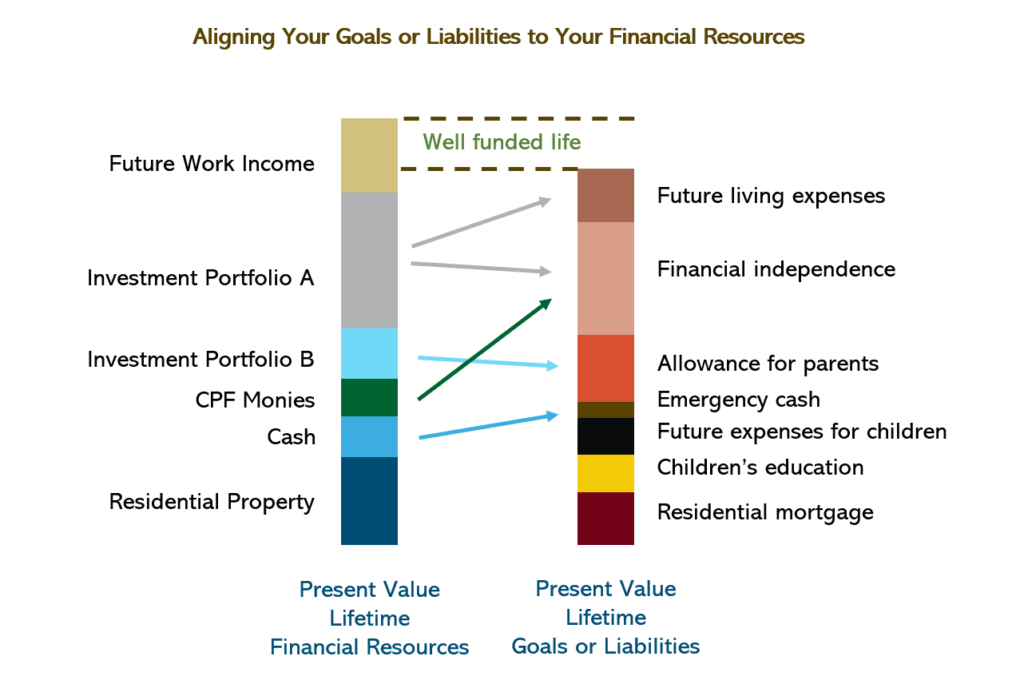

Step 5 would look like something in the diagram above. This is essentially what we call liability-driven investing.

Over time, your life changes:

- You defined new goals.

- You realize some goals are not relevant anymore.

- You paid off some liabilities earlier.

- Your career took a turn and you make more money than anticipated.

- Your investments grew much better or worse than you anticipated.

As your life changes, financial planning is iterating through step 1 to step 4 again in the section above again.

Here is my elaboration of this plan.

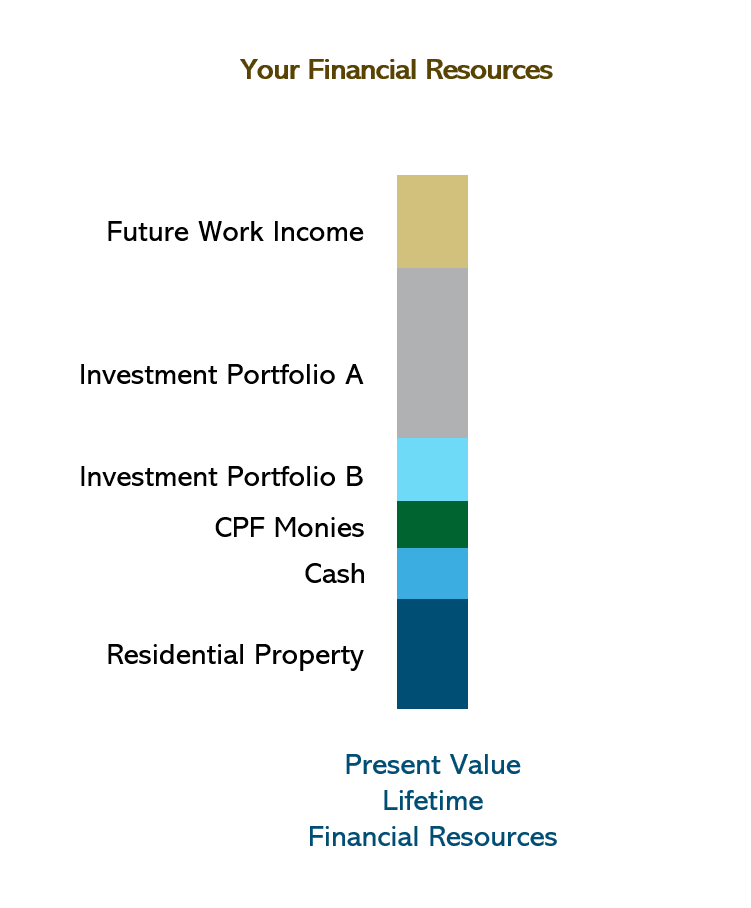

Step 1: Identify and Add up the Current and Present Value of your Lifetime Financial Resources.

Financial resources in accounting terms is called your assets.

An asset is something that is of value to you or your family.

If you are a young person just starting out to work, you may feel like you don’t have anything to your name. Someone who is in their 50s may have quite a diverse group of financial resources.

Some common financial resources are:

- Cash in your savings account.

- Cash in your time deposits.

- Your investments in your brokerage accounts.

- Your investments in your Robo-adviser platform.

- Endowment plans that are meant as savings.

- Cash-value whole life insurance that is meant more

- Unit trusts, stocks, ETFs, options, futures account with any positive values.

- Residential properties.

- Investment properties.

- Artwork, cryptos, collectables that will retain value over time.

- CPF or an equivalent government pension or social security in your own country.

The list above is not exhaustive but should give you a good idea of what is considered financial resources.

For a young person, you may notice that you would not have too much of this and you may think that you do not have anything of value now.

We called this your lifetime financial resources because there may be some financial resources that would only become tangible over time.

There are three that we can think of:

- Your income from work throughout your lifetime.

- Inheritance from parents or others in the future.

- Gifts from others in the future.

#2 may sound a bit morbid but realistically that may come in different amounts for different people.

You might need some help to calculate the present value of these cash flows or lumpsum that happen in the future.

Let me explain here.

