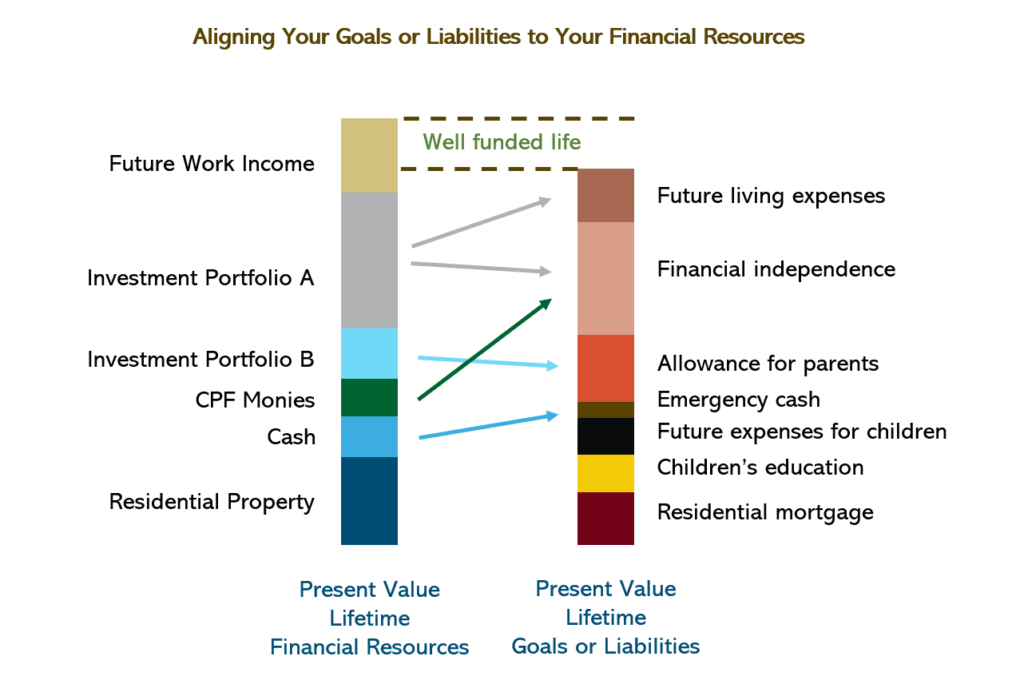

In match your wealth with your goals in life, I explained the right philosophy you should have when thinking about your assets and liabilities.

This liability-driven investing is quite an approach taken from how actuaries look at things.

An Actuary is a person or someone who analyzes the consequences of risk. Actuaries use mathematics, statistics, and financial theory to study uncertain future events, especially those of concern to insurance and pension programs. Actuaries may work for insurance companies, consulting firms, government, employee benefits departments of large corporations, hospitals, banks and investment firms, or, more generally, in businesses that need to manage financial risk.

I feel that actuaries are the people who try to model the fluffy stuff we think cannot be modelled.

Sometimes, their model is the most sound as it takes out the human side of things. Recently, I came across an ETF based on an actuarial approach that eliminates companies with a high probability of underperformance from the S&P 500 and the performance is great. I may talk about it in the future.

You may wonder whether there is another view or example of a lifetime balance sheet of a person.

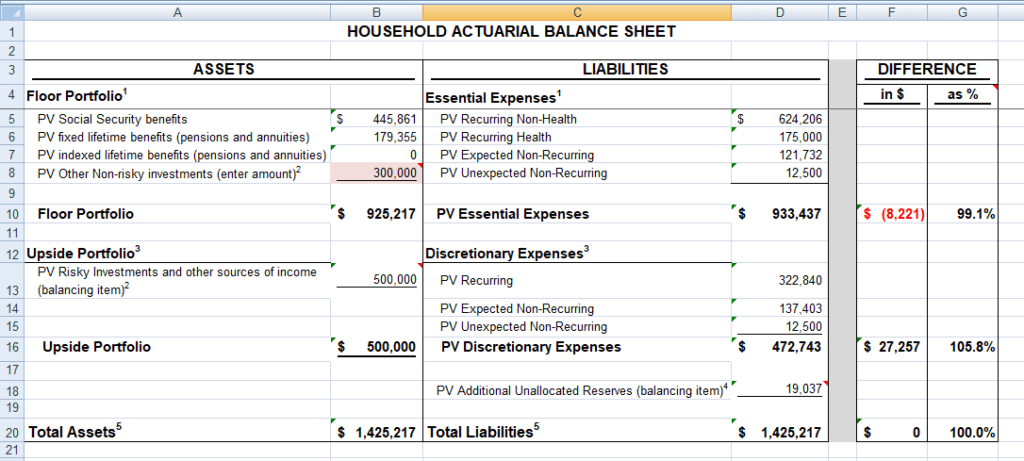

The two actuaries over at How much can I afford to spend in retirement added this actuarial balance sheet to their excel sheet.

I thought it will give you a different view about how they view assets and liabilities.

On the left side, we have the assets we own and on the middle, we have our liabilities.

On the right, the spreadsheet computes the difference between assets and liabilities.