A. What is Present Value?

Before we go into those cash flows, I think I may need to explain what is the present value is.

There is this financial concept called present value.

Suppose in 20 years you will have $100,000.

That $100,000 is not worth $100,000 today. Due to inflation (which may run at 3% a year), what was the equivalent of $100,000 20 years from now is only worth $55,367 today.

To calculate the present value is to figure out how much a lump sum or a stream of money in the future is worth today.

Basically, to figure out that $55,367.

There is a mathematical formula that you can easily find online or in your regular spreadsheet.

B. Your Income from Work Throughout Your Lifetime – A Big Future Financial Resource

The biggest financial resource for a young person is #1 your future savings or surplus from work.

If you do not have the investments for retirement today, that can be build up in the future as your income increases, as you control your expenses and learn to invest well. (You can read my wealthy formula to understand more about these three rather important factors to build wealth)

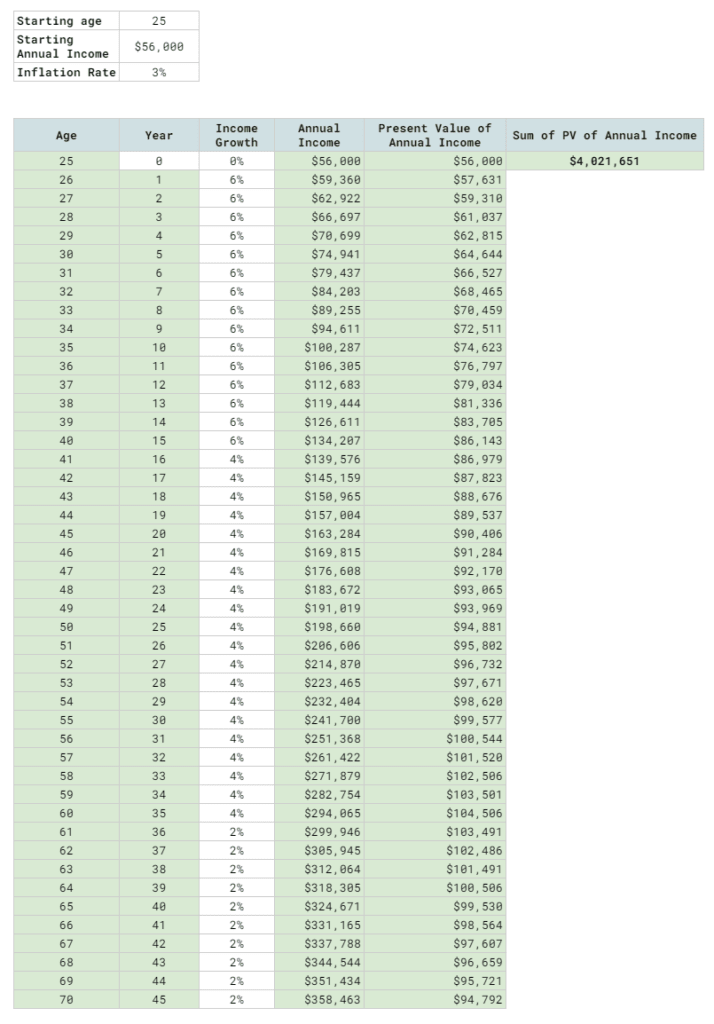

If you are 25 today, you may earn a starting take-home of $4000 a month, with 2 months of bonus. Your income grows at 6% for the first 15 years, 4% in the next 15 years, 2% in the next 15 years.

We can determine how much this stream of income is worth in today’s money.

We are trying to compute the present value of your future work income.

To do that we will need a discount rate, which is usually equivalent to an arbitrary long term inflation rate. In this case, we can use 3% a year or you can use 4% a year if you are ultra-conservative or 2% if you are more optimistic.

If you use a higher discount rate/inflation rate, the present value of financial resources you have is smaller (hence more conservative as it treats that you have less) and if you use a lower discount rate, the present value of the financial resources you have is larger (hence more optimistic).

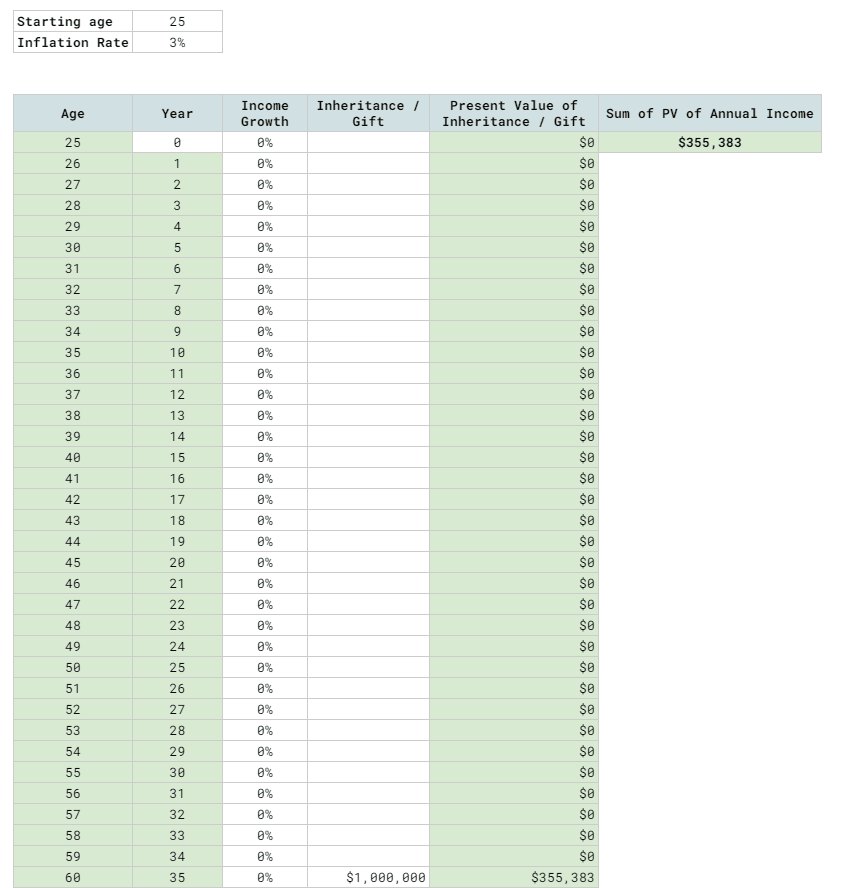

The table below shows the present value of your lifetime work income:

This 45-year stream of work income is $8.8 million. But after factoring in inflation, it is worth $4,021,651 today.

I will go through how to compute this near the end of this article.

You cannot see this $4 million today but over time it will be available to you.

C. What is the Present Value of Future Inheritance

What about a gift or an inheritance in the future?

The difference between this and the previous one is that this is a lump sum while the future income is a stream of cash flow.

In any case, we can come up with a present value of that inheritance if you were to receive it today.

It is more common for someone to receive an inheritance in their 60s. So suppose you are 25 and let’s say at 60 you received $1 million. How much would that be worth today?

$1 million at age 60 will be worth $355,383 today.

Should you factor in a future inheritance as your assets today? That is a good question because how confident do you believe you would eventually get the money? If you do not get it, then you are overestimating things.

So we would often not add it. We will go through some actual kickboxing moves later.

For now just understand that whether it is a stream of income or a lump-sum gift, you can compute the present value.

D. What is the Present Value of your Investment Shares today?

This is simple.

Suppose you take a peek at the total value of your shares in your Interactive Brokers account and find that the market value is $233,333.

Then the present value of your shares is $233,333.

For those assets that you own, you can calculate the current value.

If it is your investment property, residential property, you would need to take a look at comparable value based on the recently sold property transaction in your housing project.

For your Rolex watches, you would need to find the market value in your own way.

E. Sum up the Present Value of All Your Lifetime Financial Resources

If you manage to identify all your financial resources, what you need to do is add them up.

That is the present value of all your lifetime financial resources.

To make it simple for you here is a rule of thumb: Usually it is the financial assets you own today plus the present value of your future income.

For most people, it is like that unless you know some gifts or inheritance coming your way.

So if I use myself as an example it would be:

- My portfolio of stocks + cash

- Some cash in a savings account

- Present value of 50% of what my parents have today (though I tend not to include this), which includes 50% of a residential property

- My future income potential

So that is about it.

Step 2: Identify and Add up the Current and Present Value of your Lifetime Goals or Liabilities.

Your goals or liabilities in financial account terms is your liabilities.

Liabilities is what you owe to others.

Similar to Step 1, you would need to identify and add up your current liabilities and the present value of your future goals or liabilities.

A. Why are Your Goals Lump Together as a Liability?

A goal or a financial goal is something that you felt… is something worthwhile and high priority enough that you would like to talk about.

That you would like to tell others.

If you fail in your goal, your family or yourself might not be too delighted.

In a way, if it is important enough for you, it can be seen as a burden.

In a certain way, it is a liability to yourself or your family.

If you disagree with me, just accept it for now and then we will try and further discuss this later.

B. Liabilities can be Translated to Financial Burdens that Need to be addressed by Financial Resources

Most liabilities can be translated to a goal to be funded by money.

I will give you some of the most common goals:

- For my wife to further her education 5 years from now.

- So that we can have a comfortable retirement at 60 years old.

- Plan to send my kid 15 years from now to an overseas university education.

- I want to make sure to leave aside $1 million for my second son.

- I want an alternate holiday home when I retire.

Almost all of these goals need to be funded by money.

That would come from the financial resources you have come up with for the previous section.

C. Here are the most common goals and financial liabilities we came across

Experience tells us that these are the most common goals that people plan for.

This means that you would have these financial liabilities somewhere in your future, even if you are unaware of them today.

I have tried to arrange them in chronological order when you would need them:

| Goal / Liability | Nature of Liability |

| Future essential expenses | Stream of cash flow |

| Future discretionary expenses | Stream of cash flow |

| Wedding | Lump-sum |

| Residential downpayment | Lump-sum |

| Future expenses for kid 1 | Stream of cash flow |

| Future expenses for kid 2 | Stream of cash flow |

| Future allowances for parents | Stream of cash flow |

| Kid 1 university education | Lump-sum |

| Kid 2 university education | Lump-sum |

| Financial independence | Stream of cash flow |

| Provide a legacy for kids | Lump-sum |

| Residential Mortgage | Lump-sum |

That is about all.

Next to it, I have listed down whether that goal is made up of a stream of cash flow or a lump-sum.

Some of them might be a bit subjective. Technically, you may be able to break down financial independence to your essential and discretionary expenses. I think that would be better.

For most people, they might only be able to see a few of these financial goals, so I hope this table gives you an idea of the financial burden of living a good life.

D. Calculate the Present Value of Your Future Goals or Liabilities

The struggle most have is that usually these financial goals is in the future and not today.

You would need to calculate the present value of each of these goals and then later we will add them up.

To do this, for each goal, you would need to figure out:

- When you need the money. This means how long from today till the day you need the money. 6 months? 2 years? or 18 years?

- What is the inflation rate to use? Some people believe university education and healthcare cost will go up faster than the standard inflation. So you would need to use a higher inflation rate.

- What is the aggregate value of a stream of cash flow at the time you need it? You would need to calculate the value of a stream of cash flow that happens in the future. A good example of this would be your financial independence.

I think some of the less financial mathematics-inclined folks may struggle with this.

This guide is not to teach you the math so much but on a high-level how you plan. Mathematics is not tough and if you Google you should find out how to calculate this in Excel.

Let me go through some of the bigger goals and liabilities.

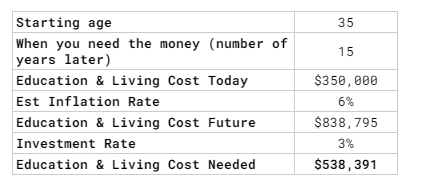

E. Present Value of Your Children’s University Education

This is a lump sum.

Why? Isn’t a university education spanning 4 years or 5 years?

I think most people would appreciate that during their child’s studies, everyone has peace of mind that if the markets are volatile, it will not affect the funds available for their child during any of those 4 years.

How much should you prepare for?

You can calculate how much it cost in tuition fees and living cost for local or overseas studies today.

An overseas education today may come up to $350,000 if you add the living cost and tuition fee that is needed over 4 years. This should be what you prepare for.

You can imagine setting aside $350,000 of your money today in some investment, grow at 6% or more over 15 years, to get $838,795 in the future, which should be enough for your kid to pay for their 4-year university degree.