Notice that in both assets and liabilities, the line items show a PV.

PV stands for present value. Basically, we would have to compute a stream of future cash flows, or a lump-sum asset or liability in the future back to its value today.

If everything is in present value, we have a common denominator that we can use to determine if we have a shortfall or surplus in our lives.

What goes into the Assets?

Notice that in the assets, they broke things up into two sections:

- Floor portfolio

- Upside portfolio

Basically, they categorize your assets based on the nature of liabilities and the goals you are targeting.

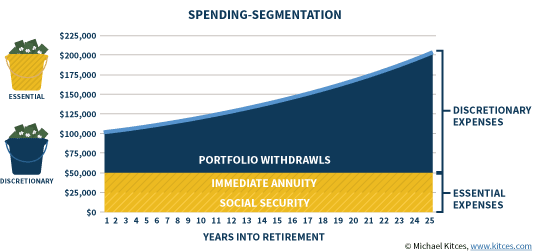

The floor portfolio consists of very bond-like, stable assets that give you utter predictability. Or they transfer the investment responsibility to an institution that has an obligation to give you utterly predictable cash flow.

So you can see bond ladders, annuities, government pensions as part of this part of your assets.

The upside portfolio consists of the assets that have greater risk levels.

For all these, we present value a stream of income we will receive in the future to get a lump sum value today.

What goes into the Liabilities?

The liabilities are generally grouped into two sections as well:

- Essential expenses

- Discretionary expenses

The essential expenses are those expenses that you can absolutely not compromise and the discretionary ones are more optional.

Notice that for each of essential and discretionary expenses, they are broken up further to:

- Recurring

- Non-recurring

Within each of these, there are definitely expenses that are lumpy and recurring. The way to present value and account for them is different.

An essential recurring expense would be your family’s food for survival. You always need to eat to survive. Minimal transport and rent are recurring essential as well.

An essential non-recurring expense is to replace your fridge and washing machine. You need some of this stuff but you don’t replace them every month. Each of them may have a different lifespan.

Discretionary recurring expenses are the food that you eat to give you much higher satisfaction. This is recurring but in truth, if times are bad, you cut down on these.

Discretionary non-recurring expenses could be the more longer, luxurious vacations. They do not occur month to month and it is something that you could choose to take more off if the portfolio does well.

The spreadsheet introduces two more breakdowns for both essential and discretionary non-recurring:

- Expected

- Unexpected

This is pretty new to me but it makes sense. Most of what we can plan for… is expected. There will always be unexpected which is what the emergency fund is for.

If we are to do this today, it would mean we need to break down our expenses in this way.

Matching the assets to the liabilities

The segmentation is to match your essential liabilities to the floor assets and the discretionary liabilities to the upside assets.

That is probably the elegant way to look at things.

In the balance sheet above, you would realize the floor assets are less than the essential liabilities. But the upside assets are more than the discretionary liabilities.

Net-net, total assets matches total liabilities.

What this means is that this person, at this point, has “settled” their discretionary needs in the future for the whole lifetime.

But they have not taken care of their essential needs.

There are some further on years or part of all years going forward where they won’t have enough to spend on their essential expenses.

Something will give way.

Conclusion

As I said in previous articles, I think this is the most logical way to reason our financial life.

But it is something that the layman will find it tough to visualize.

The layman visualizes things year by year in cash flow.

A balance-sheet view gives them a snapshot at this point.

If you are planning for retirement, your takeaway maybe how much the expenses drive how much you need.

I would go so far as to say: If you have limited human capital, and limited resources (time and money), the nature of your expenses matters a lot.

Most of us would rather say: “My expenses are $7,000 a month. How much do I need to accumulate so that I have a very high degree of confidence to stop work early?”

I would tell them: “If you want a very high degree of confidence, I would use a 2.8% initial withdrawal rate, which means you need $3 million dollars today in present value assets.”

And that might kill you because you barely have 30% of that.

If you don’t want to do granular things, then it’s $3 million. If we look deeper, the amount may be lesser.

You don’t have $3 million, you don’t have the option of stopping work with a high degree of confidence.

Or do you want to define things better to know out of all your expenses, which are the expenses currently you have matched with assets with a high degree of confidence?

Ironically, I get the feeling that the rich would feel that this is a very poverty-driven mindset and be uncomfortable with planning this way. They prefer an abundance mindset.

So they would work hard to fulfil a larger asset base that they need. They have the human capital and resources to do that.

The middle-income also have an abundance mindset here but realistically, many do not have the great human capital or resources.

Going granular might be very poverty-driven, but fuck, at least it gives you a higher probability of a better future life.

More on retirement, financial independence in Retirement planning, Financial independence and spending down money below.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Sinkie

Saturday 24th of July 2021

For the actuarial-based ETF, I think it's rather new & not so liquid?

But the backtested index looks great. So if it works it's good for buy & hold.

I would have preferred if they could have extended the study at least to 1980 with higher inflation environment.

WTK

Saturday 24th of July 2021

Hi,

Does this 3 million include CPF as per your perspective?

WTK