But if you wish to be conservative and set aside more for the financial goal, you can approximate the $838,795 back to today’s value with a 3% investment rate.

The present value today would be roughly $538,391.

This is a bigger sum than $350,000 but essentially you are being conservative and planning a bigger liability.

You might not have all your money but if the present value of your future work income is $4 million, $538k will have to be used to fund the

F. Present Value of Your Financial Independence Expenses.

This is a very common goal.

The liability of your retirement goal depends on

- The retirement methdology used

- When you wish to stop work

- How much is your retirement spending today

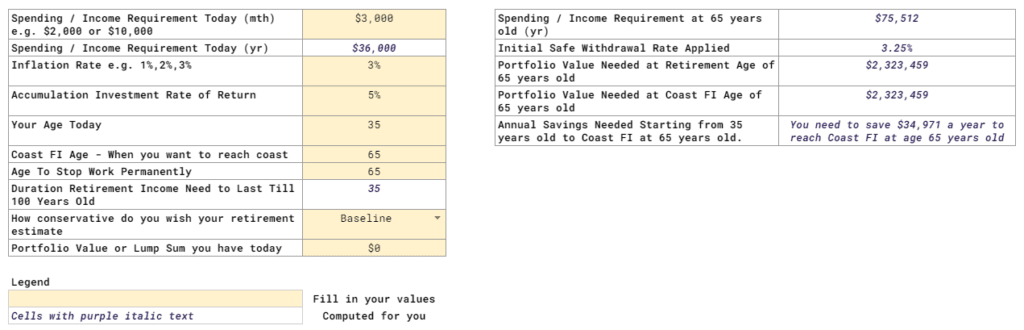

If your retirement methodology is to use a safe withdrawal rate method, you can use the CoastFI Calculator I introduce to my readers in my CoastFI article here to calculate based on your retirement age, what is the amount you need.

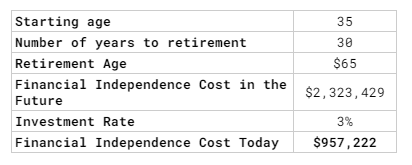

Suppose you and your partner discussed and your retirement lifestyle would cost you $3,000 a month today. You are 35 today and wish to retire at 65 years old. Based on my CoastFI calculator, you would need $2.3 million at 65 years old, or 30 years later.

You would need an additional step to figure out how much is $2.3 million today based on a conservative investment return.

If you are comfortable, you can use the inflation rate.

The present value of that $2.3 mil today, based on an investment rate of 3% is $927,222. If you use a higher investment rate, the liability is smaller (but less conservative) and if you use a lower investment rate, the liability is bigger (but more conservative)

This means that if the present value of your future income is $4 mil, part of that $4 mil needs to offset this $957k in financial independence liability.

G. Present Value of Your Future living expenses

Before you think about retirement, you have a huge liability which is your living expenses for your family before retirement.

You could break this down to essential or discretionary or even further down if you wish to . But here, let us keep it simple by just call it living expenses.

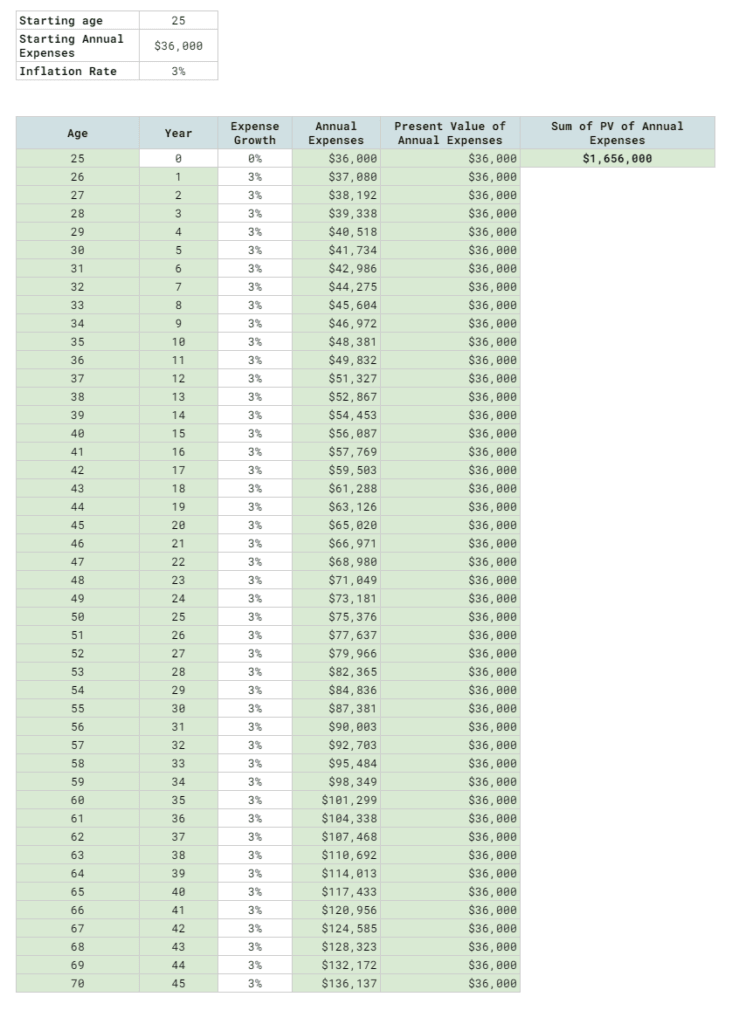

We go back to the first example, where you are a 25 year old spending $36,000 a year.

You can assume that your expenses go up with inflation over time.

The present value of your expenses to age 70 is $1.6 million today.

So while the present value of your income is $4 mil, $1.6 mil of that will have to be spent.

H. Sum up the Present Value of All Your Lifetime Goals or Liabilities

Just like the present value of your lifetime financial resources, you will need to sum up all the present value of your liabilities and goals.

Step 3: Do You Have Enough for Your Future Goals?

Once you have the present value of your financial resources and your goals or liabilities, you will easily know whether at this point, you have enough.

If the present value of your financial resources exceed that of the present value of your goals and liabilities, you have the financial resources to fully fund all your goals.

If you have a shortfall, this means that you do not have enough.

It is that simple.

If you have a shortfall, we can later go into what you can do about it.

Step 4: Rank and arrange your Current and Future goals.

Suppose that you have identify that you have the following goals and liabilties:

- Pay off your current residential mortgage

- Financial independence

- Children’s education

- Funding your emergency fund

- Funding today’s living expenses

I would prefer that you rank what you wish to prioritize.

It can be something like this:

- Funding today’s living expenses

- Funding your emergency fund

- Pay off your current residential mortgage

- Children’s education

- Financial independence

Ranking your goals or liabilities is important because we all may not have enough resources. Ranking allow us to discuss with our other half and others the best way to deploy our limited resources.

If you have a certain ranking it will be easier for you to see where you can cut if currently, you do not have enough resources.

Step 5: Reallocate your Financial Resources so that you can better target the Uniqueness of each goal and Liability

Once you can see whether you have enough or not enough resources, you can then decide the best and optimize way to deploy your financial resources.

More sophisticated money managers call this LDI or liability driven investing.

Each of these goals have rather unique characteristics:

- The time horizon is specific

- For some goals, you might need to minimize the volatility

- For some goals, you need to continue to invest during spending stage while others you cannot have volatility in spending

- For some goals, the spending is one-off lumpsum while in others the spending has to be recurring

Given the different profile, it would be better to use a specific solution for each goal.

For example, design a solution around investment portfolio A and CPF monies to match the financial independence goal. This solution requires the income to last for 45 years, inflation-adjusted and recurring.

Design a solution around investment portfolio B so that to provide allowance for parents. This solution is design around that the income is sporadic and if this portfolio run out earlier than expected so be it.

Notice that due to the unique nature, the investment and spending rules for each goal can be different.

Step 6: Reassess Step 1 to 5 Periodically

The last step is to re-assess Step 1 to 5 on a periodic basis.

The only constant in life is change. You might make more money. You might not need certain goals. You might add new goals.

You may have enough 3 years ago, but with the latest changes, you might not have enough.

The Advantages of this Financial Asset and Liability Matching Strategy

This strategy of determining whether you are allocating your resources well or not has certain advantages.

You can tell whether you have enough without an elaborate visual diagram

Firstly, the biggest advantage is that it allows you to bring a diverse group of cash flows in your life into a “common denominator”.

This allows you to determine if a client or yourself have enough without an elaborate visual diagram.

The direct competitor to this strategy is the cash flow method. The cash flow method is the method that is favoured by many financial planning firms.

The problem with financial planning is that some of the cash inflow take place sometime in the future, over some number of years. Then, some cash outflow takes place in the future over a different number of years.

The cash flows and lumpsum can be very uneven.

How are you able to confidently tell yourself or your client if they have enough at a certain point?

The asset and liability matching strategy forces every dollar of financial resources or liability to present value, which is the common denominator.

You do not need to invest so much in complex financial planning tool and can rely on a spreadsheet.

Allows You to Carve Out Specific Investments Based on Particular Goal or Liability

The second advantage is that for each goal or liability you can better target them by allocating the financial resouces to investments that fit the goal better.

For example, the nature of your financial independence goal is different from children’s education.

The time horizon is different both in accumulation and deaccumulation. In financial independence, your money still needs to be invested to grow but for children’s education you do not need to do that.

If you can identify the nature of your goal and liability, you can use a specific financial solution to better target it.

You can use Portfolio A to grow your money during accumulation stage of your financial independence then deploy to Portoflio B which has a different risk and return profile when you are spending down.

You can use Portfolio C for children’s education.

This, in essence, is what they call in the institutional world Liability Driven Investing (LDI). Your investment strategy is driven by your goal and liability.

Surgically Re-allocate your Capital to Target New Goals or When Existing Goal is not Required.

To build on the previous point, our financial lives is pretty dynamic.

You might realise that your child do not need so much funds for overseas education.

If you match each goal with a specific investment solution, you can surgically reduce or tear it down without affecting the rest of the plan.

This is because the financial resources and the goal and liability is a one to one matching.

Similarly, if you wish to add more resources to a particular goal, you have an easier time pinpointing where you need to free up the resources (take from the financial resources of Goal A to give to the new Goal).

The Disadvantage of this Financial Asset and Liability Matching Strategy

I think a big disadvantage is that… people prefer to see in cash flow most of the time.

They feel shiok when they see that the net inflow for every year is enough for the net outflow.

If I just tell you that today you have $5 mil and your goals will cost you $4 mill, you would have some distrust of how this is implemented on a day to day manner.

And this is why elaborate cash flow tools is still required, unfortunately.

Now let us go through some Questions and Answers.

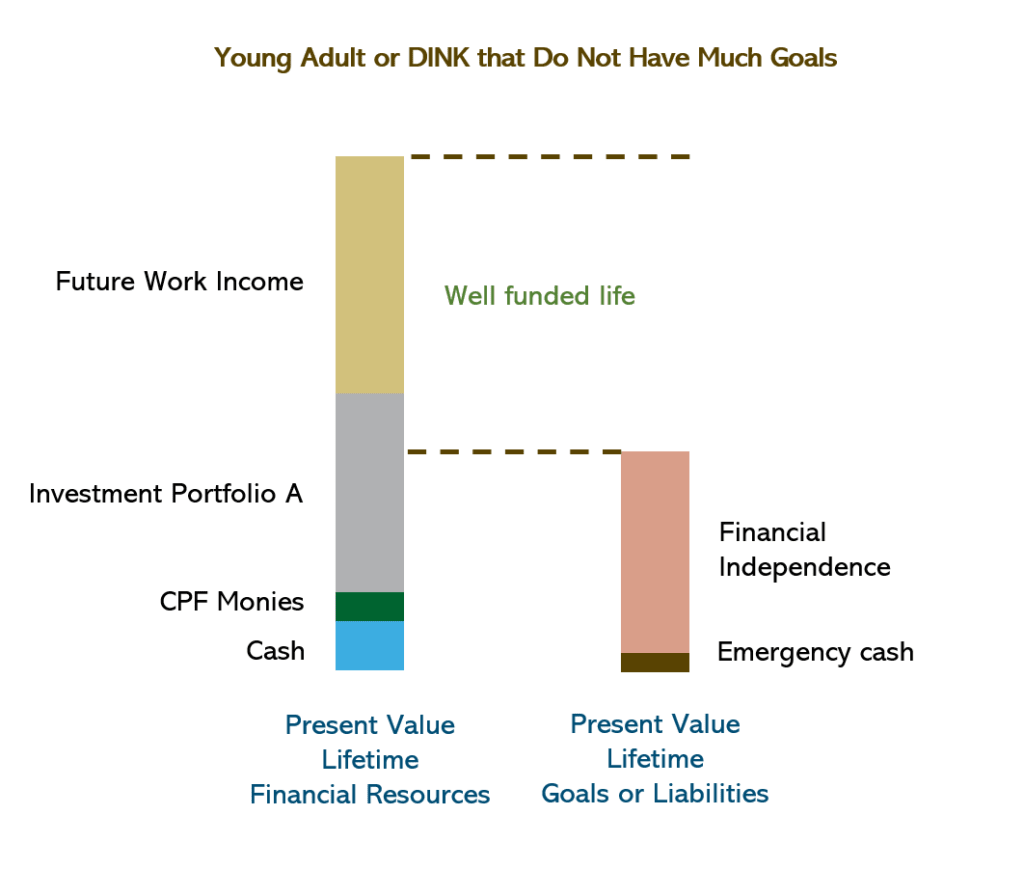

If I Don’t Know What My Future Looks Like, and I have Not Many Goals In the Future, Can I Say that I have “Enough”?

This is a very common problem.

Some folks are in a rather enviable position because they are in a relatively good job at the start of their career and manage to build up quite a fair bit of financial resources.

The present value of their lifetime financial resources and lifetime goals and liabilities would look like this.

Very well funded and in theory, they have enough because their goal is to be financially self-sufficient.

The thing about life is that… it does change quite a fair bit.

Some say they don’t want children, don’t want to get married but in the future life throws them a curveball and things change.

I firmly think that most young people have some goals and liabilities that they have yet to identify.

This can be due to:

- Inexperience. Thinking that life is just that simple. If you say you won’t get married or have children, that will confirm happen.

- Not sure if it will happen.

#2 is challenging because if you are not sure whether that will happen or not, then should you commit and save for that goal?

I think you can look at things in a spectrum.

For some, they have not met the other half but has a philosophy that they would be open about marriage and children.

If that is the case, that is a whole suite of financial liabilities that will come with that.

Then even if you do not need it now, and you are still productive, save for it!

On the other hand, if you do not feel strongly about it, frame it the other way, if you enjoy your work or feel focused on your work, do the financially prudent thing and save enough in case you need it.

Be aware of the privilege that you are in a good financial position but have enough financial humility to know that there might be more financial commitments in the future that you need to prudently put away money for potential future goals.

But you could afford to enjoy a little.

What if the Present Value Lifetime Goals or Liabilities is more than the Present Value of the Lifetime Financial Resources?

It is possible that if we ask you what you want and the picture ends up like this:

In short, our estimation of what you have today and your future potential income is less than the present value of your future liabilities.

You do not have enough resources EVEN AFTER FACTORING YOUR FUTURE INCOME POTENTIAL.

There is a reason we do step 4, which is to rank your goals. For some, your wants are so much versus what you have that, you got to make some hard decisions.

Here are some remedial actions to improve the situation:

- Relook at the inflation rate, investment rate, and the cash flow needs of each goal and do some hard rationalization.

- You might need to cut away some goals.

There is also possible saving grace in that we might be underestimating your future work income potential.

But I always feel it is right to use conservative growth assumptions when estimating the present value of your future work income.

This is why we should revisit these calculations a few years later. Rationalizing your goals and liabilities helps. But if you continue to improve, in the future the numbers may work out better if your income surprises on the upside.

What if I feel Less Strong About a Goal in the Future?

If you feel less strong, we can always remove the present value of that goal from the left column.

If you lay out the present value of your goals and liabilities this way it is very plug and play.

In a similar fashion, if you are unsure whether you can afford to buy a bigger residential property, a quick glance of the present value of your lifetime financial resources and goals will allow you to see what happens if you take some of your resources and replace it with the present value of the property and if you add on the present value of the future mortgage.

If all else are equal, adding this property and mortgage result in the right bar be higher than the left bar, than you are overstretching your resources.

Advanced Liability Driven Investing (LDI) Ideas

I really like the LDI concept.

I like it to such an extend that I in my head, I don’t see things as cash flow but what are the goals and the investment portfolios to address the need.

I feel that if you define your goals and needs to a granular level, you can identify specific investment portfolio and rules for certain goals.

For example, I think everyone wishes to secure their basic essential food, utilities and conservancy cost.

You want an investment portfolio that is able to provide inflation-adjusted income, to pay for this perpetually.

So if it cost $550 a month for food, $80 a month for utility and $80 for the conservancy, that would be $710 a month or $8,520 a year.

If we want to use a 100% equity portfolio and ensure that the money does not run out, we can use an initial withdrawal rate of 2.5%.

We will need $8,520/0.025 = $340,800.

While I do not break up my investment portfolio into different sub-portfolios, I do think about in some of the worse drawdowns, would my portfolio be less than $340,800.

That would require more than nearly 76% fall to breach that. So that is some assurance. That would need some market plunge more awful than the Great Financial Crisis.

If we go granular, I can identify how many financial resources to set aside to address certain needs.

For example, I have some stream of cash flow that I am currently paying on a recurring basis but it is not to perpetual.

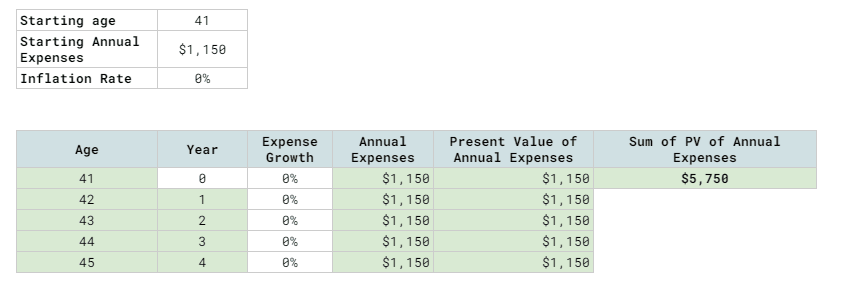

One example is a limited whole life that I would still ahve 5 more years of premiums outstanding.

So instead of looking at the expense to be +$100 a month, I look at it as a lumpsum of $5,750 of my net worth is meant for this insurance.

If I wish to, I could do the same for my term life insurance premium. This is because these premiums do not go up with inflation and they are fixed duration.

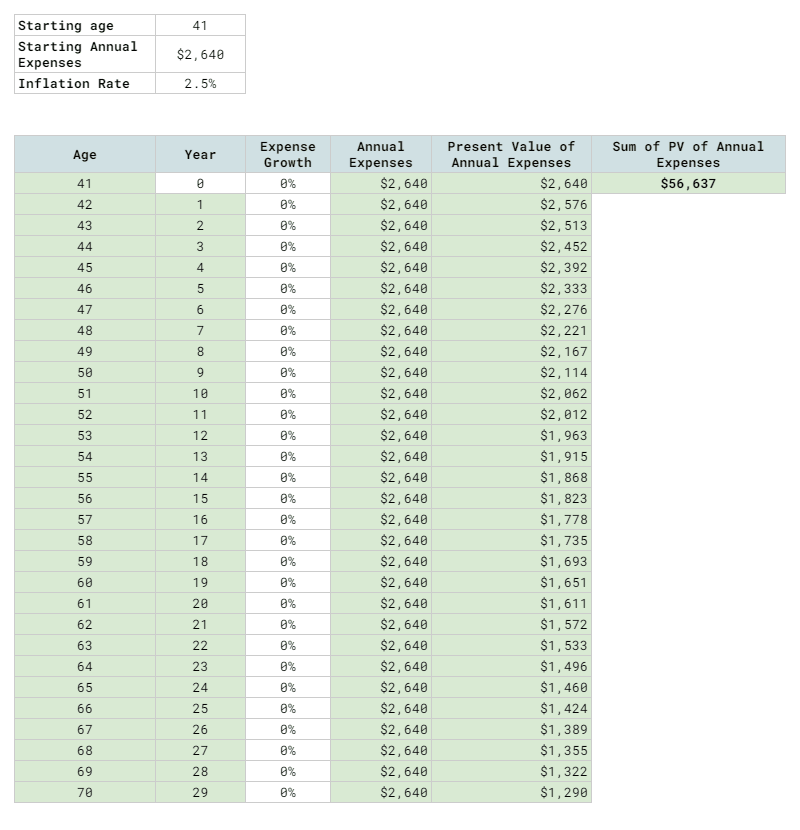

My premiums is about $220 a month or $2,640 a year.

Technically, I can carve out a 60% equity and 40% bond portfolio with an expected return of 5% but to be conservative I will plan with a 2.5% investment return.

So out of my 100% investment portfolio, probably $56,637 is to pay for the rest of my insurance premium for the next 30 years.

If we optimize and use an LDI approach versus setting aside a perpetual sum to pay for the limited whole life and term insurance to perpetuity, here is the amount of difference:

| Strategy | Amount needed to set aside today |

| LDI Strategy | $56,637 + $5,750 = $62,387 |

| $315 a month for insurance premium to perpetuity at a 3% safe withdrawal rate. | ($315 x 12)/0.03 = $126,000 |

The difference is almost a 50% savings.

This might feel a bit anal to some but it feels clear to me:

- $340,800 – Perpetual food, utilities and conservancy that is inflation-adjusted.

- $62,387 – All future life insurance premium is taken care of.

- $5,688 – Outstanding mortgage.

What is left are the very variable expenses such as entertainment, medical, household, cable broadband, transport, income tax.

LDI is useful if you wish to break out your spending into a few goals that you felt the cost and portfolio needs are different:

- Core essential expenses plus some discretionary expenses that you need very stable income.

- Discretionary expenses can be rather variable.

- Medical expenses may escalate over time but can be rather unpredictable.

By breaking it up, up into three different buckets or segments, you can identify portfolios and solutions to better target each spending goal.

My Present Value Spreadsheet for the Figures in this Article.

To help you get started in an easier manner, I will be sharing the spreadsheet for some of these calculations here.

You can make a copy, learn from it and use it.

A Different View of Matching Your Goals to Assets

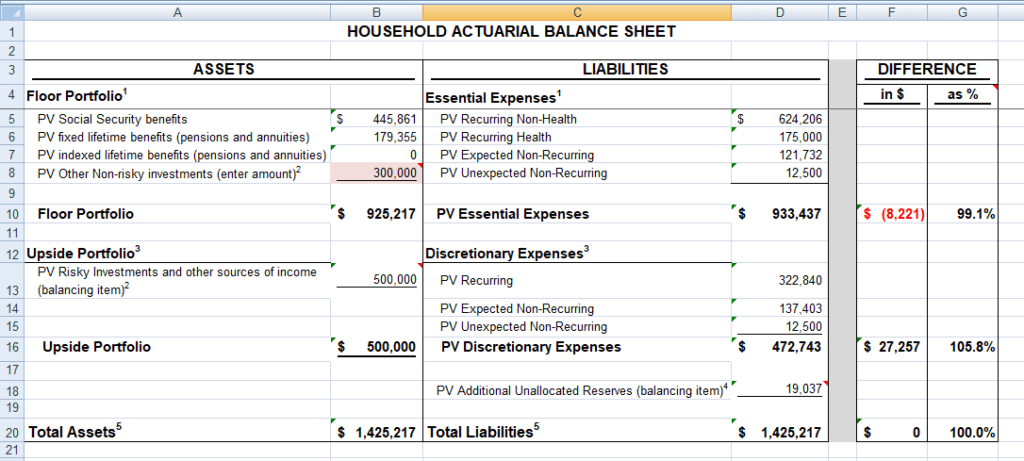

Two actuaries created a household balance sheet that may give you a different way to view your goals/liabilities and the assets you own.

I wrote about it here in a Logical Personal Balance Sheet.

Who did I learn this from?

I gain the most insight on how actuaries look at financial planning from two actuaries who share their thoughts at How much can I afford to spend in Retirement (yes… that is the full URL)

Their articles is very to the point. They will critique the pros and cons of their actuarial way versus other methods like safe withdrawal systems and other DIY systems.

Through those discussions, I learn more about some of the considerations that didn’t surface in the past.

They are also advocates of Do-It-Yourself financial planning and they have a really interesting set of Excel spreadsheets.

Do check them out and send the love.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

lalaman

Monday 21st of June 2021

Kyith thanks for sharing the article.

What would be useful is to actually break down the major daily expense categories like Food, Mortgage, Healthcare, Education (for kids), Travel, etc. into different buckets and apply inflation rates to each one of them over a 30/40/50 year timeframe assuming live till 100 years.

We all know healthcare and educ cost are not increasing at 3% (more likely 8 - 10%) ; likewise Food, Mortgage, Travel and Clothing expenses will go down over time. Big ticket items like Fridge, Washer, Aircon, Mobile phone repairs/replacement would be one-off items every 5-10 years and likely to become cheaper over time so I wouldn't worry too much about it.

Believe Dept of Stats should have the various inflation rates for each major category. This would be a more comprehensive exercise if we want to be as close to the pin as possible ... Of course, the simpler way would be to just add X% to whatever your original spreadsheet churns out and be comfortable with it (and deal with the unforeseen cost when the time comes).

The range can be so wide just like the CNA video ... some can survive on 2k per month hdb/cai png lifestyle comfortably ; others need at least 10k to "retire with dignity" in condos/biz class travel.

Kyith

Tuesday 22nd of June 2021

Hi lalaman, i think you get the general idea. But i think food, and transport they do go up with inflation but if the percentage of your total expense is smaller, I think it will be ok. In a way if the inflation for food stuff is too great... it would be a social problem. I guess it will be in more control.

retirewithfi

Monday 21st of June 2021

@lalaman, Hi,

Quite a few FIRE/personal finance bloggers have written about the concept of personal inflation rate. By tracking expenses over a long period of time, they worked out their personal inflation rates which may differ from the CPI or equivalent of MAS's Core Inflation. Example: https://monevator.com/personal-inflation-rate/ and https://actuaryonfire.com/whats-your-personal-inflation-rate-inflation-risk-for-retirees-part-2/

Derrick

Sunday 20th of June 2021

Very valuable insights!!

Kyith

Sunday 20th of June 2021

Thank you Derrick.

Pete

Sunday 20th of June 2021

2 points:

1. I believe expenses for retirees decreases over time instead of having a flat amount 2. The end-point is the hardest to define. Why end calculation at 70? Why not 90? Or 85? or some national suggested end? Will I outlive my resources?

I am older and I use a simple spreadsheet to chart out my resources and expenses over the entire timeline of my remaining life. For e.g. I have insurance plans that will mature at different time which would inject cash into my resources; I predicted some expenses that will come in at regular intervals (such as replacing that split-aircon, washing machine, fridge, flat general maintenance which may look like small amount but if you had to spend them every few years, they do add up)

I still find point (2) above most difficult to counter so I stretch my timeline as far as my resources could support, the same question remained; can I retire this year or next or 3 years' time? 😂

Pete

Monday 21st of June 2021

@Kyith, thanks!

So many moving pieces, this retirement planning is hard work.

Kyith

Sunday 20th of June 2021

Hi Pete, thanks for your question. I think there are few research or article that say that inflation and deflation in different line items plus the usage decrease and increase in some line items will make spending rather flat. Like what retirewithfi said, Blanchett was the one who determine it is a smile. It is a mystery to me how it looks like. I would say its good to plan with some inflation but know full well that your spending could be flat (and you have overcompensated)

In some of my income and expenses, I used 70 as an example because that is roughly when this 25 year old will totally stop working. in reality, that will be a bit difficult. I guess that is why I say we should revisit this calculation maybe every 3 years. as an older person you might feel good working for 10 years but 3 years later, you might have a different idea.

For the expenses, I decide to stop at 70 because I split expenses into expenses during work and the expenses provided by financial independence goal. I could always combine them.

The weakness of this present value is you cannot see the year by year play of these cash flow. But you can present value the insurance cash value that you will receive and the cost.

I suggest for the cost, treat it as an essential ad-hoc lumpy expense and create a goal for it. if you estimate well you could always smooth it out and work these lump things into your annual expenses. This one no choice have to depend on your experience, e.g. a washing machine usually may break down after 3 years. fridge 10 years. Vacuum cleaner 3 years? TV 5 years? If you add up these cost on a 10 year basis, you might be able to figure out roughly how much to set aside.

retirewithfi

Sunday 20th of June 2021

http://rivershedge.blogspot.com/p/here-are-retirement-formulas-i-seem-to.html Equation 9 if readers want to investigate further on Stochastic Present Value.

retirewithfi

Sunday 20th of June 2021

@Pete,

Point 2: Researchers use the more advanced concept of Stochastic Present Value which combine the PV of assets/liabilities and the stochastic nature of a person's life span and investment returns.

Point 1: You can look up Blanchett's spending smile. There is a decrease in the middle but it increases again due to the healthcare expenses & long-term care at the tail end.

retirewithfi

Sunday 20th of June 2021

Hi Kyith,

Great article and I learned about LDI here and I like it as well. A question I have: how would you calculate the PV of CPF which is actually many schemes (LIFE,MA,OA for housing etc) in 1 name? I just used cash flow as I couldn't figure it out.

For sharing, these retired actuaries worked out different actuarial calculators for various demographic profiles (single/couple/retiree/pre-retiree): https://howmuchcaniaffordtospendinretirement.blogspot.com/p/articles-spreadsheets.html.

retirewithfi

Sunday 20th of June 2021

@Kyith,

I looked at the actuarial model of CPF LIFE published by some SMU researchers which includes the payout and the bequest. Couldn't figure it out so just took the payout/bequest values from the LIFE estimator and used the payout as cash flow.

In theory, the PV of LIFE can be computed but I don't have the capability to do it - if your company has an actuary on board, they shouldn't have any difficulty doing the computation and my understanding is Moneyowl does this sort of computation in their comprehensive financial planning.

Kyith

Sunday 20th of June 2021

Hi RetireWithFi, thank you! I almost forgot to give them credit. These are the folks I learn from!

As to your question I think is a good one. I wonder if I take the $2k a month CPF life and present value to today, whether that is a good way of calculating it or can I just trust the full retirement sum today will be equal to an adequate cash flow in the future. As for the other money (CPF OA, Medisave) i feel we have to pigeon hole it to some goals. Then we can make use of the inflation and the growth. for example... link CPF OA to part of the retirement liability.